Sunday, October 16, 2011

Arrests Spread as Occupy Wall Street Spreads

Like a disease.

Last time I checked, ZERO Tea Partiers have been arrested for anything since 2009, but just over the weekend unruly Occupy Wall Streeters in scores have been arrested:

175 arrests in Chicago;

another two dozen in New York City (where police were injured);

an unknown number of arrests in Tucson;

maybe 40 in Phoenix;

and at least two dozen in Colorado.

See the AP story here.

Tea Partiers protested bailouts in the name of free market capitalism's cure for failure: bankruptcy. They showed up at the ballot box in November 2010 and put a stop to Barack Obama's Democrat Party. Now they wait for November 2012.

Meanwhile, Occupy Wall Streeters suddenly decide to protest bailouts in the name of bailouts for their student loans, a living wage, and sundry other entitlements which don't yet exist but they hope to extract by mob action and intimidation, the modus operandi of the unions.

A cold snap can't come soon enough, or a flu epidemic.

Labels:

bankrupt,

Barack Obama 2011,

Climate 2011,

CNBC,

Education,

Occupy Wall Street

Is The Price of Owning the S&P500 Low, or High?

Everything depends on how you calculate the price.

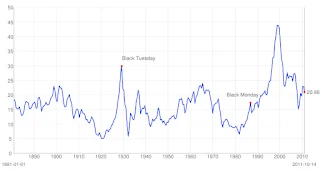

This way, where the financial crisis in 2007-2008 represents the all-time high:

Or Shiller's way, where the peak was way back in 1999:

Bailed Out GSEs Send 87 To Mortgage Bankers Association Annual Convention, Spend At Least $227,000 Of Your Tax Money For Fling In Chitown!

The New York Times has all the gory details here.

Friday, October 14, 2011

Richard Viguerie Rips Romney and Cain New Ones For Supporting TARP

Here:

Defending TARP should burst Herman Cain’s populist bubble, but Romney in particular, defended the 2008 bank bailout in one of the most disingenuous statements of the evening, if not the entire debate cycle.

According to Governor Romney, the $700 billion Wall Street rescue package "was designed to keep not just a collapse of individual banking institutions, but to keep the entire currency of the country worth something."

Noting could be further from the truth and Romney knows it.

ObamaCare's Long Term Care Insurance Provision Bites The Dust Already

Because its costs were too high to attract participation, as reported here:

Monthly premiums would have ranged from $235 to $391, even as high as $3,000 under some scenarios, the administration said. At those prices, healthy people were unlikely to sign up.

Well duh! Healthy people who signed up at age 50 not long ago could get excellent coverage for two people for less than $60 a month through Barack Obama's favorite fascist, Jeff Immelt of GE.

Government does very little well, and never cheaper than the private sector.

Rep. Bachmann Finally Sends Me An Email!

Gee, I signed up sometime in June for campaign updates, and never heard a thing. I complained about the fact, here, later that month.

Suddenly today, four months later, I get an email asking me to fill out a survey and to contribute to the campaign.

Well, we've had PerryCare = ObamaCare since then, which really is unfair to ObamaCare, and now 999 upside down is 666 and such like. Not exactly what I want my president to be saying out loud.

"Sundown, ya better take care . . .."

Well, we've had PerryCare = ObamaCare since then, which really is unfair to ObamaCare, and now 999 upside down is 666 and such like. Not exactly what I want my president to be saying out loud.

"Sundown, ya better take care . . .."

Flashback to Obama, March 2009: "Nobody would be happier than me to stay out of it. I have more than enough to do without having to worry about the financial system."

Quoted here:

"Well, I just think it’s clear by the time we got here, there already had been an enormous infusion of taxpayer money into the financial system. And the thing I constantly try to emphasize to people if that coming in, the market was doing fine, nobody would be happier than me to stay out of it. I have more than enough to do without having to worry the financial system. The fact that we’ve had to take these extraordinary measures and intervene is not an indication of my ideological preference, but an indication of the degree to which lax regulation and extravagant risk taking has precipitated a crisis."

Matt Taibbi: Elizabeth Warren For President in 2012

Just a little humor to start the day.

Matt Taibbi, already deeply dissatisfied with Obama in October 2009, said that here:

"Warren to me makes the most sense for the simple reason that it will be virtually impossible for the Democratic Party hacks to dismiss her as a fringe character, given that they themselves gave her such a big public position as chief of the Congressional Oversight Panel.

"This is a woman who understands the finance issues as well as we can hope to expect from any politician . . .."

You know Elizabeth Warren. She's the one who repeatedly said here "the rest of us paid for" everything which the rich used to get wealthy, so they owe us, as if the rich hadn't already paid one red cent in taxes for any of those things, too.

Yep, that's the best reasoning we can hope to expect from the Democrats.

Thursday, October 13, 2011

Weekly Standard: Income Growth Has Slowed and Gone Negative in August?

See the figures, especially in Table 1 here, at the Bureau of Economic Analysis.

After reaching a peak in July, August personal income fell below that of July, but is still higher than personal income was in June, and January.

The Weekly Standard is making much of the steady decline in income growth so far in 2011 here, but without once mentioning the boost to incomes the temporary reduction in the payroll tax was supposed to supply.

According to the Bureau of Labor Statistics here, average weekly hours have been stagnant for a year, so income gains cannot be coming from more hours worked. In fact, all other things being equal, you would expect nominal income to remain the same. Which is to say, no one is getting much of a raise, but they still have jobs.

But here the BLS shows that average weekly earnings have increased 1.85 percent year over year in August 2011.

Hm.

Interestingly enough, the difference between a payroll tax of 6.25 percent on $100 of income and 4.25 percent on $100 of income is . . . $1.82 less tax, going straight into people's paychecks.

And after 7 months in 2011, using the seasonally adjusted annual numbers of the BEA, income is up 1.94 percent, including the downtick in August.

1.85, 1.82, 1.94 . . . looks like a pattern to me.

Nominal incomes are up slightly in consequence of the payroll tax cut. Otherwise, it's a stagnant income picture, just like the unemployment picture.

Unless of course you factor in CPI and discuss real incomes. But that's a whole other, and very real, problem.

Labels:

BEA,

BLS,

Jobs 2011,

Personal Income,

Social Security,

The Weekly Standard,

The Worker

Involuntary Part-Time Has Surged 10 Percent in September Since July 2011

Herman Cain's 999 Plan is Under Attack by Bloomberg and WAPO

Herman needs to respond with numbers, and soon.

Occupy Wall Street Demands Student Debt Bailouts

So says Scott Cohn for CNBC.com here:

One proposed list of demands for the Occupy Wall Street movement includes "free college tuition" and "immediate across the board forgiveness" of student debt. While neither demand may be very realistic, the student debt problem is very real.

According to FinAid.org, which carries a "student debt clock" on its website, outstanding student debt is on pace to top $1 trillion in a matter of months. Student debt surpassed credit card debt in 2010, and has not looked back. The average 2011 college graduate had $27,204 in student debt, according to the organization.

The price of worship at the altar of the god, Education. Its high priests rob the easy.

Wednesday, October 12, 2011

Why Elites Think They Can Say The Middle Class Has All The Money, So Tax Them Instead

Because the top ten largest tranches of net compensation aggregates spanned incomes from $20K to $70K in 2009, for example, that's why.

And 8.2 million people in the $35-$40K category had the single largest pile of dough at nearly $310 billion, while the lowest tranche in the top ten were the 3.1 million people who had nearly $211 billion in net compensation and hailed from the $65-$70K category.

All told, over 68 million wage earners in the $20K to $70K category pulled in $2.7 trillion in net compensation, not quite half of the total $5.9 trillion.

The only thing is, the richer have a lot of income which escapes the categorization called net compensation by the federal government, at least another $2.5 trillion. That's how total adjusted gross income for the whole country gets to $8.5 trillion and higher on some 140+ million tax returns.

When it comes to compensation, however, it is the human factor which gives these numbers some life:

73 million people made less than $25K in 2009 (totaling less than $750 billion);

41 million made between $25K and $50K (totaling $1.5 trillion);

19 million made between $50 and $75K (totaling $1.2 trillion);

another 8 million made between $75 and $100K (pulling in together barely $716 billion);

and at the top were 9.5 million people making in excess of $100K. They alone accounted for $1.8 trillion in net compensation in 2009, the single largest sum.

If I were them, I'd try to move the spotlight somewhere else, too.

Democrat Rep. Steny Hoyer Blames Gridlock on Voters Last November

Here:

“The American people have every right to be angry [and] disappointed by the performance of the Congress.

“Of course, the American people have also elected people with hard stances, so that to some degree the American people are realizing the results of their votes.

“If elections have consequences — which I think they do — some of those consequences are getting what you vote for.

“In this case, many people voted for people who thought compromise was not something that they ought to participate in.”

Firm grasp of the obvious there, Steny. We voted to stop you and prefer things this way to the alternative.

But there was plenty of gridlock before we stopped you, too. When Democrats ruled the roost in 2010, unactioned bills in the Democrat-controlled Senate sent to it by the Democrat-controlled House went from 290 at the beginning of 2010 to 420 a month before the November elections.

For that kind of impotence there is no pill.

Tuesday, October 11, 2011

Whatever It Is, What We Have Is NOT Free-Market Banking

John Carney is absolutely correct:

In a system of fiat money controlled by a central bank, with fractional reserve banks backed by deposit insurance, characterized by enormous mega-banks that have grown so large primarily because of concentration-inducing regulation, there is no pre-existing free market into which the government can intervene.

Read the rest here.

This is where all the trouble begins: "Our money is your money, we print it for you to use."

It's the only game in town, until it isn't. And until it isn't, we don't have to like it.

Misery Index Hits Highest Level in 28 Years

From a Herman Cain economic adviser here:

There is certainly more than enough misery to go around. With the unemployment rate at 9.1%, and the 12-month change in the CPI at 3.77%, the “misery index,” the sum of the two, in August was 12.87, its highest level since May, 1983. And, last week’s report that the unemployment rate remained stuck at 9.1% in September means economic misery remains high.

Subscribe to:

Comments (Atom)