Penetrating analysis here from the chief economist at Delta Global Advisors.

November 5, 2009

The Feds Have No Faith in Recovery

By Michael Pento

The stock market has enjoyed a significant rally since the end of the first quarter. The Bureau of Economic Analysis reported last week that the economy grew at a 3.5% annual rate in the third quarter--a figure they achieved by that claiming inflation was running at only a 0.8% annual rate, despite a sharp drop in the dollar, a spike in commodity prices and record highs for gold.

The cyclical bull market in stocks and positive print on GDP has caused some on Wall Street and in Washington to claim the recession has ended. Despite all the good economic news, an end to fiscal and monetary stimulus is nowhere in sight, precisely because policymakers know the happy news is artificially derived.

A closer look indicates that neither the administration nor the Federal Reserve believes its own recovery rhetoric. They understand that the economy will not prosper without continued life support.

I believe removing such artificial stimulus is needed so the country can immediately begin de-leveraging and to prevent the accumulation of yet more baneful debt. What is truly amazing is how many people on Wall Street are foolish enough to postulate that our problems have been solved. The stock market will not be so easily fooled for much longer.

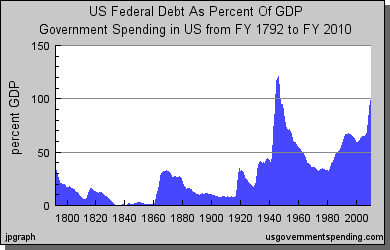

The Great Depression Part II was narrowly averted last year by slashing interest rates to near zero. The Fed made money virtually free because the record level of indebtedness ($34 trillion) in the economy required such low rates so that borrowers could service their obligations. Otherwise a cataclysmic domino effect of defaults and bankruptcies would have occurred. To avoid that scenario, the public sector assumed some of the private sector's debt and then subsequently took on a significant amount more. The debt of the nation continues to increase at a 4.9% annual rate. All public debt is ultimately the responsibility of the private sector to pay off--either directly or through future taxes. As a result, the economy has never been more precarious than it is today.

In spite of this, the stock market appears to be doing quite well. We've seen a 57% rally off the March lows in the S&P 500. However, if you measure the market against other assets its performance is much less impressive. Since the beginning of 2000 the S&P is down about 50% measured in terms of a basket of currencies other than the falling U.S. dollar. The index is down nearly 80% against the real inflation hedge--gold!

The sad truth is that this recent market rally has been produced on the back of a weakening dollar and the slashing of corporate overhead. Cutting payrolls and research and product development projects are not a prescription for sustainable growth. As I like to say, you can't burn your furniture to keep your house warm forever. Eventually, top-line revenue growth must emerge or Wall Street's game of beat-the-expectations will be short lived.

It's also worth noting that a country cannot devalue itself to prosperity and that a bull market cannot survive an inflationary environment for long. In the short run, nominal gains in the averages can occur since everything priced in dollars tends to increase in value. However, the rally will be truncated unless the Fed provides consumers and corporations with a stable currency.

The ramifications of a crumbling currency are vastly misunderstood. A strong dollar is the cornerstone of a healthy economy. It is essential for balanced growth and healthy investment to occur. On the other hand a weak currency decimates the middle class and the corporate sector's ability to maintain earnings growth. Inflation lies behind all infirm currencies, and it is inflation that destroys the purchasing power of consumers. The diminished value of their wallets leaves them with the ability to buy only non-discretionary items. As a direct result, unemployment rates soar and economic output plunges.

I believe we will suffer from a protracted period of stagflation. Money supply, as measured by M2, has increased 5% Y.O.Y. Meanwhile the output of goods and services is falling. As long as the money supply is chasing a shrinking GDP pie, there will be upward pressure on prices.

Making the situation even worse is the manner in which the money supply is growing. The quality of growth is very low because the increase in supply is coming from commercial bank purchases of Treasury debt, rather from an issuance of credit to the private sector for capital goods creation. Total Loans and Leases at Commercial banks are down 8.2% from last year. Meanwhile, the amount of Treasuries held at all commercial banks is up 20% year-on-year.

That means money supply growth is emanating from government's misallocation and redirection of capital. It isn't being loaned out to build mines and factories; it is instead being loaned out to increase consumption and build even more consumer debt.

If the Treasury and Federal Reserve truly believed the economy and the stock market were on a sustainable recovery path, talk of extending and increasing the home buyer's tax credit would be off the table. The Fed would already be reducing the size of the monetary base. The truth, however, is that no one in government really believes in this recovery. If they did, they would be hiking interest rates and the deficit would be shrinking.

The government's realization of our precarious economic condition means its largess will continue. Near term, that may ease some pain. So did the artificial stimulus that gave rise to the housing boom. In the end, a protracted period of a near-zero interest rates, along with endless economic stimulus, will spawn another bubble and not a genuine recovery.

Michael Pento is chief economist at Delta Global Advisors and a contributor to greenfaucet.com.