Monday, December 23, 2024

Sunday, December 22, 2024

Fox News dipshit says Trump gave a masterclass lol

DAVID MARCUS: De facto President Trump's handling of shutdown threat was a masterclass

The piece of legislation which the boss said at 4:00 PM on the 19th was very important and even vital to making America great again was defeated 235-174 not three hours later at 6:54 PM lol.

Maybe the dumbest line though was this:

. . . having slayed the dragon of out-of-control spending . . ..

David is too dumb to understand that a continuing spending resolution simply continues the spending which already put fiscal 2024 $1.9 trillion in the hole.

The extra $100 billion for the tent people of Western North Carolina is just the insult added to the injury.

I seem to recall that throughout the aftermath of the hurricanes there was vigorous protestation from the right about FEMA still having plenty of money and they didn't need any more. But here we are.

Saturday, December 21, 2024

Do you think these guys even once sat down together to discuss the continuing spending resolution before this week's fiasco?

Maybe James Braid, new Director of the Office of Legislative Affairs, knows lol.

|

| Is this James Braid? |

Luigi's mom: I could see him doing something like that

When detectives reached out to accused CEO killer Luigi Mangione’s mother after the first photos of the suspect emerged, she said she wasn’t certain it was him – but told investigators the shooting “might be something that she could see him doing,” a New York Police Department official said Tuesday.

Here.

The US House passed a continuing spending resolution through March 14, 2025 at 5:59PM yesterday, the US Senate passed it this morning at 12:23AM, averting a federal government shutdown

The House roll call vote (366-34-1-29nv) is here. 34 Republicans voted Nay.

The Senate roll call vote (85-11-4nv) is here. 10 Republicans voted Nay, as did pinko commie Bernie Sanders.

The continuing spending resolution includes NO extension of the suspended debt ceiling time limit demanded by president-elect Trump, who now gets to waste his precious time trying to primary all 170 Republicans in 2026 who just voted for this

LOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOL,

something he had threatened on Wednesday.

170 House GOP just told Donald J. Trump Nay Nay by voting Yea, proving once again that he is just a paper tiger.

Meanwhile the debt ceiling and the income tax remain chief among the failed gimmicks of the Progressive Era, dating to 1917 and 1913. The one hasn't stopped the debt from exploding to $36 trillion, and the other hasn't paid that bill.

The continued existence of these gimmicks serves to remind us, but only periodically, of the lies we tell ourselves, which is why we have to keep them.

Friday, December 20, 2024

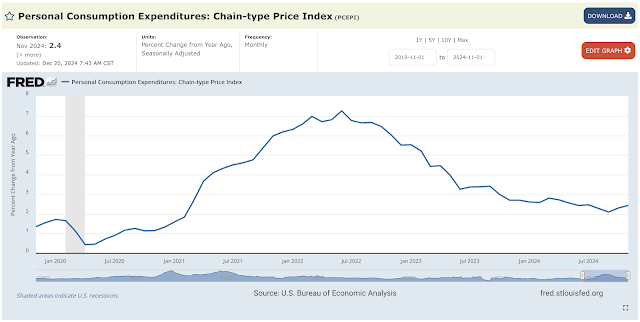

Stock market cheerleaders say inflation data is encouraging, lower than expected, but it's up lol

Dow bounces 800 points Friday on encouraging inflation data after rough week: Live updates

Key Fed inflation measure shows 2.4% rate in November, lower than expected

These people are incorrigible liars.

Headline pce inflation ticked up from 2.30% year over year in October to 2.44% in November.

Core pce inflation ticked up from 2.79% year over year in October to 2.81% in November.

"We expected worse! Buy stonks!"

And so they did.

Thursday, December 19, 2024

S&P 500 Equal Weight Index down 7.25% in December to date, US Treasury yields up a net 2.13% in the aggregate since the end of November

Both stocks and fixed income down at the same time is a real bummer, you know, like in 2022.

UST yields in the aggregate tonight are at 4.45 vs 4.356 at the end of November.

UST yields have risen 375 basis points net in the aggregate in the three months since the Fed started cutting the Fed Funds Rate on September 18. That's +6.93%, which is hilarious.

Trump's first defeat lol: You might say the two billionaires were shown who's boss

Second continuing spending resolution goes down in flames, after Elon Musk and Donald Trump said Nay to the first one, which never even came to a vote. Speaker Johnson and the Democrats had worked on that compromise deal for three months.

The roll call vote is here.

CNBC story here.

Extremely amusing.

|

| The Republicans Who Said Nay |

Trump's a Democrat now lol

Making chumps of us all.

President-elect Donald Trump said Thursday that Congress should get rid of the debt ceiling, a day after he came out against a deal reached by congressional lawmakers to fund the government before a shutdown occurs.

In a phone interview with NBC News, Trump said getting rid of the debt ceiling entirely would be the “smartest thing it [Congress] could do. I would support that entirely.”

“The Democrats have said they want to get rid of it. If they want to get rid of it, I would lead the charge,” Trump added.

Trump suggested that the debt ceiling is a meaningless concept — and that no one knows for sure what would happen if it were to someday be breached — “a catastrophe, or meaningless” — and no one should want to find out.

“It doesn’t mean anything, except psychologically,” he said. ...

In his call Wednesday for Republicans to ditch the negotiated bipartisan short-term spending bill, Trump also demanded that lawmakers increase the debt ceiling — something that hadn’t been on the table at all.

I can't wait for Moody's to downgrade the USA from Aaa to Aa, to make it a Trinity of lost AAA.And why not? It's only pSyChOlOgIcAl.

The UK Daily Mail thinks Joe Biden dropped out on June 21, not July 21 lol

Those UK reporters really don't have a firm grasp of the timeline. They prefer to concentrate on the gossip and innuendo.

A particular target for the First Couple is said to be former house speaker Nancy Pelosi, who led the effort to push Biden out of the 2024 election race – personally calling him and demanding he quit in the hours before he withdrew on June 21.

More.

No one really knows what Pelosi said to Joe, or when she said it, but it wasn't on June 21 lol.

CNN reported on Wednesday July 17 (updated Thursday July 18) that Pelosi had been in California since Friday July 12, one day before Trump was shot in Butler, PA, and that she claimed she hadn't spoken to Joe Biden from July 12-17 even though CNN said it had four sources saying she had:

This phone call would mark the second known conversation

between the California lawmaker and Biden since the president’s

disastrous debate on June 27. While the exact date of the conversation

was not clear, one source described it as being within the last week.

Pelosi and Biden also spoke in early July. ...

A Pelosi spokesperson told CNN that the former House speaker has been in California since Friday and she has not spoken to Biden since.

The CNN timeline leaves room for Pelosi talking to Joe Biden as described in the story on Friday July 12, or even the day or two days before that.

CNBC reported on Sunday July 21, the day Joe dropped out, and relying on one source, that Pelosi spoke with Joe on Saturday July 20, but Pelosi's spokesman also denied this, consistent with the denial to CNN:

A spokesman for Pelosi later told CNBC after publication of this story “not true. Speaker Pelosi has not spoken to the president since she left Washington more than a week ago.”

Pelosi was in North Carolina on Saturday July 20 giving a tepid pep talk about the accomplishments of the Biden-Harris ticket:

In her roughly half-hour speech, Pelosi said the president’s name only sparsely, and primarily in reference to his role in passing legislative priorities.

Wednesday, December 18, 2024

US Treasury yields are looking more normal!

UST averages tonight: Bills 4.365 Notes 4.410 Bonds 4.695.

Low duration issues yield the least, long duration issues the most, and the middle looks like the middle should look, middling.

That's how it should be.

Low duration issues have been dominating the curve, yielding the most. Why, just at the beginning of the month the 1MO still yielded 4.75, more than any other security. Tonight the 1MO yields 4.44 and the 20Y yields 4.74, the leader. The yield laggards are the 6MO and 1Y at 4.30. That's what you want to see happen.

The Fed today dropped the Federal Funds Rate 0.25 points to 4.25. I expect the short end to keep moving lower as a result, and the middle to rise more in tandem with the long bonds as inflation continues to bite.

But we shall see.

The Fed Chair Jerome Powell gave them what they wanted, a one quarter point interest rate cut, and the spoiled markets threw a fit anyway because of what he said about next year

The S&P 500 Equal Weight Index is down almost 7% this month, to date.

Meanwhile, more inflation for the rest of us, which Powell has never really tried to stop. You know, like Christianity hasn't failed, it just hasn't really been tried.

Tuesday, December 17, 2024

The idiots at Newsweek think the House Republican majority is in peril in part because of Lori Chavez-DeRemer going to Trump's cabinet, not realizing she lost her election and is not part of the 220 equation to begin with

Republican House Majority in Peril

The Republican wafer-thin majority in the House of Representatives is facing growing uncertainty as GOP members of Congress line up for Donald Trump's Cabinet. ...

[Victoria] Spartz's move [not to caucus with the Republicans] could throw the slim Republican majority in the House into peril amid other GOP members of the House being tapped to serve in Trump's Cabinet. ...

Representative Lori Chavez-DeRemer of Oregon has also been nominated to serve as labor secretary. ...

Waltz has already submitted his resignation and, combined with Gaetz's resignation and the possibility of Spartz refusing to caucus with Republicans, as well as Stefanik and Chavez-DeRemer being confirmed to Cabinet positions, the Republican majority could collapse, jeopardizing their ability to advance Trump's agenda.

Waltz counts, Gaetz counts, and Stefanik counts, taking the 220 win down to 217 temporarily. Spartz not caucusing with the GOP creates a 216-215 GOP majority, not a 215-215 tie as Newsweek shows. Spartz remains a Republican, however, and presumably will vote with the Republicans.

The uninformed Newsweek writer is from . . . the UK lol.

And, of course, Drudge just repeats the stupidity:

Republican House Majority in Peril...

Average US Treasury yields aggregated monthly started to normalize in November as yields fell for bills but rose for bonds

Interpreted politically one could say yields for notes and bonds reversed their slide starting in October as Harris' lead evaporated at the end of September and bond markets started to bet on a Trump win, bringing with it higher deficits because of his proposed tariffs and tax cuts.

Monday, December 16, 2024

We're finally getting some yield curve interest rate normalization with the 1MO yield leader being replaced by the 20Y, as it should be

The UST Bills end averages 4.353 as of Friday Dec 13th, while the Bonds end averages 4.650.

Still soft in the middle, though, with Notes averaging 4.288. Would like to see Bills and Notes the reverse of that for a nicely steepened slope from short duration to long.

Sunday, December 15, 2024

It's good to know that Luigi Mangione's new lawyer thinks assassinating people is bad lol

So they're going to plead "not guilty by reason of insanity", right?

Based on this hire he must be crazy.

Saturday, December 14, 2024

Mitch McConnell, 82, has five of nine lives left, sprains wrist in fall

Mitch fell in 2019 and broke a shoulder, requiring surgery.

Last year he fell and was hospitalized with a concussion.

Mitch is a childhood polio survivor who in the US Senate saw to it that Trump's appointments to the Supreme Court were confirmed.

I have had nothing good to say about Nancy Pelosi ever, but I wish her well all the same

Having a hip injury at 84 is really bad news. It can be a death sentence. I don't wish that on her, and neither should anyone else.

Friday, December 13, 2024

Inflation impact on low income households is more like 6.3% when weighing necessities higher, says retail expert Howard Jackson

The Wall Street Journal reports here, also saying low income wage growth now lags everyone else's:

Howard Jackson, president of retail-focused firm HSA Consulting, estimates that inflation has actually averaged about 6.3% over the past 12 months for low-income households. Jackson said this estimate adjusts the consumer-price-index basket to weigh necessities—such as rent, utilities and food—higher than things they tend to spend less on, such as cars, furniture, clothes and consumer electronics. His estimate considers what items constitute the food basket, based on surveys of low-income consumers. “If you don’t have much money, you keep your pair of jeans a lot longer. Those are the purchases that get deferred,” Jackson said.

Spineless jellyfish Pete Hegseth does 180 on women and gays in the military lol

Hegseth does a 180 on women and gays in combat

Hegseth has called policies allowing gays and transgender troops to serve in the military part of a “Marxist agenda.” But on Thursday, when he met with Sen. Rand Paul (R-Ky.), reporters asked him whether he thought gays should serve in the military, and he replied, “Yes.”

And once an unapologetic critic of women serving in combat roles, Hegseth called women “some of our greatest warriors” during a recent Fox News appearance. ...

Hegseth has been working to explain himself behind closed doors. [Senator] Collins, after meeting with him for nearly 90 minutes, told reporters that he had backpedaled on women in combat. ...

“He was asked in our post-meeting gaggle [with reporters] whether he was supportive of women in combat and his answer was he was supportive of that,” [Senator] Hawley said. ...

“I heard he was changing his tune a little bit on women in combat,” said Sen. Tommy Tuberville (R-Ala.), a Trump ally. “Sometimes you make comments that you don’t really want to stand by, sometimes, you know, when you’re not up for confirmation.”

Thursday, December 12, 2024

More inflation: Core producer prices, aka core wholesale prices, have been up four months in a row measured year over year, the last three increases all above 3% yoy

3.2%, 3.4% . . . and 3.5% year over year now in November 2024.

Overall prices are up 3% yoy in November.

Wholesale prices rose 0.4% in November, more than expected:

Final-demand goods prices leaped 0.7% on the month, the biggest move since February of this year. Some 80% of the move came from a 3.1% surge in food prices, according to the BLS.

Within the food category, chicken eggs soared 54.6%, joining an across-the-board acceleration in items such as dry vegetables, fresh fruits and poultry. Egg prices at the retail level swelled 8.2% on the month and were up 37.5% from a year ago, the BLS said in a separate report Wednesday on consumer prices.

The Fed is expected still to cut again at the next meeting despite all the evidence pointing to persistently high and increasing inflation, hiding behind the skirts of fear of job losses, a smokescreen for gifting easier money to speculators, and to federal authorities who now need to finance $36.1 trillion in the national debt at lower rates.

20Y and 30Y bonds are revolting, demanding 4.624 and 4.551 as we speak, now the highest yields across the curve, as the short end yields in US Treasury bills come back down to earth.

Subscribe to:

Comments (Atom)