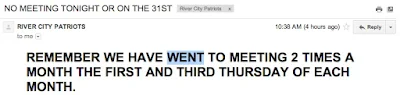

Thursday, January 24, 2013

People Who Won't Spell Are The Enemy

"We are perfectly in the right to abandon conventions if we can afford to."

Seen here (what a shock, right?).

There is nothing too low which will not be lifted up by this sort.

ObamaCare Is Fascism? So Is The Federal Reserve.

And TARP. And Dodd-Frank.

So says Robert Romano for Investors.com here:

[ObamaCare] guarantees customers to large companies, in this case insurance providers that supported passage of the legislation, and in the process cartelizes the system.

In other words, private profits are being embedded into the law, and enforced by the bureaucracy, which will levy fines on individuals and employers that fail to comply with the mandates. ...

[T]he level of state control in this new system, and insurance industry participation in implementing it to its own benefit, is undeniable. It is corporatism defined.

One could compare it to the National Industrial Recovery Act of 1933 that implemented the National Recovery Administration, which may have been patterned after Mussolini's labor laws, as summarized in a 1991 Yale Law School study by James Whitman, before it was subsequently overturned by the Supreme Court.

Or the Federal Reserve Act of 1913, which gave privately owned banks the power to appoint regional Fed chairmen and outsourced creation of the public currency to a banking cartel.

Or more recently, one might examine the Troubled Asset Relief Fund (TARP), Dodd-Frank's "orderly liquidation fund" and the Fed's continued mortgage-backed securities purchase program — all bailout programs that privatize profits and socialize losses in the financial sector. More corporatism.

This country has been a veritable cornucopia of fascism since the days of Woodrow Wilson and FDR.

Has free market capitalism failed in the United States? It's hardly been tried.

So says Robert Romano for Investors.com here:

[ObamaCare] guarantees customers to large companies, in this case insurance providers that supported passage of the legislation, and in the process cartelizes the system.

In other words, private profits are being embedded into the law, and enforced by the bureaucracy, which will levy fines on individuals and employers that fail to comply with the mandates. ...

[T]he level of state control in this new system, and insurance industry participation in implementing it to its own benefit, is undeniable. It is corporatism defined.

One could compare it to the National Industrial Recovery Act of 1933 that implemented the National Recovery Administration, which may have been patterned after Mussolini's labor laws, as summarized in a 1991 Yale Law School study by James Whitman, before it was subsequently overturned by the Supreme Court.

Or the Federal Reserve Act of 1913, which gave privately owned banks the power to appoint regional Fed chairmen and outsourced creation of the public currency to a banking cartel.

Or more recently, one might examine the Troubled Asset Relief Fund (TARP), Dodd-Frank's "orderly liquidation fund" and the Fed's continued mortgage-backed securities purchase program — all bailout programs that privatize profits and socialize losses in the financial sector. More corporatism.

This country has been a veritable cornucopia of fascism since the days of Woodrow Wilson and FDR.

Has free market capitalism failed in the United States? It's hardly been tried.

Annual Percentage Increases To Federal Spending Since Fiscal 1999

Fiscal Year / Percentage increase to outlays over prior year

1999 / 3.0%

2000 / 5.1

2001 / 4.1

2002 / 7.9

2003 / 7.4

2004 / 6.2

2005 / 7.8

2006 / 7.4

2007 / 2.8

2008 / 9.3

2009 / 17.9

2010 / (1.8)

2011 / 4.3

2012 / 5.3

Average annual increase over the last 14 fiscal years: 6.2%.

At that rate, the rule of 72 says outlays will double in fewer than 12 years. Outlays for 2012 are estimated to finish at $3.8 trillion. Half of that is $1.9 trillion. Actual outlays in 2001, eleven years prior, were $1.9 trillion.

So in 2023, eleven years from 2012, expect outlays to reach $7.6 trillion.

Wednesday, January 23, 2013

What Is The Cost Of 5 Million Homes Repossessed By The Banks?

In 2009, it is estimated the average mortgage was $172,000. If 5 million homes have been repossessed by banks in the current 7 year housing catastrophe, using that average amount as a proxy for the cost would mean a hit to the banks of about $860 billion, far less than the $7.7 trillion in emergency lending extended by the Federal Reserve which we have learned about.

The government could have stepped in, if it had had the resolve, and paid off each mortgage at that cost to save the banks in question who were on the hook, and renegotiated ownership with each homeowner. An additional 10 million plus mortgages today are underwater, and could have been incorporated also into the payoff deal.

For its part, the government could have prevented moral hazard in the arrangement by enforcing foreclosure and assuming ownership where applicable, and expanded its public housing role by radically expanding its owned housing stock and becoming the landlord to the former owners, now transformed into renters.

Why that is not preferable to the current arrangement where we continue to bail out the banks and extend and pretend on housing I do not know. It would be bad, but it couldn't be worse.

Yes, it is a formidable logistical task, not without considerable cost in itself, but we'd have this behind us by now if there had only been resolve and decisive action had been taken.

It takes imagination, and our leaders don't have it, in either party.

Latest Real Case Shiller Home Price Index Shows Prices Top Of Range Pre-Bubble

If you take out the obvious housing bubble, the graph shows how prices for housing today are at the upper range of historical experience when adjusted for inflation. These are prices in December 2012 dollars going back to 1890, over 120 years. It doesn't get more current than that. Housing assets are still expensive on this showing, about 12% too expensive, imho. Price discovery is being impeded by Federal Reserve zero interest rate policy. See the graph here.

Money Available For Spending Is Up Over 70% Since 2008, But Total Debt Is Up 7%

M1 money supply has gone up about $1 trillion between mid-2008 and now, almost 5 years. This is basically spending money which is not being spent.

Total credit market debt fell an equivalent amount, but all of it in 2009, so one cannot say the one "offset" the other. (The extra M1 was saved over the nearly five year period. The debt was discharged somehow, through pay-downs or defaults, and relatively quickly during the year of the biggest GDP decline in post-war memory). And since early 2010, total debt is back up over $2.5 trillion. And since 2008 TCMDO is up over $3.6 trillion overall.

Somebody is ramping up debt just like before the crisis, but it's not the consumer.

Somebody is ramping up debt just like before the crisis, but it's not the consumer.

The Anti-Rush Morning Update

Don't blame the Republican base, or the American people, or the 47 percent for that matter . . . lead them!

Tuesday, January 22, 2013

Zillow Recognizes 2012 Housing Value Increase Is Double The Norm

The final three months of 2012 marked five consecutive quarters of U.S. home value appreciation, and the near 6% annual jump is roughly double the historical average that has home values climbing about 3% a year, Zillow said.

“Good news for homeowners after years of poor performance,” Stan Humphries, Zillow’s chief economist, said in a statement. But Humphries cautioned consumers against expecting 2012-like gains in the future, saying we expect this recovery to continue into 2013, but at a more sustainable pace.”

The rest is here.

Without a driver for jobs, I see no reason for housing to appreciate at even 3% per year. In fact, prices today are within that percentage of the historical top of their range prior to the bubble. In other words, prices are still too high, historically, but Zillow isn't going to tell you that, at least not that way.

Buyer beware, imho.

Rush Limbaugh Continues To Blame The Republican Base

Since the end of the first half of the second hour of the broadcast today, Rush Limbaugh again repeatedly blamed the Republican base for Romney's loss, instead of blaming the Republican Party for nominating the wrong candidate, and Romney for being the wrong candidate.

So not only did Romney blame the 47 percent who wouldn't vote for him, Rush Limbaugh continues to blame Republican conservatives for not voting for Romney. If you want to know what's wrong with the Republican Party, that's it.

Romney was the wrong candidate, because he wasn't a conservative, and had no fire in the belly for anything, including holding Obama's feet to the fire.

So what do Rush and Republican liberals like Colin Powell have in common? Criticism of conservatives. And Rush starts the show bemoaning the growing isolation of conservatives, and then proceeds to contribute to that isolation.

Gee whiz. Rush had a nice long weekend to rest up, and this is the best he can do? I swear he got more than a cortisone shot from that doctor he just met.

The time has long since passed that Rush should have retired.

205 Million To Be Unemployed Worldwide By 2014

So says the ILO, the International Labour Organization, noting that 205 million unemployed worldwide will break the 2009 record of 198 million. Unfortunately on the way to that, we'll exceed the record already in 2013 with 202 million unemployed worldwide.

Call it trickle down unemployment:

"Unemployment remains as dire as it was during the crisis in 2009," Ekkehard Ernst, chief of the employment trends unit at the ILO, which wrote the report, told CNBC.

While the crisis may have originated in the developed world, the report noted that 75 percent of 2012's newly unemployed came from outside it, with East Asia, South Asia and Sub-Saharan Africa being the worst affected.

Ernst attributed this to the "spillover effect" of weak growth in advanced economies, and in particular, the recession in Europe.

Read the rest here at CNBC.com.

A Busted Inaugural JumboTron For A Busted ObamaNation

Video here. People simply gave up and left.

The rest of us have been experiencing broken down conditions like we're suddenly living in a third world country, so why not at the inauguration, too?

I guess The Washington Post has decided it's safe to do journalism again.

Monday, January 21, 2013

5 Years Of Uncommon Snows Give London Mayor Boris Johnson An Open Mind

Lord I wish Boris Johnson, Mayor of London, England, were my mayor, my governor, hell, my president for crying out loud.

This guy, trained in the study of classical antiquity, utters more civilization and common sense in one brief column than I've heard in four years from Barack Obama on any subject, let alone from nearly anyone else in this increasingly barbarous republic of ours, if it can still be called a republic. And that's saying a lot because President Obama has been talking non-stop now for four years and hasn't said one damn thing yet, even when the teleprompter is working properly. Where else can you learn about the Maunder minimum, Martinis, the Dalton minimum, William Shakespeare and solar science all wrapped up in a delightful bow about winter snow? I know not where.

Notably, the mayor ends his column with the humility characteristic of a man who one day will doubtless be the leader of many more in England than just the happy inhabitants of London, or at least it can be hoped:

I am speaking only as a layman who observes that there is plenty of snow in our winters these days, and who wonders whether it might be time for government to start taking seriously the possibility — however remote — that [astrophysicist Piers] Corbyn is right. If he is, that will have big implications for agriculture, tourism, transport, aviation policy and the economy as a whole. Of course it still seems a bit nuts to talk of the encroachment of a mini ice age.

But it doesn’t seem as nuts as it did five years ago. I look at the snowy waste outside, and I have an open mind.

And on this quotation, "Sometime too bright the eye of heaven shines", which he makes from Shakespeare's sonnett, in the bleak mid-winter I can live for days as I remind myself that not everything dies forever, least of all the good, the true, and the beautiful:

Thou art more lovely and more temperate:

Rough winds do shake the darling buds of May,

And summer's lease hath all too short a date:

Sometime too hot the eye of heaven shines,

And often is his gold complexion dimm'd;

And every fair from fair sometime declines,

By chance, or nature's changing course, untrimm'd;

But thy eternal summer shall not fade,

Nor lose possession of that fair thou owest;

Nor shall Death brag thou wander'st in his shade,

When in eternal lines to time thou growest;

So long as men can breathe, or eyes can see,

So long lives this, and this gives life to thee.

Moochelle Shovels It In At Inaugural Lunch Like She Hasn't Eaten In Days

Mabel, Mabel, strong and able, get your elbows off the table. This is not a horse's stable, but a first class dining table.

And shouldn't the First Lady finish chewing and swallowing before shoveling in the next fork full?

Meanwhile everybody else is talking about the eye-rolling, while the president seems genuinely affable toward his nemesis.

Video here.

Bush And Obama Piss Down The Backs Of Older Workers And Tell Them It's Raining

In the post-war period, the unemployment level for workers 55 and over first reached the 400,000 mark in 1948, and rattled up and down around that for five decades, briefly doubling during the recessions after 1980 and 1990. The weakness was already apparent however by July 1974, when the level last got effectively to 400,000, at 402,000. The superlative growth of GDP under Truman, Eisenhower and JFK/Johnson had propelled the country strongly forward but ran out of gas, quite literally, the summer after I graduated from high school. It was the immediate aftermath of the Arab oil embargo, and also the summer when Richard Nixon's presidency went tits up. The Vietnam denouement occurred the following year, Jimmy Carter got elected a year after that, and within four years interest rates and inflation rose to crippling levels. America had lost her way. The reforms during the Reagan/Bush years would take until the presidency of Bill Clinton in the 1990s to make GDP look once again like it did during the immediate post-war years. Things got so good by the late 1990s that people routinely quit their jobs, looking for greener pastures elsewhere. Finding and keeping qualified workers became very difficult for employers. But it was not to last.

It was in May 2001 that the unemployment level for America's oldest workers last saw that old normal territory, at 493,000, and it hasn't looked back since.

Since that date there has been a sustained problem of unemployment for older workers, for whom the new normal level quickly became 800,000 during the Bush administration. Now it has ramped up much higher than that under Obama, the new normal since 2008 rising five times the old normal to 2 million. The unemployment level for workers 55 and over has gone from 493,000 in 2001 to a peak of 2.233 million in 2010, an increase of nearly five fold. Today the level remains stuck just under 2 million.

Under George Bush the unemployment level for older workers never really came down, and under Obama it has hardly moved after ramping up so high. It is hard to believe that it isn't by design, since older workers tend to be the highest earners. You can save a lot of money as an employer by firing them. 2 million workers no longer making $50,000 a year comes to a savings of $100 billion annually.

Older workers no longer working aren't depreciating assets. They're expenses, written-off.

Who will be next?

Labels:

Barack Obama 2013,

Bill Clinton,

Education,

Energy 2013,

GDP 2013,

Hysteria,

Jimmy Carter,

Jobs 2013,

Richard Nixon,

Saving,

yields

Depression Of 2008-09 Doubles Move From Employees To Independent Contractors

I know the truth of this story first hand.

|

| Obama's laser-like focus vaporizes jobs. |

The income in this household shifted to income from contract work almost immediately after Barack Obama's election in 2008, just six weeks after which a long career as an employee involuntarily came to an end. For two years every nickel of such income was reported as 99ers, which reduced and/or eliminated any income received from extended unemployment insurance benefits, as is only right. When that ran out in 2010, it was strictly catch as catch can from then on. From month to month you don't know if the phone will ring with a job, or an email will arrive asking for a bid. The new reality is living on 50% of what we used to, and paying for our own benefits, and double to Social Security.

That was over four years ago, and with ObamaCare set to be implemented one year from now, the war on American jobs will only get worse as employers keep full-time employees under 50 in number if they can, make as many employees part-time as they can, and hire independent contractors as they can, all to avoid having to provide health insurance under ObamaCare.

This is what the government mandate means: compulsion, tyranny and poverty. In order to provide coverage for a few, it first has to be destroyed for the many.

The story in The Wall Street Journal, here, deserves your full attention:

Typically, independent contractors are less expensive for employers, who don't have to pay taxes on wages or supply benefits, as they would for their employees. Reliance on independent contractors has increased over the years, particularly in the recession, when employers sought less expensive labor.

In December 2012, 6.7% of payroll checks written by small employers went to 1099 workers, or those not considered employees of a company, according to SurePayroll, a Chicago-based payroll firm that caters to 40,000 small employers with an average of seven employees. That's roughly double the 3.5% of payroll checks that went to 1099 workers in December 2007.

The trend is expected to accelerate this year given the framework of the looming health-care law, employment analysts predict.

Labels:

Gort,

Health Insurance,

Jobs 2013,

Obamacare 2013,

poverty,

Social Security,

Tyranny,

WSJ

Ingenious Fascists At HHS Change Name Of Healthcare "Exchanges" To "Marketplaces"

The national socialists presiding over the failure of the healthcare "exchanges" under ObamaCare have decided, in the wake of the refusal of Republican governors to implement them, to change their name.

That's the story from TheHill.com, here:

The Health and Human Services Department suddenly stopped referring to insurance “exchanges” this week, even as it heralded ongoing efforts to prod states into setting up their own. Instead, press materials and a website for the public referred to insurance “marketplaces” in each state. The change comes amid a determined push by conservative activists to block state-based exchanges in hopes of crippling the federal implementation effort. Dean Clancy, the director of healthcare policy at FreedomWorks, said HHS’s decision to ditch the “exchanges” label shows that opponents of the healthcare law are succeeding. ... Changing the name to “marketplaces” won’t make any difference, Clancy said. “They could call them motherhood or apple pie, but it wouldn’t change our feelings about them,” Clancy said. “We're encouraged that they're showing signs of desperation. I think that it’s too late in the game to try to start calling this something different. And [we’re] not going to spend a lot of effort fighting over a word.”

Oh, but it will make a difference, mon ami. Blaming the free market is what these people are all about. Americans aren't going to be flocking to the exchanges to buy insurance because it will simply be cheaper to pay the penalty knowing that it's cheaper to do so, with the certain knowledge that guaranteed issue when they need it means they can put off getting insurance until it's absolutely necessary. The result is that more people, not fewer, will be without health insurance under ObamaCare. And that failure will be blamed on the free market's "marketplaces" when the time comes for the statists to argue openly for single payer, which has been the goal all along.

George Orwell would be impressed.

Pittsburgh Tribune Review Agrees Obama Is Essentially A Fascist

According to an editorial in Saturday's Pittsburgh Tribune Review, here, agreeing with John Mackey the CEO of Whole Foods, Obama is essentially a fascist. The editorial approvingly quotes this definition of fascism by libertarian Sheldon Richman:

“As an economic system, fascism is socialism with a capitalist veneer. For those with the hubris to think they, not free markets, could better serve society, ‘fascism‘ (or as we prefer, 'fascistic economics') was seen as the happy medium between boom-and-bust-prone (classic) liberal capitalism, with its alleged class conflict, wasteful competition and profit-oriented egoism, and revolutionary Marxism.”

Just when you thought there's been no progress defining for the public who and what is Obama, a businessman and a newspaper provide some:

Not that America's odd mixture of socialism and capitalism is something new.

It was Herbert Hoover, as far as I know, who was the first liberal to identify the American phenomenon of a mixed economics. Hoover located it in the blended strongman presidency of FDR, which was based more on Roosevelt's admiration for Stalin, Mussolini and Hitler as leaders than it was on substantive convictions about the dismal science. The alphabet soup of government which we take for granted today is the direct descendant of Roosevelt's impulse to try something, try anything, until it worked. Well, they're still trying.

Under Roosevelt, perfectly good food was deliberately destroyed by government to keep it from reaching the market in order to support prices in a deflationary economy even as people went hungry all across the country. Today we deliberately devote half the corn crop to produce an expensive, politically correct fuel boosting the cost of food animals while the number of people on food stamps is at an all time high and consumer demand has fallen like a rock. In the immortal words of Curly, if at first you don't succeed, keep on sucking until you do succeed.

But Hoover the loser was on to something, even if calling the man who beat him an un-American dictator lover was beyond the pale for some people. History eventually proved Hoover right when FDR broke with American tradition dating from the founding by running for a third term, and then a fourth. It took until 1951 for the American people to wake up and put a stop to that, with the ratification of the 22nd Amendment. Some dictators are assassinated, others just end up in the circular file. In many ways, Roosevelt simply out-Hoovered Hoover's own liberalism. People forget that FDR ran on what amounted to a repudiation of Republican liberal economic interventionism in the economy, and promptly ramped it up beyond anyone's imagination after he was elected.

But the blended system in America surely began much earlier. We could dial it back probably all the way to Lincoln himself, which would be fitting if only because the current occupant of The White House who practices fascism goes to such great pains to style himself after him, the president who chose to make the principle of national union over sovereign States the new definition of America. That fact of working a revolution, of remaking the country, should trouble everyone who has an ounce of independence left flowing through his veins, which is what troubles so many people who hear Obama speak of transforming the country. For half of us, one such revolution was enough.

This year we might do well to reflect on a later example, however, seeing that it is the anniversary of the abolition of private banking 100 years ago. It's strangely coincidental. The Federal Reserve Act was signed into law in 1913 by a fanatical progressive Presbyterian named Woodrow Wilson, a Democrat who hated the encumbrances placed upon government by the constitutional order and wanted to forge a new world where nations disarmed, lived in peace and cooperated toward a common goal, with the US not at its then natural place, at the head. The Federal Reserve Act was passed in thoroughly partisan fashion by Democrats who had swept to power in the election of 1912 and rammed it through the Congress without Republican support. Their dollar then is now worth 4 cents.

If Woodrow Wilson doesn't yet remind you of Obama and ObamaCare, maybe its because after 100 years of the pernicious effects of American style fascism, you're just too poor to pay attention.

Sunday, January 20, 2013

The Next Thing You Know It'll Be An AR-47

The caption writer for the UK Daily Mail gets all confused and calls the AR-15 an "AK-15"in a story about yesterday's pro-gun rallies. Just a typo, I'm sure, since the previous picture got it right, but still, the next thing you know the Kalash will become the AR-47!

Gotta love the instincts of the guy with the sign. Just sending a little political message to the (national) socialists in Washington, DC. Couldn't have said it better myself.

5 Million American Homes Repossessed In The Last 7 Years

DrHousingBubbble.com has a sobering post at the end of November 2012 here looking at the big picture for American homeowners in the wake of the bursting of the housing bubble.

Out of 10 million foreclosure filings since the beginning of 2006, about half have ended up in flat-out repossession by the banks. With 50 million mortgages out there, that means roughly 9% of mortgaged homes have ended belly up over the period.

With 5.3 million mortgages currently 30 days or more in arrears, a similar repo rate would mean we could expect another 2.5 million mortgages to go to the dogs.

It's still my opinion that housing in the United States is about 12% too expensive overall at the very minimum, and that federal interventions on a massive scale are prohibiting price discovery for this and other asset classes.

Probably more than anything else, however, those interventions are not designed to obscure these matters intentionally, nor to help individual Americans with their financial problems even as they protest to the contrary. Instead the interventions are primarily designed to rescue the biggest banks which have all these non-performing loans turning their books into Swiss cheese, not to mention helping their pals in Congress who need the cheapest dollars they can get to finance all the overspending which keeps them in power.

Saturday, January 19, 2013

Sen. Rob Portman Made An Excellent Point On Today's Larry Kudlow Radio Program

Sen. Rob Portman, Republican from Ohio, made an excellent point on today's Larry Kudlow Radio Program on wabcradio.com. Sen. Portman led off by gently correcting Larry Kudlow for criticizing attempts to use the debt ceiling as leverage to obtain spending cuts.

Sen. Portman pointed out, about 33 minutes into the podcast, that the technique has been used successfully since the days of Warren Rudman, and that we wouldn't have the spending sequester agreed to, admittedly very reluctantly by both political parties, in August 2011 without it, an agreement which, however inelegantly, lops $100 billion off spending annually, if only future Congresses stick to it. Unfortunately for us, the last Congress which agreed to the sequester in the first place already postponed its original implementation date by two months in the fiscal cliff deal over the New Year Holiday. That is a bad sign, preceded by a good sign.

It is heartening to see a Republican Senator wholeheartedly affirming the idea that the politics of the debt ceiling is helpful to the interests of the American people. But I would caution that Sen. Portman's feet need to be kept to the fire. His performance today on Kudlow's program looks to me like fence mending with the US House, an apology of sorts to the House after upstaging it in 2011 with his dalliance with the Gang of Twelve.

It is heartening to see a Republican Senator wholeheartedly affirming the idea that the politics of the debt ceiling is helpful to the interests of the American people. But I would caution that Sen. Portman's feet need to be kept to the fire. His performance today on Kudlow's program looks to me like fence mending with the US House, an apology of sorts to the House after upstaging it in 2011 with his dalliance with the Gang of Twelve.

Whatever else may be said, his instincts expressed today are right. Spending must be reduced, and the debt ceiling is a weapon which the US House must use to get that, no matter how messy.

State Gasoline Taxes Today Represent Almost 10% Of The Cost

Gasoline taxes in January 2013 are averaging $.488 per gallon nationally. That's up slightly, about 1.5%, from January 2011 when taxes averaged $.481 per gallon nationally.

The average gallon in the last five observations of spot prices of refined product ready for shipment has an actual cost $2.614. This yields an average expected price nationally of $3.102, whereas today's current national average is $3.267, meaning the local gas station's profit per gallon cannot be any more than about $.165 per gallon because he pays out of that a mark-up to the supplier for his profit and delivery costs.

Whatever else may be said about how much profit is buried in the spot price accruing to the oil companies and the refiners, the distributors and retailers are fighting for profits from just 5% of the cost of a gallon, whereas government from top to bottom takes a 15% cut, for doing absolutely nothing.

And the roads in this country still suck.

The federal cut alone is 5.6% of the cost of gasoline today, $.184 per gallon everywhere, but the states' cut is a whopping 9.3% on average. Compare that to the current average of state sales tax rates nationwide, which is just 5.04%. On average everyone who fills up at the gas station is paying 85% more in taxes to state government for that product than would be paid on toilet paper.

That doesn't make any sense!

Friday, January 18, 2013

The Invasion Of The Body Scanners: Nude X-Ray Scanners To Be Out By June

TSA is getting rid of the invasive nude x-ray technology by June to comply with a Congressional directive.

But you're still being searched, and whether you get felt up or not is beside the point, because the generic image scanners will stay.

The Fourth Amendment means nothing in an airport, and I predict this "compromise" will speed the way for the invasion of the body scanners into every sphere of public transportation, including busses, subways, commuter trains and even tollways and interstates.

Story here.

Tendentious Headline Alert

Campus conservatives are dying? Really? The New Republic says that?! Truly shocking. But while the book, apparently, and the review don't flatter a certain type of conservative, neither the review nor the book, evidently, says that they are "dying", illustrating that headline writers often excel at expressing a prejudice. A promising future no doubt awaits at The New York Times.

Three Dubious Firsts For Obama In Quick Succession In 2011

The dollar hit its all time low under Obama, on 5/2/11 at 67.97, but this has not been much discussed even though it is surely related to the following other firsts.

On 8/5/11 Standard and Poor's downgraded the US for the first time ever, from AAA to AA+, primarily because it was looking for $4 trillion in spending cuts over ten years and only got $1 trillion in the sequestration deal.

And then on 9/2/11 it was reported that for the month of August 2011 net zero jobs had been created, the first time since World War II that a month went by without job creation.

These are remarkable and dubious firsts, three of them in a row in the span of four months.

It is clear how much two of these still rankle Obama, who views them in purely political terms instead of as injuries to all of us. In a press conference on the debt ceiling almost a year and a half later, held this last Monday, Obama brought up both the AAA rating loss and the net zero jobs milestone, seeking to blame them both on Republicans:

"And they'd better choose quickly because time is running short. The last time Republicans in Congress even flirted with this idea [of not raising the debt ceiling], our triple-A credit rating was downgraded for the first time in our history, our businesses created the fewest jobs of any month in nearly the past three years, and ironically, the whole fiasco actually added to the deficit."

The revisionist history on the jobs number is noteworthy. Who would even remember the fact now unless he brought it up?

The fact of the matter is, however, that the weak dollar, which is not even on Obama's radar screen, is the root of the problem for both our out of control debt and deficits and the dearth of jobs.

And Jeffrey Snider, coincidentally, says just as much today, here, concluding this way:

"The politics of the debt ceiling really should be concerned with monetarism rather than focused solely on spending or deficits. But that is a hard position for either party to take. Democrats won't because their interests are aligned with monetarism, while Republicans have at many times embraced monetarism with equal passion. Neither seems to want to move outside conventional economics that salutes as policy success a 64% increase in total debt without any perturbation in interest costs.

"We have not just a fiscal problem, but a persistent and massive monetary imbalance through dollar debasement that is directly related to both the debt disaster and the weak economy. Without directly facing it and working toward currency stability, we will be stuck with both the continued debt trajectory and no real growth. Neither can be adequately solved without first solving the dollar by ending capital repression."

On 8/5/11 Standard and Poor's downgraded the US for the first time ever, from AAA to AA+, primarily because it was looking for $4 trillion in spending cuts over ten years and only got $1 trillion in the sequestration deal.

And then on 9/2/11 it was reported that for the month of August 2011 net zero jobs had been created, the first time since World War II that a month went by without job creation.

These are remarkable and dubious firsts, three of them in a row in the span of four months.

It is clear how much two of these still rankle Obama, who views them in purely political terms instead of as injuries to all of us. In a press conference on the debt ceiling almost a year and a half later, held this last Monday, Obama brought up both the AAA rating loss and the net zero jobs milestone, seeking to blame them both on Republicans:

"And they'd better choose quickly because time is running short. The last time Republicans in Congress even flirted with this idea [of not raising the debt ceiling], our triple-A credit rating was downgraded for the first time in our history, our businesses created the fewest jobs of any month in nearly the past three years, and ironically, the whole fiasco actually added to the deficit."

The revisionist history on the jobs number is noteworthy. Who would even remember the fact now unless he brought it up?

The fact of the matter is, however, that the weak dollar, which is not even on Obama's radar screen, is the root of the problem for both our out of control debt and deficits and the dearth of jobs.

And Jeffrey Snider, coincidentally, says just as much today, here, concluding this way:

"The politics of the debt ceiling really should be concerned with monetarism rather than focused solely on spending or deficits. But that is a hard position for either party to take. Democrats won't because their interests are aligned with monetarism, while Republicans have at many times embraced monetarism with equal passion. Neither seems to want to move outside conventional economics that salutes as policy success a 64% increase in total debt without any perturbation in interest costs.

"We have not just a fiscal problem, but a persistent and massive monetary imbalance through dollar debasement that is directly related to both the debt disaster and the weak economy. Without directly facing it and working toward currency stability, we will be stuck with both the continued debt trajectory and no real growth. Neither can be adequately solved without first solving the dollar by ending capital repression."

Central Banks In 2012 Bought 536 Tonnes Of Gold, The Most In Half A Century

So reports Ambrose Evans-Pritchard, here:

"[C]entral banks around the world bought more bullion last year in terms of tonnage than at any time in almost half a century.

"They added a net 536 tonnes in 2012 as they diversified fresh reserves away from the four fiat suspects: dollar, euro, sterling, and yen."

In dollar terms with gold at $1,600 the ounce, 536 tonnes is an allocation of roughly $30.26 billion to gold by central banks in 2012, conservatively speaking.

To put central bank demand in 2012 in its context, compare this from Reuters, here:

Jewellery buying, the largest demand segment, fell 4.4 percent to 1,885 tonnes [in 2012]. Global coin minting is forecast to have dropped to a four-year low of 199 tonnes, down 19 percent from the previous year. ... On the supply side of the market, mine supply is expected to tick up 1.5 percent to 1,389 tonnes in the first half [of 2013].

In other words, falling demand in jewellery and coin minting was offset to some extent by central bank buying in 2012, supporting the price of gold, which began the year near $1,600 and ended it near $1,650.

The bankers obviously saw 2012 as a buying opportunity in the wake of weak demand.

Separately, as I noted here, central bank purchases year over year in March 2012 had ramped up to 400 tons from 156 in the prior period.

Predictions last summer, when prices were at their 2012 nadir, that central bank purchases going forward would come in at roughly 375 tons max obviously underestimated the reality significantly, way over 40%.

To put central bank demand in 2012 in its context, compare this from Reuters, here:

Jewellery buying, the largest demand segment, fell 4.4 percent to 1,885 tonnes [in 2012]. Global coin minting is forecast to have dropped to a four-year low of 199 tonnes, down 19 percent from the previous year. ... On the supply side of the market, mine supply is expected to tick up 1.5 percent to 1,389 tonnes in the first half [of 2013].

In other words, falling demand in jewellery and coin minting was offset to some extent by central bank buying in 2012, supporting the price of gold, which began the year near $1,600 and ended it near $1,650.

The bankers obviously saw 2012 as a buying opportunity in the wake of weak demand.

Separately, as I noted here, central bank purchases year over year in March 2012 had ramped up to 400 tons from 156 in the prior period.

Predictions last summer, when prices were at their 2012 nadir, that central bank purchases going forward would come in at roughly 375 tons max obviously underestimated the reality significantly, way over 40%.

Thursday, January 17, 2013

Republican Chuck Hagel Would Gut Our Nuclear Arsenal

The guy would totally sell us out, which is why Obama wants him for Secretary of Defense. What better way to achieve the Democrat goal of unilateral disarmament than blaming it on a Republican?

Story here:

As senators and their staff prepare to examine Hagel’s nomination to the Pentagon, it is critical that they closely and carefully scrutinize Hagel about the implications of his public proposals to slash the U.S. nuclear arsenal for their states—and, most importantly, for America’s national security. Understanding these implications are all the more important, given that President Obama still has not fully lived up to his 2010 promise to Congress to modernize the U.S. nuclear deterrent, the ultimate guarantor of America’s national security. What’s troubling is that Senate confirmation of Chuck Hagel as the next secretary of defense almost certainly assures that the president never will.

Sen. Baucus, Author Of One Size Fits All ObamaCare, Rejects One Size Gun Laws

As reported here:

Sen. Max Baucus (D-Mont.) indicated he was hesitant about supporting new legislation.

“Enforcing the laws we already have on the books is good first step, and it's clear more needs to be done to address access to mental health care,” he said in a Wednesday statement. “Before passing new laws, we need a thoughtful debate that respects responsible, law-abiding gun owners in Montana instead of ... one-size-fits all directives from Washington."

Ha Ha Ha Ha Ha.

Ann Coulter's Hero, NJ Gov. Chris Christie, Will Never Be President

Gov. Christie shows his true colors in attacking the NRA ad which points out Obama's hypocrisy for denying your children armed protection in schools while making sure his kids have it, effectively forever.

Gov. Christie is obviously fighting to survive his reelection fight in NJ, but any Republican who suggests, as Ann Coulter has, that Christie is the preferred Republican candidate for president is smoking what Obama wants to legalize.

Story here.

Why isn't the conservative Ann Coulter married? Shouldn't she be having children by now? Or is the future of America of no interest to her?

Naked Capitalism Is All In For Oliver Stone's Favorite Commie, Henry Wallace

The number of dopes swallowing Oliver Stone's latest lies about Henry Wallace grows, but NC is too smart to be a mere victim. It's a true believer.

Here.

Conrad Black has a good counter at National Review, just out, here, featuring a lengthy quotation from expert Ron Radosh (italicized below):

With mounting incredulity and alarm — like, I am sure, many readers — I have watched the exhumation, by Oliver Stone, Peter Kuznick, and other members of a leftist claque of revisionist historians and pseudo-historians, of the putrefied historic corpse of Vice President Henry Agard Wallace. Wallace was the eccentric and impressionable son of the agriculture secretary who served under Presidents Warren Harding and Calvin Coolidge, and Wallace himself held the same position under Franklin D. Roosevelt for eight years. When FDR broke a tradition as old as the republic by running for a third term in the war emergency of 1940, he astounded and scandalized his party by choosing Wallace as his running mate. ...

Wallace would have created [as president] an American foreign policy run by Soviet agents he had installed in the White House, including Lauchlin Currie, Harry Dexter White, his former assistant at Commerce, and the secret Communist and Soviet agent Harry Magdof, who wrote Wallace’s Madison Square Garden speech in 1946 . . . all of whom would have given Joseph Stalin precisely what he sought: control of Eastern Europe and inroads into subversion of France, Italy, and Great Britain as well. The result would have been a deepening of Stalinist control of Europe, and a tough road that might well have made it impossible for the West actually to have won the Cold War and to have defeated Soviet expansionism. Moreover, as Gaddis suggests, new evidence has emerged that points to just how much Wallace was under the control of the Soviets, and how they were counting on him as the man in the United States best suited to serve their ends.

Labels:

Commies,

Conrad Black,

England,

food,

France,

Henry Wallace,

Italy,

Naked Capitalism,

National Review,

Oliver Stone,

Ron Radosh,

Stalin,

USSR

CNBC's John Carney Defends The Debt Ceiling

John Carney is a rare voice of reason at CNBC.

Here's the conclusion to his defense of the authority of Congress over appropriations, taxes and borrowing:

The logic of the opponents of the debt ceiling is that Congress implicitly approves borrowing when it votes for spending and taxing laws. By this same logic the President should have the power to tax unilaterally based on spending authorizations and borrowing limits. Likewise, the President should have spending powers based on directions to federal agencies in the absence of legislative appropriations.

This isn't the logic of the Constitution's framers, who built a system in which Congressional mandates do not imply a power to spend, in which appropriations do not imply a power to tax, and in which neither mandates nor appropriations imply a power to borrow. Each requires distinct, specific Congressional authorization.

The framers built this around a revolutionary idea: that these powers, which had so often been held by kings, should be held by legislatures. Authority that still rests in the hands of the executive branches of government across much of the world is, in the United States, in the hands of legislators.

This cannot be undone with a bill. It would require a constitutional amendment. And, of course, a rejection of the framers's wisdom about who should have the power to borrow on the credit of the United States.

In a word, the president of the United States isn't a king. The current one just thinks he is.

Wednesday, January 16, 2013

CNBC Laughably Portrays Sen. Alan Simpson Of Wyoming As A Conservative

|

| Sen. Lisa MirrorCowSki gets ready for a date! |

Republican Alan Simpson has never been a conservative and hates conservatives. When CNBC portrays him as one, here in "More Conservatives Tell GOP: Don't Mess With Debt Ceiling", it's pure propaganda:

"It would be a grave mistake to use the debate on the debt ceiling to get President Obama to agree to spending cuts," Alan Simpson, co-founder of the Campaign to Fix the Debt and former GOP senator from Wyoming told CNBC's "Closing Bell" Tuesday.

"I know they're (GOP lawmakers) going to try it and how far they'll go with that game of chicken I have no idea," said Simpson, who was co-chair of the Simpson-Bowles Commission that looked at reducing government debt.

The former Senator from Wyoming may carry some weight with liberal Republicans, like Sen. Lisa Mercowsky of Alaska, but not with conservatives. The last thing liberal Republicans want is for the gravy train to run empty.

Continuing resolutions have done nothing but continue to fund government at the new much higher baseline established by Democrats in 2009 with the addition of massive stimulus spending, after which they have passed no budgets. It was an ingenious strategy to ramp up government spending and keep it there. Republicans only participate in this charade by continuing to raise the debt ceiling which facilitates it.

Republicans should shut down the government until the lawful budget process is restored, which means Sen. Reid must pass a budget out of the Democrat-controlled Senate and send it to the House, which he has not done in violation of the law in place since 1974. If anyone should be impeached in this country, it is Sen. Reid.

"A 30 Round Magazine Might Be Too Small"

|

| ". . . from my cold dead hands!" |

Many historians have come to view the American Revolution as a conservative revolution. The revolutionaries believed they were protecting their English rights from the Glorious Revolution of 1688. They were, in effect, revolting to demand the rights they thought they already had as English citizens. It is why, for much of 1775, they petitioned the King, not Parliament, for help because they had, separated by distance and time, not kept up with the legal evolution of the British constitutional monarchy in relation to Parliament. The colonists believed themselves full English citizens and heirs of the Glorious Revolution.

One of the rights that came out of the Bill of Rights of 1689 in England following the Glorious Revolution was a right to bear arms for defense against the state. The English Bill of Rights accused King James II of disarming protestants in England. That Bill of Rights included the language “That the Subjects which are Protestants may have Arms for their Defence suitable to their Conditions and as allowed by Law.”

The Americans, however, saw the British government, via Parliament, begin curtailing the rights of the citizenry in the American colonies. When they formed the federal government with ratification of the Constitution, the colonists, now Americans, were deeply skeptical of a concentrated federal power, let alone standing armies to exercise power on behalf of a government. This is why, originally, the colonists chose to require unanimity for all federal action under the Articles of Confederation that the Constitution would replace. Likewise, it is why many early state constitutions gave both an explicit right to keep and bear arms, but also instructed that standing armies in times of peace should not be maintained.

Prior to the Civil War, the Bill of Rights only applied to the federal government and that first Congress dropped references to “as allowed by Law” that had been in the English Bill of Rights. The Founders intended that Congress was to make no law curtailing the rights of citizens to keep and bear arms.

In other words, removing "as allowed by Law" means the right to keep and bear arms is not susceptible of further modification by legislative, or executive, action. Or for that matter by judicial action. The Second Amendment is a settled matter. Americans have simply forgotten this, and to the extent they have are already slaves.

Labels:

2nd Amendment,

Civil War,

England,

Erick Erickson,

FBI,

Oathkeepers,

Protestant,

RedState,

standing armies,

Tyranny

Tuesday, January 15, 2013

Dr. Strangeobama Blames Republicans Yesterday For Net Zero Jobs In August 2011?

It's like a scene out of Dr. Strangelove, where the delusional General Ripper blames fluoridation of the water supply beginning in 1946 on the Commies.

Here's Obama yesterday, finally blaming Republicans, not Bush, which is a sort of progress, I guess, for losing the AAA credit rating, adding in the zinger that the debt-ceiling showdown in summer 2011 somehow was responsible also for net zero jobs created in August 2011, the first time that's happened since World War II. Boy, that report must have really rankled him to bring it up now, a lot more than losing the AAA credit rating. Who even remembers that?!

From the transcript of Obama's remarks yesterday, here:

So we’ve got to pay our bills. And Republicans in Congress have two choices here. They can act responsibly, and pay America’s bills, or they can act irresponsibly and put America through another economic crisis. But they will not collect a ransom in exchange for not crashing the American economy. The financial wellbeing of the American people is not leverage to be used. The full faith and credit of the United States of America is not a bargaining chip. And they better choose quickly, because time is running short.

The last time republicans in Congress even flirted with this idea, our AAA credit rating was downgraded for the first time in our history. Our businesses created the fewest jobs of any month in nearly the past three years, and ironically, the whole fiasco actually added to the deficit.

Got that? "The fewest jobs of any month in nearly the past three years." He's not referring to last month, December 2012. He's referring to August 2011, and trying to rewrite that history by blaming it on Republicans and couching it in the context of the last three years when the news reported August 2011 as a sensational first in the post-war period. That's how keenly Obama feels the sting of his lousy job creation record. He's the worst president for jobs in 65 years, and he knows it.

Labels:

Barack Obama 2013,

CNBC,

Commies,

Credit Ratings Agencies,

Downgrades,

Jobs 2011,

Jobs 2013,

WaPo,

Zeroes

Obama's Gangster Government Of, By And For The Banks

Matt Taibbi provides a pretty thorough look at the recent history of the bailout alliance between the federal government and the big banks for Rolling Stone, here, from which this excerpt:

All of this – the willingness to call dying banks healthy, the sham stress tests, the failure to enforce bonus rules, the seeming indifference to public disclosure, not to mention the shocking lack of criminal investigations into fraud committed by bailout recipients before the crash – comprised the largest and most valuable bailout of all. Brick by brick, statement by reassuring statement, bailout officials have spent years building the government's great Implicit Guarantee to the biggest companies on Wall Street: We will be there for you, always, no matter how much you screw up. We will lie for you and let you get away with just about anything. We will make this ongoing bailout a pervasive and permanent part of the financial system. And most important of all, we will publicly commit to this policy, being so obvious about it that the markets will be able to put an exact price tag on the value of our preferential treatment.

But Taibbi goes pretty easy on Obama's role in all of this, who has profited handsomely from it with reelection, focusing instead mostly on underlings like Geithner and Summers. Taibbi seems to hate only the big bankers for their profiteering, not the administration responsible for the continuing massive bailouts. He never connects Obama's admiration for dictatorship in China with our gangster government's stick up of the American people, and even gives Obama credit for some success with HAMP. It's as if the imperial president is merely an accessory to the crime, which Taibbi calls right up front "one of the biggest and most elaborate falsehoods ever sold to the American people."

By the way, Taibbi endorsed Elizabeth Talking Bull for president.

By the way, Taibbi endorsed Elizabeth Talking Bull for president.

Labels:

Barack Obama 2013,

Chinamerica,

Gangs,

Matt Taibbi,

Pocahonky,

Rolling Stone,

Tim Geithner

Monday, January 14, 2013

What The Country Needs Most Right Now Is . . .

. . . a new federal holiday!

Your proposals should include someone born in March, April, June or August, to fill in the months missing a federal holiday.

James Madison, the father of the Constitution, was born in March 1751. Thomas Jefferson, the principal author of the Declaration of Independence, was born in April 1743. Jefferson Davis, the president of the Confederate States of America and defender of both the Constitution and the Declaration, was born in June 1808. Barack Obama, the current president of the United States and the opponent of both the Constitution and the Declaration, was born in August 1961, or so they say.

Seeing that Barack Obama isn't dead, yet, I think your choices are limited to Madison, Jefferson, or Davis. But maybe we should just get all three right now, because the country may not last long enough under Obama to add them all in, slow like.

Housing Prices Rise To Within 3% Of Pre-Bubble 20th Century Highs

Housing prices according to the Case-Shiller Housing Price Index for the 3rd quarter of 2012 here have clawed their way back to within 3% of the 20th century's historic high before the housing bubble.

The index has climbed in 2012 from 124.48 at the end of March to 132.97 at the end of June, and now sits at 134.97 as of the end of September 2012, a rise of 8.4% in just six months.

Prices at this level are high by historical standards, if one ignores price action during the housing bubble. Excepting that period, the high water mark for housing prices in the 20th century was reached on Sep 30, 1989 at the level of 138.54 on the index, 8 years before the tax law was changed to make it possible to churn real estate capital every 2 years, which was the real fuel for the housing bubble.

From the 1950s right up to the end of 1997, prices on the index hewed closely to 120, rising above that level and below it in a cyclical manner in the absence of meddling with housing and tax law. But after 1997 prices became unhinged and rapidly increased, shooting above the upper range limit of 140 in September 2000 on their way to the bubble peak of 218.72 in December 2005. We all know the sorry aftermath of that.

Today prices for housing assets are very high by historical standards. The new fuel for them is Federal Reserve zero interest rate policy, which represents violent meddling with interest rate markets designed in part to help homeowners refinance existing mortgages and buyers buy at affordable rates. This is surely frustrating and destructive at the same time, as any person without a job needing to refinance and any person needing interest income can tell you.

While it is difficult to predict what the new normal should look like with respect to future housing price trends as the market adjusts to the exploded bubble and current housing policy and tax laws, prices supported by federal manipulation cannot be real.

The country desperately needs a free market in housing, but it doesn't have one.

Subscribe to:

Comments (Atom)