|

| Existing crisis loans 1st of the month in billion$ |

That TARP was just a sideshow was not known at the time in 2008, but it should be known by now.

Too bad conservatives haven't paid attention.

TARP assumed the role of the main actor on the stage of the financial panic as the liberal government of George W. Bush tried to show that it was capable of doing something to bring the panic of 2008 to an end. Bush at length signed the TARP legislation on October 3, 2008, at which point the stock markets promptly rewarded him by caving over the next three weeks, setting the stage for the final denouement by March 2009. Only Securities and Exchange Commission changes to mark-to-market accounting rules at that point stopped the cratering and put a floor under stock prices. Meanwhile behind the scenes the liberal government of Woodrow Wilson in the form of the Federal Reserve had already been hard at work for months frantically doing the real rescue.

Now that TARP is over, liberal political operatives are wont to characterize TARP as a success because it supposedly made a profit accruing to the government, and hence to The People, who are ever almighty in liberalism. They also say this to keep our eyes off the ball. "Conservatives" continue to take that bait and argue there was a loss to TARP, never examining themselves to see if they are in the larger truth. National Review's Matt Palumbo is just the latest example, here, quibbling over a few measly billions of dollar based on an argument from inflation to substantiate a loss to TARP.

It doesn't get much more pathetic than that.

TARP became the sideshow it always was once and for all when Bloomberg News, using the Freedom of Information Act, forced the Fed long after the fact in late 2010 and early 2011 to reveal the true scope of its bailout of the world in 2008-2009. Behind the scenes the rest of us had groped in the dark trying to fathom TARP's $700 billion bailout, when that turned out to be just a decimal point in the real bailout, the Fed's $7.7 trillion lending authority through the discount window and other programs.

"Conservatives" still haven't grasped this.

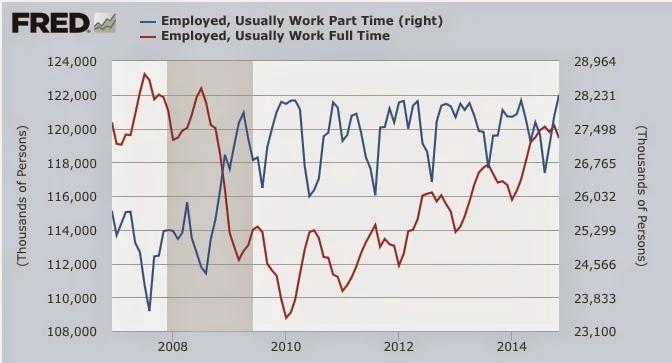

Over five million Americans lost their homes in the wake of the panic, almost 30 million ended up filing first time claims for unemployment in 2009 (85% more than did just last year), and almost eight years after the employment peak of 2007 full-time jobs still have not recovered, the most disgraceful record in the post-war.

The Federal Reserve bailed out hundreds upon hundreds of large banks and corporations not just in the United States but all across the globe by backstopping them with promises of huge sums if needed while regular Americans were simply left to fend for themselves:

$7.77 trillion -- The amount the Fed pledged to rescue the financial industry, according to Bloomberg research that examined announced, implied or actual upper limits on lending and guarantees. This number, which represents potential commitments, not money out the door, was first published in March 2009, when it peaked.

“One of the keys to understanding why we’ve avoided another Great Depression, so far, is to see how bold the Fed was in 2008 and 2009,” said Niall Ferguson, a Harvard University history professor. “That boldness consisted of a range of contingency commitments that backstopped the banking system. Just because they weren’t used doesn’t mean they weren’t important.”

---------------------------------------------------------------------------------------------

Actual loans at rock bottom prices over time amounted to about half that, at $3.3 trillion, as can be appreciated here in just one of the lending programs of the Fed, the famous discount window. The low interest rates charged there, a sideshow in themselves, are thought to have benefited the banks at the same time by about $13 billion, according to Bloomberg, over what they would have had to pay at market rates.

That was simply the cherry on the gargantuan crony capitalism cake, an object, I am sure, of singular fascination for the likes of the Matt Palumbos of the world.

|

| That spike in the graph is the discount window lending in the 2008 panic |