Wednesday, October 2, 2013

Obama Shuts Down Government, Wins Non-Essential Employee Of The Month Award

Andrew Malcolm for Investors.com, here:

What if an intransigent Obama forced a partial government shutdown, the 18th in recent decades? And what people noticed was that things actually seemed to run pretty well with nearly 900,000 "non-essential" federal workers furloughed from Obama's bloated workforce of 2.2 million? Why should American taxpayers pay for any non-essential workers? If we can do without nearly 900,000 "non-essential" personnel today with all their costly benefits and accruing pensions, why not tomorrow? And next week? And next year? Which is the smaller government argument that so many conservatives will make in advance of Nov. 4, 2014. Now just 399 days away.

Don't Ask, Don't Tell Used To Be "The Law Of The Land" Too, But That Didn't Stop Democrats From Trying To Repeal It

Rich Lowry in The New York Post, here:

Having done the deed, Democrats now expect Republicans to salute smartly, accept “the law of the land” and suggest minor improvements that Democrats will, in their wisdom, decide whether or not to adopt. In other words, they recommend the acquiescence of surrender. If this were a consistent principle rather than opportunistic advice, Democrats would have been content to leave “don’t ask, don’t tell” in place and never would have agitated to repeal the Bush tax cuts, out of deference to duly constituted policy and law. ...

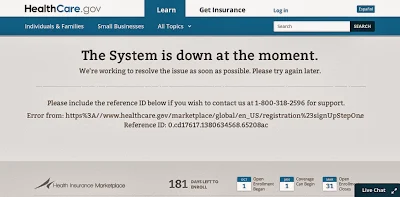

[T]he law suffers from basic design flaws beyond the question of whether the Obama administration can get its software to work. It depends on young, healthy people buying insurance even as it reduces their incentive to do so; it encourages employers to dump workers off their current insurance; it suppresses full-time work, through the employer mandate; in 10 years, the law still leaves 30 million people uninsured.

Tuesday, October 1, 2013

5 Years After Saying "Sell" Jim Cramer Says "Sell"!

Almost 5 years to the day after going on national television the Monday after TARP was signed and recommending that people sell their stocks if they needed the money in five years, Jim Cramer again tells people to sell.

Hm. Must mean there's more upside.

Here.

ObamaCare Will Force Millions More Into Medicaid, And DENY Them The Right To Buy Private Insurance

It will deny them because ObamaCare-compliant plans will simply be too expensive for them to afford, and those will be the only ones available.

John Goodman tried to warn us over two years ago, here:

"While defenders of the new law have chattered endlessly about people who are uninsured because of pre-existing conditions (turns out there are only 12,500 of them) almost no one seems to have noticed that 16 million people are not only going to be forced into Medicaid, they are effectively going to be denied the right to buy any private insurance — whether or not they have a pre-existing condition."

---------------------------------------------------------------------------------

But today it is coming true.

For example, in one county in Michigan an older, married, full-time worker with one child still in the home must make at least $19,530/year to get a tax credit to make the bargain basement Bronze plan monthly health insurance "affordable" for his family, but go below that threshold and he loses the subsidy entirely and ends up in Medicaid whether he likes it or not. That means he must make almost $9.39/hour, almost $2/hour above the Michigan minimum wage of $7.40/hour, or he's out of luck.

A single parent in the same situation must make no less than $15,510 to stay out of Medicaid and get the subsidy.

A single parent in the same situation must make no less than $15,510 to stay out of Medicaid and get the subsidy.

There were almost 61 million Americans making less than $20,000/year in 2011, and nearly 50 million making less than $15,000, meaning many of them will be forced into Medicaid under ObamaCare if they are not among the 70.4 million already in Medicaid in 2011, already 46.5% of all wage earners in the country that year.

Two kinds of insurance, ObamaCare and its crappier forerunner Medicaid, and one unhappy nation.

Two kinds of insurance, ObamaCare and its crappier forerunner Medicaid, and one unhappy nation.

Monday, September 30, 2013

Total Public Debt Outstanding Kept At $16.738 Trillion By Treasury Dept. For Four Months!

I can't show you all of the data because the format is too long for me to capture it all in a single screen shot.

All of June, all of July, all of August, and now all of September at $16.738 trillion, despite the fact that federal revenues are estimated to be running at $226 billion per month in fiscal 2013.

See for yourself here.

Sunday, September 29, 2013

Most Of The Free-Rider Problem Is An EMTALA Problem, Not A General Healthcare Problem

|

| Maybe a guy who can't count shouldn't mess with your health insurance. |

One good estimate of the cost of uncompensated hospital and doctor care in 2008 was just $43 billion, or 5.7% of a hospital care economy of $750 billion that year. But total spending on health care is much higher than that. For example, for 2011 the total size of the healthcare economy has been estimated at $2.7 trillion.

Consistent with that, Megan McArdle recently cites an Urban Institute estimate here for the following year, 2009, showing costs of all uncompensated care, not just for hospitals and doctors, at $62 billion, saying "this is a relatively small amount of overall health spending ... in the trillions."

She's right. $62 billion is just 2.3% of a $2.7 trillion healthcare economy.

The spread between those two numbers for 2008 and 2009 is $19 billion. Assuming a 4% increase in the costs of the hospital/doctor portion only from 2008 to 2009, the spread declines to $17 billion. That's the non-hospital side of the free-rider problem in 2009, less than 1% of all healthcare spending in 2011. Passing ObamaCare to fix that is like firing a bazooka to kill a gnat.

Clearly the bulk of the free-rider problem has been in the hospitals, which will continue to experience problems with uncompensated care despite Obama's Affordable Care Act.

That problem exists because of Ronald Reagan's 1986 signature on EMTALA, requiring hospitals to provide care regardless of citizenship, legal status or ability to pay. It drove up visits to emergency rooms over 26% in the first 15 years, and uncompensated cost totals over 600% since 1983, when they were just $6 billion compared with over $45 billion today. Those costs have been paid by all of us over time in a variety of ways, not the least of which have been increased healthcare insurance premiums, higher taxes, and longer waits in fewer available ERs.

While we're at it trying to overturn ObamaCare, EMTALA should be scrapped with it.

Saturday, September 28, 2013

Tapering Delay Makes People Think It's Safe To Go Back In The Bond Water

Just because someone got killed at the beach last week by a great white shark is no reason not to go swimming here, right?

Bond mutual funds are witnessing net asset value increases in the wake of the Fed's decision announced on Wednesday, September 18th to delay tapering.

For example, VBISX a week ago closed at 10.51. Yesterday it closed at 10.53. VBIIX a week ago was 11.24. Yesterday it closed at 11.31. VBLTX a week ago closed at 12.51. Yesterday it closed at 12.64.

In other words, every part of the bond spectrum is up from 0.2% to 1.0% in just one week, even though none of the net asset value prices had yet fallen below their respective high end of normal prices.

Fools dare where angels fear to tread.

10-Year Treasury Rate Ends The Week At 2.64%

The 10-year US Treasury Rate ended the week at 2.64%, 43% below the mean level going back to 1871.

Despite the best efforts of the US Federal Reserve to suppress interest rates on behalf of other "investments" like housing and stocks, the current rate of the 10-year Treasury still bests the dividend yield of the S&P500 by 34%, which ended the week at 1.97%. From another perspective, it's even worse than that.

John Hussman noted this week here that based on the ratio of equity market value to national output, you might expect less than zero from the S&P500 going ten years out:

Likewise, Buffett observed in 2001 that the ratio of equity market value to national output is “probably the best single measure of where valuations stand at any given moment.” On that front, the chart below [follow the link above] shows the value of nonfinancial corporate equities to GDP (imputed from March to the present based on changes in the S&P 500). On this measure, the likely prospective 10-year nominal total return of the S&P 500 lines up at somewhere less than zero. Suffice it to say that our estimates using both earnings and non-earnings based measures suggest a likely total return for the S&P 500 over the coming decade of less than 2.9% annually, essentially driven by dividend income, and implying an S&P 500 that is roughly unchanged a decade from now – though undoubtedly comprising a volatile set of market cycles on that course to nowhere.

In other words, it's possible stocks could return absolutely nothing over the next decade, or just barely beat bonds by less than 10% based on the current 10-year Treasury rate. For sleeping soundly at night, the choice is easy.

The 10-year Treasury rate has backed off about 10% since Ben Bernanke reversed himself on tapering bond purchases this month, seeing how it was knocking on the door of three.

Normalization of the 10-year yield would cost the US government dearly, jacking up interest expense costs over time which are paid from current tax revenues, by nearly double. In the last four years under Obama, interest payments on the debt have averaged $403 billion annually. Increasing those payments 43% would add another $173 billion to budgetary requirements, again, not all at once but over time.

Friday, September 27, 2013

Seymour Hersh, For The Ages: "Our Job Is To Find Out Ourselves"

Here, in the UK Guardian:

"Our job is to find out ourselves, our job is not just to say – here's a debate' our job is to go beyond the debate and find out who's right and who's wrong about issues. That doesn't happen enough. It costs money, it costs time, it jeopardises, it raises risks. There are some people – the New York Times still has investigative journalists but they do much more of carrying water for the president than I ever thought they would … it's like you don't dare be an outsider any more."

Talmudic Asset Allocation Strategy

A third in land, a third in business, a third in reserve. (h/t Mebane Faber)

"And Rebbe Yitzchak said, A person should always divide his money into three: one third in land, one third in commerce, and one third at hand."

-- Babylonian Talmud, Bava Metzia 42a (quoted here)

Thursday, September 26, 2013

Total Credit Market Debt Has Grown Less Than 9% In The Last Three Years

The debt deflationary depression continues.

Total credit market debt owed (TCMDO), now unhelpfully renamed by the Federal Reserve "All Sectors; Credit Market Instruments; Liability" and perfectly Orwellian in doing away with both information-rich terms "debt" and "owed", has grown 8.76% from the recent April 2010 low to April 2013, about $4.64 trillion.

To put that in context, there have been episodes going back to 1949 when this measure has exploded 50% in three years' time so that doubling times for TCMDO have been as short as 6 years. The longest periods between doubling have been around 11 years long, and since 1949 have averaged about 8 years. The last time the metric doubled was in July 2007, at just under $50 trillion. At almost six years out from that date, we could well have been close to witnessing the number double again to $100 trillion by now based on past experience, or certainly something like half the way there, say to $70-$75 trillion. But here we are instead, at less than $57.6 trillion. It's like we hit a brick wall, the brick wall of a repossessed house most likely.

Say what you will against such a debt-based economy, its fundamental immorality, unsustainability and limits, but that's the economy we have, where the real money in the post-war has been in growth in borrowing, not in the money supply. From this perspective we have entered a long debt-deflationary depression, to get out of which borrowing will have to pick up to at least the point where TCMDO doubles at the extreme of the post-war experience, say by 2018, 11 years on from 2007.

Unfortunately for us, if the last three years are indicative of the new normal pattern of very slow debt expansion, it will take until about the year 2042 for TCMDO to double again to $100 trillion, another 29 years, an unprecedented slowdown in the American way of life.

This is what Chris Whalen meant when he warned in 2010 of decades of economic shrinkage ahead.

Labels:

Christopher Whalen,

Federal Reserve,

George Orwell,

Reuters,

TCMDO

Q2 2013 GDP 2.5% Annualized In 3rd Estimate, Nearly 11% Lower Than In 2012

The full GDP report from the BEA is here.

Subdued growth in the last three quarterly reports, 0.1% for the last quarter of 2012, 1.1% in Q1 and now 2.5%, in part reflects on-going effects from Hurricane Sandy last November, little remarked in the press since then probably because of all the heat Obama got in 2011 for blaming exogenous events for poor GDP performance, but correctly forecast by Rosie in the instance.

Since about 25% of GDP is government spending at any given time, the real economy is piddling along at about 1.88%.

Wednesday, September 25, 2013

Face It, The Heritage Foundation Has Been And Remains Confused (By Liberalism)

As the photo at left demonstrates but conservatives want to ignore, including Erick Erickson here at Red State, a Heritage Foundation representative was present for the signing of RomneyCare in 2006 because Heritage invented the damn idea way back before HillaryCare raised its ugly head and Heritage was happy to see it made into law (so was Senator Ted Kennedy). That was just seven years ago, but now Heritage would just rather have you ignore all that.

Forcing people to sign up for health insurance at the point of a gun has its analog, of course, in forcing people in distant lands to adopt Western-style democracy, something we heard the heir of Republican conservatism, George Bush, incessantly preach: "The long-term solution is to promote a better ideology, which is freedom. Freedom is universal." (Whether they want it or not). To this day, as Molly Ball's article in The Atlantic points out here, "universal coverage" is still Heritage's position:

In my interviews with them, Heritage officials could recite chapter and verse on why Heritage turned against the individual mandate -- a turn, they claim, that occurred before Romney or Obama adopted the idea. “We still believe universal coverage is a good idea,” [Phillip] Truluck [VP and COO] said. But none of the four Heritage officials I interviewed could tell me offhand how the foundation proposes to reform health care and cover the uninsured if Obamacare is scrapped. (Later, an assistant followed up by emailing me links to Heritage papers on “putting patients first,” regulating the health-insurance market, and Medicare reform.)

The place is universally incoherent, and always has been. It has been against Drugs for Seniors as an expansion of big government, but supported the line-item veto, thus expanding the authority of the executive part of government, even as it once used to warn about the imperial presidency. Today it is famously against the current immigration amnesty plan but was pro-immigration for the longest time. It had a founder who has moved notably left liberal, but now it has a libertarian-friendly leader in Jim DeMint. It was for ObamaCare before it was against it. Something about the Heritage Foundation is really off for it to be the home of so many contradictory currents. If conservatism is the negation of ideology, as Russell Kirk taught us, Heritage knows nothing about it.

Maybe they should just rename the place The John F. Kerry Foundation and be done with it.

Subscribe to:

Comments (Atom)