Saturday, January 11, 2014

Those usually working part-time have not increased in number since passage of ObamaCare in 2010

|

| November 2008 through December 2013 |

And that's because the government measure of part-time doesn't care if you work 29 hours, 30 hours or 34 hours per week . . . all are equally part-time schedules to the Bureau of Labor Statistics.

The increasingly less deep lows in the summers since 2010 are consistent with the long term trend of increasing part-time work as population grows. Significant new highs above 28 million, however, remain non-existent.

Crony Capitalism Is A Feature, Not A Bug, Of Contemporary Liberalism

Jeffrey Snider, here:

Employment grows not on the pace of redistribution-derived consumer spending in the lower classes, but as new firms innovate and grow to replace older firms that have seen their last days. Failure and rebirth are the capitalist "secrets", and demand always follows supply in that line. Interrupt it at your peril.

Unfortunately, we see in the 21st century a different strain of imperialism that is rooted in Hobson's preferred solutions to it. By giving government more power over industry and business, Hobson suggested that government would be able to end business agitation toward external colonialism. But in doing so, governments have introduced the seeds of cronyism that take the form of internal imperialism. Big businesses have achieved regulatory leverage in a manner that may preclude the innovation and business cycles from creating that positive economic trajectory. And monetary policy, all in the name of aggregate demand, appears to be playing a large role.

... OWS [Occupy Wall Street] and its sympathizers ... are really protesting their own philosophies put into practice via a bastardized capitalism - so corrupted by devotion to aggregate demand in this era that it can hardly be referred to as such.

There will never be, and has never been, any such thing as fully free markets, nor should there be. What we are arguing is not absolutes but proportions. ... In perhaps the greatest and most tragic of ironies here, the Fed appeals directly to inflation as a means to destroy savings, an impulse to which I have to think Hobson would readily approve, but that inflation is itself a means of redistribution that further concentrates savings among the wealthy. More than an irony, it seems as if this inconsistency is a feature of this philosophy, as taken to its logical ends it produces something akin to circular reasoning. It is a place where the socialists of OWS criticize directly the tools of socialist monetary policy as if they are anything apart from each other.

New study finds psychotic episodes occur at an earlier age among marijuana users

Yahoo reports here:

Among more than 400 people in South London admitted to hospitals with a diagnosed psychotic episode, the study team found the heaviest smokers of high-potency cannabis averaged about six years younger than patients who had not been smoking pot. ... The researchers found that males were more likely overall to use cannabis and also had a younger age of onset of psychosis. The mean age at the time of the first psychotic episode for male users of cannabis was 26, and for female users was nearly 29. That compared with nearly 30 years old for male non-users and 32 for female non-users.

Friday, January 10, 2014

December 2013 Unemployment Falls To 6.7%, Total Nonfarm Jobs Up Only 74,000

The employment situation report for December 2013 is here.

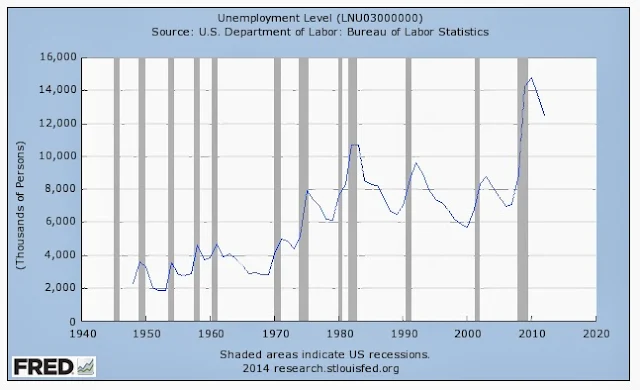

The headline rate falls to 6.7% ending 5 years of unemployment at or above 7%, with massive numbers of people continuing to leave the labor force.

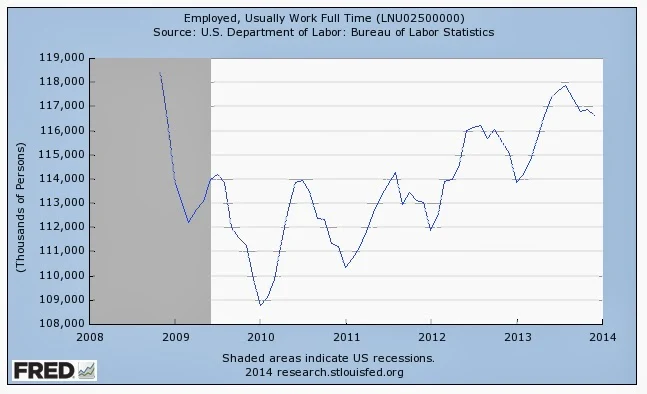

In the last year the number counted as unemployed fell 1.9 million, while nonfarm employment grew at a rate of 182,000 per month in 2013 vs. 183,000 per month in 2012, or 2.18 million. Roughly a wash.

Total nonfarm employment continues below the 2007/2008 peak of 138.1 million, still lagging that level by 1.2 million fully 6 years later (seasonally adjusted) despite growth in the population since that time of at least 14.3 million.

The headline unemployment rate has fallen from 7.9% at the beginning of 2013 to 6.7% at the end largely because those not in the labor force increased by 2.89 million in the last year (not-seasonally-adjusted). The not-seasonally-adjusted level reached a new high at 92.338 million. People who leave the labor force are not counted as unemployed.

In the 8 years from 2001 through 2008 under Bush those not in the labor force increased by 10.3 million, or 14.7%. That record has already been matched under just 5 years of Obama: 11.3 million have left the labor force, or 14.0% (numbers seasonally adjusted).

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

Thursday, January 9, 2014

Wednesday, January 8, 2014

Rush Limbaugh Today Totally Botches Income Quintiles On The Program

|

| "You keep using that word. I do not think it means what you think it means." |

The relevant passage is here:

Poverty is expressed as an income level. Most economists break down income in America to five brackets, called quintiles, and people move in and out of these. The top quintile, I think, is like a million plus, and that'd be the top 1% of 1%. I forgot what the breakdown is, but the poverty level, it's roughly, what, $14,000 for a family of four? It's around there. People move in and out of these all the time.

------------------------------------------------------------------------

This is rich.

A quintile in this instance is one of any of the five groups of American households divided into those five groups based on how much money they make.

By definition, then, the top quintile is the richest 20% of households in America. So it's impossible for the top quintile to be "the top 1%", let alone "the top 1% of 1%".

As embarrassing as that is, Rush has absolutely no concept what it means to reach the top 20% of household income in this country.

The fact is it doesn't take all that much, and certainly nothing close to $1 million, hard as it may be to get there.

Currently the point in the middle of the top 20% of households by income is only about $181,905 per annum. That means about half the people in the top quintile make more than that, and about half make less. And interestingly enough, the middle of the richest 5% of households in this country isn't anywhere close to $1 million, either. The average household income of the top 5% is just $318,052. (For a good presentation of the data, see here.)

And Rush is equally out of touch about what it means to be poor. The federal definition for a family of four is about $23,500, not $14,000. The latter is about what it means for just one person to be poor, not four (see here).

Rush Limbaugh complains constantly about the sorry state of public education in this country. He even did so today in the same segment:

[L]ook at [President] Johnson's solutions. Education, job training, medical care, housing. That hasn't changed. The same weapons, the same language, the same way they tug at heartstrings. It's 1964, and they keep using the same lingo, obviously because it works. But look at how our education system's been since 1964 with them in charge.

Yep. Look at how it's been.

Rush is Exhibit A . . . the most popular radio host ever for a reason.

Tuesday, January 7, 2014

Monday, January 6, 2014

"Ben Bernanke Has An Almost Unbroken Record Of Being Wrong"

Bye Bye Ben.

Seen here:

Ben Bernanke has an almost unbroken record of being wrong.

In 2006, at the zenith of the housing bubble, he told Congress that house prices would continue to rise. In 2007, he testified that failing subprime mortgages would not threaten the economy.

In January 2008, at a luncheon, he told his audience there was no recession on the horizon. As late as July 2008, he insisted that mortgage giants Fannie Mae and Freddie Mac, already teetering on the verge of collapse, were “ adequately capitalized [and] in no danger of failing.”

Following the Crash of 2008, Bernanke’s prognostications did not much improve. Nor did Yellen’s, who had also misjudged the housing bubble, and who became Fed vice chairman in 2010.

The two of them got the “recovery” they predicted, but the weakest “recovery” in history.

Labels:

Ben Bernanke,

Fannie Mae,

Federal Reserve,

Freddie Mac,

Housing 2014,

Janet Yellen

Peter Wallison Says The Housing Bubble Is Back

Here in The New York Times, where he blames sub-prime down payments, not interest rates:

Between 1997 and 2002, the average compound rate of growth in housing prices was 6 percent, exceeding the average compound growth rate in rentals of 3.34 percent. This, incidentally, contradicts the widely held idea that the last housing bubble was caused by the Federal Reserve’s monetary policy. Between 1997 and 2000, the Fed raised interest rates, and they stayed relatively high until almost 2002 with no apparent effect on the bubble, which continued to maintain an average compound growth rate of 6 percent until 2007, when it collapsed. ... Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent.

Many commentators will attribute this phenomenon to the Fed’s low interest rates. Maybe so; maybe not. Recall that the Fed’s monetary policy was blamed for the earlier bubble’s growth between 1997 and 2002, even though the Fed raised interest rates during most of that period.

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down. ...

When down payments were 10 to 20 percent before 1992, the homeownership rate was a steady 64 percent — slightly below where it is today — and the housing market was not frothy. People simply bought less expensive homes.

Obama Has Completed 160 Golf Outings In The Last 5 Years: The Practice Hasn't Helped

White House Dossier here reports that the president golfed 9 out of the 15 days while on his Hawaiian vacation, which means Moochelle was pretty much a golf widow during the time.

She did not return to DC with her family. The cost to the taxpayers of this early "birthday gift" of an extended stay may come to as much as $200,000 or more according to a separate entry here.

The Washington Times noted here the family's vacation was already "regal", and featured a video in which the president misses a long put on a green and then takes what he clearly deems a "gimme" but misses it, and picks it up off the green, not out of the cup. I'll bet his scorecard is minus the stroke . . . a lie like everything else about these people.

Sunday, January 5, 2014

Saturday, January 4, 2014

Vanguard's Worst Performing Bond Funds In 2013

Long Term Treasury Fund, VUSTX: -13.03%

Long Term Government Index Fund, VLGSX: -12.74%

Long Term Bond Index Fund, VBLTX: - 9.13%

Inflation Protected Securities Fund, VIPSX: - 8.92%

Long Term Corporate Bond Index Fund, VLTCX: - 6.86%

Long Term Investment Grade Fund, VWESX: - 5.87%

And as badly as they have performed, I don't see a net asset value for any fund which represents a bargain: they all still look too expensive to me.

Friday, January 3, 2014

Antarctic Global Warming Scientists Rescued, But Rescue Ship Also Gets Stuck In Ice: Story Never Mentions It's Summer In Antarctica

|

| Chinese Snow Dragon stuck in ice after rescue |

Why would they go there at this time if they didn't think they could get to Antarctica?

The story is here.

Evidently the rescue ship is Chinese, but the scientists were transported from their stuck vessel to an Australian vessel which subsequently has been dismissed from the area despite the troubles of their rescuers' vessel, also now stuck.

Reminds me of the tow truck which came to retrieve a neighbor's dead vehicle the other day. The tow truck itself got stuck, and had to be towed by another tow truck. Needless to say the neighbor's vehicle didn't get towed until yet another tow truck came yesterday.

And that's how icy it is, from Antarctica to Michigan.

Labels:

Antarctic,

Australia,

China,

Climate 2014,

Sea Ice,

The UK Telegraph

Current Fair Value Of The S&P500 Is . . . 1005

Doug Short updates his regression analysis for the S&P500, adjusted for inflation, to come up with the S&P500 today about 80% above the long term trend going back to 1871:

"If the current S&P 500 were sitting squarely on the regression, it would be around the 1005 level. If the index should decline over the next few years to a level comparable to previous major bottoms, it would fall to the 450-500 range."

Charts and discussion here.

Subscribe to:

Comments (Atom)