Today, here:

The middle class still is, in an aggregate sense, where all the money in the country is. That's where all the money is in the economy. The rich do not hold all the money.

This is the voice of a very rich man who is under attack by a leftist president and a leftist consensus which says that the rich do not pay their fair share, the voice of a man who is not reasoning as a conservative but emoting as a rich man. If he reasoned as a conservative, if The Wall Street Journal reasoned as conservatives, we would be seeing something other than the suggestion that the leftists go victimize the middle class. Like the bank robber, this thinking, if it can be called thinking at all, maintains that you should tax the middle class because that's where the money is.

As such what Rush says is not conservative, but purely reactionary in the worst sense of the term: it responds to an historical development in which it finds itself the victim and seeks escape instead of statesmanship. This is what you get from a Rush Limbaugh, who abhors learning. You wouldn't get that from a William F. Buckley, Jr.

It goes without saying that it is absurd to suggest that all the money is in the middle, but apparently we must insist that it is not so.

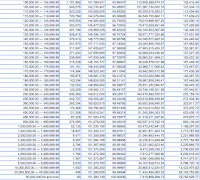

The middle quintile of households made a median income of almost $50,000 in 2011. Generously speaking, this approximates to every single income in the country in 2011 making between $35,000 and $65,000 annually, 35 million workers, accounting for $1.7 trillion out of $6.2 trillion in net compensation, just 27% of the total pie. The bottom end of the richest quintile, on the other hand, begins somewhere just north of $100,000 annually, 10 million workers, accounting for $2.1 trillion out of $6.2 trillion in net compensation in 2011, significantly more at almost 34% of the total pie.

But this is no way for a conservative to look at it.

The founders of the country envisioned equality of contribution from taxation, which the original constitution required to be direct, apportioned according to population. This is why taxation was always very low, because the poor could not afford it. This is also why we have a census in the constitution, not so that we may learn how many Americans are of Italian descent, but simply how many there are, for tax purposes. If it is pleaded that the constitution has been changed to permit indirect taxation, it is still more originally American to insist on equality of treatment under the tax code. The real problem with America is that originalist principles were thrown under the bus in the early 20th century by progressives like Teddy Roosevelt, and enshrined in constitutional amendments under people like Woodrow Wilson.

Equality of treatment under the law is the principle conservatives should be trumpeting. But you will listen for that in vain from Rush Limbaugh.

The progressives like Wilson, a Presbyterian whose grandiose ideas bordered on the fanatical and are reminiscent of no one so much as George W. Bush, misused Christianity by insisting that "to whom much is given, much is required" in arguing for progressive taxation, and forgot that "no one can be my disciple who does not say goodbye to everything that he has". The actual price of Christian discipleship was everything you had, whether you were rich or poor. But in the secularized, immanentized bastard version of this under progressivism, the price became distorted so that the richer you were the more you owed, the poorer the less. It is little wonder that for that the rich demanded more, and eventually got it, in special rules in the tax code designed especially for them, which since that time have evolved into the elaborate distortions and complexities of the tax code we face with trepidation and consternation today.

In a very real sense when it comes to the tax code, The American Century has been the most un-American one of all, and the crying need of the time is to reverse it and refound the country anew on the original American principle of equality of treatment.

.jpg)