Monday, January 6, 2014

"Ben Bernanke Has An Almost Unbroken Record Of Being Wrong"

Bye Bye Ben.

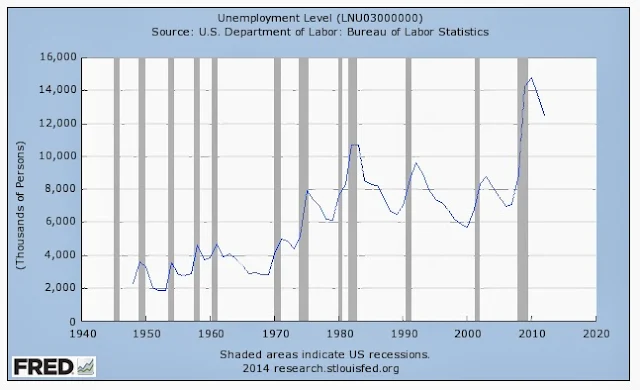

Seen here:

Ben Bernanke has an almost unbroken record of being wrong.

In 2006, at the zenith of the housing bubble, he told Congress that house prices would continue to rise. In 2007, he testified that failing subprime mortgages would not threaten the economy.

In January 2008, at a luncheon, he told his audience there was no recession on the horizon. As late as July 2008, he insisted that mortgage giants Fannie Mae and Freddie Mac, already teetering on the verge of collapse, were “ adequately capitalized [and] in no danger of failing.”

Following the Crash of 2008, Bernanke’s prognostications did not much improve. Nor did Yellen’s, who had also misjudged the housing bubble, and who became Fed vice chairman in 2010.

The two of them got the “recovery” they predicted, but the weakest “recovery” in history.

Labels:

Ben Bernanke,

Fannie Mae,

Federal Reserve,

Freddie Mac,

Housing 2014,

Janet Yellen

Peter Wallison Says The Housing Bubble Is Back

Here in The New York Times, where he blames sub-prime down payments, not interest rates:

Between 1997 and 2002, the average compound rate of growth in housing prices was 6 percent, exceeding the average compound growth rate in rentals of 3.34 percent. This, incidentally, contradicts the widely held idea that the last housing bubble was caused by the Federal Reserve’s monetary policy. Between 1997 and 2000, the Fed raised interest rates, and they stayed relatively high until almost 2002 with no apparent effect on the bubble, which continued to maintain an average compound growth rate of 6 percent until 2007, when it collapsed. ... Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent.

Many commentators will attribute this phenomenon to the Fed’s low interest rates. Maybe so; maybe not. Recall that the Fed’s monetary policy was blamed for the earlier bubble’s growth between 1997 and 2002, even though the Fed raised interest rates during most of that period.

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down. ...

When down payments were 10 to 20 percent before 1992, the homeownership rate was a steady 64 percent — slightly below where it is today — and the housing market was not frothy. People simply bought less expensive homes.

Obama Has Completed 160 Golf Outings In The Last 5 Years: The Practice Hasn't Helped

White House Dossier here reports that the president golfed 9 out of the 15 days while on his Hawaiian vacation, which means Moochelle was pretty much a golf widow during the time.

She did not return to DC with her family. The cost to the taxpayers of this early "birthday gift" of an extended stay may come to as much as $200,000 or more according to a separate entry here.

The Washington Times noted here the family's vacation was already "regal", and featured a video in which the president misses a long put on a green and then takes what he clearly deems a "gimme" but misses it, and picks it up off the green, not out of the cup. I'll bet his scorecard is minus the stroke . . . a lie like everything else about these people.

Sunday, January 5, 2014

Saturday, January 4, 2014

Vanguard's Worst Performing Bond Funds In 2013

Long Term Treasury Fund, VUSTX: -13.03%

Long Term Government Index Fund, VLGSX: -12.74%

Long Term Bond Index Fund, VBLTX: - 9.13%

Inflation Protected Securities Fund, VIPSX: - 8.92%

Long Term Corporate Bond Index Fund, VLTCX: - 6.86%

Long Term Investment Grade Fund, VWESX: - 5.87%

And as badly as they have performed, I don't see a net asset value for any fund which represents a bargain: they all still look too expensive to me.

Friday, January 3, 2014

Antarctic Global Warming Scientists Rescued, But Rescue Ship Also Gets Stuck In Ice: Story Never Mentions It's Summer In Antarctica

|

| Chinese Snow Dragon stuck in ice after rescue |

Why would they go there at this time if they didn't think they could get to Antarctica?

The story is here.

Evidently the rescue ship is Chinese, but the scientists were transported from their stuck vessel to an Australian vessel which subsequently has been dismissed from the area despite the troubles of their rescuers' vessel, also now stuck.

Reminds me of the tow truck which came to retrieve a neighbor's dead vehicle the other day. The tow truck itself got stuck, and had to be towed by another tow truck. Needless to say the neighbor's vehicle didn't get towed until yet another tow truck came yesterday.

And that's how icy it is, from Antarctica to Michigan.

Labels:

Antarctic,

Australia,

China,

Climate 2014,

Sea Ice,

The UK Telegraph

Current Fair Value Of The S&P500 Is . . . 1005

Doug Short updates his regression analysis for the S&P500, adjusted for inflation, to come up with the S&P500 today about 80% above the long term trend going back to 1871:

"If the current S&P 500 were sitting squarely on the regression, it would be around the 1005 level. If the index should decline over the next few years to a level comparable to previous major bottoms, it would fall to the 450-500 range."

Charts and discussion here.

Government Just Made Two Things You Liked Obsolete: Your Health Insurance And The Lightbulb

Tim Carney, here, says the government ban on the traditional lightbulb is a case of crony capitalism in which industry persuaded government to help it increase energy efficiencies profits by eliminating the bulbs which consumers preferred in order to give them bulbs they didn't want but which cost a lot more, boosting profits they couldn't otherwise make.

You know, just like ObamaCare gives you coverages you neither want nor need and makes your insurance much more expensive than it used to be, and forces everyone to buy it. Insurance companies are happy to get all the new customers, and all the extra profits.

Big business is the enemy of Americans, and of capitalism. Unfortunately, so is the government.

Thursday, January 2, 2014

Jobless Claims Average 435,000 Per Week In Last Month, 17.75 Million Total In 2013

The report for the last week of 2013 is here.

At the current average per week in the last month sustained over a whole year the result would yield 22.6 million first time claims. That doesn't square with the claim that the economy is now in full trot as one headline puts it this morning.

17.75 million actual first time claims for unemployment in 2013, not-seasonally-adjusted, represents the best showing yet under Obama, but still far above George W. Bush's best years in the 16 million range when participation rates were much higher.

With nearly 12 million people having left the labor force since Obama was elected in 2008, far too many of those still working in a much smaller labor pool continue to lose their jobs every week. The levels today only seem less alarming because we remember them from when labor force participation rates were much higher. Now that they are not and levels are still high shows that labor is still flat on its back in this country.

If this is the best Obama can do, it's going to be a very long three more years.

Wednesday, January 1, 2014

Obama's America: Nearly 12 Million Have Given Up And Left The Labor Force Since His Election

In April 2011 over 1 million people, desperate for work, applied for just 50,000 burger-flipping jobs at McDonalds, which ended up hiring 62,000, 24% more than planned.

Where are the other 938,000 today?

The story is still here, thanks to former Mayor Bloomberg.

Those 938,000 most likely ended up joining another 10 million-plus who have left the labor force altogether.

President Obama meanwhile enjoys day 12 today vacationing in Hawaii snorkeling and golfing, according to news reports, after all his hard work fundamentally transforming the country.

Labels:

Barack Obama 2014,

Bloomberg,

Jobs 2014,

McDonalds,

Michael Bloomberg

Tuesday, December 31, 2013

John Crudele Of NY Post Still Not Really Sure What The Fed Has Been Trying To Do

Here in "Bernanke's rate ploy robs from middle class" John Crudele of The New York Post still can't seem to put two and two together even after all this time:

1:

Bernanke, who is leaving his job next month, controls something called the Fed Funds Rate. That’s the rate at which banks can lend each other money for a very short term, generally overnight. That rate is set by the Fed and has been stuck at a puny 0.25 percent for the last few years as the Fed tries to — well, I’m not really sure what the Fed has been trying to do. ...

2:

One of the few rates he has been able to keep low is the yields on things like money-market and savings accounts. The banks love him, since the less they pay out to depositors, the more money they earn.

--------------------------------------------------------------------

What do I gotta do, John, spell it out for ya?

The Fed has been trying to . . . rescue the banks. They don't keep the rate next to zero for this long if they didn't need to.

The middle class has been punished in the process, but lower interest rates presumably have allowed some in the middle class to refinance expensive loans at lower rates while their retirement investments have reflated. That's the rationalization, if not the reality experienced by most.

The banking crisis is over when ZIRP is over.

Labels:

Ben Bernanke,

Federal Reserve,

John Crudele,

Middle Class,

NYPost,

Saving,

yields,

ZIRP

Middle Class In Flames: All The Fed Has Done Is Help The Banks

|

| Naked Capitalism supports Occupy Wall Street. Heh, heh. Does Jeep know? |

Yves Smith of Naked Capitalism, here:

Oh, puhleeze. Robust recovery for who? The Fed not only threw staggering amounts of firepower at salvaging bank balance sheets, while showing no interest in rescuing ordinary Americans. It was also all-in on the Administration’s program to paper over the banks’ chain of title problems and their widespread servicing abuses, and didn’t bother to obtain any meaningful concessions or reforms, the most important of which would have been principal modifications, a remedy favored by investors as well as homeowners. The Fed has been all too happy to accept mission creep rather than speak up forcefully for the need for more fiscal stimulus.

-------------------------------------------------------------------------------

The analysis is right, but the prescriptions are left: raising the minimum wage, breaking mortgage contracts, and spending money we do not have. Oh, puhleeze. It's Naked Liberalism.

But she's great on Obama's Mussolini-style corporatism, most recently here in response to The New Republic:

I’m actually a bit miffed that Konczal treats the “corporatism” appellation as the sole property of the right wing (in the style sheet of the Vichy Left, calling them “hysterics” is redundant but necessary for the rubes), since I have a prior claim. And what is particularly rich is that Konczal apparently regards the allusion to Mussolini to be unfair . . ..

Obamacare IS corporatist. Here we have the industries that are significant contributors to why the American medical system is so overpriced – the health insurers and Big Pharma – actually playing a major role in writing the legislation. And how is it not a sop to large companies to have the government require that citizens buy your product or else pay large tax penalties? Mr. Market certainly thought so, for the price of health insurer and drug company stocks jumped the day the ACA passed. And remember, the beneficiaries of Obamacare extend beyond the insurers and pharmaceutical makers. Hospitals, who increasingly engage in oligopoly pricing (most surgeries need to be done in hospitals), also come out even stronger because new requirements imposed on doctors’ practices will make it difficult for a retiring MD who practices medicine, as opposed to servicing the rich (e.g., cosmetic surgeons) to sell their business to anyone other than a hospital.

And the label fits in the banking arena like a glove. I’ve ... called both the Bush, but far more often the Obama bank-friendly policies “Mussolini-style corporatism” since 2008, and well before what [Mike] Konczal [of The New Republic] claims is the origin of this description, Tim Carney’s book Obamanomics, published November 30, 2009.

Monday, December 30, 2013

North Dakota Railroad Involved In Accident Causing Oil Inferno Is Wholly Owned By Warren Buffett

The New York Post has the story here, but never mentions Warren Buffett, who has become richer off transportation of oil by rail because his pal Barack Obama did him a favor by stopping the XL pipeline in exchange for his support for higher taxes on the rich:

The derailment happened amid increased concerns about the United States’ increased reliance on rail to carry crude oil. Fears of catastrophic derailments were particularly stoked after last summer’s crash in Canada of a train carrying crude oil from North Dakota’s Bakken oil patch. Forty-seven people died in the ensuing fire. The tracks that the train was on Monday pass through the middle of Casselton, and Morris said it was “a blessing it didn’t happen within the city.” The train had more than 100 cars, and about 80 of them were moved away from the site.

According to Wikipedia, here, and BNSF's own website:

The BNSF Railway is the second-largest freight railroad network in North America, second to the Union Pacific Railroad (its primary competitor for Western U.S. freight), and is one of seven North American Class I railroads. It has three transcontinental routes that provide high-speed links between the western and eastern United States. BNSF trains traveled over 169 million miles in 2010, more than any other North American railroad. ... Headquartered in Fort Worth, Texas, the railroad is a wholly owned subsidiary of Berkshire Hathaway Inc.

Labels:

Barack Obama 2013,

Canada,

NYPost,

Taxes 2013,

Warren Buffett,

Wikipedia

Global Warmists Stuck In 5 Meters of Sea Ice In Antarctic SUMMER Now Require RESCUE

|

| Warming scientists stopped by 5m of SUMMER Antarctic ice |

Story here, which never mentions it's the Antarctic SUMMER, and you have to read the picture caption to know how DEEP the ice is:

They went in search evidence of the world’s melting ice caps, but instead a team of climate scientists have been forced to abandon their mission … because the Antarctic ice is thicker than usual at this time of year. The scientists have been stuck aboard the stricken MV Akademik Schokalskiy since Christmas Day, with repeated sea rescue attempts being abandoned as icebreaking ships failed to reach them. Now that effort has been ditched, with experts admitting the ice is just too thick. Instead the crew have built an icy helipad, with plans afoot to rescue the 74-strong team by helicopter.

-----------------------------------------------------------------------------

Yeah, "thicker than usual this time of year": five meters of ice. Do you think these warmists went there expecting to be stopped in their tracks by that?

When tabloid journalists start telling the truth . . . what? Hell will freeze over?

Sunday, December 29, 2013

Aging Lesbian Camille Paglia Still Longs For A Man

Reported here:

Politically correct, inadequate education, along with the decline of America's brawny industrial base, leaves many men with "no models of manhood," she says. "Masculinity is just becoming something that is imitated from the movies. There's nothing left. There's no room for anything manly right now." The only place you can hear what men really feel these days, she claims, is on sports radio. No surprise, she is an avid listener. The energy and enthusiasm "inspires me as a writer," she says, adding: "If we had to go to war," the callers "are the men that would save the nation."

Saturday, December 28, 2013

One Week Later, Michigan Ice Storm Still Had 30,000 Without Power Saturday Morning, But Only 8,100 By Evening

Story here:

In Michigan, roughly 30,000 Consumers customers remained without power, down from 399,000 since a weekend ice storm swept across the state. The worst-hit area continued to be around Lansing, where 3,000 customers were still in the dark Saturday morning.

But this evening, the number is down to 8,100 as reported here:

As of 4:30 p.m. Saturday, Dec. 28, 8,100 customers statewide remained without service. The majority of those people are expected to be restored by midnight Sunday, the utility says.

Mortgaged States Their Grandsires' Wreaths Regret

Where wasted nations raise a single name,

And mortgaged states their grandsires' wreaths regret,

From age to age in everlasting debt;

From age to age in everlasting debt;

Wreaths which at last the dear-bought right convey

To rust on medals, or on stones decay."

To rust on medals, or on stones decay."

-- Samuel Johnson, The Vanity of Human Wishes (1749)

Total Credit Market Debt Owed Has Grown Just 16% In 6 Years, The Smallest Increase On Record

Between July 2007 and July 2013, total credit market debt owed (TCMDO) has grown just 16%, by barely $8 trillion. It's the smallest increase on record for any six year period going back to when the data series begins in October 1949.

Going back six years from 2013 is instructive because the summer of 2007 was when the level of TCMDO last doubled (going back to the summer of 1999), and if you go back to the beginning of the data series you find doubling times of as few as 6 years in length to as many as almost 12. In other words, in a period of rapid credit expansion TCMDO might have conceivably doubled in our last six year period, but it hasn't. We sure could have used it. Instead it has for all intents and purposes collapsed, growing just $8 trillion from $50.032 trillion in 2007 to $58.082 trillion now.

From humble beginnings in 1949 when TCMDO stood at $400 billion, the level went on to double in the summers of 1961, 1970, 1977, 1983, 1989, 1999 and 2007. In order to double again (to a level of $102 trillion) by, say, 2019 (12 years from 2007), we're going to have to pick up the pace just a little . . .. Unless, of course, this debt-based economy has reached the limits of what it can do, which may be what the last six years is trying to tell us.

Here's the data for TCMDO for the six year periods going back to July 1953:

7/1/13 $58.1 trillion (up 16%)

7/1/07 $50.0 trillion (up 74%)

7/1/01 $28.8 trillion (up 58%)

7/1/95 $18.3 trillion (up 45%)

7/1/89 $12.6 trillion (up 102%)

7/1/83 $06.3 trillion (up 97%)

7/1/77 $03.2 trillion (up 87%)

7/1/71 $01.7 trillion (up 57%)

7/1/65 $01.1 trillion (up 49%)

7/1/59 $00.7 trillion (up 42%)

7/1/53 $00.5 trillion.

As Ambrose Evans-Pritchard formulated it in 2011, "debt draws forward prosperity". In other words, we've already enjoyed the prosperity years ago which should be present today by literally pulling it back there from here, and now that we're here, well, there's nothing here, except for a measly 0.97% real average GDP report for the six years 2007-2012.

Time to pay.

Friday, December 27, 2013

About 61,000 In Michigan Still Without Power Two Days After Christmas

|

| Blotches indicate some of the 61,000 still w/o power today in MI |

Story here:

Michigan utilities reported that over 61,000 customers remained without power Friday morning and said it could be Saturday before all electricity is restored.

Wednesday, December 25, 2013

Over 200,000 Still Without Power In Michigan On Christmas Day After Ice Storm

|

| Consumers Energy outage map showing some of Michigan's 200,000 without electricity on Christmas Day |

According to The Detroit News, here:

Roughly 214,000 homes and businesses across lower Michigan were without power late Tuesday. Officials at the area’s major provider, Consumers Energy, described the storm that hit the region over the weekend as the largest Christmas-week storm in its 126-year history. Overall, it’s the largest storm in the last decade, they added.

Sunday, December 22, 2013

Flashback March 2010: Sen. Max Baucus Forgot To Mention Income Redistribution Was FROM The Middle Class, Not To It, Or Did He Just Lie Like Obama Did?

|

| Reward for his service to the State: ambassadorship to China |

Actually, ObamaCare, which is the handiwork of Sen. Max Baucus, will transfer income from the middle class to the lower class and wipe out the middle.

Here, March 25, 2010:

Sen. Max Baucus (D): "Too often, much of late, the last couple three years the mal-distribution of income in America is gone up way too much, the wealthy are getting way, way too wealthy, and the middle income class is left behind. Wages have not kept up with increased income of the highest income in America. This legislation will have the effect of addressing that mal-distribution of income in America."

Meanwhile, income inequality has never been worse, reaching its all time high under just four years of Obama.

Flashback to HuffPo, here in 2012:

In the 2009-2010 period, a time of modest economic growth, the top 1 percent of U.S. earners captured 93 percent of all the income growth in the country.

Got that? Now compare it to how the mega-rich made out during the Bush upswing years of 2002 to 2007. During that time, the top 1 percent of earners captured just 65 percent of all the income growth.

The numbers don't lie. Income inequality has grown at a rate 4.75 TIMES faster under Obama compared to Bush (perfect equality is 0 on the scale, perfect inequality is 1). Inequality has never been higher than under Obama. The nomenklatura gets richer.

The numbers don't lie. Income inequality has grown at a rate 4.75 TIMES faster under Obama compared to Bush (perfect equality is 0 on the scale, perfect inequality is 1). Inequality has never been higher than under Obama. The nomenklatura gets richer.

ObamaCare's Draconian Tax Increase On The Middle Class: Wisconsinite To Pay $7573 Tax On $5000 Of Extra Income

|

| The middle class is the greatest enemy of the proletarian revolution. |

Great example of ObamaCare's war on the middle class from The New York Times, here:

A 60-year-old living in Polk County, in northwestern Wisconsin, and earning $50,000 a year, for example, would have to spend more than 19 percent of his income, or $9,801 annually, to buy one of the cheapest plans available there. A person earning $45,000 would qualify for subsidies and would pay about 5 percent of his income, or $2,228, for an inexpensive plan.

----------------------------------------

Obama's message to America: Don't EARN too much, people, or it'll happen to you, too.

Friday, December 20, 2013

Obama Alters His Own Law Of The Land Yet Again, John Fund Says For At Least The 14th Time

Here:

Yesterday the Obama administration suddenly moved to allow hundreds of thousands of people who’ve lost their insurance due to Obamacare to sign up for bare-bone “catastrophic” plans. It’s at least the 14th unilateral change to Obamacare that’s been made without consulting Congress.

Whether It's ObamaCare Or The Gay Mafia, Camille Paglia Detects Stalinism And Fascism

Lesbian Camille Paglia, quoted here:

“To express yourself in a magazine in an interview — this is the level of punitive PC, utterly fascist, utterly Stalinist, OK, that my liberal colleagues in the Democratic Party and on college campuses have supported and promoted over the last several decades. ... This is the whole legacy of free speech 1960’s that have [sic] been lost by my own party. ... I think that this intolerance by gay activists toward the full spectrum of human beliefs is a sign of immaturity, juvenility. ... This is not the mark of a true intellectual life. This is why there is no cultural life now in the U.S. Why nothing is of interest coming from the major media in terms of cultural criticism. Why the graduates of the Ivy League with their A, A, A+ grades are complete cultural illiterates, etc. is because they are not being educated in any way to give respect to opposing view points. There is a dialogue going on human civilization, for heaven sakes. It’s not just this monologue coming from fanatics who have displaced the religious beliefs of their parents into a political movement. ... And that is what happened to feminism, and that is what happened to gay activism, a fanaticism.”

Here's Paglia in October on ObamaCare:

"But the ObamaCare is, to me, a Stalinist intrusion--okay?--into American culture."

Labels:

1st Amendment,

Camille Paglia,

Daily Caller,

Libya,

Obamacare 2013,

Perversion,

Stalin

Q3 2013 GDP Third Estimate At 4.1%, But Inventories Constitute 41% Of That

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 4.1 percent in the third quarter of 2013 (that is, from the second quarter to the third quarter), according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.5 percent. The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued on December 5, 2103. In the second estimate, the increase in real GDP was 3.6 percent (see "Revisions" on page 3). With this third estimate for the third quarter, increases in personal consumption expenditures (PCE) and in nonresidential fixed investment were larger than previously estimated. ... The change in real private inventories added 1.67 percentage points to the third-quarter change in real GDP, after adding 0.41 percentage point to the second-quarter change. Private businesses increased inventories $115.7 billion in the third quarter, following increases of $56.6 billion in the second quarter and $42.2 billion in the first.

---------------------------------------------------

That's a huge inventory number compared to the recent past.

Personal consumption expenditures, which in the second estimate came in at a paltry 1.4%, suddenly are revised up 0.6 to 2.0% in the third estimate, also contributing significantly to the up revision of GDP. In the second estimate it looked like the consumer was pulling back by over 20% from the second quarter. In the third estimate it now appears the consumer ramped it up by over 10% in Q3 compared to Q2, quite the reversal.

Someone wanted to go home early: Both reports in html and pdf say "December 5, 2103".

Hey. They're just numbers. Time for a beer.

---------------------------------------------------

That's a huge inventory number compared to the recent past.

Personal consumption expenditures, which in the second estimate came in at a paltry 1.4%, suddenly are revised up 0.6 to 2.0% in the third estimate, also contributing significantly to the up revision of GDP. In the second estimate it looked like the consumer was pulling back by over 20% from the second quarter. In the third estimate it now appears the consumer ramped it up by over 10% in Q3 compared to Q2, quite the reversal.

Someone wanted to go home early: Both reports in html and pdf say "December 5, 2103".

Hey. They're just numbers. Time for a beer.

Thursday, December 19, 2013

Economic Stress Continues: Average US Car 11.4 Years Old In August, Another Record

|

| 1997 Olds LSS |

The story was reported here:

The average age of vehicles on America's roads has reached an all-time high of 11.4 years, according to the market research firm Polk. And that average age is sure to keep climbing, the firm said. ... In 2002, the average vehicle was 9.6 years old. In 1995, it was 8.4 years.

----------------------------------

While cars are getting better and lasting longer, this may also be a picture of economic stagnation, and perhaps decline.

Deleveraging: Consumers Reduced Debt By Less Than 8% Between January 2008 and July 2012

And household debt is on the rise again since summer 2012, up now to just under $13.1 trillion.

Squawkers everywhere (here and here) are making a big deal of this, but I'm still not convinced. We're only talking $169 billion of borrowing in the last year, July on July.

16 million vehicle sales per year at $15,000 each is $240 billion. Presumably there are some good credit risks buying some of those new vehicles, as there always are. But with the average US car age at 11 years old in summer 2012 increasing to 11.4 years old in summer 2013, record highs, and projections expecting average age to increase still more years down the road, I'd say the very slight increase in indebtedness may have more to do with necessity playing out than with a fundamental return to healthy debt-fueled growth.

As I pointed out from a source in the earlier post on this subject, many more of the new car loans are subprime, higher loan to value to be able to afford the down payment, and longer term than they used to be. The quality of the increased indebtedness is nothing to be happy about, and tells a tale of continued economic stress, not of economic recovery.

Libertarians At Forbes Completely Misrepresent The Mortgage Interest Deduction

Here:

The mortgage interest deduction (MID) is the largest personal tax deduction on the books and is widely considered one of the most sacrosanct tax benefits in the country because it is seen as making homeownership more affordable for middle-class Americans. Our new Reason Foundation research suggests, though, that the average benefits from the MID are not enough to be the difference between renting and home owning for a household.

----------------------------------------------------------------

If there's a sacrosanct tax benefit in this country, which by the way benefits mostly upper income people who also pay most of the taxes, it's reduced rates of taxation on dividends and long term capital gains, which the Joint Committee on Taxation says costs the federal government $596 billion in lost revenue between 2012 and 2016. The mortgage interest deduction, by contrast, will cost the feds $364 billion. Leave it to Forbes not to mention that.

The mortgage interest deduction may or may not be "the largest personal" deduction, but in the big picture of revenue forfeited by the feds due to tax preferences, which is categorized as "tax loss expenditure", the mortgage interest deduction represents just 6.9% of the revenue lost out of the largest 21 line items in the JCT's report representing $5.25 trillion in tax loss expenditures for the period mentioned (here).

Preferential treatment of income from stocks isn't the biggest preference either (11.4%), but it is much bigger than the preference given to mortgage interest. But businesses do get the biggest preference. When employers provide healthcare contributions, health insurance and long term care insurance, they get to deduct all of that. Cost to the feds? A whopping $706.6 billion (13.5%). And that figure will only grow under ObamaCare.

And how about retirement plan contributions? Cost of excluding both defined benefit and defined contribution plans comes to $505.3 billion over the period (9.6%).

Compared to these, the mortgage interest deduction comes in a distant fourth (in fifth is the earned income tax credit at $319.7 billion).

Compared to these, the mortgage interest deduction comes in a distant fourth (in fifth is the earned income tax credit at $319.7 billion).

The much-maligned charitable deduction, meanwhile, which was the original basis for the standard deduction in the tax code, at $172.4 billion represents just 3.3% of the lost $5.25 trillion in revenue from 2012 to 2016. It comes in fourteenth.

There's lots of things wrong with the world, but changing the home mortgage interest deduction isn't going to fix them. For libertarians to focus on it as they do should tell you there's more going on here than meets the eye: an ideological bias against home ownership because it limits "freedom". Millions beg to differ.

Largest Sums Of Federal Revenue Forfeited Because Of The Tax Code, Joint Committee On Taxation, 2012-2016

$706.6 billion: exclusion of employer contributions for healthcare, health insurance premiums and long term care insurance premiums.

$596.0 billion: reduced rates of taxation on dividends and long term capital gains.

$505.3 billion: net exclusion of pension contributions and earnings to defined benefit/contribution plans.

$364.0 billion: mortgage interest deduction.

$319.7 billion: earned income tax credit.

$305.0 billion: exclusion of Medicare Parts A&B benefits.

$289.4 billion: credit for children under 17.

$259.2 billion: deduction of nonbusiness state and local government income taxes, sales taxes and personal property taxes.

$239.7 billion: deferral of active income of controlled foreign corporations.

$236.1 billion: exclusion of capital gains at death.

$184.3 billion: subsidies for participation in healthcare exchanges.

$182.8 billion: exclusion of interest on public purpose state and local government bonds.

$175.8 billion: exclusion of benefits provided under cafeteria plans.

$172.4 billion: deduction for charitable contributions.

$172.1 billion: exclusion of untaxed Social Security and railroad retirement benefits.

$153.8 billion: exclusion of investment income on life insurance and annuity contracts.

$143.0 billion: property tax deduction.

$124.1 billion: exclusion of capital gains on the sale of a home.

$119.1 billion: credits for tuition for post-secondary education.

Wednesday, December 18, 2013

The Market Goes Irrational Whether The Fed Pumps, Stands Pat Or Tapers

Today the Fed announced a reduction of MBS and Treasury purchases of $10 billion, from $85 billion to $75 billion a month.

Usually when the Fed has announced things are still weak and that purchases will continue as planned, the market has rallied strongly. Same with announcements of new asset purchases.

Today the Fed announced the opposite, intending to scale back purchases, and the market rallied huge.

If you are looking for stupid pills at Walgreens, they're all out. Anyway that's what my broker said.

John Hussman Is Right: High Valuations Since The Late 1990s Have Coincided With Smaller S&P500 Returns

Here's Hussman:

Yes, several reliable valuation measures have hovered at much higher levels since the late-1990’s than were generally seen historically. But that in itself is not evidence that these historically reliable valuation measures are “broken.” It matters that those high valuations have been associated with a period of more than 13 years now where the S&P 500 has scarcely achieved a 3% annual total return.

Here's Ironman's chart of S&P500 returns for the 15 years ended October 2013 showing a real, that is inflation-adjusted, total annual return with dividends fully reinvested of . . . 2.88%:

|

| click to enlarge |

Here's Morningstar's chart showing how much better you'd have done in intermediate term bonds like Vanguard's VBIIX, 5.88% nominal per year over the last 15 years (roughly 3.4% real), and that's including this year's bond slaughter:

|

| click to enlarge |

Here's the Shiller p/e as of this morning, clearly and excessively above the mean level of 16.50 for most of the time from the 1990s:

|

| click to enlarge |

Hussman says investors should expect poor returns from stocks going forward:

[S]tocks are currently at levels that we estimate will provide roughly zero nominal total returns over the next 7-10 years, with historically adequate long-term returns thereafter.

Tuesday, December 17, 2013

Greedy Democrats Have Used Medicaid Since 1993 To Take Your Assets, Now It Ramps Up Under ObamaCare

Signing up for Medicaid may be signing away everything you own.

From the story here:

The Omnibus Reconciliation Act of 1993 [under Bill and Hillary Clinton and a Democrat Congress] requires states to pursue Medicaid asset recovery from persons who receive benefits at age 55 or older. At first, this applied mainly to nursing home benefits, but at state option, it could now include any items or services provided under Medicaid. ... A potential for greatly expanded use of estate recovery was created in Obamacare, as pointed out in an anonymously authored, well-documented article distributed by economist Paul Craig Roberts. Obamacare increases the number of people eligible for Medicaid by dropping the asset test for enrollment (Page 162 of Obamacare). ... Medicaid, supposed to be a program to help the poor, has become a cash cow for multibillion-dollar, managed-care companies, who milk federal and state taxpayers. Expanding Medicaid to persons with modest assets will enable estate recovery to become a cash cow for states to milk the poor and the middle class.

American Killer Obama Shakes Hands With Cuban Killer Castro

The outrage is that Obama's still our president, not that he shook hands with a fellow murderer.

Story here.

Monday, December 16, 2013

Former MT Governor Democrat Brian Schweitzer Calls Obama A Corporatist

The story, here, is attracting quite a discussion in the comments section about how a lefty like Obama could possibly also be a fascist, since Schweitzer characterizes Obama's entire presidency as a move to the right.

The true believers are furious with Obama.

Subscribe to:

Comments (Atom)