|

| M1 since the 2008 panic |

|

| M2 since the 2008 panic |

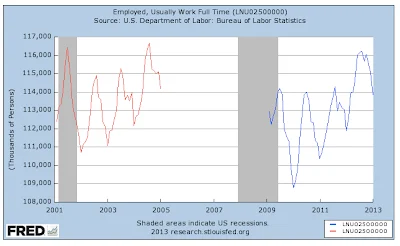

M2 is up $2.71 trillion since the crisis, M1 $1.05 trillion. That means since September 1, 2008, nearly 39% of the rise in M2 is directly the result of the increase in M1 (checkable deposits, i.e. the spending money in circulating cash and checking accounts).

Overall, M1 is up nearly 75% over the period, but M2 just 35%. But back out the M1 and M2 is up only 21% net, or $1.66 trillion. Still, that's a lot of moolah being saved and not flowing into stock markets.

Enter Jim Cramer, who

here says that as CD instruments (M2) mature now, they will not be rolled over but get invested in the only thing going for return, namely stocks:

"Every-day CDs from the halcyon days of the middle of the last decade, when rates were going higher, will come due -- and the dramatic decline in the rollover CDs should force that money into the stock market. Invariably I hear that this flow won't amount to a lot of money. Just dismiss these people out of hand; they are either short or ignorant."

"Force"? "I hope" is more like it. I smell a book-talker.

Most of this CD and money market fund money is money of "households", small time stuff under $100,000. With plunging returns on savings over the period as the US Federal Reserve Bank pursues its policy of financial repression through zero interest rate policy, Cramer is hoping households will suddenly become the greater fools with markets at all time highs and plunge into stocks even though households have been net negative all along since the crisis, pulling out $250 billion from the stock markets according to widely reported figures from Standard and Poors.

In contrast to households it's the funny money which has been driving the markets higher, banks and other corporations doing stock buy-backs to the tune of $1.2 trillion net over the period. Most troubling of all, a year ago already banks were reported to be responsible for fully 32% of the ownership of the total market all on their own, rivaling the household sector's 37% share. If you want to understand how markets are up so much, you have to look there.

Suckers who took Cramer's sell advice in early October 2008, people who "need their money in the next five years", have entirely missed this bank-driven rally which has been aided and abetted by the Fed. And potentially they lost as much as 25% right up front in just the first three weeks after his sell announcement on the nationally televised NBC Today Program, before the markets opened on Monday morning, October 6, 2008, the Monday after TARP was signed.

And here he is, 4.5 years later, hoping people will take his advice again and plunge in because there's plenty of liquidity to keep markets buoyant. Well, plenty as long as you provide it.

You know. Sell low, buy high.

They should hang a warning label around that guy's neck.