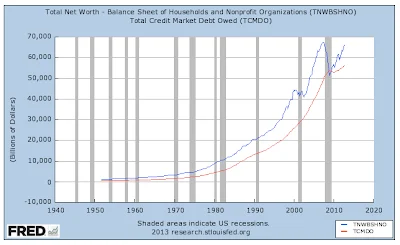

Quantitative easing is for the banks and nothing else, despite the long-standing professorial deflections to the contrary by Ben Bernanke.

Oh, he can say it's to help housing recover, or employment, or whatever else happens to be languishing depending on the exigencies of the moment. But God forbid Ben should say what everyone ought to have understood from the beginning, that there's a huge pile of non-performing loans on the banks' books. Ben's various iterations of QE have kept him busy systematically transfering to the books of the Federal Reserve Bank of the United States significant tranches of those bad loans, and it won't be until those transfers end decisively that you can be sure that the banks are finally in the clear.

Meanwhile, have you considered that when Keynes said markets can stay irrational longer than you can remain solvent that Keynes never imagined how un-free markets were to become in the Western world? Five years out from the troubles of 2008, that the purchases of MBS continue apace should at once frighten everyone and galvanize support to reform the banking system and prioritize the commitment of its central bank to the integrity of the US dollar.

The voices warning us are out there. You just won't hear them on your television, which you should turn off at a minimum, and preferably execute loudly in your backyard with a shotgun, or drop on your driveway from a second story window. Please send film.

Consider this from Manuel Hinds, former finance minister of El Salvador and 2010 winner of the Hayek Prize, here:

"[H]igher interest rates would burst the bubbles in asset prices that monetary printing has created, bringing to the surface the losses that banks have accumulated by years of lending to unsustainable activities. Thus, the Fed is between a rock and a hard place. If it does not increase the rates of interest, excess demand will explode leading to high inflation, large current account deficits or both. If it increases interest rates, the activities that are profitable only with very low interest rates will collapse, including the equity and commodity markets. This would expose the banks to very large losses, which would trigger a serious crisis because the banks have accumulated bad assets for over a decade now and have cleansed them only partially because they trust that the government will save them without having to take painful write-offs. As a snowball going down a slope, the problem gets worse with time. ... The coming breakdown is likely to be much worse than that of 2008."

Or this from Joseph Calhoun of Alhambra Investment Partners, here, who doesn't consider that QE is so negative for present GDP growth because it is "financing" past growth now ensconced as bad debt:

"There are any number of reasons why QE might be negatively impacting growth, from high oil prices to the diversion of capital to speculative purposes to its effects through exchange rates on other countries with which we trade. I do not claim to know the full extent of the effects of QE but most importantly, neither does Ben Bernanke. That being the case and considering the evidence to date, why does Bernanke persist in pursuing the policy? Is there some other reason for the policy other than the stated one of spurring economic growth? If so, Bernanke sure isn't telling anyone what it is."

Or this from the ever-wise John Hussman, here:

"Meanwhile, with a monetary base of $3.27 trillion and an estimated duration of at least 7 years on present Fed holdings, the recent 100 basis point move in bond yields has created a loss of over $200 billion for the Fed. The Fed reports capital of only $55 billion on its consolidated balance sheet. but then, just like major banks, the Fed does not mark its assets to market. Most likely, the Fed is now technically insolvent. Moreover, the Fed is levered more than 59-to-1 even against its stated capital. The benefits of QE seem vastly overpriced and excessively trusted, particularly in an environment where the internal debate even within the Fed is becoming more pointed. Two members already want the Fed to taper in order “to prevent the potential negative consequences of the program from exceeding its anticipated benefits.” ... We don’t observe any material economic impact from quantitative easing, and continue to believe that the key event in the recent credit crisis was the FASB move to abandon the requirement for mark-to-market accounting among financial institutions (the Fed’s zero interest policy has merely allowed banks to recapitalize themselves on the backs of savers and the elderly on fixed incomes)."

QE is financial repression of the American taxpayer for the benefit of institutions which should be wound down and broken up. How long are you going to put up with it? Can you last another five years?