Sunday, April 21, 2013

Julius Genachowski, Public Menace At The FCC

|

| Obama's amoral commie at the FCC. |

To Julius Genachowski, public menace:

Your statement excusing the public profanity of Red Sox player David Ortiz is completely unacceptable.

It's public officials like you who are responsible for advancing the decline of America pushed by its worst examples in sports and entertainment. You are supposed to enforce standards of public decency, but your disgusting rationalizations only mean our children will be exposed to more and more barbarity without our consent, degradations from which we find it increasingly difficult to protect them.

I can't say for whom I feel more contempt, David Ortiz, you, or the ne'er-do-well who gave you your job.

Signed,

A Patriot

Saturday, April 20, 2013

Incompetent Government Couldn't Stop Tsarnaev Or Find Him Afterwards

Our incompetent government, after spending billions of our dollars to stop terrorists and shredding our liberties in the process through surveillance of email and cellphone traffic and body searches at airports, couldn't stop yet another massacre by a couple of determined punks.

And afterwards it couldn't find the last suspect, even though the rights of a free people were trampled with the imposition of a police state and the shut down of a great American city:

"Up until the younger man's capture, it was looking like a grim day for police. As night fell, they announced that they were scaling back the hunt because they had come up empty-handed," it was reported here.

"Up until the younger man's capture, it was looking like a grim day for police. As night fell, they announced that they were scaling back the hunt because they had come up empty-handed," it was reported here.

Maybe we should rethink who we let in here and why, instead of what we are doing, which is acting more like the unfree world from which immigrants to our country flee.

Why A Hailstorm Of Gunfire If Tsarnaev Was Found By Homeowner Curled-Up In A Ball?

These reports don't add up:

CNN here, where the video doesn't show the boat covered in a blue tarp but white, casting doubt on the credibility of what the stepson says but CNN seems to accept as fact anyway:

Henneberry [the homeowner] climbed a stepladder to look inside. "He basically stuck his head under the tarp (and) noticed a pool of blood," Duffy said. It was dark under the tarpaulin, so the boat owner could only make out vague contours, "but he definitely noticed there was something crumpled up in a ball," the stepson said. A pool of blood; a manhunt in Watertown; time to call 911. Squad cars with lights flashing raced in and lined the streets. Officers fanned out around the house. ... Duffy said he tried frantically to call his mother and stepfather as he watched on TV while law officers unleashed a hailstorm of gunfire into the backyard.

UK Daily Mail here, whose photos clearly show not a blue tarp but white, quotes the police spokesman unaccountably ringing the same bell that Tsarnaev was too out of it to resist:

'He had lost a lot of blood. He was so weak that we were able to just go in and scoop him up,' state police spokesman David Procopio told the Boston Herald adding that the suspect was in 'serious if not critical condition'.

Another video of gunfire, here, which is mostly noteworthy for what you hear, not what you see:

Barack Obama Wants Us All To Become Yuri Zhivago

"Yuri Zhivago (Omar Sharif) is essentially apolitical but he is also an idealist and when he returns home from the war to Moscow to discover that the People have taken over his home and moved 15 families into it, he pauses to process this infomation and then says 'It's much better this way. More just.' When his slightly more cynical uncle (Ralph Richardson) laughs at this, Yuri insists, 'but it is more just!'"

-- Kyle Smith, here

"President Obama’s fiscal 2014 budget has a section prohibiting individuals from accumulating over $3 million in tax-preferred retirement accounts. It states: 'Individual Retirement Accounts and other tax-preferred savings vehicles are intended to help middle class families save for retirement. But under current rules, some wealthy individuals are able to accumulate many millions of dollars in these accounts, substantially more than is needed to fund reasonable levels of retirement saving. The budget would limit an individual’s total balance across tax-preferred accounts to an amount sufficient to finance an annuity of not more than $205,000 per year in retirement, or about $3 million for someone retiring in 2013.'"

-- Blake Hurst, here

Friday, April 19, 2013

Louis Woodhill: Gold As Money Is Inevitably Deflationary In Terms Of Its Supply

So says Louis Woodhill for Forbes, here:

"The most fundamental issue that determines the workability of a gold standard is whether it attempts to use gold as money. Any gold standard system where the size of the monetary base is determined by the physical supply of gold will eventually suffer a deflationary collapse. The economic catastrophe that occurred in 1930 was inevitable, given the design of the gold standard system in use at the time. ...

"The use of gold as base money would quickly become the biggest single source of demand for gold, just as was the case during the years prior to the Great Depression. Sooner or later, this new demand for gold would cause the real price of gold to start rising. This would automatically cause the real value of the dollar to rise, precipitating a financial and economic crisis.

"Our highly leveraged financial system simply cannot tolerate monetary deflation. During a financial crisis, everyone tries to become more liquid at the same time. That is, everyone tries to increase their holdings of money, because the possession of money itself is the only thing that can guarantee that you will be able to pay your debts.

"If gold is money, and money is gold, this means that, once a liquidity crisis started, the demand for gold would increase. This would drive up gold’s real value even farther, intensifying the crisis. A destructive feedback loop would develop, leading to a complete meltdown of the financial system and the real economy. This is exactly what happened in 1930."

It should be added that a monetarist system, by way of contrast, cannot tolerate credit deflation, but that is exactly what the United States is now facing with total credit market debt outstanding slowing to a crawl of $1.17 trillion added per year between 2007 and 2012. At the very slowest it should be growing at a rate of $4.33 trillion per year by historical measures, and at its fastest by $8.31 trillion per year.

The United States at present is in the throes of a deflationary collapse of monetarist making, not of dollar currency but of credit money, and it is the principal reason for the collapse of GDP. One of the largest sources of the "currency" of credit money in recent years has been mortgages, which are now effectively unacceptable as collateral because of the rot permeating the system in the form of defaults and underwaters.

Federal Reserve policy has actually been removing such collateral from circulation, along with US Treasuries, by placing it on its balance sheet. But since there is nothing "real" behind the dollars the Fed replaces this collateral with, there is no corresponding expansion of credit in size to match the former vigor of the process.

So perhaps the Fed should QE gold instead of MBS and Treasuries to provide something real behind the money created which would give that money a surer basis in collateral.

Central banks around the world have been buying gold in quantities not seen in 30 years in order to fill the collateral gap. The Fed should join them.

Labels:

cash,

Federal Reserve,

Forbes,

GDP 2013,

gold standard,

Housing 2013,

Louis Woodhill

Bob Pisani's Wrong: GLD ETF Is Much Larger Than He Says

Bob Pisani reported here on Monday that the ETF GLD "only has 1,300 tons of gold":

"The largest gold ETF, the GLD, only has 1,300 tons of gold. Compare that to the 8,000 tons the U.S. has."

But Bloomberg's Nicholas Larkin reported here on Tuesday it's twice that amount as recently as December, and still nearly 2,400 tons since the price drop:

"The metal’s drop wiped out almost $1 billion of hedge-fund manager John Paulson’s wealth in the past two days. The 57-year-old began the year with about $9.5 billion invested across his hedge funds, of which 85 percent was in gold share classes. He’s sticking with his thesis that gold is the best hedge against inflation and currency debasement, John Reade, a partner and gold strategist at New York-based Paulson & Co., said in an e-mailed statement.

"Paulson is the largest investor in the SPDR Gold Trust (GLD), the biggest bullion-backed exchange-traded product. Global holdings in the products declined 9.5 percent this year to 2,382.4 tons, according to data compiled by Bloomberg. Assets reached a record 2,632.5 tons in December.

"The cost of protecting gold from losses in the options market increased. Puts protecting against a 10 percent drop in the SPDR Gold Trust cost 4.28 points more than calls betting on a 10 percent gain, the biggest difference on record, according to three-month data compiled by Bloomberg."

GLD is a much larger market maker for gold than many people realize.

Thursday, April 18, 2013

Forget The "Threat" Of Deflation. Its Crushing REALITY Means Monetarism Is Doomed.

|

| Galactic hitchhikers know this is the answer to everything. |

Ambrose Evans-Pritchard and Lars Christensen, here, think deflation is only an omnipresent threat:

The world is still in a contained depression. Sliding commodities tell us global money is if anything too tight. "There is a threat of deflation almost everywhere. A lot of central banks will have to follow the Bank of Japan, whatever they say now," said Lars Christensen from Danske Bank.

The era of money printing is young yet. Gold will have its day again.

I couldn't agree less. The threat isn't everywhere. The reality is everywhere.

Total credit market debt outstanding (TCMDO) for the five years ended on July 1, 2012 was up a paltry $5.83 trillion. Yes, I said paltry. For monetarism to continue working as it has in the past, TCMDO needs to double on average every 8.25 years. That's the historical experience of America going back to the beginning of the post-war. At the current rate since 2007, however, it's going to take until the year 2049 for TCMDO to double from July 1, 2007.

We've had periods of doubling as short as six years for TCMDO, and periods as long as 11.5 years, but at the current rate over the last five years continued into the indefinite future it's going to take 42 years to double. 42 years. Not 11.5 years. And not 6 years. 42 YEARS. America has hit a brick wall.

People who talk about an L-shaped recovery and decades of economic shrinkage ahead may not appreciate quite adequately enough just how right they are.

Jim Cramer Gets It Right, Links Long Rise Of Commodity Prices To Creation Of ETFs

Think GLD, SLV, etc., as we've been saying.

Here:

"In the past two decades we have seen an unprecedented financialization, if you will, of all commodities. Pretty much everything is traded either through glibly created ETFs or through futures backed up by warehouses somewhere or through physical hoarding via tanker ships. The pools of money that have chosen to make commodities as an asset class is much larger than we can ever know because those funds aren't registered anywhere and pretty much report to no one.

"I am sure at one time, before the ETFs and the large pools of capital, you might have traded these commodities on actual supply and demand. ...

"What mattered was the financial buyer not the natural buyer."

So we all have been paying too much for this stuff for a long time already.

Same thing happened in housing, and commodities will end up just like housing, down big time.

Twelve Times Today's Silver Price Means $279 Gold

Louis Woodhill doesn't get there by the same rule, but he's in the same ballpark in this story from May 2012, when the average price of gold was $1,586:

[I]t only makes sense that the gold price be set by the application of a rule, and not via discretion exercised by “experts”.

It is possible to imagine catastrophic consequences to setting the value of the dollar in terms of either a gold price of $800 or $1600/oz. In The Golden Constant, Roy Jastram argued that, over time, gold maintains its value in terms of the general price level. If Jastram is correct (and he may well be), the gold price that would be consistent with today’s general price level would be around $225/oz.

Based on the average price of silver in May 2012, twelve times that yielded $343 gold.

Plato's Gold/Silver Ratio was 12, Founding Fathers' 15. At this hour it is 59.7!

Socrates

Now answer this further question: you say that if one acquires more than the amount one has spent, it is gain?

Friend

I do not mean, when it is evil, but if one gets more gold or silver than one has spent.

Socrates

Now, I am just going to ask you about that. Tell me, if one spends half a pound of gold and gets double that weight in silver, has one got gain or loss?

Friend

Loss, I presume, Socrates for one's gold is reduced to twice, instead of twelve times, the value of silver.

Socrates

But you see, one has got more; or is double not more than half?

Friend

Not in worth, the one being silver and the other gold.

-- Plato's Hipparchus 231cd

First Time Claims for Unemployment In 2013 Still About Like Last Year: Bad

The raw number of first time unemployment claims averaged 336K per week in the last month in today's report. The seasonally-adjusted 4-week average number of first time claims for unemployment is higher at 361,000.

The raw figure of 336K yields an annualized 17.5 million, the seasonally-adjusted number 18.8 million. Both are still in excess of the annual actuals for 2006 or 2007, before the financial crisis, which were 16.2 million and 16.7 million respectively.

Actual claims for 2012 were 19.4 million, so we are right now in the last month still doing better than last year's overall rate of claims, at roughly 10% higher than pre-crisis averages. However, the average of all the raw claims for 2013 year to date is running at 375,000 per week, which annualized is 19.5 million, just slightly worse than last year.

At the height of the unemployment crisis in 2009 the raw number of first time claims totaled 29.5 million for the year, a rate of 567,000 per week.

Today's report is here. The link to past data which was unusually missing in last week's report got put back in today's.

Wednesday, April 17, 2013

Barry Ritholtz Is Against The World Religion Of Gold

Barry Ritholtz here recently had some fun with the goldbugs, whom he ridicules as devotees of a "religious cult".

The piece is regrettably inflammatory. Doesn't he know he's writing off the whole world as a bunch of religious kooks in this temper tantrum? That's pretty much what ideologues do when reality won't cooperate with their theories, but surely he must know that sovereigns and central banks the world over continue to build their hoardes of gold year upon year, now approaching 32,000 tonnes and 20% of all the stuff ever pulled out of the ground. That's quite the foundation for the edifice of the worldwide church of gold.

The piece is regrettably inflammatory. Doesn't he know he's writing off the whole world as a bunch of religious kooks in this temper tantrum? That's pretty much what ideologues do when reality won't cooperate with their theories, but surely he must know that sovereigns and central banks the world over continue to build their hoardes of gold year upon year, now approaching 32,000 tonnes and 20% of all the stuff ever pulled out of the ground. That's quite the foundation for the edifice of the worldwide church of gold.

In fact, many of the central banks in particular have been on a tear recently, acquiring the stuff in quantities not seen in 30 years. Evidently they are to a man possessed by the Oracle of Au (pronounced "Ow"). But try as they may to acquire new gold reserves, no one of them yet even comes close to the chief priest bowing and scraping before the barbarous relic, namely the USA, the number one holder of gold in reserve to the tune of 8,134 tonnes (not to be confused with tons).

That even the USA with all its fiat money still considers this gold to be the most sublime of all currencies can be seen in its own gold issues. Gold Eagles, in one ounce sizes down to tenth ounce, are denominated from $50 down to $5. It says so right on the coins. (I understand if you don't believe me because you haven't seen one. They are expensive these days.) I myself haven't seen one of these things in my change at Walmart recently, or anywhere else, but theoretically you could. In various places around the country they are in fact found in Salvation Army kettles from time to time, usually around the time of a holiday formerly known as "Christmas".

There is a reason for what appears on a Gold Eagle: The US government has decreed that gold is money, and that the price of gold cannot fall. It has fixed the price at $42.22 per troy ounce since 1973, and it hasn't fallen since. The one ounce $50 Gold Eagle thus closely approximates this valuation, as it should if America wants to maintain its credibility as the leader of the free world and the spokesman for truth, justice and the, well, American way. The excess, in case you were wondering, is simply a small bonus in exchange for providing the world with both its security and its reserve currency, both of which are quite costly to the inhabitants of the land of the free.

There is a reason for what appears on a Gold Eagle: The US government has decreed that gold is money, and that the price of gold cannot fall. It has fixed the price at $42.22 per troy ounce since 1973, and it hasn't fallen since. The one ounce $50 Gold Eagle thus closely approximates this valuation, as it should if America wants to maintain its credibility as the leader of the free world and the spokesman for truth, justice and the, well, American way. The excess, in case you were wondering, is simply a small bonus in exchange for providing the world with both its security and its reserve currency, both of which are quite costly to the inhabitants of the land of the free.

Over our long history, the price of gold has indeed risen despite the best efforts of "manipulators" to stop it from doing so. For a long time the price of gold had been ruthlessly kept down at $20.67, from the War Between the States to FDR, but suddenly became $35 when the greatest Democrat ever saved us from the bad old ways. Not to be outdone, however, the great Republican Richard Nixon managed to make gold higher still, at $42.22, where it has stood ever since.

See, the price of gold hasn't ever fallen in America, it's only risen, just like Jesus. It's God's will. It is our manifest destiny.

See, the price of gold hasn't ever fallen in America, it's only risen, just like Jesus. It's God's will. It is our manifest destiny.

That said, more people these days do need to come to accept the reality of this defacto gold standard to which our benevolent government all too secretly adheres. Younger generations of mockers actually have arisen among us who need to repent of their intemperate outbursts against gold and believe in the Gold Gospel once again. Instead of denying the reality of this kingdom of gold, which is really present here and now in the sacramental dollar, they need to wake up and consider the future possibilities of our great civilization and its gold religion.

Perhaps then there would be more public support for all these central bankers who print funny money to drive gold prices higher, especially for our own Ben Bernanke at the Federal Reserve who far excells all others at this. What he really needs most right now is more public encouragement to use that funny money like our competitors do in the world. Like them, we need to start augmenting our gold reserves once again using funny dollars to buy gold just as they are doing using, say, funny yuans. After all, this is actually a divinely sanctioned practice, what the Bible calls making use of "unrighteous mammon". You can look it up, it's right in there. Ben really needs to get on this right away. It should be a matter of his monetary policy to drive up the price of gold by hoarding it. Who knows, maybe we can even get our tonnage back up where it used to be after WWII, around 20,000 tonnes, and just think, all it will cost us is some paper and ink.

Meanwhile gold continues to work for us in season and out of season, in good times and in bad. Our reserves have seen us through thick and thin, whether it's been the boom times under Reagan/Bush/Clinton or the misery index years of Jimmy Carter or the new depression years of Barack Obama. Our gold is still there, just like the flag. It hasn't rusted, shrunk in the rain, or even tarnished. Good as gold as they say. Things might be even better if we had more of it, but you've got to be thankful for your blessings, thankful for what you do have.

The truth is, even in the very worst of circumstances imaginable gold has performed miracles for people. A few well-placed gold coins not that long ago meant the difference between some of our fellow countrymen coming here or going to the gas chambers. Ask them and their progeny if escaping an apocalypse wasn't "just fine", even if they were penniless afterward.

No, the only suckers when it comes to gold have been those who let theirs go when misguided government came looking for it. Some of those babies confiscated in 1933 now fetch $300,000. The rest appreciated in value in their melted down form in the government's vault, but only 6600%. You could go to Harvard today with just 120 of those ounces. In the present banks and governments across the globe are finding the collateral gold provides rather more reliable than US Treasuries in a pinch, which is why they keep acquiring it. Evidently we haven't yet understood the message that this sends.

Meanwhile gold continues to work for us in season and out of season, in good times and in bad. Our reserves have seen us through thick and thin, whether it's been the boom times under Reagan/Bush/Clinton or the misery index years of Jimmy Carter or the new depression years of Barack Obama. Our gold is still there, just like the flag. It hasn't rusted, shrunk in the rain, or even tarnished. Good as gold as they say. Things might be even better if we had more of it, but you've got to be thankful for your blessings, thankful for what you do have.

The truth is, even in the very worst of circumstances imaginable gold has performed miracles for people. A few well-placed gold coins not that long ago meant the difference between some of our fellow countrymen coming here or going to the gas chambers. Ask them and their progeny if escaping an apocalypse wasn't "just fine", even if they were penniless afterward.

No, the only suckers when it comes to gold have been those who let theirs go when misguided government came looking for it. Some of those babies confiscated in 1933 now fetch $300,000. The rest appreciated in value in their melted down form in the government's vault, but only 6600%. You could go to Harvard today with just 120 of those ounces. In the present banks and governments across the globe are finding the collateral gold provides rather more reliable than US Treasuries in a pinch, which is why they keep acquiring it. Evidently we haven't yet understood the message that this sends.

It's true in a sense that gold is a rejection of government control, but only in the sense of its opposite, self-control, which is what in America is the unique basis of our form of government. It was an idea bequeathed to us by Protestantism, and also by Plato, both of which are unhappily out of favor. But seeking to control your own destiny, which is what many foreigners are doing by acquiring gold, is actually the sincerest form of flattery of what the United States used to stand for. Free from the control of a reserve currency, there's no telling what others in the world may accomplish without us. But under a universal currency, there's no telling what we could still accomplish together.

Tuesday, April 16, 2013

QE Removes Banking Collateral, So Gold Steps In And The Price Plunges

So says Jeffrey Snider of Alhambra Investment Partners, here, who sees it as a sign of big trouble ahead, with banks out front in the lead:

[I]n times of extreme stress, gold acts like a universal liquidity stopgap – when all else fails, repo gold. The operational reality of a gold repo is a gold lease, charged at the forward rate (GOFO). In terms of market mechanics, a dramatic increase in gold leasing is seen as a massive increase in supply on the paper markets. For various reasons in the past five years, collateral chains and the available collateral pool has dwindled dramatically. That has left banks to scramble for operational bypasses, but it also has led to periods of very acute stress. When we match the price of gold against these stressed periods, they coincide perfectly. In other words, whenever collateralized lending has become problematic banks appeal to the universal collateral. Unfortunately, that looks like gold selling to the uninitiated. These large declines in gold prices match date for date the extreme developments in the banking system across several currencies. And in each case the gold selloff has previewed a larger decline in systemic liquidity that eventually catches other asset classes.

Did you get that? The price drops on the appearance of a massive increase in supply, on the paper markets, when in actuality there is nothing of the kind.

Monday, April 15, 2013

Another Gold Bear Recognizes Fair Value Is Below $500 The Ounce

Noted by Bob Pisani, here:

Gold bears like MKM note that if gold had simply moved with the CPI basket since 1913, it would stand at $490 an ounce. Wow. That is more than 60 percent below it's [sic] already low price. I doubt it will go anywhere near there.

Pisani and just about everyone else is focusing on the run-up in gold since 2008 to its extraordinarily high levels of recent years, finding it nearly inconceivable that gold could lose all of those gains since 2008, while ignoring at the same time the run-up to 2008 which established gold's floor for the last five years' move to the stratospheric level.

It would be easy to blame the financial crisis and/or QE for the last five years of gold price rises to $1900, but QE had nothing to do with the five to seven years before 2008 when gold rose to $800 from $300. Perhaps easy money could be credited with that in the 2000s, but we've had easy money before 2003, too. Alan Greenspan's easy money from 1995 did nothing for gold, which continued down to $263 by late 2000. So what made gold skyrocket beginning after 2003? Everyone is ignoring who were the buyers then who helped drive up the price of gold.

The answer is buyers of GLD, the gold ETF launched in 2004. If puny little Cyprus can set off a wave of gold selling today with 14 lousy metric tonnes in question at the maximum, think about what GLD has done to gold buying, and thus to the gold price, over the years building up a wave of 1300 tonnes from 2004. GLD easily qualifies as the major player in the buying action in an annual production environment of about double that figure. It's just that now the limit has been reached under current conditions, and people are starting to realize that confiscation is becoming thinkable again. The gold price has slowly eroded from the September 2011 peak, and is now being shoved over the edge by confiscation fears.

You build a market and they will come, until actual ownership becomes more important than a paper proxy. That is a problem GLD cannot solve, nor any other gold "investment" which does not involve transfering physical possession to the buyer. Germany, for example, no longer trusts its gold in others' hands and wants it back in country. Try telling that to GLD, which won't be transferring gold to any "owners". I'd say that's very negative for GLD going forward, and very negative for gold prices generally because of GLD's sheer heft, just as possible confiscation of weak sovereigns' gold looming as a very real possibility is negative for gold prices because of their relative size and importance.

When it comes to GLD or any other form of paper gold, the only important question is, "Where are all the customers' yachts?"

Labels:

Alan Greenspan,

Bob Pisani,

CNBC,

Cyprus,

Federal Reserve,

Germany,

gold,

Jesse Livermore

Carnage in Gold Creates Near Perfect Gold/Oil Ratio of 15.2

The collapse in NY gold from $1501 on Friday to $1352 tonight adds a nearly 10% decline on top of Friday's 4% decline.

Oil closed down too, today, just below 89, yielding a nearly perfect gold/oil ratio of 15.2.

Based on the decline in the ratio down to this point, the buy signal for oil the higher ratio indicated comes off. But that doesn't mean we've got a buy signal for gold. Yet.

At 82.29, the US Dollar Currency Index is not indicating any real new strength on these developments.

Caution is indicated as gold may well continue down, and oil may follow it.

TIPS Sell-Off A Sign Of Deflation In The Economy?

Bloomberg has the story about the sell-off in Treasury inflation-protected securities, here:

For the first time since the depths of the financial crisis in 2008, mutual funds that target Treasury Inflation-Protected Securities have seen outflows for three straight months, according to Morningstar Inc.

Even after the Fed injected more than $2.3 trillion into the financial system since 2008, inflation is under control, bolstering the appeal of bonds while providing the central bank with more scope to provide stimulus as needed to foster the economic recovery. Commodity prices are down and wages have grown just 1.9 percent on average since 2009, below the 3.1 percent in the prior three years, government data show.

“With such weak labor markets, flat income growth and flat wages, and commodities weak, we just won’t see the inflation that the TIPS market is pricing in,” Dan Heckman, a fixed- income strategist at the U.S. Bank Wealth Management unit of U.S. Bancorp, which manages $110 billion, said in telephone interview April 9.

Art Cashin Looks For A Watering Hole, Out Of The Deflationary Wind

Five o'clock has been replaced. Our kind of guy:

"It's always noon somewhere."

On the Friday just past, here.

Josh Brown Doesn't Think Too Much Of Your Paper Gold

|

| Oliver Cromwell |

And he's not too fond of the real thing sitting right in front of you, either, here:

'It is utterly uninteresting to me and gold equity investing - things like paper ETFs and the shares of horrible gold miners - seems to defeat the whole purpose of an end-of-the-world asset class in the first place. I promise, should a torrent of plague and genocide wash across the land on a roaring floodtide of blood and economic catastrophe, your stupid-ass "stock market gold" shan't be left unscathed. And if I am dismissive of it as an investment, you can imagine how I feel about it as an actual real-life medium of exchange - I live in the United States of America in the 21st Century and I have no interest in exchanging dollars in my savings account for something that hedge funds and sovereign governments can pump and dump at will.'

Well, they can pump and dump worthless paper currencies, too, and are. That's the problem. But as I pointed out here last year, gold has been on a tear ever since paper gold in the form of GLD made its appearance in November 2004. At the time, the US Dollar Currency Index opened the month at 81.82, just a little under where it is today, and then promptly rose, but gold closed that year under $440 the ounce, as it had the year before. After dropping about 4% on Friday to $1,501 the ounce, gold today is presently down another 6% to $1,404, but even that is a price which is much too high even though gold is now technically in a bear market, down over 26% from the September 2011 highs around $1,900.

They have made a market of gold which didn't exist before, and the price went up, up, up, just as they have made a market of mortgages and of houses through securitization and commoditization, and the price went up, up, up, until it came down, down, down.

I'd say gold has about another $1,000 down to go to get to fair value, but if you follow Louis Woodhill a price in the $200s is more like it, and John Tamny rather likes it at $800. Which is to say, there is lots of distortion in markets generally which is preventing price discovery.

Time will tell. So keep your powder dry as they say, if you've got any left. If you don't, maybe you'll have to sell some gold.

Labels:

gold,

Housing 2013,

John Tamny,

Josh Brown,

Louis Woodhill,

Saving,

SPX

"Invest" In Housing? Real Home Prices Up 0.2 Percent Per Annum 1890-1990.

So warns Robert Shiller, here:

"Home prices look remarkably stable when corrected for inflation. Over the 100 years ending in 1990 — before the recent housing boom — real home prices rose only 0.2 percent a year, on average. The smallness of that increase seems best explained by rising productivity in construction, which offset increasing costs of land and labor."

Sunday, April 14, 2013

Tax Compliance Costs: Over A Full Week Of Your Time

|

| The poll tax in the north for 1873 |

If it takes 6.1 billion hours to comply with the tax code as reported here, for 114.7 million households that's over 53 hours per household, or 6.7 eight hour days, each.

It took me four six hour days but still, this is insane.

Saturday, April 13, 2013

Libertarian Megan McArdle Makes Me Want To Puke

Because she thinks there is anything which can make abortion humane, here:

"I knew about the Gosnell case, and I wish I had followed it more closely, even though I'd rather not. In fact, those of us who are pro-choice should be especially interested. The whole point of legal abortion is to prevent what happened in Philadelphia: to make it safer and more humane. Somehow that ideal went terribly, horribly awry. We should demand to know why."

Abortion at any stage is the brutal murder of another human being, the mark of an unrefined, barbarous people, and our country is full of them. To exercise humanity in this situation would be to sterilize every woman who comes into an abortion clinic, and every man who put her there. They should have no right ever again to inflict such pain and injustice on another utterly defenseless human being.

Robert Samuelson: Obama Is Timid, Lazy, Phony, Tiny and Small

"Timid, lazy, phony, tiny and small" doesn't quite have the same ring as "solitary, poor, nasty, brutish and short", but you never know, it might catch on.

Here:

There is something profoundly timid about President Obama's proposed $3.778 trillion budget for 2014. ... [T]he budget is a status-quo document. It lets existing trends and policies run their course, meaning that Obama would allow higher spending on the elderly to overwhelm most other government programs. This is not "liberal" or "conservative" so much as politically expedient and lazy. ...

Obama remains unwilling to grapple with basic questions posed by an aging population, high health costs and persistent deficits. Why shouldn't programs for the elderly be overhauled to reflect longer life expectancy and growing wealth among retirees? Shouldn't we have a debate on the size and role of government, eliminating low-value programs and raising taxes to cover the rest? The "spin" given by the White House -- and accepted by much of the media -- is that the president is doing precisely this by putting coveted "entitlement" spending on the bargaining table.

It's phony. Compared with the size of the problem, Obama's proposals are tiny. The much-discussed shift in the inflation adjustment for Social Security benefits to the "chained" consumer price index would save $130 billion over a decade; that's about 1 percent of projected Social Security spending of $11.23 trillion over the same period. ...

The work of politics is persuasion. It is orchestrating desirable, though unpopular, changes. (Popular changes don't require much work.) . . . Already, his small proposed cuts in Social Security benefits have outraged much of the liberal base.

So Obama has taken a pass. He has chosen the lazy way out. He's evading basic choices while claiming he's bold and brave. ...

Despite Gold's Drop, Gold/Oil Ratio Finishes The Week At Oil-Bullish 16.45

|

| texasbullfights.com |

Even at the spot price of gold of $1,477 after the NY close the ratio is 16.18, indicating that oil remains on sale relative to gold.

Gold closed at $1501.40, well below what is understood to be a key support level of $1,521. There is talk of price falling to below $1,300 by early 2014.

At current prices of oil around $90, $1,300 gold would be an attractive buy, but it remains to be seen if oil can remain that expensive in a period of reduced demand due to chronic, severe unemployment, increasing domestic supply from oil shales, replacement of diesel with natural gas and increased passenger vehicle efficiency standards.

Rising dollar strength from early February to as high as 83.22 on the index in late March may well be the result of these oil trends, along with relative constraints on US federal spending due to divided government and more certainty about government revenue streams due to the settlement of long-standing income tax impermanencies.

Friday, April 12, 2013

Gold Fell Out Of Bed Today, Dropping 4%

The carnage continues in after hours trading with spot prices around $1,477 the ounce.

It is thought in some quarters that the terms of the Cyprus deal requiring Cyprus to sell some of its gold to contribute for its bailout sets a bad precedent for other periphery countries in the Euro who may also be asked to sell gold to help pay for bailouts. The increased supply would be hugely negative for prices.

Sounds like people got out of GLD in particular big time just as the rumors were breaking in the middle of the week, and today the facts are spreading a dim pall over the entire gold market.

Deposit confiscation, then sovereign gold. Are they going to start going through the safe deposit boxes, too?

Real Retail Remains In Depression, Still Over 8% Down From 2005 Peak

Doug Short explains his chart, here.

Real retail remains mired in a depression, despite the progress made digging out of the bottom of the hole reached in 2009. Adjusted for population and inflation, and backing out gasoline sales which Short rightly deems a tax, the current level remains over 8% off the 2005 peak, eight years ago.

Thursday, April 11, 2013

Russia Was Just The Excuse For The Eurogroup To Steal From Cyprus

So says Ambrose Evans-Pritchard, here, for the UK Telegraph:

"First they purloin the savings and bank deposits in Laiki and the Bank of Cyprus, including the working funds of the University of Cyprus, and thousands of small firms hanging on by their fingertips. Then they seize three quarters of the country’s gold reserves, making it ever harder for Cyprus to extricate itself from EMU at a later date. ...

"Cypriots are learning what it means to be a member of monetary union when things go badly wrong. The crisis costs have suddenly jumped from €17bn to €23bn, and the burden of finding an extra €6bn will fall on Cyprus alone. ...

"The workhouse treatment of Cyprus is nevertheless remarkable. The creditor powers walked away from their fresh pledges for an EMU banking union by whipping up largely bogus allegations of Russian money-laundering in Nicosia. A Council of Europe by a British prosecutor has failed to validate the claims. The EU authorities have gone to great lengths to insist that Cyprus is a 'special case', but I fail to see what is special about it. There is far more Russian money – laundered or otherwise – in the Netherlands. The banking centres of Ireland and Malta are just as large as a share of GDP. Luxembourg’s banking centre is at least four times more leveraged to the economy. ...

"The original plan in Cyprus – approved by the Eurogroup, but rejected by the Cypriot parliament – was to steal the money from any bank regardless of its health, and from small depositors regardless of the €100,000 guarantee. They have shown their character. The Eurogroup don’t give a damn about moral hazard. They are thieves."

Jim Cramer Still Thinks You Are A Fool. He May Be Right.

|

| M1 since the 2008 panic |

|

| M2 since the 2008 panic |

M2 is up $2.71 trillion since the crisis, M1 $1.05 trillion. That means since September 1, 2008, nearly 39% of the rise in M2 is directly the result of the increase in M1 (checkable deposits, i.e. the spending money in circulating cash and checking accounts).

Overall, M1 is up nearly 75% over the period, but M2 just 35%. But back out the M1 and M2 is up only 21% net, or $1.66 trillion. Still, that's a lot of moolah being saved and not flowing into stock markets.

Enter Jim Cramer, who here says that as CD instruments (M2) mature now, they will not be rolled over but get invested in the only thing going for return, namely stocks:

"Every-day CDs from the halcyon days of the middle of the last decade, when rates were going higher, will come due -- and the dramatic decline in the rollover CDs should force that money into the stock market. Invariably I hear that this flow won't amount to a lot of money. Just dismiss these people out of hand; they are either short or ignorant."

"Force"? "I hope" is more like it. I smell a book-talker.

Most of this CD and money market fund money is money of "households", small time stuff under $100,000. With plunging returns on savings over the period as the US Federal Reserve Bank pursues its policy of financial repression through zero interest rate policy, Cramer is hoping households will suddenly become the greater fools with markets at all time highs and plunge into stocks even though households have been net negative all along since the crisis, pulling out $250 billion from the stock markets according to widely reported figures from Standard and Poors.

In contrast to households it's the funny money which has been driving the markets higher, banks and other corporations doing stock buy-backs to the tune of $1.2 trillion net over the period. Most troubling of all, a year ago already banks were reported to be responsible for fully 32% of the ownership of the total market all on their own, rivaling the household sector's 37% share. If you want to understand how markets are up so much, you have to look there.

Suckers who took Cramer's sell advice in early October 2008, people who "need their money in the next five years", have entirely missed this bank-driven rally which has been aided and abetted by the Fed. And potentially they lost as much as 25% right up front in just the first three weeks after his sell announcement on the nationally televised NBC Today Program, before the markets opened on Monday morning, October 6, 2008, the Monday after TARP was signed.

And here he is, 4.5 years later, hoping people will take his advice again and plunge in because there's plenty of liquidity to keep markets buoyant. Well, plenty as long as you provide it.

You know. Sell low, buy high.

They should hang a warning label around that guy's neck.

For What The Nation Earns Homes Are Still Overpriced (15%)

So says Bloomberg Businessweek, here:

"[H]ouses are overvalued. From 1988 through 1999, median home values averaged 2.6 times the median annual income. As the bubble kicked into gear, prices pushed up to almost four times income. With the crash, that ratio has come down—but not far enough, largely because incomes have been stagnant, if not declining, in recent years. Home values are now at three times the median income—that’s 15 percent higher than they have historically been, relative to what Americans earn."

From the point of view of the Case Shiller Home Price Index, a 15% correction to the current index value of 136 would imply 115.

In the post-war period, we have witnessed 115 on the index in December 1982, March 1975, December 1973, September 1968, and December 1952.

Tuesday, April 9, 2013

Jim Cramer Blames President's Fear-Mongering Over Sequester For March Jobs Number

Here:

"I think the report can be totally explained by our Fear Monger in Chief (i.e., President Obama), who scared the heck out of everyone as he talked about the massive job losses coming from sequester. I am sure that'll be the case, but the real impact here was similar to the U.S.'s pre-cliff non-dive, when the country's business was frozen."

35% Of Long Islanders Seriously Delinquent On Mortgages, Banks Not Foreclosing

And the people just keep living in the homes so long the notices of default expire and have to be refiled.

So says Keith Jurow for BusinessInsider here, who thinks the recovery in the housing market is a mirage actually created by the banks to help them unload some inventory at higher prices:

"I have solid figures from the Federal Reserve Bank of New York on the number of first mortgages in both NYC and Long Island. So the latest figures from the NYS Division of Banking indicate that roughly 30% of all owner-occupied properties in NYC are now seriously delinquent. For Long Island, it is an incredible 35%. ...

"Had the banks been foreclosing in the NYC metro, then the total number still delinquent would certainly be much lower than the Division of Banking figures. But the banks are not foreclosing in the NYC metro. I have shown this in several previous articles. ...

"Once a filing (called a notice of default) has been active for three years, it expires under NY state law. So the attorney for the lender has to refile the notice and begin the process all over. Picture those owners living in their house for more than three years without having paid a nickel toward the mortgage. It’s crazy, but that is what is occurring throughout Long Island."

US Prints Record 3+ Billion $100 bills in 2012

The US Bureau of Engraving and Printing issued a record 3.0272 billion individual $100 bills in fiscal year 2012, according to its website here. Production problems with the new $100 bill for 2011 release as reported here resulted in only $72.32 billion in $100 bills being produced in fiscal 2011. The $100 note is the most produced paper currency in the US, averaging $173 billion worth annually for the last five years.

The $100 denomination's print run in fiscal 2012 alone is worth $302.72 billion.

The total production figures since 2008 for all paper money are as follows, averaging $216 billion annually:

2008 $154.2 billion

2009 $219.5 billion

2010 $239.5 billion

2011 $109.7 billion

2012 $358.9 billion.

Since over 90% of the notes replace money which is or has been in circulation, on average about $21 billion annually is actually being added to the currency supply, which is peanuts in a banking system with in excess of $10 trillion in deposits.

It is reported here that total circulating cash presently comes to about $1.175 trillion, so it would take about 6 years to replace all circulating currency at current production levels, perhaps a little longer as some currency effectively disappears because it is destroyed in accidents, sold on the collector market, or hoarded, the latter becoming more popular abroad. Currency in circulation, however, appears to be up about 26% since 2010 when $930 billion was reported to be in circulation. That's an increase of $245 billion in just over two years, which is curious if it's true since one might expect an increase of barely $50 billion over that short a time.

If that is thought to be highly inflationary, however, the figure actually pales in comparison to the real money increase in the country since 2008, namely total credit market debt outstanding, which is up $4.5 trillion to October 2012.

Monday, April 8, 2013

Margaret Thatcher Was No Libertarian, Moving Leftward To Adapt Like Sen. Rand Paul

Marco Rubio, are you listening?

Ben Domenech, here:

Thatcher was originally seen as a Heath acolyte within the Tory wing, given a cabinet position in Education – but the distance between them grew, and she became closer to fellow Cabinet member Keith Joseph, forming a tiny band of back benchers disagreeing with the aims of the party leadership. ...

Heath’s approach failed at the ballot box. After losing the election in 1974 and failing to form a coalition government with the Liberal Party (a No Labels-esque Government of National Unity), he took it as a sign that the Tories had to move leftward in order to adapt to the opinions of the nation. Thatcher disagreed, and that made all the difference. When Joseph announced that he would challenge Heath for party leadership, Thatcher was the only Cabinet member to endorse him; when Joseph was forced to withdraw (thanks to demography comments implying the working class really ought to consider using birth control more regularly – the speech is here), he was forced to withdraw. So Thatcher insisted she would run. ...

The dominant assumption was that [Thatcher] would have to moderate to become acceptable to the British people. She did not. Instead, she repackaged conservative principles with a message of common sense and optimism, attacking nonsensical regulation, union dominance, and high taxes with verve. She promised hope and growth, not dour austerity, and insisted that acceptance of a nation in decline was a choice, not an inevitability.

Thatcher: "Socialist governments ... always run out of other people's money."

Llew Gardner:

There are those nasty critics, of course, who suggest that you don't really want to bring them down at the moment. Life is a bit too difficult in the country, and that … leave them to sort the mess out and then come in with the attack later … say next year.

Mrs. Margaret Thatcher:

I would much prefer to bring them down as soon as possible. I think they've made the biggest financial mess that any government's ever made in this country for a very long time, and Socialist governments traditionally do make a financial mess. They always run out of other people's money. It's quite a characteristic of them. They then start to nationalise everything, and people just do not like more and more nationalisation, and they're now trying to control everything by other means. They're progressively reducing the choice available to ordinary people. Look at the trouble now we're having with choice of schools. Of course parents want a say in the kind of education their children have. Look at the William Tyndall School—an example where the parents finally rebelled. Of course they did. These schools are financed by taxpayers' money, but the choice to parents is being reduced.

Look at the large numbers of people who live on council estates. Many of them would like to buy their own homes. Oh, but that's not approved of by a Socialist government … . oh no! But that's absurd. Why shouldn't they? Well over thirty per cent of our houses are council houses. Why shouldn't those people purchase their own homes if they can?

-- February 5, 1976, Thames TV interview, here

Thatcher's Finest Hour: And So Say All Of Us

"She always afterwards regarded the Falklands War as the most important period of her premiership."

-- The UK Telegraph, here

"The Prophet Without Honor In Her Own Country": Thatcher Dead at 87

|

| both free at last |

'The second negative [which helped end her prime ministership] was [Mrs. Thatcher's] intransigent attitude to further European integration; this put her in a minority in her own party. But re-reading her strident speeches today gives no sense of them being out-of-date or belonging to a by-gone era. She dismissed the idea of a United States of Europe as a fantasy. I believed in it at the time, but now I see that she was correct. She thought that the European Union should be simply a free trade area with limited co-operation between sovereign nations. That is what an increasing number of us who were once fervent Europeans would like to get back to. As she said in a famous speech in Bruges that was widely criticised: “Working closely together does not require power to be centralised in Brussels or decisions to be taken by an appointed bureaucracy… We have not successfully rolled back the frontiers of the State in Britain, only to see them re-imposed at a European level with a European super-state exercising a new dominance from Brussels.”

'... [I]n light of the perpetual crisis in which members of the Eurozone have found themselves since the onset of the financial banking crisis in 2007 as a result of misjudged integration, those negative judgments now appear wrong. In this respect at least, she was an example of the prophet without honour in her own country.'

-- Andreas Whittam Smith in The UK Independent, here

Sunday, April 7, 2013

Since ObamaCare Was Upheld 2.03 Million Jobs Have Simply Disappeared

|

| Ho-ney? I shrank the workforce! |

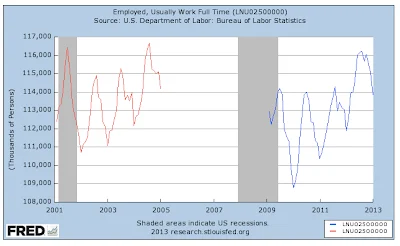

The Supreme Court upheld ObamaCare on June 28, 2012.

Since July 1, 2012, full-time jobs are down 1.335 million over the eight months.

Part-time employment for economic reasons is down 607,000.

And part-time for noneconomic reasons is down 84,000.

So ObamaCare appears to be more negative for full-time jobs, but part-time employment is down also, by 691,000.

ObamaCare doesn't yet appear to be transforming the workforce into part-time. It just appears to be shrinking it, period.

Friday, April 5, 2013

Why Both Bush And Obama Were Re-elected

Bush and Obama both were re-elected in part because full-time jobs under their respective watches started and ended at almost precisely the same levels. Full-time employment was at 112 million and change at the beginning for each, and at 113 million and change at the end for each.

Full-time jobs were up 1.6% under George W. Bush, and up 0.8% under Barack H. Obama.

Figures are for first terms beginning after accession to office through calendar election years, beginning on Feb. 1 and ending on Dec. 31.

Strange, but true.

Subscribe to:

Comments (Atom)