Showing posts with label GDP 2015. Show all posts

Showing posts with label GDP 2015. Show all posts

Saturday, November 14, 2015

Monday, October 26, 2015

The unending fascination of Sarah Palin for little Democrat minds

Dunderhead Democrat Party hack William Daley is stuck on stupid.

Here he is in full flutter in WaPo, like a moth drawn to a lightbulb, typing "The GOP’s dysfunction all started with Sarah Palin". It proves nothing but that it takes a dunderhead to know a dunderhead. The GOP has failed, he says, to distance itself from this simpleton who flunked Newspapers 101, and her ilk. Reading it one wonders when Democrats will distance themselves from ignoramuses like Bill Daley, but then you realize they're all ignoramuses. Where would they go?

Certainly not Chicago.

Here he is in full flutter in WaPo, like a moth drawn to a lightbulb, typing "The GOP’s dysfunction all started with Sarah Palin". It proves nothing but that it takes a dunderhead to know a dunderhead. The GOP has failed, he says, to distance itself from this simpleton who flunked Newspapers 101, and her ilk. Reading it one wonders when Democrats will distance themselves from ignoramuses like Bill Daley, but then you realize they're all ignoramuses. Where would they go?

Certainly not Chicago.

Bill Daley, it must remembered, comes from the same Democrat family which presided over the decades long ruination of the finances of that once great city, and with it of the state. The place is now so bankrupt it can't even pay lottery winners. Those who can flee the state, do. Illinois ranks first in America for out-migration in 2014. These nincompoop Daleys are the same people who seriously thought they could afford to host the Summer Olympics next year, forgetting how all those $100,000+ pensions for unionized teachers can really add up. As it is Chicago's bonds have this year achieved junk status, despite the highest sales taxes in the nation and the highest property taxes of any state, save New Jersey. The place is teetering on the edge of bankruptcy because of perennially spendthrift Democrats.

In charge of the Department of Commerce under Bill Clinton, Bill Daley long ago proved his own incompetence. The man couldn't even manage to find a staffer at the Bureau of Economic Analysis to give him the correct figure for year 1900 gross domestic product in a 1999 speech commemorating the invention of the metric under FDR. Daley was only off by an order of magnitude and fifty years at the time, saying the year 1900 $20 billion economy was actually $300 billion in size, a level which it did not reach . . . until 1950! Bill Daley only ran the place. You'd think he could at least get its monthly claim to headline fame right.

But Democrats have good reason to forget the size of things, especially GDP. After all under them it took eleven long years to restore the 1929 $100 billion economy back to its size, in 1940. And presently the chief Democrat holding a veto pen in one hand and a copy of Rules for Radicals in the other is on schedule to produce the very worst GDP record since that Great Depression.

At least Sarah Palin has learned a few things along the way since her quixotic candidacy, for example rejecting the appropriateness of bailouts and crony capitalism. Democrats on the other hand have learned nothing, and only keep repeating the mistakes of the past.

But Democrats have good reason to forget the size of things, especially GDP. After all under them it took eleven long years to restore the 1929 $100 billion economy back to its size, in 1940. And presently the chief Democrat holding a veto pen in one hand and a copy of Rules for Radicals in the other is on schedule to produce the very worst GDP record since that Great Depression.

At least Sarah Palin has learned a few things along the way since her quixotic candidacy, for example rejecting the appropriateness of bailouts and crony capitalism. Democrats on the other hand have learned nothing, and only keep repeating the mistakes of the past.

Sunday, October 25, 2015

Big mistake: Donald Trump says he's 100% in favor of ethanol

The Donald, quoted here on September 22nd:

'Trump said that he supports the RFS at Iowa’s Faith and Freedom Forum, “I am totally in favor of ethanol, 100 percent.” This is the first time Trump gave his stance on the topic publicly.'

So far this only amounts to Trump supporting the current Renewable Fuel Standard signed into law by George W. Bush in 2005, but that's still bad policy. Ethanol is inefficient as a fuel, bad for engines and does zero to reduce carbon emissions. It diverts corn from animal feed, driving up the cost of food supplies from beef, pork and poultry, and from corn added to other products. Ethanol also makes it more lucrative to put more and more land into corn production than would otherwise be the case, potentially stressing the environment.

Arguably Ben Carson's success in Iowa over Trump in part has to do with Carson's pledge to push for 30% ethanol fuel blends, a tripling of the current standard.

The crony capitalism involved with ethanol is YUGE, making Iowa more important politically than it otherwise would be were it not for federal gasoline dictates:

"Iowa produces nearly one-third of the nation’s ethanol and nearly half of Iowa’s corn goes into ethanol production, according to the Iowa Corn Growers Association.

"Iowa’s renewable fuels industry, which includes biodiesel production, supports 47,000 jobs and accounts for $5 billion of the state’s gross domestic product, according to the Iowa Renewable Fuels Association."

That's about 3.2% of 2014 Iowa GDP.

Nebraska estimates Iowa production capacity at 25% of the nation's capability, ahead of Nebraska in second at 13%. Illinois, Minnesota, Indiana and South Dakota round out the top six, who all exceed the 1 billion gallon level of capacity per year. At 10.8 billion gallons of available capacity, the top six states produce almost as much as they can at 10.6 billion gallons, over 70% of total national production.

A number of the current crop of Republicans running for president is more or less opposed to ethanol:

"Former Florida Gov. Jeb Bush, Texas Sen. Ted Cruz, Carly Fiorina, Louisiana Gov. Bobby Jindal, former New York Gov. George Pataki and Florida Sen. Marco Rubio have all expressed interest in eliminating or phasing out the ethanol mandate that requires a certain percentage of ethanol in transportation fuel."

Trump's position may reflect a conviction that he generally needs to be supportive of ethanol in these states to win them in the general election even though it appears Carson has outbid him in the primary season.

Sunday, October 18, 2015

It's significantly warmer in Michigan, but it's nothing to get hysterical about

This graphic from Climate Central showing Michigan annual average temperature increasing 0.622 degrees F per decade 1970-2011 is pretty amazing.

I went to NCDC's Climate at a Glance page and reproduced that same result for myself just to verify it (0.6 degrees F per decade).

I went to NCDC's Climate at a Glance page and reproduced that same result for myself just to verify it (0.6 degrees F per decade).

But one has to ask, Why confine results to 1970-2011 (the terminus ad quem for the study, published in 2012, was 2011) when you can easily go back to 1895 and get a per decade trend result for a much larger sample?

The change in average temperature on a per decade basis for the whole available sample period 1895-2014 produces 0.2 degrees F per decade in Michigan, three times less per decade than for 1970-2011 alone. The result is identical also through 2011. Despite the significant warming since the year 2000, the long term trend remains unmoved and the current period of warming may actually have run out of gas.

|

| Michigan average temperature is increasing 0.2 degrees F per decade 1895-2014 |

I thought it would be interesting to use the length of the sample period in question (42 years) and go back to the beginning of the record in 1898 and look at each 42 year period from then going forward to 1973 (which takes you through 2014) to see if there are any periods of decadal warming trend comparable to +0.6 degrees F per decade in 1970-2011. I chose 1898 to avoid some gaps in the record in some places in prior years in Michigan.

The results are graphed below.

It turns out there are five 42-year periods showing temperature trend of +0.5 degrees F per decade on the left side of the graph, beginning in 1903, 1912, 1914, 1915 and 1916. (Students of the Dust Bowl beginning in 1930, take note, as also those studying economics. Weak GDP of the era may be associated with warmer climate, as it also seems to be now.)

These correspond to six 42-year periods showing temperature trend of +0.5 degrees F per decade on the right side of the graph, beginning in 1960, 1961, 1962, 1963, 1964 and 1973.

If that were all that were to it, there would be no discussion of global warming today, despite the consecutive nature of the recent examples. The two data sets are almost a wash.

What is remarkable about the more recent data is the presence of four 42-year periods of +0.6 degrees F decadal trend (beginning in 1967, 1968, 1969 and 1970), and four of +0.7 degrees F (beginning in 1965, 1966, 1971 and 1972), all in conjunction with the +0.5 degrees F periods. It's a trifecta of warming data.

Still, overall the results show that there are two distinct periods where the decadal trend is consistently +0.2 degrees F or above: the 27 years from 1898 to 1924, and the 20 years from 1954 to 1973. In the former the average of the decadal uptrend is +0.3555 degrees F per decade. In the latter the average of the decadal uptrend is +0.4950 degrees F per decade. Clearly the latter period, contemporary with us, is significantly warmer than the former, by 39%, about which some of us have become hysterical.

The antidote to this is the trough of downtrend years in the middle of the graph which coincides with the period of the global cooling hysteria of the late 1960s and 1970s. The 42-year trend record went negative for 1928-1969 and stayed negative to flat until the period 1946-1987, nineteen years straight, twenty if you count the flat period 1927-1968. Year after year, the 42-year trends ended -.1 degrees F decadal trend or -.2. Many climate scientists predicted the return of an ice age while unbeknowst to them the seeds of a warming era were already germinating.

The record shows how quickly things can turn, for example 0.5 degrees F in trend in just seven years from 1923 to 1930, from above trend on net to well below it.

The decadal trend fell by a whopping 50% between 1917-1958 and 1918-1959, from +0.4 degrees F to +0.2.

More recently the decadal trend fell by 28.5% between 1972-2013 and 1973-2014, from +0.7 degrees F to +0.5. (It's entirely within the realm of possibility that decadal trend could revert to normal by the close of 2017.)

There was just one similar abrupt change to the upside. Between 1964-2005 and 1965-2006 the decadal trend shot up 40% from +0.5 degrees F to +0.7.

Otherwise the record shows incremental change in the trend from year to year, 0.1 degree F up or down at the most.

Don't be surprised when you see it.

Wednesday, September 30, 2015

The Tax Foundation says Trump tax plan will blow up the deficit, reducing revenues to 12% of GDP

From Alan Cole, here:

"Looking at these rates, collectively, note that Mr. Trump is frequently cutting rates in half, and sometimes cutting them by even more than that. Taken together, these rate reductions are enough—by my estimates—to reduce tax collections from about 18 percent of GDP to about 12 percent. Under rates as low as these, economic growth—moderate or otherwise—cannot restore federal revenues to current-law levels.

"Tax cuts can do a great deal of good; each of the provisions I outlined above could help a lot of people lead better lives. However, the reductions in federal revenue need to be acknowledged, and likely mitigated through substantial cuts in spending, in order to make this plan feasible."

Wednesday, September 16, 2015

Something down is up in Russia

Normally traffic from Russia represents over 10% of my blog audience, going back years, but in the last week that has dropped off the cliff to zero.

It's like somebody turned off the spigot.

Reuters provides clues here:

"The large Moscow street protests of 2011 and 2012 illustrated the connection between economic growth and demands for greater political participation by the chief beneficiaries of Russia’s then-prosperity. Now, as the collapse in oil prices and Western sanctions undermine the economy, the mood inside Russia could hardly be more different. The creative class in big cities like Moscow is depressed and increasingly disengaged from political life. Some have given up and are just leaving the country. The combination of economic crisis, heavy propaganda, patriotic mobilization and hybrid war inside Ukraine have produced conformism, passivity and insensitivity."

Labels:

Crony Capitalism,

GDP 2015,

Kremlin,

Propaganda,

Reuters,

Vladimir Putin

Tuesday, August 18, 2015

Friday, August 14, 2015

Greeks pass third draconian austerity/bailout package 222 to 64 with 11 abstentions

Looks like Alexis Tsipras' Syriza MPs defected in a big way: 32 No votes this time with 11 abstentions and 1 absent. This could prove fatal to Tsipras' continuance as Prime Minister. The Syriza coalition of the Left with 149 members partners with Independents with 12 in the 300 seat parliament. Tsipras' core support in parliament appears to have fallen to 39%.

The "erratic Marxist" Yanis Varoufakis voted No, after voting Yes and No previously, and reportedly offered to resign his seat so that Tsipras may appoint a reliable vote to replace him.

The Guardian has full coverage here.

Labels:

Alexis Tsipras,

Draco,

GDP 2015,

Greece,

Marx,

Syriza,

THE GRAUNIAD,

Yanis Varoufakis

Friday, August 7, 2015

Fox News didn't want Repubicans to discuss the economy and jobs last night because that didn't fit Fox News' agenda

Jim Tankersley noticed the glaring omission from last night's Republican debate, here:

Polls continue to show that Americans care more about the economy than any other election issue. Fox News moderators noted that they had received more than 3,000 economy-themed questions on Facebook before the debate. Which is why it's so baffling that neither the questioners nor most candidates seemed eager to talk about growth, jobs and - as Republicans have been promising to do all election cycle - America's beleaguered working class. ...

"Way too little discussion" of economic growth, the conservative commentator Larry Kudlow tweeted after the prime-time debate ended. "If you're one of the 65 percent of Americans who think the U.S. is on the wrong track," said James Pethokoukis, a conservative writer for the American Enterprise Institute who has pushed Republican candidates to address worker angst, "what have these debates offered?"

----------------------------------------------

Obviously the economy and jobs didn't fit Fox News' agenda last night, which was to destroy the candidacy of Donald Trump, who has pledged to end the flood of illegal immigration stealing Americans' jobs, end the farce of free-trade and become the greatest jobs president the country has ever seen.

Fox News, like The Wall Street Journal, is owned by the open borders, free-trade libertarian Rupert Murdoch. It has its marching orders. And every candidate who takes money from the libertarian Koch brothers has his and is similarly beholden to the same ideology which demands the cheapest labor possible in service of the almighty bottom line, not in service of the country's citizens. The involvement of Facebook and Debbie Washerwoman Schultz of the DNC were just the bow around the illegal alien amnesty package.

And that's why Donald Trump scares the crap out of them and must be destroyed:

He doesn't need their money to run for president, and won't do their bidding when he wins.

Obama's horrible, awful full-time jobs record

The numbers are out this morning and they are not pretty.

Full-time jobs for July 2015 registered at 123.142 million in the report today, not seasonally adjusted. The previous high for the measure was set, wait for it, way back in July 2007 at 123.219 million.

That means full-time jobs still have not recovered to the peak level set eight years ago. Examine the record of recessions since 1969 and you will see that full-time jobs always have bounced back to pre-recession levels after two to three years ... until now.

In fact there are today still 77,000 FEWER full-time jobs than there were eight summers ago. That means it will likely take until next summer to surmount the 2007 peak. That'll make it nine years, versus two to three normally.

Yes, there are 2.4 million more jobs today than there were eight years ago, but they are all part-time: 26.6 million part-time now vs. 24.1 million then, for an increase of 2.5 million part-time. Subtract the decline in full-time and you arrive at just 2.4 million more net jobs in eight years while the population has grown by 19 million.

Obama crows about the all the jobs he's created, but only out of the depths of their decline which he oversaw and did nothing to stop. Full-time jobs fell in a panic by 6 million in the three months from his election in 2008 to his inauguration in 2009, and by another 5 million in the next year.

Arguably all those jobs went away out of fear over what Obama would do to the economy, which after six full years of his maladministration has grown at its slowest pace in the post-war and 26% worse than for the same period under George W. Bush, a surprising outcome considering that there was nowhere to go but up once the economy had crashed.

If the Obama rate of GDP growth from the first six years of his tenure is sustained through the end of it, Obama GDP will underperform the previously worst record of George W. Bush by over 20%. And more than likely, full-time jobs will continue to suffer as a result.

Sunday, July 26, 2015

Paying off the $18.1 trillion national debt in 30 years . . .

Financed at 3.5%, it would require annual payments of $977.4 billion to retire the $18.1 trillion national debt in 30 years.

This assumes deficit spending (projected to average $512 billion annually, already factoring in increasing revenues going forward to 2020) would cease in order to balance the books and cap the debt.

Together debt repayments and cessation of deficit spending imply cutting current allocations by a total of $1.5 trillion annually, leaving just $1.7 trillion to fund government outlays in fiscal 2015 projected to soar to $3.8 trillion.

Out of control and misplaced spending therefore amounts to 55% of projected outlays in fiscal 2015, or $2.1 trillion.

In the already low GDP environment, a 55% fiscal contraction is utterly unthinkable to anyone in either political party, the equivalent of an 8.5% hit to the current dollar GDP at $17.69 trillion.

The revenue projection for fiscal 2015 is just $3.2 trillion, but will be the highest ever.

Tuesday, July 21, 2015

Sorry Noah Smith: There isn't just one way to boost GDP growth

Smith says we need more immigration to solve our low growth problem. There is an alternative. Have more children of our own.

Noah Smith, here:

"Gross domestic product is simply the product of output per person and the number of people. The more people in your country, the higher the output. That's why China, whose output per person is only about a quarter of the U.S.'s, is now the largest economy on the planet. It just has more bodies."

The open borders libertarians

Noah Smith for Bloomberg, here:

"Exactly this sort of open borders immigration policy has received enthusiastic support from a dedicated core of libertarian economists, notably Bryan Caplan of George Mason University. These economists believe in relaxed immigration rules not because they want higher GDP growth, but because of principle -- they view national borders themselves as an unacceptable form of government intervention in the economy. The open borders crusaders are so zealous that moderate supporters of increased immigration, such as tech entrepreneur Vivek Wadhwa, are often the targets of their ire. University of Chicago economist John Cochrane has also voiced support for the open borders idea."

Thursday, July 16, 2015

Euro Group creditors made a bundle off Greece's problems in 2014: 13 billion EUR

Moody's on Greece indicated today that the debt/GDP burden was already 177% before Syriza was even elected in 2015, but one man's debt burden is another man's opportunity.

Seen here:

'We assess Greece’s Fiscal Strength as `low’, because of the country’s high debt burden, which stood at around 177% of GDP at the end of 2014, one of the highest debt burdens in the universe of Moody’s-rated countries. Moreover, the potential to meaningfully improve the debt trend over the next 3-5 years is highly uncertain given that the large-scale reforms that could spur growth are currently hampered by ongoing political uncertainty.'

-------------------------------------------

Eurostat shows Greek GDP in current euros was just shy of 179.1 billion in 2014, down 26% from the 2008 peak. Greece is in a long, severe depression. Central government debt rose to 324 billion EUR at the end of 2014 and actually dropped to 313 billion EUR in the first quarter of 2015. Syriza was elected to power on January 25, 2015.

Those awful conditions developed under years of austerity government, after years of profligacy, which Syriza promised to end. Now that Syriza has been forced to double down on austerity, expect conditions in Greece to worsen dramatically without debt forgiveness or a generational period of grace from repayment obligations.

Little discussed in that regard, however, is the fact that in 2014 Greece is said to have paid an interest rate on its debts of 4% nominal and 2.6% effective. This is happening in a world where the ECB has just decided to keep the headline lending rate at the record low level of 0.05%.

Whatever else may be said, Euro Group creditors by comparison are making a killing off Greece's predicament: almost 13 billion EUR in debt service revenues in 2014 alone.

If Europe is serious about keeping Greece in the Group, maybe it could start by stopping the profiteering.

Labels:

Credit Ratings Agencies,

GDP 2015,

Greece,

Syriza,

THE GRAUNIAD,

The UK Telegraph

Tuesday, July 14, 2015

IMF signals that it cannot now participate in the third bailout of Greece

Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far. ... Greece cannot return to markets anytime soon at interest rates that it can afford from a medium-term perspective. ... Greece is expected to maintain primary surpluses for the next several decades of 3.5 percent of GDP. Few countries have managed to do so. ... Greece is still assumed to go from the lowest to among the highest productivity growth and labor force participation rates in the euro area, which will require very ambitious and steadfast reforms. ... [G]overnance issues ... are at the root of the problems of the Greek banking system. There are at this stage no concrete plans in this regard. ... The dramatic deterioration in debt sustainability points to the need for debt relief on a scale that would need to go well beyond what has been under consideration to date—and what has been proposed by the ESM. There are several options ... maturity extension ... of, say, 30 years on the entire stock of European debt, including new assistance. ... Other options include explicit annual transfers to the Greek budget or deep upfront haircuts. The choice between the various options is for Greece and its European partners to decide [i.e. not the IMF].

Sunday, May 31, 2015

Thursday, May 21, 2015

Obama's winter GDP isn't a victim of bad BEA methodology, it's just UNUSUALLY bad

CNBC and Obama's other excuse makers in the media don't want you to focus on how unusually bad Obama's winter GDP has been.

The fact is nominal GDP over the 69 winters from 1947 has improved from 4Q to 1Q on average by 1.77%. That includes every recession year, and Obama's entire record to date which pulls down the average. Pulling Obama's record out lifts the average to 1.94%.

Obama's record over the 7 winters from 2009 has averaged just 0.24%.

Whatever may be said about the existence of methodological problems with BEA's seasonal adjustments and the lack of transparency involved with its raw data, the point is those problems have persisted over time and infect the whole record. They aren't new to the Obama era. What is new is how CNBC and The New York Times have offered up this red herring this spring since it became clear the 2015 winter was nowhere near as bad as the last one and couldn't be plausibly blamed for the 1Q2015 GDP disaster.

Traditionally the BEA is always involved in revising its reporting based on better information and methods. That's the whole point of the comprehensive revisions published every five years in the summer (one of which we just had in 2013) and of the annual revisions every summer. BEA's decision to revise the Obama record and going back only to 2012 in the upcoming summer 2015 annual revision looks as unusual as Obama's GDP record itself, and smacks of pure politics. If the BEA had any integrity it would follow its normal process.

It is a complete red herring to focus on those problems as if they can in any way excuse Obama's awful record.

The political hacks who never stopped telling you how bad the economy was under George W. Bush aren't telling you now that Bush's winter GDP averaged 1.15%, almost five times better than under Obama.

We should be so lucky to have George Bush's rotten economy today instead of Barack Obama's.

Sunday, May 17, 2015

The US winter of 2015 was not severe by any measure, so its unremarkable cold and snow can't be blamed for poor GDP

Snow cover averaged 1.19% below the baseline since 1967 for the first quarter.

For average temperature the first quarter ranked 95th warmest out of 121 years, 5.6% above the baseline.

For minimum temperature it ranked 96th, 6.7% above the baseline.

For heating degree days it ranked 75th, just 2.3% colder than the average. By contrast 1Q2014 was 6.8% colder than the average, and the 18th coldest by this measure since 1895.

For cooling degree days, a measure of uncomfortable warmth, 1Q2015 ranked tied for 12th warmest winter at 40% above the baseline. 1Q2012 was the warmest in the series at 136% above the baseline.

Better to blame the languid GDP on the heat than the cold.

Tuesday, May 12, 2015

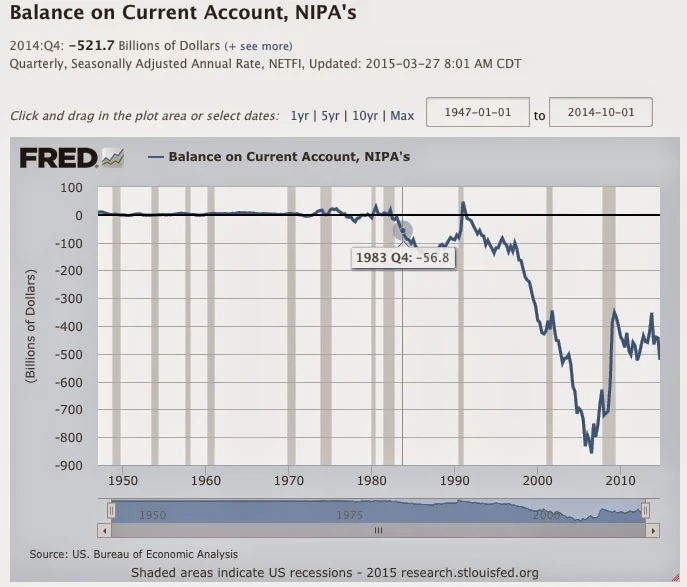

Why we're poorer: America is $10 trillion poorer since 1983 because of libertarian free-trade ideology

That's $10 trillion of GDP we're missing, because net imports are a subtraction from the calculation.

Imagine having an extra $333 billion every year for 30 years: In the last 12 months, GDP is up $670 billion, so we'd have 50% MORE in the last year. Instead we're exporting that GDP to others, building up foreign middle classes at the expense of our own while enriching the few owners at the top in our own country.

Traitors to America they are.

Saturday, May 2, 2015

Bush's GDP in winter was 208% better than Obama's

Bush's nominal GDP record in winter, quarterly change from 4Q to 1Q, recessions excluded, coldest to warmest:

2003: 1.2%

2004: 1.4%

2007: 1.1%

2005: 2.0%

2002: 1.2%

2006: 2.0%

Average: 1.48%

Obama's nominal GDP record in winter, quarterly change from 4Q to 1Q, recessions excluded, coldest to warmest:

2014: -0.2%

2015: 0.1%

2010: 0.8%

2011: 0.1%

2013: 1.0%

2012: 1.1%

Average: 0.48%

Add in the recession winters in 2001, 2008 and 2009 and Bush's average becomes 1.15% in winter, 379% better than Obama's 0.24%.

Labels:

Adolf Hitler,

Barack Obama 2015,

Bush 43,

Climate 2015,

GDP 2015,

winter GDP

Subscribe to:

Comments (Atom)