And it's not exactly his fault.

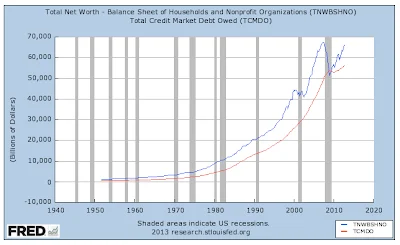

Historically in the postwar period, the increase in Total Credit Market Debt Outstanding (TCMDO) has closely shadowed the increase in Total Net Worth, seemingly helping to finance it, until the late great recession when for the first time, and very briefly, net worth flagged below the level of the debt owed. (Ignoramuses in the Doomosphere everywhere cried "Insolvency" at the time, not understanding the meaning of the term "net"). Ex post facto, net worth has made a dramatic upswing while the debt owed has increased at a much reduced rate by historical standards. To quote a famous president, "That doesn't make any sense."

Despite all the debt naysayers out there, total credit market debt is not increasing at anything like it should be, and appears to be disconnected to a significant degree from the recent increase in total net worth, which is up 29% since its nadir at the beginning of 2009, or $14.7 trillion. For the whole five year period from July 2007 (the last time TCMDO doubled, going back to 1999) to July 2012, TCMDO increased at a rate of just 12% and real GDP increased just 2.9%, whereas TCMDO increased at a rate of 100% between 1949 and 2007 on average every 8.25 years. The shortest doubling times have included two periods of 6 years each, one of 6.75 years, one of 8 years, one of 9.5 years, one of 10 years, and one of 11.5 years. The very worst real GDP performance of all of those was for a 6 year doubling period when we got 14% real GDP, nearly 5 times better than we're getting now. All the rest posted real GDP of between 23% and 56%.

It is evident that Ben Bernanke's quantitative easing program (right scale) anticipated the leveling off of TCMDO (left scale). Clearly he expected the troubled banks to need a push to keep the credit money creation process going, but didn't understand how fruitless it would be. One notes that he has added about $2 trillion to the monetary base from the middle of the late great recession. By contrast, TCMDO is up (only!) $9 trillion from the beginning of 2007. By historical standards TCMDO should be up $25 trillion by now if TCMDO is to double again in ten years from 2007. And it should be up a lot more than even $25 trillion by now if it's to double sooner than ten years. At the average doubling time of 8.25 years, the $49.8 trillion of TCMDO in July 2007 should hit $99.684 trillion by October of 2015 if the postwar pattern is to continue. Instead, at the current rate of growth in TCMDO, it's going to take an unprecedented 27 years to double it, unless of course there are limits to borrowing to fuel growth, as many are beginning to tell us. In either event one can only assume there will be only pathetic real GDP growth going forward, if there is any at all.

Clearly something is horribly amiss in the transmission process of credit money creation for the first time in the postwar. Seemingly gargantuan quantities of money from the Fed through the process of quantitative easing should be seeding the banks who in turn should be creating massive amounts of credit way beyond the $9 trillion so far created. Instead, the banks are doing something else with it, by-passing the normal distribution channel. Some of the seed money is being held back to comply with increased capital requirements, to be sure, but more appears to be going directly into household net worth creation through investment gains from the stock market, enriching a very few bondholders, shareholders and banking industry players through the private trading desks of the banks, a unique development by historical standards made possible only since 1999 with the abolition of Glass-Steagall through the Gramm-Leach-Bliley Act. As an act of Congress, Ben Bernanke can't do much about that even if he is the most powerful man in the country.

In the absence of a creative policy change from the Fed whereby Congressional intent would be thwarted and money would actually reach the marketplace through a different avenue than the uncooperative banks, one must conclude that the Fed thinks it necessary to continue the various easing schemes because it judges the banks to be still too fragile to risk stopping them. That would be putting the best construction on the matter, to borrow a phrase from Luther's catechism. Either that, or the Fed itself has been completely captured by the bankers.