From his speech today to the Economic Club of Minnesota:

One striking aspect of the recovery is the unusual weakness in household spending. After contracting very sharply during the recession, consumer spending expanded moderately through 2010, only to decelerate in the first half of 2011. The temporary factors I mentioned earlier--the rise in commodity prices, which has hurt households' purchasing power, and the disruption in manufacturing following the Japanese disaster, which reduced auto availability and hence sales--are partial explanations for this deceleration. But households are struggling with other important headwinds as well, including the persistently high level of unemployment, slow gains in wages for those who remain employed, falling house prices, and debt burdens that remain high for many, notwithstanding that households, in the aggregate, have been saving more and borrowing less. Even taking into account the many financial pressures they face, households seem exceptionally cautious. Indeed, readings on consumer confidence have fallen substantially in recent months as people have become more pessimistic about both economic conditions and their own financial prospects.

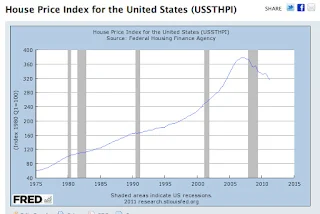

Here's the Fed's House Price Index on 8/24/11, which shows prices at late 2004 levels:

The fact is, prices have fallen to 1999 levels and may continue to fall to 1997 levels and perhaps lower than that:

Bernanke doesn't understand the severity of the home equity massacre which the consumer has sustained since 2006. That was the primary source of wealth for the vast majority of Americans, and Bernanke doesn't get that a whole decade of gains has been wiped out. His own data are off by five years.

Everyone hangs on every word of the Fed. "Don't fight the Fed" they say. Too bad the Fed doesn't know what it's talking about.