Thursday, April 7, 2011

Wednesday, April 6, 2011

The Tyrant is the Flatterer of the Vilest of Mankind

In "Obama's Close Friend Arrested In Prostitution Sting," here, we learn that Bobby Titcomb is a former classmate who holidays, golfs and picnics with the president, and has hosted him at his home in Hawaii for a barbecue.

Birds of a feather, perhaps?

Everything's a Conspiracy at Washington's Blog: Now He's a Melter, Too

So the meltdown denial from the Nuclear Regulatory Commission is a cover-up:

Did Markey misunderstand what the NRC was telling him? Or is the NRC covering up the situation by publicly denying what it told Markey in a private briefing?

If We Want More Home Sales, Subsidize Home Ownership, Don't Tax It

It's an old principle too often forgotten in discussions of economic policy:

"If you want less of something, tax it; if you want more of something, subsidize it."

We've learned in America that when you don't limit welfare in some way, you'll get lots more people on it. And tax people too much like we did in the 1970s, and you'll proliferate money in tax shelters.

What we need more of right now in America is home sales. 18.4 million dwellings sit vacant in the US, and homeowners all across the country who want to sell and scale down or sell and move up can't, because of the housing slump. Properties go unsold season after season, and people are stuck.

Jonathan Swift put it this way a long time ago:

"Money, the lifeblood of the nation,

Corrupts and stagnates in the veins,

Unless a proper circulation

Its motion and its heat maintains."

Logic tells us that we should subsidize housing through tax policy even more than it already is, but the Obama regime, and a bunch of misguided libertarians, want to do the opposite: recover the "tax loss expenditure" created by the mortgage interest deduction.

In other words, they want to tax home ownership, in the name of tax neutrality, handing the advantage to landlords who can still deduct their mortgage interest, along with the maintenance and depreciation which homeowners cannot deduct. It almost sounds like planned crony capitalism.

If Obama and company succeed, we'll have even less home ownership than we have now, and even lower values, but lots of new politically favored slumlords.

The following is an excerpt from John C. Weicher's "Repealing the Mortgage Interest Deduction? Hold the Applause!," found here, which touches on some of these issues:

The President’s budget for 2012 proposes to take a small but significant step in the same direction. The value of the deduction would be reduced for families with incomes above $250,000. These are the same taxpayers for whom Mr. Obama wanted to raise taxes back in December - “the rich.”

But the deduction isn’t a particular benefit for rich people. ... they only account for about 20% of all mortgage interest reported on tax returns, according to the IRS.

Most of the benefit of the mortgage interest deduction goes to households who are not “rich,” households with incomes between $75,000 and $200,000. These are middle-class families, reasonably well off, but working, and working hard. ...

Repealing the mortgage interest deduction will make it harder for young families to become homeowners. Repealing the capital gains exclusion, another Commission recommendation, will make it harder for older families, when they want to move to a retirement home or move to be near their children and grandchildren.

What the Richest 5 Percent Pay

Taxpayers with incomes above $200,000 pay:

over 50 percent of all income taxes;

over 50 percent of state and local income taxes;

almost 50 percent of charitable contributions;

but only 20 percent of mortgage interest.

More here.

Zen and the Art of Economic Cycle Maintenance

In which Louis Woodhill asks the disciples of John Mauldin:

“In a time of famine, would you plant less rice?”

Read it all at Forbes.

Tuesday, April 5, 2011

Hutaree Militia Update: Big Talk, No Plot?

All behind the scenes stuff about what is and is not evidence in the case:

Defense lawyers have spent the past year arguing over evidentiary issues and trying to frame the case as a First Amendment fight.

There was no plan and no target identified by the Hutaree members, said lawyer Todd Shanker of the Federal Defender Office, who represents the Hutaree leader's stepson, David Stone Jr.

"A few of the people talked a lot and talked big in front of their friends and fellow militia members," Shanker told The Detroit News.

"But everybody, I think, was there for different reasons."

There's more here at The Detroit News.

Q4 2010 GDP Revised Up to 3.1 Percent from 2.8 Percent in Final Estimate

The final number for all of 2010 comes in at 2.9 percent (up), after the historic decline in 2009, when GDP was down 2.6 percent.

Pretty pathetic after all the trillions of dollars in stimulus, bailouts and lending at taxpayer expense.

Radiation in Namie, Japan, Approximately 37.88 Microsieverts Per Hour

As reported here (but you have to do the math of 10 mSv divided by 264 hours times 1000):

On Monday, the [Japanese] government announced that radiation of more than 10 millisieverts had been detected at one location in Namie Town, some 30 kilometers northwest of the plant. The figure is what a person would be exposed to if they stayed outdoors for 11 consecutive days at the location. It is 10 times higher than the 1 millisievert-per-year long-term reference level for humans as recommended by the International Commission on Radiological Protection.

The prefectural government is measuring from Tuesday more than 1,400 institutions in the prefecture outside the 20-kilometer evacuation zone.

If the recommended limit is 1 mSv per year, however, it is utterly misleading to suggest the problem in Namie is 10 times higher than it should be. It is, but only for eleven days. This is comparing 11 day apples with 365 day oranges. The problem is much worse.

The fact is, people are getting almost a millisievert per 24 hour day, 909 microsieverts to be exact, if the radiation has been properly measured. At the levels indicated, people in Namie would get 332 mSv in a year, 332 TIMES normal for a year, if normal is 1.

The reported radiation level of almost 38 microsieverts per hour, if it is accurate, is much lower than prior reports here and here, which were 161 microsieverts per hour around March 21st and 1,400 microsieverts per hour around March 27th.

Radiation at the main gate to Fukushima Daiichi, one kilometer from the reactors, at the latest reading was 121 microsieverts per hour, over three times worse than in Namie.

Radiation Next to Reactor Buildings 100 Millisieverts Per Hour, Inside Off the Scale

So reports NHK World, here:

A radiation monitor at the troubled Fukushima Daiichi nuclear power plant says workers there are exposed to immeasurable levels of radiation.

The monitor told NHK that no one can enter the plant's No. 1 through 3 reactor buildings because radiation levels are so high that monitoring devices have been rendered useless. He said even levels outside the buildings exceed 100 millisieverts in some places.

Monday, April 4, 2011

Your Kid Still Can't Read, But His Teacher Retires a Millionaire

From Scott Johnston's The Naked Dollar:

Let's get back to my millionaire claim about teachers, which on the face of it, should seem preposterous. Teachers are by far the biggest public employee category, and their contract terms are illustrative of what goes on elsewhere. In my town, a teacher retiring today gets 70%, give or take, of his or her salary for the rest of his or her life. That's about $84,000 a year (not taxed by the state, incidentally). Plus, they get health benefits for their entire family for life. That's worth another $16,000 a year, for a total of $100,000 a year. Live for 25 years and that's a total of $2.5 million. Discounted at 4%, it's $1.6 million.

To quote our president, "let's be clear": there is zero difference between this and having an IRA with a value of $1.6 million, except the rest of us didn't demand that taxpayers fund our IRAs.

But it's much worse than that.

Read the whole thing here.

Headline Unemployment Drops to 8.8 Percent

The Wall Street Journal has an excellent interactive graphic of unemployment showing every month going back to January 1948 here:

The broader measure known as U-6 is still high at 15.7 percent, and 13.5 million, dropouts not included, continue to look for work.

Employment in America hasn't been really solid since the 1960s, except for a few months in the year 2000.

Sunday, April 3, 2011

Fleep.com/earthquake Has The Most Comprehensive Fukushima Accident Radiation Data

Here is a sample, graphing the differences between the histories of the radiation levels measured at the two gates to the reactor facility, compared with the main building of the complex itself, from March 24th until April 1st:

Note that the radiation in the main building is still close to a full millisievert per hour (1000 microsieverts). You would absorb there in just 6 hours what the average American absorbs in a year.

Radiation in the most sensitive areas of the reactors themselves, and the turbine buildings, has been reported as high as 1000 millisieverts per hour, even now. Expressed in full sieverts, an hour of such exposure equals 1 sievert. 8 of those will kill you very quickly.

When it comes to radiation, distance away is your friend: first the main building, then the main gate, then anyplace else, even Iitate.

Radiation Level in Iitate, Japan, Down to 6.65 Microsieverts/Hour

As of 2:00 PM, Japan time, April 3, 2011 according to the Main Disaster Office of Fukushima Prefecture (here):

The level is down from 12.1 microsieverts per hour, reported here on March 21.

Friday, April 1, 2011

Radiation Report About Iitate, Japan, Had to Be Wrong

Nothing illustrates the incredibility of some of the radiation reports about Japan in the popular press than the case of Iitate, Japan.

Today The Wall Street Journal is reporting here that the radiation level at the main gate to the Fukushima Daiichi Nuclear Plant is 144 microsieverts per hour. Inside the grounds of the plant, high level readings have been reported in reactor and/or turbine buildings all the way between 200, 300, and 400 millisieverts per hour on the lower end to as much as 1000 millisieverts per hour or more at the higher end, readings worlds away from microsieverts per hour (1 millisievert per hour is the same as 1000 microsieverts per hour).

The main gate is exactly one kilometer distant from the reactors, while the west gate is just slightly farther out.

This means that despite the catastrophe unfolding at the water's edge, a kilometer away the radiation levels drop dramatically. It doesn't mean they are safe, but the decline is dramatic with distance.

Compare that observation with the report by Kyodo News (which we detailed here) in which the spokesman for the Japanese Nuclear and Industrial Safety Agency is quoted as saying radiation levels in Iitate, Japan, 25 to 30 miles away, were at 25 millisieverts per day, or 1.04 millisieverts per hour, if one spent a maximum of eight hours outdoors. In microsieverts per hour, that would have to be 1,040.

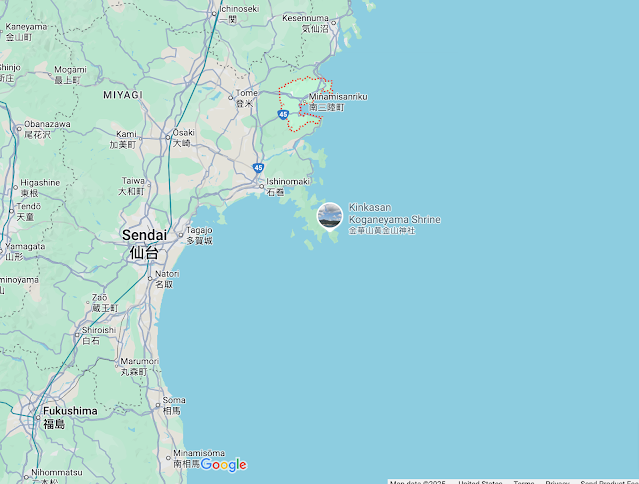

The following map (source) of today's conditions shows that that statement must be in error, and wildly so:

All the readings in the affected area displayed here are measured in microsieverts, and very low measurements are reported.

There is only one line of contamination running northwest of the reactors where there are reports of relatively higher readings, the highest of which is around 70 microsieverts per hour, still much lower than at the main gate to Fukushima, and nowhere even remotely in the vicinity of 1,000 microsieverts per hour.

Fukushima Daiichi Main Gate Radiation at 3:00 PM at 144 Microsieverts Per Hour

According to this cool interactive map from The Wall Street Journal here:

As of now, there's only one data point available in Fukushima Prefecture, and that's at the main gate to Ground Zero, but it's better than nothing.

At the stated level of 144 microsieverts per hour, you'd get 3.456 millisieverts camping out there for 24 hours, 6.912 millisieverts in 48 hours (just over the average American's ANNUAL exposure), and 483.6 millisieverts (the average American's exposure in a 78 year lifetime) in just 140 days (that's 20 weeks for those of you in Rio Linda).

Fukushima Reactors 2, 3 and 5 Jolted Beyond Worst Case Projections

As reported here:

Three of the six reactors at the Fukushima Daiichi nuclear power plant experienced a jolt stronger than a worst case projection when hit by Japan's largest-ever earthquake March 11, provisional data by the operator Tokyo Electric Power Co. showed Friday. ...

According to the data, the lowest underground levels of the Nos. 2, 3 and 5 reactor buildings faced a seismic movement of 550, 507 and 548 gals in the east-west direction, respectively, and each figure exceeded the projected level.

The limits, according to the following data (source), were 438, 441 and 452, respectively:

This means the effect of the 9.0 quake on these reactors was 25%, 15% and 21% beyond the design parameters.

The limits, according to the following data (source), were 438, 441 and 452, respectively:

This means the effect of the 9.0 quake on these reactors was 25%, 15% and 21% beyond the design parameters.

Obama, Distributor of Miseries, Must Resign

Friday-Morning, April 1, 2011

The True-born Sons of Liberty are desired to hear the public Resignation, under Oath, of Barack Hussein Obama, a Dastard, Distributor of Miseries for the United States of America.

A Resignation ? YES.

Source

Thursday, March 31, 2011

Radiation in Iitate, Japan, at 25 Millisieverts Every 24 Hours

If that's really true, that's FOUR years' worth of normal exposure in America IN A CALENDAR DAY, AND STILL THEY WON'T EVACUATE Iitate, Japan.

Hidehiko Nishiyama, a spokesman for the Nuclear and Industrial Safety Agency, . . . said at a press conference in the afternoon [Thursday] that the agency's rough estimates have shown there is no need for people in Iitate to evacuate immediately under criteria set by the Nuclear Safety Commission of Japan.

''The radiation dose of a person who was indoors for 16 hours and outdoors for eight hours (and continued such a lifestyle) would be about 25 millisieverts, which is about half the level which requires evacuation based on the commission's criteria,'' he said.

The commission explained that domestic criteria are based on measurements at radiation in the air, and not the soil.

The data was buried here, in a story about groundwater contamination near reactor one. The technique appears to be an old one: casually refer to the touchiest subject as an aside in a report about something entirely unrelated.

Khalif Saed: The Voice of Libyan Professional Credibility

If there's an ammunition shortage, no one has told Khalif Saed. He was firing off a large machine gun welded to the back of a pick up truck, sending the contents of the heavy belt of bullets darting through the weapon and in to an empty sky. ...

Asked why he was shooting when the revolution's military leadership has appealed for discipline and its fighters not to waste ammunition, Saed said simply: "It's my gun."

Too Bad Obama Wasn't Fully Vetted: Appearing To Be Credible Since 1961, or Thereabouts

President Obama told CBS News in an interview aired Tuesday night that the few rebel leaders American officials have met were "fully vetted, so we have a clear sense of who they are, and so far they're saying the right things, and most of them are professionals, lawyers, doctors, people who appear to be credible."

More here.

More here.

Pesky Fuel Rod

The Europeans have banned "The Simpsons" for its insensitive nuclear humor.

I kid you not:

Broadcasters in Germany, Australia and Switzerland have decided to ban or censor episodes of The Simpsons that poke fun at nuclear disasters in light of Japan's atomic emergency.

More here.

Labels:

Australia,

Fukushima Japan,

Germany,

Homer Simpson,

Switzerland,

The UK Telegraph

Wednesday, March 30, 2011

News Story Misidentifies Reactors in New Photos

The UK Daily Mail has been providing up to the minute coverage with excellent and timely photographs, which, sad to say, seems to have failed us this day.

It's not a quibble either, because the import of the article is that Reactor 2 has melted through its vessel, in the opinion, OPINION!, of the GE head of safety research when the reactor was installed. And he's been all over the British press, not just the Daily Mail, repeating that OPINION:

Richard Lahey, who was head of safety research for boiling-water reactors at General Electric when the company installed the units at Fukushima, told the Guardian that he believed nuclear fuel had melted and burned through the reactor floor in unit number two.

But try to accurately identify that reactor in these photos:

|

| This photo's caption appears to be correct, but Reactor 2 appears to be the most intact. |

|

| This photo's caption appears to be incorrect. These are reactors four and three, not one and two. |

Tuesday, March 29, 2011

Latest Radiation Figures in Tokyo, Fukushima City and Iwaki City Show Broad Declines

Some meltdown, huh?

The Wall Street Journal is reporting the following declining radiation measurements in Japan today:

Tokyo: 0.105 microsievert an hour. Normal is 0.035 microsievert an hour.

Fukushima City: 3.17 microsieverts an hour, compared to 5.85 microsieverts an hour a week ago and 22.90 microsieverts an hour two weeks ago.

Iwaki City: 0.81 microsieverts an hour, compared to 2.05 microsieverts an hour a week ago and 1.34 microsieverts an hour two weeks ago.

In this statement from the article, "10,000" is a typo, and should read "100,000":

The US Nuclear Regulatory Commission sets the annual occupational dosage limit for workers who deal with radiation at 50,000 microsieverts and the limit for a nuclear event at 10,000 microsieverts.

It's the same sort of error, easy to make, which TEPCO made in recent days stating a radiation comparison, not the reading itself, was 10 million times higher than another reading, when they meant 100,000 times higher. And the numbskulls crucified them for it.

Zeroes get inadvertently added and subtracted all too often, it seems, in science, mathematics . . . and politics!

The good news is that the bad news is not as bad as it was.

The True Meaning of 666

Don't buy stocks, unless you like overpaying, says John Bethel.

Here:

Back in January 2006, I posted about something Peter Cundill referred to over the years — “The Magic Sixes.”

As I wrote at the time:

“The Magic Sixes” are something Cundill got from a man named Norman Weinger of Oppenheimer in the 1970s. They are companies trading at less than .6 times book value (or less than 60% of book value), 6 times earnings or less, and with dividend yields of 6% or more. Cundill remembers that there were HUNDREDS of publicly traded companies in the US qualifying back in those days.

When I posted the above more than five years ago, I ran a screen on Barron’s Online and it gave three stocks meeting the test.

I just ran it again a few minutes ago and it listed one stock meeting the test. And a second that was on the bubble (and might meet it as the stock price fluctuates a bit).

The Magic Sixes isn’t meant to give specific stock tips. It’s used to gauge the broad market — and whether it’s cheap or not.

It’s clearly not here in the US.

Back in January 2006, I posted about something Peter Cundill referred to over the years — “The Magic Sixes.”

As I wrote at the time:

“The Magic Sixes” are something Cundill got from a man named Norman Weinger of Oppenheimer in the 1970s. They are companies trading at less than .6 times book value (or less than 60% of book value), 6 times earnings or less, and with dividend yields of 6% or more. Cundill remembers that there were HUNDREDS of publicly traded companies in the US qualifying back in those days.

When I posted the above more than five years ago, I ran a screen on Barron’s Online and it gave three stocks meeting the test.

I just ran it again a few minutes ago and it listed one stock meeting the test. And a second that was on the bubble (and might meet it as the stock price fluctuates a bit).

The Magic Sixes isn’t meant to give specific stock tips. It’s used to gauge the broad market — and whether it’s cheap or not.

It’s clearly not here in the US.

Yes, There is a Hell. It's Called the Housing Market.

Stephen B. Meister for The New York Post takes us on a grand tour of The Inferno, from the first level to the last:

Sales of existing homes dropped 9.6 percent in February to their lowest level since 2002 -- 4.88 million per year. And that's the good news.

Sales of new homes have collapsed. In February, they dropped 16.9 percent to an all-time-record low -- 250,000 a year, down from 900,000 in early 2007. ...

The median price of an existing home dropped 5.2 percent to $156,100, while the median new-home price is down 13.9 percent, to $202,100. ...

The official statistics show an inventory of 3.67 million new and existing homes -- 8.6 months' worth at the present anemic sales rate. But the real inventory is likely double that . . ..

Nearly one in four borrowers -- more than 11 million households -- owes more than the house is worth. Another 2.4 million homeowners have less than 5 percent equity, putting them right on the edge. And those numbers will all soar as prices slide further. ...

All this means there's a backlog of some 10 million homes that must get sold before housing can truly recover. But fewer than 5 million homes now trade hands in a year -- and that's mostly sales of nondistressed homes, which aren't even part of the glut. So it's clear that home prices are bound to go down further and remain down for years.

Every economist knows you get more of what you subsidize. Due to all the overbuilding from years of federal housing subsidies, today a staggering 18.4 million homes are empty year-round. (That's down from 18.9 million a year ago, as lower prices have lured investors who've rented out homes bought at foreclosure.)

Given that there are 112.5 million occupied housing units (including rentals) in America, that means that there's one vacant home for every six occupied ones.

Short of bulldozing the millions of unneeded homes, it will take years of population growth and household formations to absorb the excess.

You won't like the rest, either, here.

Democrats For Bush's Iraq War 110, For Obama's Libya War 0

That constitution thingy, well, it just doesn't apply here according to Secretary of State Hillary Clinton, because an international agreement trumps it, which will come as quite a surprise to the Americans who have to fight it, and the rest of us who have to pay for it. But hey, who cares, they're all volunteers, right?

Peter Wehner for Commentary reminds Hillary Clinton that when it comes to unilateral wars, she at least got to vote for the last one:

On October 10-11, 2002, the House voted 296-133 in favor of the Use of Force Resolution, while the vote in the Senate was 77-23. All told, 110 Democrats in the House and Senate voted in favor of going to war – including then-Senator Hillary Clinton . . ..

The rest is also instructive, here.

Labels:

Barack Obama 2011,

Bush 43,

Commentary,

Hillary 2011,

Iraq,

Libya,

Pete Wehner

Monday, March 28, 2011

Is the Plutonium Story Being Sensationalized?

To read the online papers, like ABC News (here), you'd think the detection of plutonium around the Fukushima reactors indicates a meltdown is suddenly underway, as if nothing has been happening since the quake and tsunami struck on March 11, 17 days ago, and radiation subsequently began to pour out of the facilities.

Yet the reports from Japan are not wholly satisfactory, evidenced by speculation about a direct correlation between the problems at reactor 3 (where plutonium is an ingredient in Mixed OXide fuel) and what has been found in the soil.

Kyodo News likens the amounts detected in the soil to amounts routinely found during the era of atmospheric testing of nuclear weapons before the Test Ban Treaty (here):

[T]he levels confirmed from soil samples taken at the plant on March 21 and 22 were almost the same as those from the fallout detected in Japan following past nuclear tests by the United States and Russia, said the utility known as TEPCO.

And NHK World has perhaps a slightly different angle (here):

[T]he level detected is the same as that found in other parts of Japan and does not pose a threat to human health. ...

The Nuclear and Industrial Safety Agency says the detected level is the same as that found in the environment and not health-threatening for workers who conducted the sampling, nor residents in surrounding areas.

The question is whether the plutonium traces found are the normal residue from the era of atmospheric testing, are otherwise normal traces unrelated to that time, or are related to a problem at reactor 3.

Additional testing is said to be underway.

Meanwhile, if it bleeds, it leads.

Labels:

ABC News,

Energy 2011,

Fukushima Japan,

NHK News,

Nuclear Weapon,

plutonium

National Security Adviser: "We Don't Make Decisions . . . Based On Consistency"

WELL NO SHIT.

"We don’t make decisions about questions like intervention based on consistency or precedent," said Denis McDonough, the administration's deputy national security adviser, amid an off-camera gaggle of reporters. "We make them based on how we can best advance our interests in the region."

Uh huh.

More here.

Sunday, March 27, 2011

China Moves Forward on Discarded American Thorium Reactor Technology

Ambrose Evans-Pritchard had the story over a week ago for The UK Telegraph here, and promptly headed for the hills afterwards:

A few weeks before the tsunami struck Fukushima’s uranium reactors and shattered public faith in nuclear power, China revealed that it was launching a rival technology to build a safer, cleaner, and ultimately cheaper network of reactors based on thorium. ...

China’s Academy of Sciences said it had chosen a “thorium-based molten salt reactor system”. The liquid fuel idea was pioneered by US physicists at Oak Ridge National Lab in the 1960s, but the US has long since dropped the ball. Further evidence of Barack `Obama’s “Sputnik moment”, you could say. ...

Norway’s Aker Solution has bought Professor Rubbia’s patent. It had hoped to build the first sub-critical reactor in the UK, but seems to be giving up on Britain and locking up a deal to build it in China instead, where minds and wallets are more open.

Labels:

Ambrose Evans-Pritchard,

Energy 2011,

England,

Fukushima Japan,

Norway,

thorium,

uranium

Greenpeace Team in Iitate, Japan, Claims Measuring 7 to 10 Microsieverts/hour

The measurements were taken today, according to this report:

The team measured radiation of between 7 and 10 micro Sievert per hour in the town of Iitate, on Sunday March 27 th.

That's down from the 12.1 microsieverts/hour reported nearly a week ago, as here.

But even at 7 microsieverts/hour, it would take only about 36 days to get the annual average American dose of 6200 microsieverts. At 10 per hour, about 25 days.

Radiation in Namie, Japan, Has Risen From 0.161 to 1.4 mSv/hour

According to this report:

The Science Ministry says a reading of 1.4 millisieverts was taken on Wednesday morning in Namie Town northwest of the plant.

We reported the lower level of 0.161 on Monday last, here. The measured increase is dramatic. Just two days later the measurement is over 700 percent higher.

Background radiation plus other routine exposures in America amounts to, on average, 6.2 mSv/year. In Namie, Japan, on Wednesday, one would get that much in just under five hours.

Tsunami At Rikuzentakata Reached 42 Feet In Height

According to this report.

It penetrated to a height of two stories high one kilometer inland, sweeping away people from a gymnasium designated as a shelter.

TEPCO Stands by Radiation Figure of 1000 mSv/hour, Corrects Concentration to 100K Times Normal

So Kyodo News, dateline Tokyo, March 28:

Japan on Sunday faced an increasing challenge of removing highly radioactive water found inside buildings near some troubled nuclear reactors at the Fukushima Daiichi plant, with the radiation level of the surface of the pool in the basement of the No. 2 reactor's turbine building found to be more than 1,000 millisieverts per hour.

Exposure to such an environment for four hours would raise the risk of dying in 30 days. Hidehiko Nishiyama, spokesman for the government's nuclear safety agency, said the figure is ''quite high'' but authorities must find a way to pump out the water without sending workers too close to push ahead with the restoration work.

Plant operator Tokyo Electric Power Co. said early Monday the concentration of radioactive substances of the puddle was 100,000 times higher than that usually measured in water in a reactor core, correcting its earlier analysis of 10 million times higher.

The facts are not altered: 2 Sievert hours might very well kill you, 4 will in 30 days, and 8 will much more quickly than that.

Read the rest here.

Iodine 131 and Xenon 133 Show Up in Nevada

As reported here:

[E]xtremely small amounts of iodine-131 and xenon-133, both of which are not usually found in Nevada, were detected at a monitoring station near the Atomic Testing Museum in the city following a series of radiation leaks at the Fukushima Daiichi plant.

Fukushima Reactor 2 Basement Puddle Emitting 1000 mSv/hour

An astounding number, which amounts to 1 Sievert per hour, from a puddle.

Half of that is 500 mSv/hour, previously reported in the air over one of the reactors. That's the amount in a hour an American can expect to absorb in a life. Now double that, in an hour.

Just two hours exposed to radiation at 1 Sievert per hour is sometimes fatal, while 8 Sieverts is most definitely fatal. Chernobyl threw off 50 Sieverts near the destroyed core in just ten minutes.

The report comes from Kyodo News today, here:

The concentration level is 10 million times higher than that seen usually in water in a reactor core, according to plant operator Tokyo Electric Power Co. Hidehiko Nishiyama, spokesman for the government's nuclear safety agency, said the figure is ''quite high'' and ''likely to be coming from the reactor.'' ...

The radioactivity at the surface of the puddle at the No. 3 unit was 400 millisieverts per hour. ...

According to the latest data released Sunday, radioactive iodine-134, a substance which sees its radiation release reduced to about half in some 53 minutes, existed in water at the No. 2 reactor's turbine building at an extremely high concentration of 2.9 billion becquerels per 1 cubic centimeter.

The water also contained such substances as iodine-131 and cesium-137, known as products of nuclear fission, and thus leading to speculation that it may have come through pipes that connect the reactor vessel and turbines, where steam from the reactor is normally directed to for electricity generation.

The pool of water at the No. 4 reactor's turbine building included radioactive substances, but the concentration level was not as high as at the Nos. 1, 2 and 3 buildings, the data showed.

Friday, March 25, 2011

Incident's Radioactive Materials Leaking From Reactors, Not Spent Fuel Pools

So says Japan's Nuclear and Industrial Safety Agency. NHK World has the details here:

The Nuclear and Industrial Safety Agency spoke to reporters on Friday about an accident in which 3 workers were exposed to radiation in the turbine building of the No. 3 reactor.

It said 3.9 million becquerels of radiation was detected from 1 cubic centimeter of water sampled from the floor of the building. The radiation level was about 10,000 times higher than the water inside a normally operating nuclear reactor.

The agency said the water sample indicated it is highly likely the leak comes from the reactor itself, not from the pool storing spent nuclear fuel.

According to the officials, pressure inside the reactor core is stable and the agency doesn't believe the reactor is cracked or broken. But it says it is highly possible that radioactive materials are leaking from somewhere in the reactor.

The agency also said high levels of radiation have been measured at reactors No. 1 and 2, and speculates there may also be leakage from them. Cooling operations using seawater are continuing at the reactors.

Possible Damage To Reactor 3's Vessel, Pipes or Valves

As reported by Kyodo News, here:

A high-level radiation leak detected Thursday at one of six troubled reactors at the crisis-hit Fukushima Daiichi nuclear plant indicates possible damage to the reactor's vessel, pipes or valves, the government's Nuclear and Industrial Safety Agency said Friday. ...

Hidehiko Nishiyama, spokesman for the governmental nuclear regulatory body, told a press conference, ''At present, our monitoring data suggest the (No. 3) reactor retains certain containment functions, but there is a good chance that the reactor has been damaged.''

Nishiyama said the high-level radiation is suspected to have originated from the reactor, where overheating fuel rods are believed to have been partially melted, or a boiling pool that stores spent nuclear fuel, both of which are located in the reactor's building. ...

The Nuclear Safety Commission of Japan, a government panel, recommended voluntary evacuation as the release of radioactive materials from the plant is expected to continue for some time.

Fukushima Reactor 3's Core Believed to be Source of Radioactive Puddle

As reported here by Kyodo News:

High-level radiation detected Thursday in water at the No. 3 reactor's turbine building at the crisis-hit Fukushima Daiichi nuclear plant appears to have originated from the reactor core, the government's Nuclear and Industrial Safety Agency said Friday.

But no data, such as on the pressure level, have suggested the reactor vessel has been cracked or damaged, agency spokesman Hidehiko Nishiyama emphasized at an afternoon press conference, backing down from his previous remark that there is a good chance that the reactor has been damaged. It remains uncertain how the leakage happened, he added.

Fukushima Reactors' Surface Temperatures Exceeding Design Parameters

So said Kyodo News here on March 23:

While the maximum vessel temperature set by the reactors' designers is 302 C degrees, the surface temperature of the No. 1 reactor vessel briefly topped 400 C and dropped to about 350 C by noon, and that of the No. 3 reactor vessel stood at about 305 C, the agency said.

All Four Reactor Cores or Spent Fuel Pools Leak Highly Radioactive Water

So says Kyodo News here:

[H]ighly radioactive water was later found leaking near all four troubled reactor units at the plant.

A day after three workers were exposed to water containing radioactive materials 10,000 times the normal level at the turbine building connected to the No. 3 reactor building, a water pool with similarly highly concentrated radioactive materials was found in the No. 1 reactor's turbine building, causing some restoration work to be suspended, it said.

Pools of water that may have seeped from either the reactor cores or spent fuel pools were also found in the turbine buildings of the No. 2 and No. 4 reactors, measuring up to 1 meter and 80 centimeters deep, respectively, while those near the No. 1 and No. 3 reactors were up to 40 cm and 1.5 meters deep.

Recent reports describe two phenomena: surface temperatures on reactor vessels far exceeding the prescribed limits, and the need to keep re-filling the spent fuel pools because of rapid evaporation and/or leakage loss.

Add to these observations the new information that radioactive water is now observed pooling in various places in all four reactor facilities, and the plain statement "Tokyo Electric Power Co. said Friday it has begun injecting freshwater into the No. 1 and No. 3 reactor cores at the crisis-hit Fukushima Daiichi nuclear plant," and it is difficult not to conclude that the nuclear reactors at Fukushima I are themselves damaged and that their spent fuel ponds were cracked in the earthquake and cannot retain water without constant attention to refilling.

This is a disaster for the people of Japan, and a terrible rebuke of the hubris of the nuclear power industry.

Thursday, March 24, 2011

TEPCO Speculates Radioactive Puddle Contents Are Sign of Reactor Breach

NHK World has the story here about the puddle which injured 2 workers, exposing them to over 170 millisieverts while laying cable near the reactor 3 turbine room:

The level of radioactive cerium-144 was 2.2 million becquerels. Also, 1.2 million becquerels of iodine-131 was measured. These substances are generated during nuclear fission inside a reactor.

Tokyo Electric says damage to the No.3 reactor and spent nuclear fuel rods in a storage pool may have produced the highly radioactive water.

The level of radioactive cerium-144 was 2.2 million becquerels. Also, 1.2 million becquerels of iodine-131 was measured. These substances are generated during nuclear fission inside a reactor.

Tokyo Electric says damage to the No.3 reactor and spent nuclear fuel rods in a storage pool may have produced the highly radioactive water.

Obama Refuses to Secure America's Dangerous Nuclear Waste

For The Associated Press Jonathan Fahey and Ray Henry have an excellent story here about the problem America shares with Japan: "US Spent-Fuel Storage Sites Are Packed".

Nearly 72,000 tons of dangerous waste is being stored all over the US at reactor sites, 75 percent of it in vulnerable cooling pools just like Japan's.

We could have started moving it to Yucca Mountain long ago, but an unholy alliance between Nevada's people, its Senator Harry Reid of Obamacare fame, and President Obama himself keep the radioactive waste exposed to misfortune, mayhem and mischief in places like Illinois, Pennsylvania, South Carolina, New York and North Carolina, the top five states storing spent nuclear fuel totaling over 27,000 tons:

For long-term storage, the government had looked to Yucca Mountain. It was designed to hold 77,160 tons - 69,444 tons designated for commercial waste and 7,716 for military waste. That means the current inventory already exceeds Yucca's original planned capacity.

A 1982 law gave the federal government responsibility for the long-term storage of nuclear waste and promised to start accepting waste in 1998. After 20 years of study, Congress passed a law in 2002 to build a nuclear waste repository deep in Yucca Mountain.

The federal government spent $9 billion developing the project, but the Obama administration has cut funding and recalled the license application to build it. Nevadans have fiercely opposed Yucca Mountain, though a collection of state governments and others are taking legal action to reverse the decision.

Despite his Yucca Mountain decision, President Barack Obama wants to expand nuclear power. He created a commission last year to come up with a long-term nuclear waste plan. Initial findings are expected this summer, with a final plan expected in January.

Obama the feckless simply kicks that can down the road while he globe trots with GE's chairman Jeff Immelt in search of deals for GE's nuclear reactor business, for example in India which has had plans to spend tens of billions of dollars on nuclear, and most recently in Brazil.

In exchange look for Obama to get GE to finance his presidential library and millions in walking around money for his future "charitable" foundation which will rival Bill Clinton's.

For every operational 1000 megawatt nuclear plant a year, another 25-30 tons of the stuff piles up with no place to go.

And with Obama in charge, nowhere is where it's at.

Children Outside Evacuation Zone in Kawamata Getting 2 Microsieverts Per Hour

Kyodo News here reports that the Japanese government says 66 children checked in Kawamata (B) are not in danger of thyroid problems from radiation exposure from the crippled nuclear reactors (A).

Workers Laying Cable at Fukushima Reactor 3 Injured by Radioactive Puddle

Kyodo News reports here that the workers had on Tyvek suits but no boots and stepped into a 15cm puddle of water which threw off 200 to 400 millisieverts of radiation per hour and caused beta ray burns to the feet of two of the men Thursday morning Tokyo time.

So far 17 workers each have been exposed to over 100 millisieverts of radiation since the trouble began at Fukushima.

Wednesday, March 23, 2011

America's Number One Nuclear Problem is Spent Fuel Storage

So says Robert Alvarez for The Los Angeles Times:

[T]he nation's 104 nuclear power plants are legally storing spent fuel in onsite cooling ponds much longer, and at higher densities (on average four times higher), than was originally intended. And now that the Obama administration has called off proposed plans to store nuclear waste at the Yucca Mountain site in Nevada, fuel is likely to remain at the plants where it was used for decades to come.

This presents a serious threat. Our report found that, as in Japan, US nuclear safety authorities don't require reactor operators to have backup power supplies to circulate water in the pools and keep them cool if there is a loss of offsite power. ...

[A] severe pool fire could render about 188 square miles uninhabitable, cause as many as 28,000 cancer fatalities and cost $59 billion in damage.

Read all of it here.

Fukushima City Radiation Tuesday Evening 10 Times the US Normal Level

So Kyodo News here:

[T]he radiation dose detected in Fukushima Prefecture stood at 6.85 microsieverts per hour in the city of Fukushima at 7 p.m. Tuesday, the Fukushima prefectural government said. The dose is gradually receding in the area, it added.

At that rate one would be exposed to 60 millisieverts in one year. Normal in the US is about 6 millisieverts per year.

Based on data plugged into a computer model, the article speculates that certain individuals even outside 30 kilometers of the plant could have been exposed to 100 millisieverts since the tsunami.

About a week ago levels in the city stood at 20 microsieverts per hour, so observations are trending lower already 66 percent.

Fukushima Reactor 2 Radiation 500 mSv/hour Since Friday

As reported by Kyodo News here:

At the No. 2 reactor, workers have been unable to replace some parts to help revive its internal cooling systems since Friday as high-level radiation amounting to at least 500 millisieverts per hour was detected at its turbine building, the spokesman also said.

The equivalent in an hour of a lifetime's worth of radiation.

A Woman Decides Her Husband is Right: Women are Nuts

Her name is Heather Wilhelm:

"Men may be jerks," my husband likes to occasionally declare, "but women are insane." I hate to admit it, but he's right-and anyone who has spent two years living in a sorority house filled with alpha girls (I'm raising my hand) can attest that this is true.

Women are likely going nuts for a number of reasons. For instance, it's quite tiring and stressful, not to mention impossible, to try to have the brilliant job, the perfect family, shiny hair and manicured hands. Some women say they want total "equality" but still want guys to pick up the check. But perhaps another reason women are losing it is that they're repeatedly told that they're no different than men-and many believe it, particularly in the realm of sex.

This, of course, is clearly not true.

In other words, only the woman has the instincts to make a family perfect and all the "child men" are their fault, "with all my worldly goods I thee endow" for sex is a no brainer that proves men are inferior, and bearing children trumps making them.

You can read the rest here.

Tuesday, March 22, 2011

TEPCO Says Radiation Drops Near Fukushima Reactor Main Gate

Company officials told reporters that the radiation level near the plant's gate 1 kilometer west of the reactors was up to 1,932 microsieverts per hour at 6:30 PM on Monday.

By midnight, the figure had dropped to 331.8, and by 10 AM on Tuesday, it was down to 260.2 microsieverts per hour.

Normal in the US is less than 0.71 microsieverts per hour.

Read more at NHK World here.

Monday, March 21, 2011

Iodine 131, Cesium 134, Cesium 137, Cobalt 58 All Found in Sea Water Near Fukushima

As reported here:

According to TEPCO, radioactive iodine-131 was detected Monday in the seawater samples at levels 126.7 times higher than the legal concentration limit. Levels of cesium-134 were 24.8 times higher and those of cesium-137 16.5 times higher while a trace amount of cobalt 58 was detected in a sample of seawater taken from near the plant.

Radiation in Namie, Japan

Kyodo News reports here that radiation levels in Namie (B), 20 km north of the Fukushima Nuclear Plant (A), are 161 microsieverts per hour.

It would take just under 26 days of continuous exposure to such levels to accumulate 100 millisieverts of radiation exposure, and in a year over 1,400 mSv.

Devra Davis for Reuters, here, puts that in its health context:

In terms of cumulative exposure, 100 millisieverts a year is the lowest level at which any increase in cancer risk is clearly evident. A cumulative 1,000 mSv over a lifetime would be expected to cause a fatal cancer many years later in five out of every 100 persons with that kind of exposure.

Multiculturalism As It Was Meant To Be, Illustrated

Bruce Thornton on Islam, here:

Muslims have a religious world-view and sensibility that condition their actions and interests, and we must understand those spiritual beliefs in their own terms rather than reducing them to the materialist determinism that dominates our thinking.

Sage Advice

Hermit hoar, in solemn cell,

Wearing out life's evening gray,

Smite thy bosom, sage, and tell,

Where is bliss? and which the way?

Thus I spoke, and speaking sighed--

Scarce repressed the starting tear--

When the smiling sage replied,

'Come, my lad, and drink some beer'.

-- Samuel Johnson --

Main Radiation Effects at Fukushima I From No. 4 Spent Fuel Cooling Pond

So says Tony Irwin of the Australian National University for France24 here:

"Reactors 5 and 6, they are now in what's called cold shutdown, and the spent fuel cooling ponds are at normal temperatures.

"They are in the sort of situation now we would like to see 1, 2, 3 and 4 in.

"There was already spent fuel in there [before No. 4 was drained and emptied last November] so there was quite a high load of spent fuel in that pond. And that has been giving the main radiation effects on site."

One presumes from that that the high heat coming off the pond kept boiling away the water during the crisis and not that an earthquake related leak in the pond kept drawing down the level.

For the first time I read in the article a concern about all the sea water being poured on the stricken reactors because it thereby becomes radioactive waste.

Where is it all going, ton after ton? To air and back to sea?

Undoubtedly.

One presumes from that that the high heat coming off the pond kept boiling away the water during the crisis and not that an earthquake related leak in the pond kept drawing down the level.

For the first time I read in the article a concern about all the sea water being poured on the stricken reactors because it thereby becomes radioactive waste.

Where is it all going, ton after ton? To air and back to sea?

Undoubtedly.

Labels:

Australia,

Climate 2011,

earthquakes,

Energy 2011,

France,

France24,

Fukushima Japan,

Shutdowns

Radiation Level at Iitate, Japan

Breitbart reports here that a monitor in Iitate, Japan (A), thirty miles northwest of Fukushima I (B), recorded the highest radiation sample recently taken from 12 monitoring stations in the area: 12.1 microsieverts per hour.

That would be 290.4 microsieverts per 24 hour day, or a normal annual dose in America of 6,200 microsieverts in just 21 days.

The rate per hour of 12.1 microsieverts is over 17 times the normal rate in America of .70776 microsieverts per hour.

Smoke at Fukushima But No Reported Change in Radiation Levels

Kyodo News has the latest update here, with the following related information:

[O]ne of seven workers who were injured following a March 14 hydrogen explosion at the No. 3 reactor was found to have been exposed to radiation amounting to over 150 millisievert per hour.

The level is lower than the maximum limit of 250 millisievert per hour set by the health ministry for workers tackling the emergency at the Fukushima plant.

An emergency worker in the US is permitted a once in a lifetime maximum single exposure of 250 mSv. Added to normal radiation exposure over the course of a lifetime, such exposure raises lifetime totals from a normal 484 mSv to 734 mSv, 52 percent more than normal.

Supreme Court Rejects 8 Bank Clearing House Appeal on Loan Disclosures

The decision, which is moot as to future disclosure requirements because of the disclosure requirements under the Dodd-Frank legislation, will require that the Federal Reserve disclose loans made at the discount window in 2008. The story, excerpted below, is reported by Bloomberg here:

The order marks the first time a court has forced the Fed to reveal the names of banks that borrowed from its oldest lending program, the 98-year-old discount window. The disclosures, together with details of six bailout programs released by the central bank in December under a congressional mandate, would give taxpayers insight into the Fed’s unprecedented $3.5 trillion effort to stem the 2008 financial panic.

Subscribe to:

Posts (Atom)