Saturday, December 27, 2014

Thursday, December 25, 2014

If Obama had wanted to "rescue" the economy in 2009, he should have ramped-up the wars as he's doing now

If Obama had really wanted to rescue the economy in 2009, he would have ramped up dramatically the wars in Iraq and Afghanistan instead of putting them on the path to euthanasia. In this sense he was a very bad Keynesian who made FDR spin in his grave.

Of course, that assumes he is smart enough to understand Keynesianism, being raised as a doctrinaire Marxist who was content to bask lazily in the glow of his presidential victory while a bunch of Clinton re-treads did their mediocre best for him . . . recreating HillaryCare. A more sinister interpretation believes that the inattention to the economy was all on purpose, since suppressing the middle class is the main objective of revolutionary leftism faced with successful capitalism almost everywhere. Still others simply chalk it up to Obama's incompetence, just another example of the Affirmative Action Presidency at work.

But I digress.

But I digress.

The simple reason for the need to have ramped up the wars back in 2009 is that the radical stimulus spending called for by the likes of Paul Krugman (3x what Obama ended up spending), who ridiculed the smallness of Obama's stimulus spending plan in The New York Times here, cannot be accomplished quickly through any other department of the federal government except through what we used to call more accurately The War Department. 'There are only a limited number of “shovel-ready” public investment projects — that is, projects that can be started quickly enough to help the economy in the near term,' Krugman wrote at the time.

That's for sure.

Proof of this can now be seen in the GDP numbers in just the last year when ISIS all of a sudden became a threat on the administration's radar screen even though ISIS had been building in the open for years and the administration actually had been warned about it and knew about it.

Federal government consumption had been a net negative subtraction from GDP for each of the last three years, 2011-2013, totaling -0.28 points of GDP for each year on average, and 75% of that came on average from cutting spending on National Defense.

All of that changed on a dime in 3Q2014 when ISIS surged into Iraq. Consumption on national defense suddenly vaulted to +0.69 points of GDP from +0.12 points in 1Q and -0.07 points in 2Q, to the point where defense spending now represents fully 97% of the federal contribution to GDP in the third quarter of 2014, and over 13% of GDP overall. All the current big contributors to GDP come in lower than this except for exports, with which defense spending is tied.

Only the military can spend large sums of government money quickly in this slow-moving, inertia-plagued bureaucratic state. Future presidents, take note: War is still the father of everything.

Wednesday, December 24, 2014

Merry Christmas: The world is experiencing the benefits of Western liberty like never before

|

| The Nativity at Night c. 1490 |

Freedom from want, loneliness, ignorance, danger, disease, discomfort and drudgery.

From Richard Rahn:

As we go into this Christmas week, you should count your blessings that you live in 2014. ...

People in the world live far better today than they did a mere half-century ago. World per-capita gross domestic product is now a little more than $14,000 per year, a little less than where the United States was in 1960 or where the Japanese and United Kingdom were in the mid-1970s (inflation adjusted). In October, the World Bank reported that those living in extreme poverty fell from 36 percent in 1990 to 15 percent in 2011. ...

Read the whole thing, here.

Tuesday, December 23, 2014

Zero Hedge gets ObamaCare spending all wrong, again

The latest screed is here, claiming that healthcare spending is "the reason" behind the surge in Q3 GDP.

From the BEA here, healthcare spending contributed 0.52 points (line 17) to 5.0 GDP, about 10.4% of the total.

Zero Hedge wants to leave the impression there was no single bigger contributor to GDP, which isn't the case at all:

Equipment contributed 0.63 (line 30)

Durable goods 0.67 (line 4)

Pure consumption from defense spending 0.69 (line 55)

Export of goods 0.69 (line 47).

More importantly, it's not like we haven't spent 0.52 points of GDP on healthcare before.

We spent 0.51 in 4Q2011, 0.70 in 1Q2012, 0.48 in 4Q2013, and 0.45 in 2Q2014.

That last one is really important. It's the third estimate final figure of healthcare spending for the immediately preceding quarter, which can now be compared to the third estimate final figure for this one. The difference? Just 0.07 points, for an increase in healthcare spending of 15.5% on an annualized basis from 2Q to 3Q. As I've said, we've seen such increases before, quite apart from any new developments over ObamaCare.

The proper comparison, notably, is with 2Q, not with the previous estimate of healthcare's contribution to GDP for the current quarter, which, like everything else, was admittedly incomplete in the BEA's own words, as is always the case with the estimates before the third and final report.

And what that shows, last of all, is that GDP hasn't "surged" at all between 2Q and 3Q. The only thing which surged is the final revision based on the more complete data. The quarterly measure of GDP is up a very modest 0.40 points, from 4.6 to 5.0, or about 8.7% on the annualized basis. Healthcare's share of that increase to GDP is just 17.5%. 82.5% comes from other categories.

The worrisome thing is all kinds of people read and sometimes quote Zero Hedge: Rush Limbaugh, John Hussmann and Bill Gross come to mind. And Real Clear Markets often links to it, which is how I saw it.

Zero Hedge is embarrassing to read, kind of like pornography.

Labels:

BEA,

Bill Gross,

GDP 2014,

John Hussman,

Obamacare 2014,

Rush Limbaugh 2014,

Zero Hedge

To date current dollar GDP under Obama is running 9.6% behind Bush every year

Bush nominal GDP increased 43% over his term. To date nominal GDP under Obama is up less than 20%.

Bush nominal GDP rose $4.4338 trillion from the end of 2000 to the end of 2008, from $10.2848 trillion to $14.7186 trillion. That comes to $554.225 billion per year for eight years.

Obama nominal GDP has risen to date $2.8812 trillion from the end of 2008 to the end of 3Q2014, from $14.7186 trillion to $17.5998 trillion to date. That comes to $501.078 billion per year for 5.75 years.

The $53.147 billion difference amounts to a difference of 9.59% on average per year to date.

Total market cap to 3Q2014 GDP ratio falls slightly on third revision . . .

. . . to 1.415 from 1.419.

The ratio was 0.74 at the end of 2008, indicating that the stock market was 91.2% more expensive at the end of September 2014 than it was at the end of 2008.

At rich valuations the return from stocks over the subsequent long haul is surprisingly small. From the peak in August 2000 to now the average nominal return from the S&P500 has been just 4.22% per annum, with dividends fully reinvested. From the peak in October 2007 to now the average nominal return has been 6.35% per annum.

The great bull market from July 1982 to August 2000 produced an average annual return of 18.99%.

The dollar is trading above 90 today

The dollar is trading above 90 today, for the first time since early 2006.

Third and final revision of 3Q2014 GDP surges to 5.0% on personal consumption and investment revisions

Personal consumption added 2.21 points to today's revision of 3Q2014 GDP at 5.0% while government consumption added 0.80 points. TOGETHER they represent 60% of the total, which again gives the lie to the meme that 70% of the economy is still consumer spending.

Not any more. Frugality is still operative in this economy when only 44% of it is from the consumer side. Keep in mind that that's a one month IMPROVEMENT in the BEA's assessment of the contribution of personal consumption by 46%.

Hm. The difference a month can make.

In the second report a month ago personal consumption had added just 1.51 points, and government consumption 0.76. Personal consumption had been averaging just 1.48 points in contribution in 2011, 2012 and 2013. Government consumption had been averaging -0.45, actually adding a SUBTRACTION to GDP over the same period. The positive contribution from government spending now, however, is nearly 83% defense spending . . . the war on ISIS.

More war, more GDP.

Gross private domestic investment added 1.18 points in today's revision, but only 0.85 in the second. The three year average had been 0.94. The 39% improvement in the estimation for this category is a very healthy and welcome sign for the economy.

Net exports added 0.78 in today's report, unchanged from the second, but way up from the prior period average contribution of just 0.08 points.

Refined petroleum exports, up 3.7% on average in 2014 year to date over the 2013 average. It's a good thing.

Republican enthusiasm for the Line Item Veto began under Reagan and was their version of the imperial presidency

No different than Reagan's enthusiasm for federal mandates like EMTALA, which is the proximate cause of ObamaCare. But J. T. Young doesn't remember it that way, or that far back, here:

'Unmentioned in Obama's legacy is that he killed the line-item veto. While not having done so directly, Obama's presidency has ended this long-time Republican goal just as assuredly as if he had. The political and fiscal role reversals between the Congress and presidency - and between Republicans and Democrats - transpiring for twenty years, have culminated with this administration.

'Twenty years ago, Republicans, armed the Contract with America, dramatically rode to Congressional majorities for the first time in decades. Prominent within that important document was a call for a line-item veto for the president.

'The intent was to give a president power to eliminate wasteful federal spending with pinpoint accuracy. Instead of having to veto an entire bill, and risk shutting down all, or part of the government, a president would be able to stop particular provisions but leave a larger spending bill intact. This authority would reverse the "Hobson's Choice" that prevailed between Congress and a president.'

------------------------------------------------------------------------------

'Ronald Reagan said to Congress in his 1986 State of the Union address, "Tonight I ask you to give me what forty-three governors have: Give me a line-item veto this year. Give me the authority to veto waste, and I'll take the responsibility, I'll make the cuts, I'll take the heat."'

WHATEVER CONSERVATISM IS, IT MOST CERTAINLY IS NOT ABOUT SEEKING TO ACQUIRE MORE POWER BUT RATHER ABOUT SEEKING TO DIFFUSE AND DISTRIBUTE IT, SOMETHING THE CONGRESS DELIBERATELY BETRAYED IN THE 1920s WHEN IT DECIDED TO STOP THE NATURAL EXPANSION OF REPRESENTATION. NO BRANCH OF THE GOVERNMENT MAY BE SAID SINCE THAT TIME TO BE IN ANY WAY CONSERVATIVE IN SPIRIT, EXCEPT IN THE OCCASIONAL IRRITABLE MENTAL GESTURE IN THAT DIRECTION WHICH IS USED AS A CLOAK FOR MORE SELF-AGGRANDIZEMENT. NO ONE ANYWHERE RETAINS "SELF-RESTRAINT" IN THEIR LEXICON.

Terrorism is a feature of Islam, not a bug

"Against them make ready your strength to the utmost of your power, including steeds of war, to strike terror into (the hearts of) the enemies, of Allah and your enemies, and others besides, whom ye may not know, but whom Allah doth know. Whatever ye shall spend in the cause of Allah, shall be repaid unto you, and ye shall not be treated unjustly."

-- Surah 8:60, source of the motto "Be Prepared" of the Muslim Brotherhood, except these Boy Scouts intend to terrify, not to be helpful, friendly, courteous or kind

Sunday, December 21, 2014

Obama says you're better off than when he took office, except you are not

|

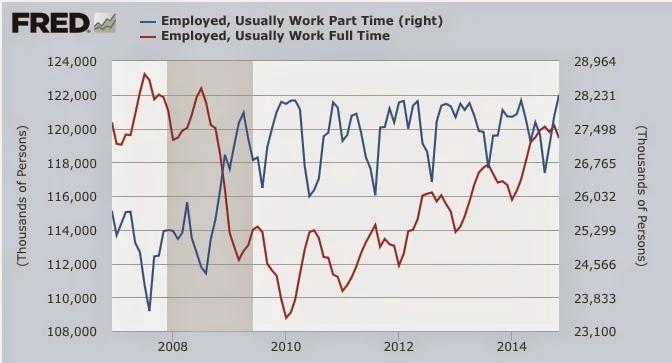

| click to enlarge |

Obama says, quoted here:

"Like the rest of America, black America in the aggregate is better off now than it was when I came into office."

On the contrary:

Full-time jobs have not recovered to their 2007 peak and won't until summer 2015, if we are lucky. That will be eight years later, when full-time jobs in the past have always bounced back after at most three years in post-war recessions. Obama has done nothing for jobs, except to let the problem fester and try to heal itself.

Health insurance costs much more, covers much less and has narrower and less convenient networks. The proof of this is in the polling, where the majority of Americans remain opposed to ObamaCare. The minority which likes ObamaCare is benefiting from it at the expense of those who don't, who are more numerous. It's called income redistribution. Otherwise known as socialism. You know, like in Cuba, Obama's new best friend.

Owners' equity in household real estate stands at 53.94%, still almost 10% below where it was in 2005. Completed foreclosures in the last month are still running 95% above normal.

More than half of the 66% of Americans who have saved anything for retirement have individually saved less than $25,000. American taxpayers are forced to contribute on average 13.5% to the pensions of the country's government employees and save for themselves only at the rate of 5%.

But perhaps the most damning indictment of Obama is how Americans of all stripes have been impoverished under his watch. Real median household income in the US is lower now than when the recession ended in Obama's first term in 2009, and much lower than when he took office:

"At this point, real household incomes are in worse shape than they were four years ago when the recession ended."

Lies told often enough can become the truth, but they are still lies.

Saturday, December 20, 2014

Amounts allocated for retirement soar to $24.2 trillion in 3Q2014

The Investment Company Institute reports, here.

IRA-type instruments continue to lead the way with 30% of the total amount saved, followed by 401k-type plans holding 27%, and government defined benefit plans at all levels 21%.

The latter figure, representing $5.1 trillion, remains remarkable in view of the fact that the taxpayers have contributed significantly to this sum through taxation, on top of funding their own retirements, or not funding them as the case may be.

As recently as 2011 the national average rate of taxpayer contributions to state employee pension plans, and teacher, police and fire retirement plans combined was 13.5%, according to data reported here by The Buckeye Institute. Contrast that with average annual personal savings rates under Bush of just 4% and under Obama of 6%. And for the most recent 5 months of 2014 the rate has fallen to 5%.

Taxpayers are funding the retirements of government workers at a rate more than double their own, which is one reason why most people haven't saved enough for their own retirements. CBS News reported again just weeks ago here that of the 66% who have saved anything for retirement, the majority have saved $25,000 or less.

Meanwhile, government pension plans, as rich as they may appear from the data, may be underfunded long term by as much as $4 trillion, according to The Boston Globe, here.

With a week left before Christmas, maybe you should make do with what you've spent so far, and put something away for a rainy day. It's a comin'.

Michigan legislators correctly send sales tax increase for roads to the voters

Mlive.com reports the story here.

As I've argued before, here, an increase in the sales tax for road repairs is far less regressive than the gasoline excises as they currently stand, so I support this if I only had various tax increases to choose from. Governor Snyder's plan to raise excise taxes even higher to pay for roads was a non-starter for this reason. Commuters to minimum wage jobs shouldn't have to bear the brunt of a consumption tax on fuel which is at least twice what it is on a roll of toilet paper.

Paying prevailing wages for road repairs under Davis-Bacon laws to union shops, however, guarantees that we pay the highest prices for roads. We shouldn't have to put up with that. Competitive bidding by non-union shops is called for.

It is also regrettable that the excise tax isn't being eliminated altogether, because, as I've said, it's about twice as onerous as the current sales tax of 6%. That it is actually being expanded somewhat under the bill is moving in the wrong direction. Maybe we can work on eliminating that in future.

Opponents of the sales tax increase should consider whether now is the time to pick a fight with the unions to get better roads at a lower price, and should also lay out what could be cut from the current budget to otherwise accomplish the goal. But the roads have been allowed to get so bad for so long it is difficult to accept the idea that we can afford to wait any longer.

The current compromise may be the best deal for everyone involved.

Michigan legislators cut the baby in half in lameduck twilight, requiring internet sales tax collection from businesses with any form of physical presence

Reported here:

SB 658 and SB 659 extend the state's sales and use taxes to out-of-state companies with a physical "nexus" or presence in the state. That would apply these taxes to companies like Amazon, which has a presence in the state but not a retail front.

A ruling worthy of a rabbi.

The latest snapshot of the asset allocation of the United States is "risk on"

Total bond market per SIFMA through 3Q2014: $38.65 trillion (49.8%)

Total stock market capitalization per ^W5000 right now: $26.07 trillion (33.6%)

Cash per MZM money stock: $12.89 trillion (16.6%)

Total: $77.61 trillion

If you add in Households, Owners' equity in real estate, you add another $10.98 trillion for a total pie of $88.59 trillion, thus 43.6% to bonds, 29.4% to stocks, 14.6% to cash, and 12.4% to real estate.

From the perspective of the Talmud this allocation is very unwise because it is much too light on cash and owners' equity. The amounts allocated to business, to cash and to your homestead should each be about 33%, indicating that we are very heavily "risk on" indeed.

Food for thought.

Labels:

asset allocation,

food,

Housing 2014,

market capitalization,

SIFMA,

SPX,

Talmud

Vanguard bond index funds, 15 year performance per annum vs. stocks

|

| HMS Vanguard |

Per morningstar.com, annual performance 15 years to date for all popular bond index funds beats stocks hands down, except for the short index:

VBISX: 4.05% (short)

VBMFX: 5.42% (total)

VBIIX: 6.48% (intermediate)

VBLTX: 8.30% (long).

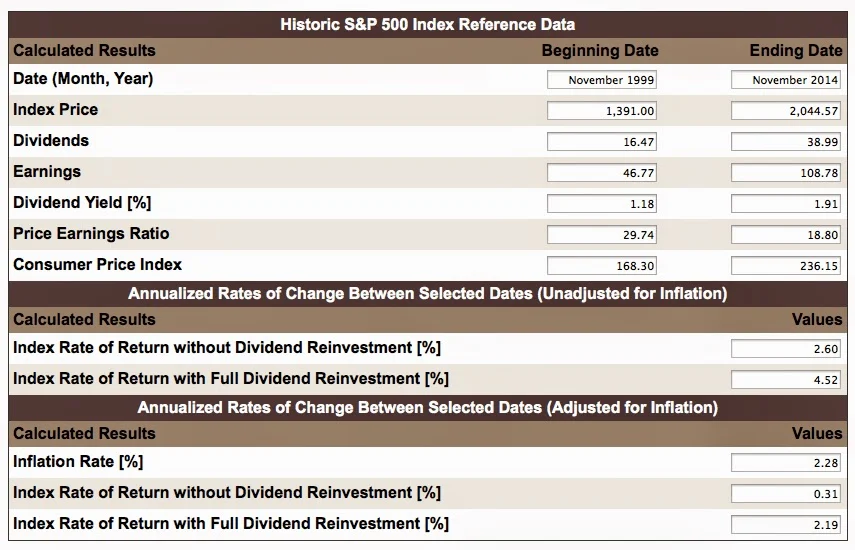

Average annual total nominal return from the S&P500, dividends fully reinvested, has been only 4.52% per annum.

That's what happens when stocks are inflated in value over a long period of time, as they have been almost continuously since the late 1990s, except for about four years between 2008 and 2012. And remember, present gains off those lower valuations are already part of the relatively poorer performance of stocks over the last 15 years. It could be much worse.

Attention dollar-cost-averagers: Through November bonds still beat stocks for the last 15 years

|

| morningstar.com |

|

| politicalcalculations.com |

Your average annual nominal return from the S&P500 for 15 years through November is just 4.52%, with dividends fully reinvested. From intermediate term bonds in an index fund like VBIIX your average nominal return for 15 years through 12/18/14 is 6.46%, and better sleep.

Friday, December 19, 2014

America pushes NATO right up to the Russian border, the EU confiscates Cyprus' assets, and the Economist calls Putin paranoid

Proving once again that the West completely disrespects Russia. They could easily be our friends, if America were still a Christian country. That, dear friends, is the root of the problem.

The story "As ye sow, so shall ye reap: The collapse in the rouble is caused by Vladimir Putin’s belligerence, greed and paranoia" is here, in the ever arrogant Economist.

Subscribe to:

Comments (Atom)