When it comes to numbers, I have observed that Rush Limbaugh can be counted on to get something horribly wrong, and today was no exception. Today he has misrepresented the routine revision of the GDP data every five years as a revision of the numbers for only the last five years, as if it were designed specifically to make Obama look better. In actual fact, the revision of the numbers goes back not five years, but all the way back to 1929.

Truly incredible, and embarrassing in the extreme, since the truth is the revision occurs every five years, and this is the 14th revision in the series. This is why conservatives hope Rush retires soon, nevermind why liberals hope he retires. He's making us all look stupid when he carries on like this.

I have shown "five" in red

below from today's Rush transcript so you can appreciate the thorough-going depth of Rush's misrepresentation of the facts:

RUSH: Here's what the Commerce Department is doing.

They have "made changes to how it calculates gross domestic product," going back five years. "At the same time, the government also went back and revised data for the past five years, to reflect more complete as well as additional statistics from a variety of sources, such as the Internal Revenue Service and the US Department of Agriculture." They have made changes to how they're calculating the gross domestic product, or economic growth, and what they're doing now is they're going back five years.

They have revised data for the past five years to, they say, "reflect a more complete, as well as additional statistics from a variety of sources, such as the IRS and the Department of Agriculture. Why do you think they decided to go back the last five years to revise data? To rewrite the horrible 4-1/2 years of Obama. There's no question. I don't know if it's fraudulent, but they're cooking the books -- and after cooking the books, after making it look as good as they can, it's 1.7% economic growth.

Here, however, is the statement from the BEA in today's official release about the routine revision every five years, which has been telegraphed to every reader of BEA GDP reports for many quarters running going back at least to last year (meaning Rush Limbaugh has never read even cursorily a single one of those GDP reports from the BEA in the interim, let alone today's):

Today, BEA released revised statistics of gross domestic product (GDP) and of other national income and product accounts (NIPAs) series from 1929 through the first quarter of 2013. Comprehensive revisions, which are carried out about every 5 years, are an important part of BEA's regular process for improving and modernizing its accounts to keep pace with the ever-changing U.S. economy.

-----------------------------------

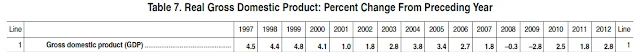

1.7% GDP in Q2 2013 is horrible enough, but the average report for the last three quarters comes in under 1%, 0.966% to be exact. So if there is some conspiracy to make things look better than they are, whoever's in charge of that ought to be fired, stat!

This country remains in deep trouble, and there is no conspiracy to hide it.