Where this is all going to end up, I'm pretty sure -- we'll see if I'm right; won't be too long, maximum next year sometime, maybe two years -- where this is all going to end up is that the middle class is going to get soaked. The middle class is going to see their taxes go up, and the reason is, that's where the bulk of the money is.

You could confiscate all the money the middle class has and run the government for quite a while. Much longer than if you confiscate all the money the rich have. There's a reason why the rich are called the top 2%. There aren't very many of them, folks. They're only the top two, the top 1%. And the idea that 98% of the country is not going to have a tax increase under this president is absurd. Everybody is going to see a tax increase under this president, because his objective is to shrink the private sector and expand the government so that the government becomes the primary source of prosperity and benefits for the vast majority of people.

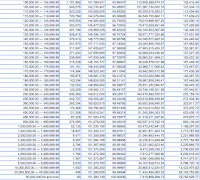

In 2011, the poorest Americans, those making between $0 and $20K, had total net compensation of $501 billion in the aggregate. The so-called middle class, those making between $20K and $75K per year where net compensation aggregates every $5K up the income ladder constitute piles of cash in excess of $200 billion each, had total compensation of $2.9 trillion in 2011.

The income tranches of the middle are what greedy liberal tax-farmers focus on, as do disingenous rich people, because they stick out like a sore thumb, representing as they do the largest individual tranches for ordinary income purposes and constituting an unbroken line of 11 of them just begging to be ogled. See them

here for yourself. You will not find any tranches among the so-called rich in excess of $200 billion. But they make a lot of money nevertheless.

Add it all up and everybody making beyond $75K per year in 2011, which includes the upper middle class, if you piled all their net compensation for Social Security purposes together, would total another $2.8 trillion, just shy of the middle's $2.9 trillion.

If you think this proves Rush's point, you would be wrong. Such net compensation isn't all there is to it, not by a long shot. It's much, much more complicated, and obscure, than that. And that's the way rich people like it. If you can't see their income you can't know how rich they are and they can thus escape becoming a target. That's why so many rich people, and their advocates like Bruce Bartlett who want to tax the middle class and deflect taxes from themselves, insist so strongly that they are middle class just like you.

While net compensation totaled about $6.2 trillion in 2011, personal income was more than twice that. The Bureau of Economic analysis,

here, reports that personal income was $12.95 trillion in 2011.

People like Jeffrey Immelt, Jamie Dimon, Mitt Romney, Warren Buffett and Bill Gates receive tons of income from stocks, bonds, capital gains, dividends, rents, royalties, et cetera et cetera et cetera, adding at least another $6.75 trillion to that $6.2 trillion in net compensation for Social Security purposes in 2011.

To be sure, lots of people who aren't the very rich receive such income, too, but there is no way on God's green earth that there are enough of them in the so-called middle receiving it to say that the bulk of the money is in the middle. The middle class would like to be receiving the bulk of its income as unearned income like the investor class does, but it doesn't for the most part. It works for its money (unless you're a government employee).

No matter how much the boob with the microphone and the subscription to The Wall Street Journal tells you otherwise, the bulk of the money is not in the middle, most people know it, and that's why Obama is succeeding with his class warfare rhetoric. He has picked his targets, personalized them, polarized them and frozen them, and all the rich can do, because there aren't enough of them, is surrender (Warren Buffett), create diversions (the home mortgage interest deduction flap) or tell lies (The Wall Street Journal).

It really is quite pathetic that we do this to rich people in America and pat ourselves on the back for it. It's actually disgraceful in a country which claims to believe in equal treatment under the law that a wealthier earner is discriminated against because we say he must pay taxes at a higher percentage rate on his ordinary income than a poorer earner must pay. And we feel guilty enough about it that we then turn around and create exceptions to these unjust tax rules when taxing income which is not ordinary. Is it any wonder then that more than half of the personal income in the country has fled for refuge to be classified as other than ordinary? The founders thought a tax was equal only if everyone in the country paid the same amount. This consensus necessarily kept federal taxation low and infrequent because the great masses of people could not afford to pay very much.

The least we could do in homage to that old idea of America would be to tax everyone's income in the country in similar fashion, at one low rate, making no distinctions between the income from a job and the income from an investment. Of course, that would mean a pretty low rate compared to what's exacted today, and would necessitate some pretty drastic cuts to spending. A 10% tax on the personal income of the country of $13 trillion in 2011 would have yielded only $1.3 trillion in revenues, far short of the $3.8 trillion or so we spent.

And that, as we on the right keep saying, is where the real problem lies. Unless we slay the spending monster, there will never be taxation equality in America.