Thursday, September 19, 2019

Trump shill Andy Puzder complains of non-existent labor shortage, suggests more legal immigration while 3 million teenagers sit idle

[T]he tight labor market is the elephant in the room. ... In July, the most recent month for which we have data, job openings stood at 7.2 million—nearly 1.2 million more than the number of unemployed. ... [A]t some point the economy will need more workers to meet that demand.

That means job training is increasingly important, particularly for discouraged workers who want to re-enter the labor force. ... Higher levels of merit-based legal immigration—as opposed to immigration based on distant family connections—could also relieve some of the pressure.

Both business owners and jobs data tell us the same thing: To sustain the recovery, the U.S. needs more workers.

The real elephant in the room is idle teenagers.

In 1978, 8.1 million American teenagers aged 16-19 had jobs, on average. That was 48.5% of their population of 16.7 million teens at the time.

In 2018 just 5.1 million teenagers worked on average, out of an equally matched population of 16.8 million aged 16-19. That's just 30.4% working.

Apply the 48.5% rate to today's average teen population and presto! 3 million more instantly working than are.

We don't need more immigrants. We need parents to kick their kids' butts, kids who increasingly fail to launch because they are in desperate need of job experience to help them grow up, become responsible and fly straight.

And it would also help to eliminate the minimum wage. What grocery store wants to pay some kid $7.25 an hour to corral shopping carts, restock returns and take out the trash? And adjusted for inflation from 1938, the minimum wage in 2018 should be closer to $4.45 an hour anyway, nearly 39% less than it is.

The higher than it should be minimum wage is a tax on teenage employment. And as with all taxes, the more you tax something the less of that something you get. That's one reason high levels of illegal immigration remain so persistent. It's a natural response to an unnatural situation created by hypocritical politicians who claim to believe in the free market but don't really.

And it's nothing new. We just hoped Trump & Co. would be different.

Labels:

Andy Puzder,

Immigration 2019,

Jobs 2019,

minimum wage,

teen employment,

WSJ

Wednesday, September 18, 2019

Tuesday, September 17, 2019

In 2013 Ilhan Omar let it slip that her father is also the father of her . . . husband

She has deleted the tweet wishing her father a happy Father's Day after being exposed by the imam of peace.

Ew. Just ewincest.

Monday, September 16, 2019

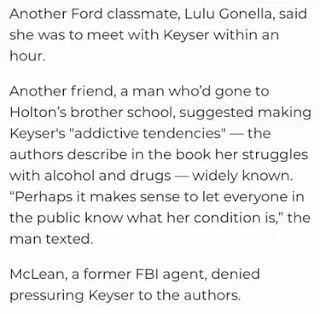

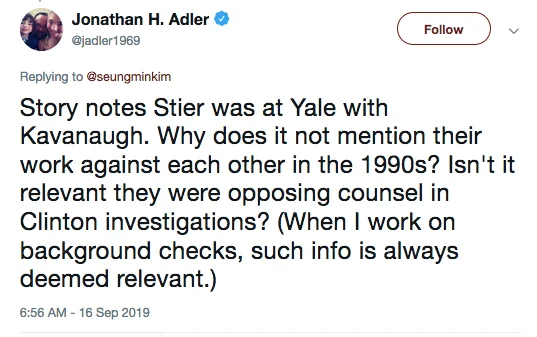

Max Stier, latest Kavanaugh accuser, has possible political motive, omitted by NY Times in addition to omission that victim has no memory of the incident

The New York Times prints a story fit for the bottom of a bird cage.

Ruth Buzzy Ginsburg must be in really bad shape.

Sunday, September 15, 2019

Department of Energy reverses Obama administration overreach on lightbulb rules

Fred Upton's damn lightbulb law remains on the books, of course, but at least the Trump administration is calling a halt to making all lightbulbs even more expensive than they already are because of it.

My wasteful, liberal neighbors, but I repeat myself, here in Michigan routinely leave all their outdoor lights on all day as well as all night, but I have to pay more and more for energy efficiency. They also leave their garage doors wide open most days in winter.

Freedom which wastes cents makes no sense.

A final rule set to be published in the Federal Register on Thursday allows the continued sale of four types of incandescent and halogen light bulbs: three-way lights, recessed can lights, candle-shaped lights used in chandeliers and round bulbs often found above bathroom mirrors. The rule is expected to be challenged in court.

The Obama administration, just as it was winding down, published a rule that eliminated exemptions that were part of the 2007 law. Under the Obama rule, the four types of light bulbs would be subject to the efficiency standards set to take effect on Jan. 1, 2020.

The Trump administration’s rule restores exemptions granted to the four products. The Energy Department said the Obama administration’s decision was “not consistent with the best reading of the statute.”

The department also said it doesn’t intend to move forward with new standards to improve the efficiency of the pear-shaped light bulbs called general service incandescent lamps. The tighter standards are “not economically justified,” according to the proposal, which is open for a 60-day comment period.

Saturday, September 14, 2019

Friday, September 13, 2019

The contagion of the record low 10-year Treasury yield of July 2016 has spread to the 30-year in August 2019

The yield on the U.S. 10-year Treasury note settled at 1.367% Tuesday, breaching the previous close low of 1.404% set in July 2012 when investors rushed into haven debt amid the depth of the eurozone’s sovereign debt crisis. Yields fall as bond prices rise. ...

On an intraday basis, the U.S. 10-year yield touched as low as 1.357%. It was 1.446% Friday and 2.273% at the end of last year. The U.S. bond market was shut Monday for a holiday.

Traders say the 10-year yield still has room to fall. Investors and analysts say bond yields are in uncharted waters now and that it is hard to predict how low yields could go in this environment.

Few in the financial markets have foreseen a period of negative interest rates touching off globally. The total of sovereign debt with negative yields jumped to $11.7 trillion as of June 27, up $1.3 trillion from the end of May, according to Fitch Ratings.

The pool is likely to expand further in the months ahead due to ongoing purchases of government bonds by the European Central Bank and the Bank of Japan. ...

The 30-year Treasury bond has been the market darling, and the buying spree has pushed down its yield to record lows lately. The 30-year bond’s yield settled at 2.138%, falling below its record close low of 2.226% Friday.

The 30-year bond was usually the playground for pension funds and insurance firms. But it is now being bid up by a broader investor base due to the global hunger for income. Analysts say it wouldn’t surprise them if the 30-year yield falls below the 2% mark in the weeks ahead.

Three years later:

In late Wednesday trading, the yields on 30-year government bonds were 1.939%, down 2.2 basis points from late Tuesday. They hit an all-time low of 1.905% earlier Wednesday.

Last night's Democrat debate was so bad . . .

. . . I couldn't find one tweet mocking it worth reproducing here.

There's exhaustion out there, people.

Thursday, September 12, 2019

Subscribe to:

Comments (Atom)