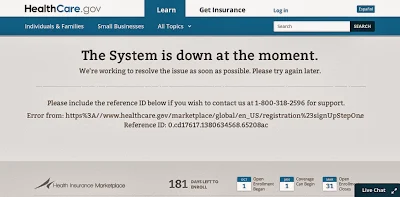

In this age of "choice", not having one is what upsets people, except Obama and his supporters.

John Harwood, here, in Wednesday's "Obama To Wall Street: This Time Be Worried", indicates the president is aware of the polling data but doesn't really care that we don't like his law, which he doesn't seem to like much either because he's unilaterally and unlawfully delayed many parts of it:

On Obamacare, the president's most significant legislative accomplishment, Obama said that despite certain polls showing it was unpopular with specific segments of the population--namely white people--the law would ultimately be accepted by the population at large. Tenets of the bill are popular among "all races" the president said. "The majority of the people who will be helped by the ACA will be white," he said.

Rasmussen reports 55% of whites and 46% of minorities don't support the individual mandate:

Fifty-two percent (52%) of black voters agree that the government should require every American to buy or obtain health insurance. Fifty-five percent (55%) of whites and a plurality (46%) of other minority voters oppose that mandate.