Saturday, June 28, 2025

Trump is the Uniparty, floats an Iran policy similar to Obama's

Friday, June 27, 2025

The weekend help has arrived early at Drudge lol

If anyone is stuck, it's Gen Xer Peter Thiel

... I’m always anti-boomer ...

In The New York Times, here.

Thursday, June 26, 2025

The consensus estimate for today's GDP report was indeed for -0.2, instead it surprised at -0.5

First-quarter gross domestic product (GDP) growth was revised lower Thursday in light of reduced consumer spending, surprising economists.

GDP contracted by 0.5 percent on an annualized basis, 0.3 percentage points lower than the last measurement from the Commerce Department.

Economists were expecting the number to stay the same at a 0.2 percent contraction. ...

More.

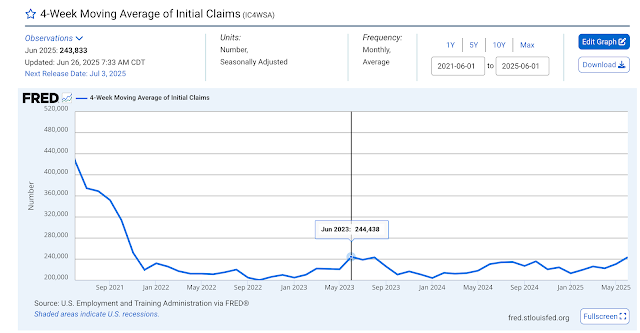

Average yields at Treasury Note auctions this week have been significantly lower than at the immediately preceding auctions, indicating there has been a flight to safety on souring economic growth expectations.

Trump may get his lower interest rates . . . the hard way, lol.

1Q2025 real GDP revised down 0.3 to -0.5 in third and final estimate on an increase in imports front-loaded into 1Q to avoid Trump's tariffs

More.

Sounds like Howard Lutnick gobbledygook at the end there. Paragraph two speaks of an increase in imports. Paragraph three of a downward revision to imports.

Which is it lol?

Nominal 1Q2025 GDP clocks in at $29.962 trillion in the third estimate. SPX was at 5612 on Mar 31, yielding a crazy high stock market valuation of 187.

The International Atomic Energy Agency, which said Iran possessed 400kg of highly enriched uranium on June 12, says they'd have to go to the bomb sites to really know the extent of the damage caused by the U.S. attacks

Iran’s nuclear facilities “suffered enormous damage” from the U.S. airstrikes Saturday, but more extensive evaluation is needed, the head of the United Nations’ nuclear watchdog said Thursday.

“I think ‘annihilated’ is too much, but it has suffered enormous damage,” International Atomic Energy Agency (IAEA) director Rafael Grossi told French broadcaster RFI. “I know there’s a lot of debate about the degree of annihilation, total destruction, and so on, what I can tell you, and I think everyone agrees on this, is that very considerable damage has been done.”

“Obviously, you have to go to the site and that is not easy, there is debris and it is no longer an operational facility,” he added.

More.

Wednesday, June 25, 2025

Federal Reserve floats proposal to ease bank capital requirements which were increased in the wake of the Great Financial Crisis of 2008, Fed Governors Kugler and Barr in opposition

In its draft form, the measure would call for reducing the top-tier capital big banks must hold by 1.4%, or some $13 billion, for holding companies. Subsidiaries would see a larger drop, of $210 billion, which would still be held by the parent bank. The standard applies the same rules to so-called globally systemic important banks as well as their subsidiaries.

The rule would lower capital requirements to range of 3.5% to 4.5% from the current 5%, with subsidiaries put in the same range from a previous level of 6%. ...

However, Governors Adriana Kugler and Michael Barr, the former vice chair of supervision, said they would oppose the move.

“Even if some further Treasury market intermediation were to occur in normal times, this proposal is unlikely to help in times of stress,” Barr said in a separate statement. “In short, firms will likely use the proposal to distribute capital to shareholders and engage in the highest return activities available to them, rather than to meaningfully increase Treasury intermediation.” ...

Methinks J. D. Vance doth protest too much about Jerome Powell

Tuesday, June 24, 2025

Food items making new all time high average prices in the United States in May 2025

All prices are FRED data from the St. Louis Fed in U.S. dollars.

Ground Chuck 6.018/lb

Coffee 7.931

White Sugar 1.054

Bananas 0.655

Potato Chips 6.731

Ice Cream 6.466/half gallon

100% Ground Beef 5.981/lb

All Uncooked Ground Beef 6.245

American Cheese 5.063

Beer 1.834/pint

Because the BBB is a GOP Christmas tree of policy-change goodies masquerading as a reconciliation bill

This was taken down pretty early this morning by the suck-ups at Real Clear Politics. I guess the bosses come in a little later than the help.

This is arguably one of the best discussions of what is really going on that you will find.

A couple dozen provisions have been removed. No ruling yet on the biggest one, which could mean $3.7 trillion in fake ‘savings.’

In most cases, the parliamentarian looks at whether provisions have a purely budgetary purpose, rather than policy dressed up as a budget item. (This is known as the Byrd Rule, after the longtime Democratic senator from West Virginia, Robert Byrd; the process by which the parties debate the provisions and by which a ruling is made is known as the “Byrd bath.”) ...

For context, the House version costs $3.3 trillion over a decade, according to the latest estimates. We’re verging on $4 trillion for the Senate bill—unless the Republicans’ wish to have the $3.7 trillion in tax cuts entered as zero passes muster with the parliamentarian. ...

Update Wed Jun 25:

Real Clear Politics put this back up in the rotation this morning, lol.

Mark Levin is right, can't understand why Trump is throwing Iran's Nazi leader a lifeline

Because Trump is weak, Mark. It's a failure of nerve. He doesn't have the right stuff.

Iran should be forced to sign a surrender document. Unconditional surrender. They lost their nukes, they’ve lost their air force, they have no ground-to-air protection. China didn’t step in, Russia didn’t step in, not a single Arab country stepped in. The Supreme Nazi is hiding in a bunker much like Adolf Hitler did. Adolf Hitler wasn’t thrown a lifeline. He wasn’t thrown a lifeline. He was going to be killed, so he committed suicide.

More.