From the very long term perspective, the spending on World War II which supposedly got us out of the Great Depression did nothing of the sort. It erected an enormous edifice which became the foundation for the present trouble, which is masked in the ever declining purchasing power of the dollar, the 1928 version of which is worth eight cents in 2008, the 1910 dollar, four pennies.

Instead of climbing out of that debt foxhole, we're digging it ever deeper, and the vicissitudes of a history of our own making are raining down upon us a torrent that will become a flood, collapsing the unsupported walls around us. The world knows a worthless currency when it sees it.

Heraclitus taught us that war is the father of everything and king of all.

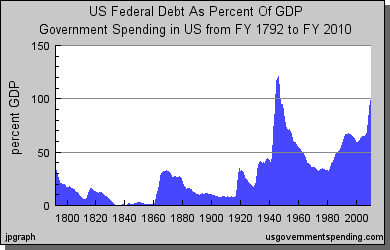

Consider the chart above.

The very American nation was itself born of monies borrowed to finance its War of Independence. Mark the sudden upticks in expenditure as a percentage of gross domestic product which commence with the War of 1812, the War Between the States, World War I, the response to the crash of 1929 and World War II, the Peace Through Strength policy to defeat the Soviet threat begun under the Reagan administration, and the adventures in Afghanistan and Iraq since 2003. We've been paying for all that with the continuing slide of a fiat dollar.

Jesse thinks the day of reckoning fast approaches:

The States racked up some serious debt in keeping the world safe for democracy in the Second World War. On a percentage basis, it has recently spent a significant amount keeping its financial sector safe from productive effort and honest labour. They will raid the Treasury, take their fill, and then compel the government to confiscate the savings of a generation by defaulting on its obligations, its sovereign debt.

So does Sprott Asset Management, here:

In case you failed to catch it in our previous articles this year, we thought we’d state it outright for our readers this month: the United States Government is on a trajectory to default on their obligations. In its current financial condition, it will not be able to fund its forecasted budget deficits and unfunded Social Security and Medicare promises on top of its current debt obligations. This isn’t official yet, and we don’t know when the market will react to it, but there is no longer any doubt about the extent of their trajectory. There simply isn’t enough taxing power, value creation or outside capital willing to support its egregious spending.

The great imperative of our time is to bring spending to a halt, or as Jesse says, to need little, and want less. Willingly or no, little and less await us.

Yet Reason frowns on war's unequal game,

Where wasted nations raise a single name,

And mortgaged states their grandsires' wreaths regret,

From age to age in everlasting debt;

Wreaths which at last the dear-bought right convey

To rust on medals, or on stones decay.

-- Samuel Johnson, The Vanity of Human Wishes