Tuesday, June 17, 2025

Thursday, May 16, 2024

It was all inflation, running at 3.4%: Advance retail sales in April up 3% year over year, but flat from March to April

You're just shelling out more for the same stuff, not buying new stuff.

“Today’s retail sales report reflects a pullback in consumer spending that retailers have called out in recent earnings reports,” said Claire Tassin, retail and e-commerce analyst at Morning Consult.

Compared with last April, sales were up 3%, but the Census Bureau doesn’t adjust the data for inflation, which came in at 3.4% on an annual basis in April, according to the latest consumer price index report. That suggests that the sales gains from a year ago are “entirely attributable to inflation, not increased consumer demand,” Tassin said.

Barron's, reproduced here.

Sunday, March 26, 2023

Sunday, July 17, 2022

LOL, nominal retail sales were up 7.7% year over year in Friday's report, but when adjusted for inflation were down 0.5% year over year

Put another way, it went up because you're paying more for food and energy, not because you're letting the good times roll.

YOU ARE SPENDING MORE FOR FEWER THINGS:

Rising costs for food and gasoline in particular helped propel the increase.

More.

Wednesday, July 6, 2022

Legalize mental and mental will trickle down

Illinois Governor J.B. Pritzker signed a bill into law in June 2019 legalizing the recreational use of cannabis by adults, including retail sales beginning on Jan. 1, 2020. The following article covers Illinois' current cannabis laws with summaries of provisions under these laws.

Friday, August 23, 2019

Clueless AP article calls US economy resilient when it's been in the rut they fear is coming since 2007

Friday, April 19, 2019

Friday, December 14, 2018

"Investor confidence cracking" in US, record flight to cash in the last week as China misses on two big measures

Uh oh.

Record $46 bln pulled from US-based stock funds in a week, according to Lipper:

China just reported 'ugly' industrial output and retail sales growth that missed expectations:

Thursday, June 14, 2018

Fake news: Drudge contributes to the false boom narrative

Saturday, January 16, 2016

Another Obama achievement: deliberately bankrupting coal companies, destroying jobs and making electricity more expensive

Wednesday, January 14, 2015

"Retail and Food Services Sales" falls 0.94% in December, which is cautionary for GDP

Friday, May 16, 2014

Warped New York Times views inflation as sign of increased demand

Monday, April 22, 2013

The New Yorker Magazine Engages In Pure Fantasy About The Underground Economy

Wednesday, March 13, 2013

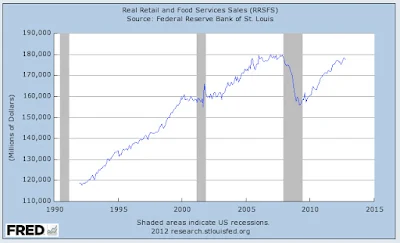

Depression In Real Retail Sales Finally Ends, Beats Old 2006 High

It remains to be seen if the new higher level of real retail sales can be sustained with increased payroll taxes factored in, presumably taking money out of retail circulation. Velocity of M2 and MZM were already at historic lows in Q4 2012 in the post-war period at the temporary lower payroll tax rate.

Gasoline prices were last consistently below $3.00 a gallon in 2010 and since then have averaged about $3.50 a gallon. At roughly 10% of total retail, sudden spikes in gasoline prices can produce expenditure on gasoline which represents a phantom increase to sales, and also mask the fact that miles-traveled remain in depression, a more concrete, so to speak, decline in velocity caused chiefly by enduring low employment by historical measures.

Update, 4-15-13: While the above graph shows real retail, that is, retail level adjusted for inflation, I have found a better representation of reality by Doug Short, reproduced and referenced here, which also adjusts for population growth and removes gasoline because it is really a form of taxation which obscures the underlying level of true retail activity. Bottom line: real retail is actually still about 8% off the 2005 high measured the same way.

Saturday, December 22, 2012

Real Retail Sales Still Remain Below The 2006 Peak

Thursday, November 29, 2012

Monday, July 16, 2012

Another Person Notices Declining Savings Fueled Personal Consumption

Friday, June 15, 2012

Retail Collapses in The Netherlands, Unsold Housing Inventory Nearing Spanish Levels

Monday, November 28, 2011

Consumers Increase Spending in 2011 From Savings and Social Security Tax Holiday

Per the data here from the Census.

Less inflation running at 3.9 percent, the net real increase appears to be 2.9 percent.

|

| $billions monthly |

Unfortunately, about $14 billion of the $26 billion nominal monthly increase could be attributed to a reprieve on Social Security taxation of 2 percentage points on employee compensation running at an annualized rate of $8.3 trillion as of October. That extra money in paychecks is simply being spent.

Where did the remaining $12 billion per month come from?

From savings.

The savings rate has plummeted since January, from a rate of 4.9 percent to 3.5 percent. In January we were saving nearly $47 billion per month, but now only $33 billion, a difference of $14 billion per month.

Add the pernicious work of inflation on top of all that, and the rosy scenario of increased consumer spending doesn't look so good after all, especially since incomes are stagnant to falling. Hours worked year over year are flat, and real average hourly earnings overall are down 1.6 percent, according to the BLS here.

When the Social Security tax holiday expires on December 31, there will be less money available to spend, automatically. Robbing from Social Security for such temporary gains is a gimmick, but don't underestimate the politicians' and the voters' eagerness to repeat it under these grim circumstances. They'll take the money, even if it means saving less, because they need it.