... The last time real GDP hit 5 percent for the entire year was Ronald Reagan’s 1984, where the number was 5.6 percent for that whole year. ...

Here.

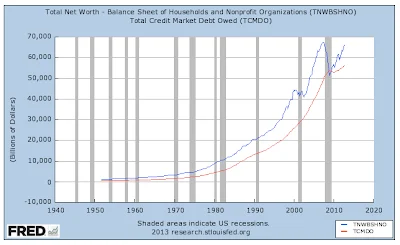

If Larry were completely honest he'd recognize that real GDP growth has been in steady decline in the entire post-war.

The percent change peaks are plain as day, unless you're an ideologue.

We've gone from 8.69% in 1950, to 7.23% in 1984, to 6.15 in 2021 (COVID panic spending), and the dozen or so routine percent change years above 5% between 1950 and 1984 when the economy was still holding its own have disappeared.

|

| click to expand |

The Reagan Revolution didn't do one thing to stem the decline, the Trump Gimmickry even less. In fact, the Reagan Revolution made it worse.

The answer why is paradoxical.

The debt-based economy of the United States ran out of gas under Reagan because he cut the taxes which paid for that debt, too much and on the wrong people. It's still a debt-based economy, but we don't want to pay for it anymore.

This is the infantile cry of libertarianism.

We all think the growth of debt has been the problem when paying for that growth has been the problem. We threw a tantrum and decided to stop paying for it, and its growth naturally contracted, and along with it GDP, in self-defense so to speak.

Growth of TCMDO, the total universe of debt, which steadily climbed the ladder in the post-war, plunged after 1985, from percent change 15.36% to 11.11% in 2004 to 9.51% in 2020 (COVID panic spending).

Debt draws future prosperity into the present, but what you get if you don't pay for it sufficiently is less prosperity when you reach the future from which you borrowed.

And as you pay less, you then borrow even more less so to speak, and get even more less. Rinse and repeat.

Welcome to the future.

It's really that simple.

Taxes have been much too low on the rich, and for a long time, and reversing that is the sober reflection of an age which realizes it made a mistake, starting long before Reagan with JFK, the libertarian cad who bedded more women in the White House than the rest of them combined. His Revenue Act of 1964 passed under LBJ cut the top income tax bracket from 91% to 70%.

The question we have to ask ourselves now is, are we ready to give our system another try and tax everyone, but progressively, and practice fiscal and moral restraint for a change . . .

or are we going to say yes to the billionaires who were made by all this obscene excess and who want to impose an un-American system of feudalism with themselves at the top and the rest of us their humble serfs?

George Washington wouldn't kneel even in church.

I'm with that guy.