Thursday, January 9, 2014

Wednesday, January 8, 2014

Rush Limbaugh Today Totally Botches Income Quintiles On The Program

|

| "You keep using that word. I do not think it means what you think it means." |

The relevant passage is here:

Poverty is expressed as an income level. Most economists break down income in America to five brackets, called quintiles, and people move in and out of these. The top quintile, I think, is like a million plus, and that'd be the top 1% of 1%. I forgot what the breakdown is, but the poverty level, it's roughly, what, $14,000 for a family of four? It's around there. People move in and out of these all the time.

------------------------------------------------------------------------

This is rich.

A quintile in this instance is one of any of the five groups of American households divided into those five groups based on how much money they make.

By definition, then, the top quintile is the richest 20% of households in America. So it's impossible for the top quintile to be "the top 1%", let alone "the top 1% of 1%".

As embarrassing as that is, Rush has absolutely no concept what it means to reach the top 20% of household income in this country.

The fact is it doesn't take all that much, and certainly nothing close to $1 million, hard as it may be to get there.

Currently the point in the middle of the top 20% of households by income is only about $181,905 per annum. That means about half the people in the top quintile make more than that, and about half make less. And interestingly enough, the middle of the richest 5% of households in this country isn't anywhere close to $1 million, either. The average household income of the top 5% is just $318,052. (For a good presentation of the data, see here.)

And Rush is equally out of touch about what it means to be poor. The federal definition for a family of four is about $23,500, not $14,000. The latter is about what it means for just one person to be poor, not four (see here).

Rush Limbaugh complains constantly about the sorry state of public education in this country. He even did so today in the same segment:

[L]ook at [President] Johnson's solutions. Education, job training, medical care, housing. That hasn't changed. The same weapons, the same language, the same way they tug at heartstrings. It's 1964, and they keep using the same lingo, obviously because it works. But look at how our education system's been since 1964 with them in charge.

Yep. Look at how it's been.

Rush is Exhibit A . . . the most popular radio host ever for a reason.

Tuesday, January 7, 2014

Monday, January 6, 2014

"Ben Bernanke Has An Almost Unbroken Record Of Being Wrong"

Bye Bye Ben.

Seen here:

Ben Bernanke has an almost unbroken record of being wrong.

In 2006, at the zenith of the housing bubble, he told Congress that house prices would continue to rise. In 2007, he testified that failing subprime mortgages would not threaten the economy.

In January 2008, at a luncheon, he told his audience there was no recession on the horizon. As late as July 2008, he insisted that mortgage giants Fannie Mae and Freddie Mac, already teetering on the verge of collapse, were “ adequately capitalized [and] in no danger of failing.”

Following the Crash of 2008, Bernanke’s prognostications did not much improve. Nor did Yellen’s, who had also misjudged the housing bubble, and who became Fed vice chairman in 2010.

The two of them got the “recovery” they predicted, but the weakest “recovery” in history.

Labels:

Ben Bernanke,

Fannie Mae,

Federal Reserve,

Freddie Mac,

Housing 2014,

Janet Yellen

Peter Wallison Says The Housing Bubble Is Back

Here in The New York Times, where he blames sub-prime down payments, not interest rates:

Between 1997 and 2002, the average compound rate of growth in housing prices was 6 percent, exceeding the average compound growth rate in rentals of 3.34 percent. This, incidentally, contradicts the widely held idea that the last housing bubble was caused by the Federal Reserve’s monetary policy. Between 1997 and 2000, the Fed raised interest rates, and they stayed relatively high until almost 2002 with no apparent effect on the bubble, which continued to maintain an average compound growth rate of 6 percent until 2007, when it collapsed. ... Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent.

Many commentators will attribute this phenomenon to the Fed’s low interest rates. Maybe so; maybe not. Recall that the Fed’s monetary policy was blamed for the earlier bubble’s growth between 1997 and 2002, even though the Fed raised interest rates during most of that period.

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down. ...

When down payments were 10 to 20 percent before 1992, the homeownership rate was a steady 64 percent — slightly below where it is today — and the housing market was not frothy. People simply bought less expensive homes.

Obama Has Completed 160 Golf Outings In The Last 5 Years: The Practice Hasn't Helped

White House Dossier here reports that the president golfed 9 out of the 15 days while on his Hawaiian vacation, which means Moochelle was pretty much a golf widow during the time.

She did not return to DC with her family. The cost to the taxpayers of this early "birthday gift" of an extended stay may come to as much as $200,000 or more according to a separate entry here.

The Washington Times noted here the family's vacation was already "regal", and featured a video in which the president misses a long put on a green and then takes what he clearly deems a "gimme" but misses it, and picks it up off the green, not out of the cup. I'll bet his scorecard is minus the stroke . . . a lie like everything else about these people.

Sunday, January 5, 2014

Saturday, January 4, 2014

Vanguard's Worst Performing Bond Funds In 2013

Long Term Treasury Fund, VUSTX: -13.03%

Long Term Government Index Fund, VLGSX: -12.74%

Long Term Bond Index Fund, VBLTX: - 9.13%

Inflation Protected Securities Fund, VIPSX: - 8.92%

Long Term Corporate Bond Index Fund, VLTCX: - 6.86%

Long Term Investment Grade Fund, VWESX: - 5.87%

And as badly as they have performed, I don't see a net asset value for any fund which represents a bargain: they all still look too expensive to me.

Friday, January 3, 2014

Antarctic Global Warming Scientists Rescued, But Rescue Ship Also Gets Stuck In Ice: Story Never Mentions It's Summer In Antarctica

|

| Chinese Snow Dragon stuck in ice after rescue |

Why would they go there at this time if they didn't think they could get to Antarctica?

The story is here.

Evidently the rescue ship is Chinese, but the scientists were transported from their stuck vessel to an Australian vessel which subsequently has been dismissed from the area despite the troubles of their rescuers' vessel, also now stuck.

Reminds me of the tow truck which came to retrieve a neighbor's dead vehicle the other day. The tow truck itself got stuck, and had to be towed by another tow truck. Needless to say the neighbor's vehicle didn't get towed until yet another tow truck came yesterday.

And that's how icy it is, from Antarctica to Michigan.

Labels:

Antarctic,

Australia,

China,

Climate 2014,

Sea Ice,

The UK Telegraph

Current Fair Value Of The S&P500 Is . . . 1005

Doug Short updates his regression analysis for the S&P500, adjusted for inflation, to come up with the S&P500 today about 80% above the long term trend going back to 1871:

"If the current S&P 500 were sitting squarely on the regression, it would be around the 1005 level. If the index should decline over the next few years to a level comparable to previous major bottoms, it would fall to the 450-500 range."

Charts and discussion here.

Government Just Made Two Things You Liked Obsolete: Your Health Insurance And The Lightbulb

Tim Carney, here, says the government ban on the traditional lightbulb is a case of crony capitalism in which industry persuaded government to help it increase energy efficiencies profits by eliminating the bulbs which consumers preferred in order to give them bulbs they didn't want but which cost a lot more, boosting profits they couldn't otherwise make.

You know, just like ObamaCare gives you coverages you neither want nor need and makes your insurance much more expensive than it used to be, and forces everyone to buy it. Insurance companies are happy to get all the new customers, and all the extra profits.

Big business is the enemy of Americans, and of capitalism. Unfortunately, so is the government.

Thursday, January 2, 2014

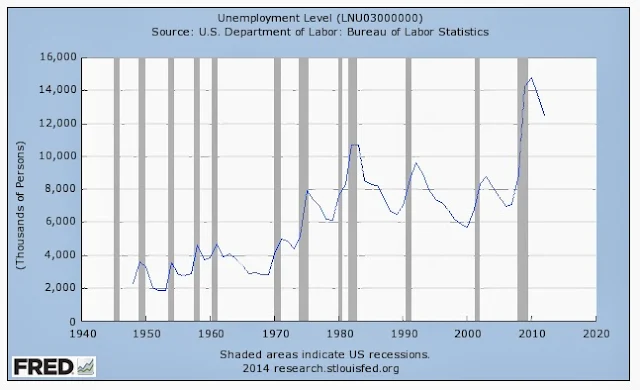

Jobless Claims Average 435,000 Per Week In Last Month, 17.75 Million Total In 2013

The report for the last week of 2013 is here.

At the current average per week in the last month sustained over a whole year the result would yield 22.6 million first time claims. That doesn't square with the claim that the economy is now in full trot as one headline puts it this morning.

17.75 million actual first time claims for unemployment in 2013, not-seasonally-adjusted, represents the best showing yet under Obama, but still far above George W. Bush's best years in the 16 million range when participation rates were much higher.

With nearly 12 million people having left the labor force since Obama was elected in 2008, far too many of those still working in a much smaller labor pool continue to lose their jobs every week. The levels today only seem less alarming because we remember them from when labor force participation rates were much higher. Now that they are not and levels are still high shows that labor is still flat on its back in this country.

If this is the best Obama can do, it's going to be a very long three more years.

Wednesday, January 1, 2014

Obama's America: Nearly 12 Million Have Given Up And Left The Labor Force Since His Election

In April 2011 over 1 million people, desperate for work, applied for just 50,000 burger-flipping jobs at McDonalds, which ended up hiring 62,000, 24% more than planned.

Where are the other 938,000 today?

The story is still here, thanks to former Mayor Bloomberg.

Those 938,000 most likely ended up joining another 10 million-plus who have left the labor force altogether.

President Obama meanwhile enjoys day 12 today vacationing in Hawaii snorkeling and golfing, according to news reports, after all his hard work fundamentally transforming the country.

Labels:

Barack Obama 2014,

Bloomberg,

Jobs 2014,

McDonalds,

Michael Bloomberg

Tuesday, December 31, 2013

John Crudele Of NY Post Still Not Really Sure What The Fed Has Been Trying To Do

Here in "Bernanke's rate ploy robs from middle class" John Crudele of The New York Post still can't seem to put two and two together even after all this time:

1:

Bernanke, who is leaving his job next month, controls something called the Fed Funds Rate. That’s the rate at which banks can lend each other money for a very short term, generally overnight. That rate is set by the Fed and has been stuck at a puny 0.25 percent for the last few years as the Fed tries to — well, I’m not really sure what the Fed has been trying to do. ...

2:

One of the few rates he has been able to keep low is the yields on things like money-market and savings accounts. The banks love him, since the less they pay out to depositors, the more money they earn.

--------------------------------------------------------------------

What do I gotta do, John, spell it out for ya?

The Fed has been trying to . . . rescue the banks. They don't keep the rate next to zero for this long if they didn't need to.

The middle class has been punished in the process, but lower interest rates presumably have allowed some in the middle class to refinance expensive loans at lower rates while their retirement investments have reflated. That's the rationalization, if not the reality experienced by most.

The banking crisis is over when ZIRP is over.

Labels:

Ben Bernanke,

Federal Reserve,

John Crudele,

Middle Class,

NYPost,

Saving,

yields,

ZIRP

Middle Class In Flames: All The Fed Has Done Is Help The Banks

|

| Naked Capitalism supports Occupy Wall Street. Heh, heh. Does Jeep know? |

Yves Smith of Naked Capitalism, here:

Oh, puhleeze. Robust recovery for who? The Fed not only threw staggering amounts of firepower at salvaging bank balance sheets, while showing no interest in rescuing ordinary Americans. It was also all-in on the Administration’s program to paper over the banks’ chain of title problems and their widespread servicing abuses, and didn’t bother to obtain any meaningful concessions or reforms, the most important of which would have been principal modifications, a remedy favored by investors as well as homeowners. The Fed has been all too happy to accept mission creep rather than speak up forcefully for the need for more fiscal stimulus.

-------------------------------------------------------------------------------

The analysis is right, but the prescriptions are left: raising the minimum wage, breaking mortgage contracts, and spending money we do not have. Oh, puhleeze. It's Naked Liberalism.

But she's great on Obama's Mussolini-style corporatism, most recently here in response to The New Republic:

I’m actually a bit miffed that Konczal treats the “corporatism” appellation as the sole property of the right wing (in the style sheet of the Vichy Left, calling them “hysterics” is redundant but necessary for the rubes), since I have a prior claim. And what is particularly rich is that Konczal apparently regards the allusion to Mussolini to be unfair . . ..

Obamacare IS corporatist. Here we have the industries that are significant contributors to why the American medical system is so overpriced – the health insurers and Big Pharma – actually playing a major role in writing the legislation. And how is it not a sop to large companies to have the government require that citizens buy your product or else pay large tax penalties? Mr. Market certainly thought so, for the price of health insurer and drug company stocks jumped the day the ACA passed. And remember, the beneficiaries of Obamacare extend beyond the insurers and pharmaceutical makers. Hospitals, who increasingly engage in oligopoly pricing (most surgeries need to be done in hospitals), also come out even stronger because new requirements imposed on doctors’ practices will make it difficult for a retiring MD who practices medicine, as opposed to servicing the rich (e.g., cosmetic surgeons) to sell their business to anyone other than a hospital.

And the label fits in the banking arena like a glove. I’ve ... called both the Bush, but far more often the Obama bank-friendly policies “Mussolini-style corporatism” since 2008, and well before what [Mike] Konczal [of The New Republic] claims is the origin of this description, Tim Carney’s book Obamanomics, published November 30, 2009.

Subscribe to:

Comments (Atom)