What's the difference between GDP growth of +3.1% and -0.1%?

If you said 3.2%, you are a dumb ass.

If you said 3.2%, you are a dumb ass.

3.2 is the spread in percentage points, not the percentage difference.

Think of the measurement, in this case of the GDP expressed as a rate, as steps on a ladder, the rungs of which each represent 0.1. You are standing way up there on rung 3.1 in Q3 2012, from which you descend during Q4 all the way down to rung 0.1, then to rung 0.0, and finally to rung -0.1, if you can imagine a ladder with zero and negative rungs.

How many steps did you take? The answer is 32. That is a long way down from where you were. Since each step has a value of 0.1, 32 x 0.1 = 3.2, the value of the spread.

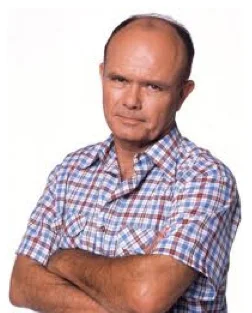

Now that you know the value of the spread, you can calculate the percentage difference between the two measurements the spread spans, otherwise called the percentage drop in this instance. This is where people, even in the financial media, get confused, because they have to figure out the percentage difference between rates, which by definition are already expressed as percentages. But really it is not difficult, no more difficult than calculating the percentage difference between two quantities of apples, oranges or any other things you can enumerate. Forget that they are percentages you are calculating the percentage difference between in this instance, and imagine instead that they are the number of times Red Forman kicked your ass last week vs. this week, or whatever else you like.

Once you know the spread between the two things, you say to yourself: "What percent of the higher number is the spread?" You ask it that way because you want to know how much you declined in percentage terms. (You'd ask the question of the lower number if it had been an increase). Since percent is the amount per hundred, you turn that word problem into an equation: x divided by 100 (what percent means the amount divided by 100), multiplied by (of) 3.1 (the higher number of 3.1 or -0.1, the place from which you climbed down to -0.1) = (is) 3.2 (the spread).

You write it this way:

x 3.1

--- x ----- = 3.2

100 1

Another way to say the same thing is:

3.1x

------ = 3.2

100

Next you begin to isolate x by multiplying each side of the equation by 100, which gives you 3.1x = 320.

Then all you have to do is divide each side by 3.1 to find the value of x. 320 divided by 3.1 = 103.2258. And what was that again? The amount per 100, otherwise called the percentage. So the answer is 103.2%. That's how much the GDP growth rate declined from Q3 to Q4. That's a lot bigger difference between the GDP numbers than 3.2%, isn't it? 3.2% is puny and insignificant on top of being just plain wrong. 103.2% is the stunning truth, and an arrestingly important warning.

Once you know the spread between the two things, you say to yourself: "What percent of the higher number is the spread?" You ask it that way because you want to know how much you declined in percentage terms. (You'd ask the question of the lower number if it had been an increase). Since percent is the amount per hundred, you turn that word problem into an equation: x divided by 100 (what percent means the amount divided by 100), multiplied by (of) 3.1 (the higher number of 3.1 or -0.1, the place from which you climbed down to -0.1) = (is) 3.2 (the spread).

You write it this way:

x 3.1

--- x ----- = 3.2

100 1

Another way to say the same thing is:

3.1x

------ = 3.2

100

Next you begin to isolate x by multiplying each side of the equation by 100, which gives you 3.1x = 320.

Then all you have to do is divide each side by 3.1 to find the value of x. 320 divided by 3.1 = 103.2258. And what was that again? The amount per 100, otherwise called the percentage. So the answer is 103.2%. That's how much the GDP growth rate declined from Q3 to Q4. That's a lot bigger difference between the GDP numbers than 3.2%, isn't it? 3.2% is puny and insignificant on top of being just plain wrong. 103.2% is the stunning truth, and an arrestingly important warning.

In other words, from Q3 to Q4, we wiped out all the growth rate, 100% of it, and a little bit more. We were up the ladder at 3.1, and walked it all the way back 31 steps to the bottom, and then some, one more step, below ground level so to speak.

Now if we could just get people like Rush Limbaugh to understand this, maybe more people in the country would begin to understand the enormity of our problems. Unfortunately for us, the enormity of our problems begins with the fact that most of the voters can't do even this simple math. If they could, they wouldn't have reelected the guy whose slogan was Forward because they would have understood that he doesn't know which direction that is, let alone how to get there.

Now if we could just get people like Rush Limbaugh to understand this, maybe more people in the country would begin to understand the enormity of our problems. Unfortunately for us, the enormity of our problems begins with the fact that most of the voters can't do even this simple math. If they could, they wouldn't have reelected the guy whose slogan was Forward because they would have understood that he doesn't know which direction that is, let alone how to get there.