From the macroeconomic point of view of GDP, jobs and homeownership, the economy under Obama has been a bad joke.

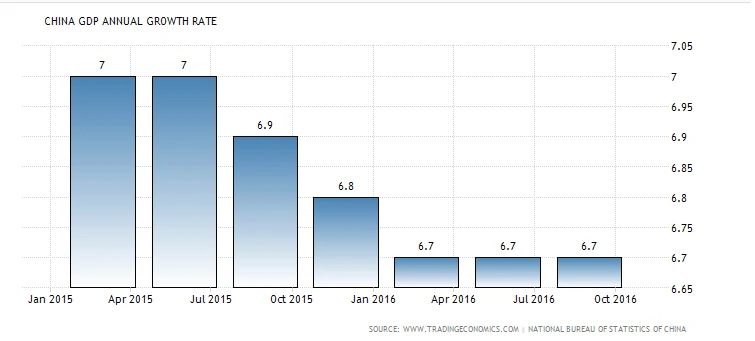

Economic growth is lagging, lagging I say, the horrible, awful George W. Bush . . . by $2 trillion. Current dollar GDP under Obama has grown a paltry 28.2%. Under Bush, the worst in the post-war until now, it at least grew by 41.7%. Obama should kill to have George Bush's economic growth, and Hillary probably will, by starting another war. Nothing boosts GDP like war-spending.

Meanwhile job growth as measured by monthly total nonfarm has slowed in 2016 by over 20% compared with 2015, to 181,000 new jobs monthly vs. 229,000 new jobs monthly last year. Is that a hopeful trend?

And if you think 2015 was so great, it wasn't. If the same percentage of the population had been working in 2015 as worked in 2007, there would have been 7 million more employed than there were. There has been a huge contraction in employment, which explains the GDP problem. Without work there is no product.

You can see this vividly in full-time jobs. Compared to October 2007, we have just 2.6 million more full-time jobs in October 2016 than we had in 2007. Think about that. Just 2.6 million more full-time jobs but population has increased by 22 million. After recessions, full-time has always recovered to the previous highs in 2-3 years, but not under Obama. This time it took 8 years, a terrible stain on the economic record.

Next consider housing. There have been 6.4 million completed foreclosures since September 2008 even as the Feds have done everything they can to get housing prices to recover, distorting the economy to the point that today the typical $247,000 existing home is unaffordable for 90% of individual wage earners. No wonder the homeownership rate, at 63.5%, has plunged to a level last seen in 1985.

In the end about all Hillary surrogates have to boast of is the stock market. Larry Kudlow featured one on his radio program this weekend doing just that. But estimates of how many Americans own stocks vary considerably.

Gallup recently put it at 52%.

Pew in 2013 put it at 45%.

Shockingly, the Federal Reserve itself estimates it's more like 13-15%. In the best case only half the country is reaping benefits from stocks, and probably a lot less than half.

Those people who had the foresight to invest in March 2009 have done extremely well. On average the S&P 500 is up over 17% per year since then through September 2016.

But how have long term investors done, people who buy and hold in retirement accounts? Since the last stock market boom peaked in August 2000, they are up only 4.32% per year. That's almost 64% worse than the historical post-war performance of 11.9% with little upside on the horizon as the market has made new all-time highs and is obscenely valued.

Nothing Hillary Clinton is proposing looks remotely likely to improve any of these measures, except maybe by starting a new war.

My boy will be 18 next year. Please don't vote for her.