Saturday, August 31, 2019

Canadian court dismisses Michael Mann's libel claim with prejudice, Mann withholds his climate data to this day

A prominent skeptical climate scientist in Canada named Tim Ball accused Mann of fraud in generating the Hockey Stick graph. The famous quote, from a February 2011 interview of Ball, was “Michael Mann should be in the State Pen, not Penn State.” In March 2011, Mann sued Ball for libel, focusing on that quote, in the Supreme Court of British Columbia in Vancouver. Here is a copy of the Complaint. (Note: In British Columbia, the Supreme Court is not the highest appellate court, but rather the trial-level court for larger cases.) The case then essentially disappeared into limbo for eight plus years. But on Friday, August 23, the British Columbia court dismissed Mann’s claim with prejudice, and also awarded court costs to Ball. As far as I can determine, this was an oral ruling, and no written judgment nor transcript of the ruling yet exists. I have asked Ball to send them along as soon as they exist.

The story of Ball’s vindication, and of Mann’s shame, is a somewhat long one, and turns on Mann’s flat refusal to share publicly the data and methodology by which he constructed the Hockey Stick graph. In about 2003 a very talented Canadian mathematician named Steve McIntyre began an effort to replicate the Mann/Bradley/Hughes work. McIntyre started with a request to Mann to provide the underlying data and methodologies (computer programming) that generated the graph. To his surprise, McIntyre was met not with prompt compliance (which would be the sine qua non of actual science) but rather with hostility and evasion. McIntyre started a blog called Climate Audit and began writing lengthy posts about his extensive and unsuccessful efforts to reconstruct the Hockey Stick. Although McIntyre never completely succeeded in perfectly reconstructing the Hockey Stick, over time he gradually established that Mann et al. had adopted a complex methodology that selectively emphasized certain temperature proxies over others in order to reverse-engineer the "shaft" of the stick to get a pre-determined desired outcome.

Labels:

Canada,

Climate 2019,

Education,

England,

Michael Mann,

Supreme Court 2019

Friday, August 30, 2019

Thursday, August 29, 2019

Trump's in denial when he says we're great again, Democrats are in denial saying we were never great in the first place

Flashback to one year ago this month when Andrew Cuomo, Democrat Governer of New York, said it plainly.

Both sides are in denial, which is one reason why little is changing for the better.

Back when America was great, Q2 real GDP used to average 4.4%, under Trump it averages 2.6%

From 1982 to 2000, coincident with the great Reagan bull market in stocks, the average report of real GDP for the second quarter was 4.4%.

Trump was going to make America like that again.

At an average report of 2.6% so far, he has no grounds for saying America is back, let alone greater than ever before. He's doing better than Obama at 2.3%, but that's about it.

The economy shrank dramatically after 2000, and no one has figured out how to fix it.

Labels:

Barack Obama 2019,

Donald Trump 2019,

GDP 2019,

Ronald Reagan,

Secular Bull,

SPX

Wednesday, August 28, 2019

US crude oil production in 2019 is at record high levels never before experienced in the post-war

|

all time high of 12162 BBL/D/1K in April of 2019 |

U.S. Oil Production Hits 12 Million Barrels a Day for First Time

Tuesday, August 27, 2019

US on its way to becoming a net exporter of oil, dominating global oil market and securing the dollar as global reserve currency

Note to Chris Irons: This is not bullish for gold.

The US is about to send a lot more oil into an already oversupplied world market:

“It will be 4 million barrels a day by six or eight months. Four million barrels a day is a lot bigger than the North Sea as a whole. That crude oil is going to go everywhere. It goes to Asia, Europe, to India,” said Edward Morse, Citigroup global head of commodities research. “If the U.S. gets to 6 million barrels a day in three years, it will be hands-down the world benchmark.” ...

“Add on the amount of petroleum products that are exported and add on the amount of natural gas that is exported. The U.S. becomes the biggest hub for energy trading in the world,” said Morse. “It has dramatic implications for the U.S. dollar.”Morse notes there are those who doubt the dollar’s future as the global reserve currency. But in a scenario where the U.S. grows into an energy powerhouse, “the dollar becomes more entrenched.”The U.S. had been the world’s dominant oil producer, prior to World War II. “This will be back to the future for the Gulf Coast,” said Daniel Yergin, IHS Markit Vice Chairman. Yergin said the U.S. would not have had the opportunity to increase production as much, were the law not changed in 2015 to allow for U.S. oil exports.

Sunday, August 25, 2019

Saturday, August 24, 2019

Black Dems in PA admit revulsion for Hillary made them not vote in 2016

More than a dozen African Americans who said they usually vote Democratic - but didn't vote at all in 2016 - blamed unease with Clinton's candidacy. They also expressed support for Biden, frequently citing his past as Obama's vice president as a major positive, and occasionally others. ... Jason Saffore, 43, an African American Democrat working in Philadelphia's Reading Terminal Market, said he couldn't bring himself to vote for Clinton in 2016 and so didn't vote at all. Next year, he said, will be different. "The guy we have in office now is not serving our country and it's time for a change," he said, as he arranged a stack of onions in a crate. "We need a president who is for all Americans. Last time I didn't really care for the Democratic field at all, so I stayed out of the mix. I think a lot of people did."

The growth in retail was a one-off in late 2017, early 2018, and the long term trend remains down

At 1.6% year over year in July 2019, we're still nowhere near the high 2s of last year which actually still disappoint because those failed to match previous more robust growth spurts even under Obama.

The Trump tax cuts went to the wrong folks. Too bad they weren't really his, but his Republican handlers'. Think of them as NeverTrump's revenge: "We'll sandbag this guy with tax cuts which will help our friends but hurt his re-election chances".

The consumer is running on empty and emptier.

I'll tell you exactly what would have happened, Joe

Obama would have been buried, and beer sales would have gone through the roof from all the people celebrating and filling up to piss on his grave, that's what would have happened.

Friday, August 23, 2019

Clueless AP article calls US economy resilient when it's been in the rut they fear is coming since 2007

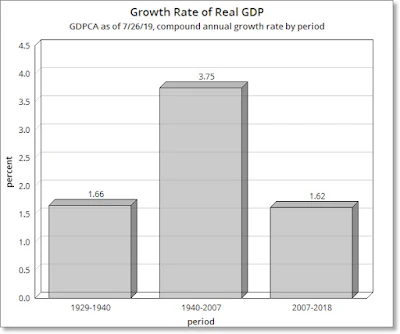

The compound annual growth rate of real GDP since 2007 has been WORSE than for the same time frame of the Great Depression, yet AP is completely oblivious. The upside is when things really go to hell they'll still be.

Barely a year after most of the world’s major countries were enjoying an unusual moment of shared prosperity, the global economy may be at risk of returning to the rut it tumbled into after the financial crisis of 2007-2009. ...

The U.S. economy, now enjoying a record-breaking 10-year expansion, still shows resilience. American consumers, whose spending accounts for 70% of U.S. economic activity, have driven the growth.

Retail sales have risen sharply so far this year, with people shopping online and spending more at restaurants. Their savings rates are also the highest since 2012, which suggests that consumers aren’t necessarily stretching themselves too thin, according to the Commerce Department.

Labels:

AP News,

Department of Commerce,

GDP 2019,

GDPCA,

retail sales,

Saving,

The Great Depression

Thursday, August 22, 2019

Current allocations to retail and institutional money funds are up 22.2% vs. the 2012-2018 average

Current allocations come to $3 trillion vs. $2.454 trillion on average 2012-2018.

Subscribe to:

Comments (Atom)