Saturday, December 21, 2024

The US House passed a continuing spending resolution through March 14, 2025 at 5:59PM yesterday, the US Senate passed it this morning at 12:23AM, averting a federal government shutdown

The House roll call vote (366-34-1-29nv) is here. 34 Republicans voted Nay.

The Senate roll call vote (85-11-4nv) is here. 10 Republicans voted Nay, as did pinko commie Bernie Sanders.

The continuing spending resolution includes NO extension of the suspended debt ceiling time limit demanded by president-elect Trump, who now gets to waste his precious time trying to primary all 170 Republicans in 2026 who just voted for this

LOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOLOL,

something he had threatened on Wednesday.

170 House GOP just told Donald J. Trump Nay Nay by voting Yea, proving once again that he is just a paper tiger.

Meanwhile the debt ceiling and the income tax remain chief among the failed gimmicks of the Progressive Era, dating to 1917 and 1913. The one hasn't stopped the debt from exploding to $36 trillion, and the other hasn't paid that bill.

The continued existence of these gimmicks serves to remind us, but only periodically, of the lies we tell ourselves, which is why we have to keep them.

Friday, December 20, 2024

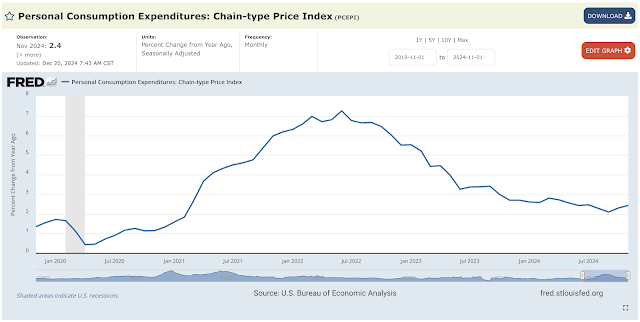

Stock market cheerleaders say inflation data is encouraging, lower than expected, but it's up lol

Dow bounces 800 points Friday on encouraging inflation data after rough week: Live updates

Key Fed inflation measure shows 2.4% rate in November, lower than expected

These people are incorrigible liars.

Headline pce inflation ticked up from 2.30% year over year in October to 2.44% in November.

Core pce inflation ticked up from 2.79% year over year in October to 2.81% in November.

"We expected worse! Buy stonks!"

And so they did.

Thursday, December 19, 2024

S&P 500 Equal Weight Index down 7.25% in December to date, US Treasury yields up a net 2.13% in the aggregate since the end of November

Both stocks and fixed income down at the same time is a real bummer, you know, like in 2022.

UST yields in the aggregate tonight are at 4.45 vs 4.356 at the end of November.

UST yields have risen 375 basis points net in the aggregate in the three months since the Fed started cutting the Fed Funds Rate on September 18. That's +6.93%, which is hilarious.

Trump's first defeat lol: You might say the two billionaires were shown who's boss

Second continuing spending resolution goes down in flames, after Elon Musk and Donald Trump said Nay to the first one, which never even came to a vote. Speaker Johnson and the Democrats had worked on that compromise deal for three months.

The roll call vote is here.

CNBC story here.

Extremely amusing.

|

| The Republicans Who Said Nay |

Trump's a Democrat now lol

Making chumps of us all.

President-elect Donald Trump said Thursday that Congress should get rid of the debt ceiling, a day after he came out against a deal reached by congressional lawmakers to fund the government before a shutdown occurs.

In a phone interview with NBC News, Trump said getting rid of the debt ceiling entirely would be the “smartest thing it [Congress] could do. I would support that entirely.”

“The Democrats have said they want to get rid of it. If they want to get rid of it, I would lead the charge,” Trump added.

Trump suggested that the debt ceiling is a meaningless concept — and that no one knows for sure what would happen if it were to someday be breached — “a catastrophe, or meaningless” — and no one should want to find out.

“It doesn’t mean anything, except psychologically,” he said. ...

In his call Wednesday for Republicans to ditch the negotiated bipartisan short-term spending bill, Trump also demanded that lawmakers increase the debt ceiling — something that hadn’t been on the table at all.

I can't wait for Moody's to downgrade the USA from Aaa to Aa, to make it a Trinity of lost AAA.And why not? It's only pSyChOlOgIcAl.

The UK Daily Mail thinks Joe Biden dropped out on June 21, not July 21 lol

Those UK reporters really don't have a firm grasp of the timeline. They prefer to concentrate on the gossip and innuendo.

A particular target for the First Couple is said to be former house speaker Nancy Pelosi, who led the effort to push Biden out of the 2024 election race – personally calling him and demanding he quit in the hours before he withdrew on June 21.

More.

No one really knows what Pelosi said to Joe, or when she said it, but it wasn't on June 21 lol.

CNN reported on Wednesday July 17 (updated Thursday July 18) that Pelosi had been in California since Friday July 12, one day before Trump was shot in Butler, PA, and that she claimed she hadn't spoken to Joe Biden from July 12-17 even though CNN said it had four sources saying she had:

This phone call would mark the second known conversation

between the California lawmaker and Biden since the president’s

disastrous debate on June 27. While the exact date of the conversation

was not clear, one source described it as being within the last week.

Pelosi and Biden also spoke in early July. ...

A Pelosi spokesperson told CNN that the former House speaker has been in California since Friday and she has not spoken to Biden since.

The CNN timeline leaves room for Pelosi talking to Joe Biden as described in the story on Friday July 12, or even the day or two days before that.

CNBC reported on Sunday July 21, the day Joe dropped out, and relying on one source, that Pelosi spoke with Joe on Saturday July 20, but Pelosi's spokesman also denied this, consistent with the denial to CNN:

A spokesman for Pelosi later told CNBC after publication of this story “not true. Speaker Pelosi has not spoken to the president since she left Washington more than a week ago.”

Pelosi was in North Carolina on Saturday July 20 giving a tepid pep talk about the accomplishments of the Biden-Harris ticket:

In her roughly half-hour speech, Pelosi said the president’s name only sparsely, and primarily in reference to his role in passing legislative priorities.

Wednesday, December 18, 2024

US Treasury yields are looking more normal!

UST averages tonight: Bills 4.365 Notes 4.410 Bonds 4.695.

Low duration issues yield the least, long duration issues the most, and the middle looks like the middle should look, middling.

That's how it should be.

Low duration issues have been dominating the curve, yielding the most. Why, just at the beginning of the month the 1MO still yielded 4.75, more than any other security. Tonight the 1MO yields 4.44 and the 20Y yields 4.74, the leader. The yield laggards are the 6MO and 1Y at 4.30. That's what you want to see happen.

The Fed today dropped the Federal Funds Rate 0.25 points to 4.25. I expect the short end to keep moving lower as a result, and the middle to rise more in tandem with the long bonds as inflation continues to bite.

But we shall see.

The Fed Chair Jerome Powell gave them what they wanted, a one quarter point interest rate cut, and the spoiled markets threw a fit anyway because of what he said about next year

The S&P 500 Equal Weight Index is down almost 7% this month, to date.

Meanwhile, more inflation for the rest of us, which Powell has never really tried to stop. You know, like Christianity hasn't failed, it just hasn't really been tried.

Tuesday, December 17, 2024

The idiots at Newsweek think the House Republican majority is in peril in part because of Lori Chavez-DeRemer going to Trump's cabinet, not realizing she lost her election and is not part of the 220 equation to begin with

Republican House Majority in Peril

The Republican wafer-thin majority in the House of Representatives is facing growing uncertainty as GOP members of Congress line up for Donald Trump's Cabinet. ...

[Victoria] Spartz's move [not to caucus with the Republicans] could throw the slim Republican majority in the House into peril amid other GOP members of the House being tapped to serve in Trump's Cabinet. ...

Representative Lori Chavez-DeRemer of Oregon has also been nominated to serve as labor secretary. ...

Waltz has already submitted his resignation and, combined with Gaetz's resignation and the possibility of Spartz refusing to caucus with Republicans, as well as Stefanik and Chavez-DeRemer being confirmed to Cabinet positions, the Republican majority could collapse, jeopardizing their ability to advance Trump's agenda.

Waltz counts, Gaetz counts, and Stefanik counts, taking the 220 win down to 217 temporarily. Spartz not caucusing with the GOP creates a 216-215 GOP majority, not a 215-215 tie as Newsweek shows. Spartz remains a Republican, however, and presumably will vote with the Republicans.

The uninformed Newsweek writer is from . . . the UK lol.

And, of course, Drudge just repeats the stupidity:

Republican House Majority in Peril...

Average US Treasury yields aggregated monthly started to normalize in November as yields fell for bills but rose for bonds

Interpreted politically one could say yields for notes and bonds reversed their slide starting in October as Harris' lead evaporated at the end of September and bond markets started to bet on a Trump win, bringing with it higher deficits because of his proposed tariffs and tax cuts.

Monday, December 16, 2024

We're finally getting some yield curve interest rate normalization with the 1MO yield leader being replaced by the 20Y, as it should be

The UST Bills end averages 4.353 as of Friday Dec 13th, while the Bonds end averages 4.650.

Still soft in the middle, though, with Notes averaging 4.288. Would like to see Bills and Notes the reverse of that for a nicely steepened slope from short duration to long.

Sunday, December 15, 2024

It's good to know that Luigi Mangione's new lawyer thinks assassinating people is bad lol

So they're going to plead "not guilty by reason of insanity", right?

Based on this hire he must be crazy.