No ads, no remuneration. Die Gedanken sind wirklich frei. The tyrant "has desires which he is utterly unable to satisfy, and has more wants than any one, and is truly poor, if you know how to inspect the whole soul of him: all his life long he is beset with fear and is full of convulsions, and distractions, even as the State which he resembles."

Thursday, April 4, 2013

Wednesday, April 3, 2013

Gold: Over 60 Million Krugerrands Circulate, More Than All Others Combined

So says the Rand Refinery's latest brochure, here, showing 2012 mint specimens. Figures through 2008 previously indicated 46 million ounces minted.

These 60 million Krugerrands are not all 1 oz. coins, but if they were, that would mean something like $96 billion worth with current gold prices around $1,600 the ounce.

Presumably therefore, there must be something like 110 million gold coins of all kinds out there if Krugerrands represent more than all the rest combined, with a current value of roughly $176 billion.

Not very much real money when you get right down to it.

Of course, there's lots of bars out there which can be turned into coin.

Official global gold reserves as of last summer were approaching 31,000 metric tons (2,204.6 lbs each), for a grand total of 68,342,600 lbs, which is 1,093,481,600 ounces, in other words, potentially about 1.093 billion more gold coins, with a current estimated value of $1.75 trillion.

Add the current gold coinage and you've got a potential $1.93 trillion in gold money for the world at current prices, 1.2 billion one ounce gold coins, or 12 billion tenth ounce gold coins, or 1.6 tenth ounce gold coins for every man, woman and child on the planet (7.1 billion), or $256 each.

Equality is such a bummer.

Meanwhile at home, current net worth of US households and non-profits in US funny money is $66.072 trillion, or $210 billion for every man, woman and child in the country.

Now, that's more like it!

Official global gold reserves as of last summer were approaching 31,000 metric tons (2,204.6 lbs each), for a grand total of 68,342,600 lbs, which is 1,093,481,600 ounces, in other words, potentially about 1.093 billion more gold coins, with a current estimated value of $1.75 trillion.

Add the current gold coinage and you've got a potential $1.93 trillion in gold money for the world at current prices, 1.2 billion one ounce gold coins, or 12 billion tenth ounce gold coins, or 1.6 tenth ounce gold coins for every man, woman and child on the planet (7.1 billion), or $256 each.

Equality is such a bummer.

Meanwhile at home, current net worth of US households and non-profits in US funny money is $66.072 trillion, or $210 billion for every man, woman and child in the country.

Now, that's more like it!

Forbes: The Fed Is The Most Hypocritical, Thieving, Incompetent Bank In The Country

Richard Salsman for Forbes here savages the thieving, incompetent US Federal Reserve for its utter hypocrisy in keeping comparatively well-capitalized big banks from paying out dividends when its own balance sheet is the most under-capitalized of all and pays out 100% of what it makes.

Not news, but it bears repeating as often as possible, especially when it's stated so well:

'[I]n the century prior to the Fed’s founding in 1913, U.S. commercial banks were far more liquid and far better capitalized; in the century since 1913, however, and especially since the FDIC was established in 1934, the banks’ liquidity and capital adequacy measures have steadily deteriorated. This artificial, policy-induced financial precariousness has been used routinely as a pretext to justify onerous regulations – which, it’s easy to notice, have never quite adequately curbed all the excessive risk-taking and hence periodic banking crises. Bank executives often oppose the onerous regulations, but not the government subsidies which invite them. ...

'What about the Fed? It’s now got the biggest balance sheet of all the major banks in the U.S. – $3.1 trillion in total assets (versus $2.2 trillion at Bank of America, the largest private-sector bank in the U.S.) – and yet the Fed also has only $55.1 billion in capital (versus $160.3 billion at Bank of America). That means the Fed’s capital/assets ratio is a mere 1.8%, less than a quarter of the average capital ratio for the top eighteen banks subject to CCAR (8.0%) and of the three banks recently deemed inadequate (8.2%). The Fed’s capital ratio is only 15% of the ratio of BB&T (11.5%), the most-capitalized of the top private banks. Moreover, the Fed’s dividend payout ratio is hardly conservative or capital-preserving (like 10-33%); it is a 100% payout, since the Fed pays all its income (mainly from Treasury bonds, notes and bills), none of which is taxed, straight to the Treasury. Whereas the Fed is leveraged 56:1 (liabilities/capital), the top eighteen banks are leveraged by just 12:1 (average), while the three censured banks are leveraged by only 10:1 (average). ...

'This is the same Fed which, over the past century, has debased the dollar to such a degree that it’s now worth only 5% of its initial real purchasing power in 1913 (whereas the dollar in 1913 was approximately as valuable as it was in 1813, because it was anchored by the gold standard, not by a flimsy Fed standard). This is the same Fed that Alan Greenspan touted in a 1996 speech as “the ultimate guardian of the purchasing power of our money.” Is it truly a “guardian” – or instead an incompetent, or perhaps a thief – who presides over a loss of 95%? This is the same Fed which now censures private banks for having capital levels many times greater than the Fed’s own capital level. Isn’t it high time we ended the hypocrisy whereby the politically-financially reckless among us rule the day?'

The big banks' off-balance-sheet assets make their capital ratios much worse than stated above, but that just makes them more like the Fed in that respect. Salsman points out that before 1913 when we still had true, private banking, capital ratios averaged 20%+, whereas today 8% is about as good as it gets.

The Nation: Bill Clinton Wrecked The Economy, Not David Stockman

So Robert Sheer, here:

It wasn’t Stockman who wrecked the economy. It was Bill Clinton who deregulated the too-big-to-fail banks, and it was George W. Bush and Barack Obama who bailed them out. But even Paul Krugman, who knows how bad things are and yet manages to be charitable in appraisals of his Princeton colleague Ben Bernanke, dismisses Stockman’s critique as “cranky old man stuff. ...” ...

Herein is a lesson that the bankers should have been taught back during the Clinton presidency when, as Stockman writes, the principle of a bailout for Wall Street’s hustlers “was reinforced by the Fed’s unforgivable 1998 bailout of the hedge fund Long-Term Capital Management.”

That fiasco’s enablers—Alan Greenspan, Robert Rubin and Lawrence Summers—and the more disastrous ones to follow were crowned “The Committee to Save the World” on Time magazine’s Feb. 15, 1999, cover and are still welcomed in those polite circles where truth-teller Stockman is being treated as a pariah.

Corporations Borrow Cheap, Drive Market Highs Since March 2009 With $1.2T In Buybacks

So reports CNBC.com here, stating individual investors by contrast have pulled out $250 billion:

Corporate stock purchases have been the principal driver of the market's surge off its March 2009 lows, as companies have helped levitate prices through nearly $1.2 trillion in buybacks since the beginning of the third quarter in 2009, according to Standard & Poor's data.

During that same time, individual investors have pulled a net of more than $250 billion out of mutual funds, according to records from the Investment Company Institute that indicate the retail crowd has mostly fled the stock market and put the bulk of its money in cash or bonds. Mutual funds are seen as a proxy for mom-and-pop investors who use funds and 401(k) plans to put money into the market.

Companies have been able to be so aggressive because the Federal Reserve has kept money cheap. The U.S. central bank has held its target funds rate near zero to maintain low borrowing costs, while it also has flooded financial markets with more than $3 trillion in liquidity through money creation.

Tuesday, April 2, 2013

American Women Abort 3,300/Day, But These Two Think White Men Are More Violent

The clueless Childresses, here:

"Nearly all of the mass shootings in this country in recent years — not just Newtown, Aurora, Fort Hood, Tucson and Columbine — have been committed by white men and boys. Yet when the National Rifle Association (NRA), led by white men, held a news conference after the Newtown massacre to advise Americans on how to reduce gun violence, its leaders’ opinions were widely discussed."

Total Credit Money Creation Has Stalled Since 2007

Total credit money creation, aka total credit market debt outstanding (TCMDO), has stalled since 2007.

Doubling time for TCMDO has averaged 8.25 years between 1949 and 2007. The longest doubling times were 11.5 years from 1949 to 1961 and 10 years from 1989 to 1999. The shortest two episodes were each six years long: from 1977 to 1983, and from 1983 to 1989.

Real GDP over the longest periods increased 56% and 36% respectively. Over the shortest periods it increased 14% and 28% respectively.

Since 2007 TCMDO is expanding at a crawl, comparatively speaking, up at just 12% for the five years ended in July 2012. Real GDP for the period is a pathetic 3%.

At the current snail's pace, $1165 billion per year for the last five years, it will take until the year 2050 for TCMDO to double again.

Current quantitative easing programs continued indefinitely at the current rate of $1020 billion per year are as unlikely as previous iterations to lead to the expansion of TCMDO. The transfer mechanism is broken because the credit money creators, the banks, now prefer the option of investing elsewhere, which they did not have before 1999. The only way to fix that is to overturn Gramm-Leach-Bliley, and to reform mortgage lending.

Credit money, the lifeblood of the nation, is not even reaching the veins, let alone flowing through them at a rate sufficient to generate any GDP heat.

Monday, April 1, 2013

Ben Bernanke Is Trying But Failing Miserably At Money Printing

And it's not exactly his fault.

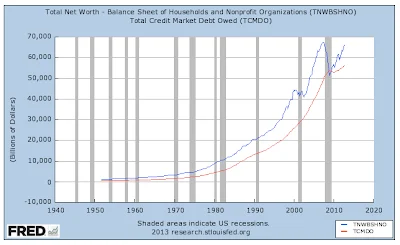

Historically in the postwar period, the increase in Total Credit Market Debt Outstanding (TCMDO) has closely shadowed the increase in Total Net Worth, seemingly helping to finance it, until the late great recession when for the first time, and very briefly, net worth flagged below the level of the debt owed. (Ignoramuses in the Doomosphere everywhere cried "Insolvency" at the time, not understanding the meaning of the term "net"). Ex post facto, net worth has made a dramatic upswing while the debt owed has increased at a much reduced rate by historical standards. To quote a famous president, "That doesn't make any sense."

Historically in the postwar period, the increase in Total Credit Market Debt Outstanding (TCMDO) has closely shadowed the increase in Total Net Worth, seemingly helping to finance it, until the late great recession when for the first time, and very briefly, net worth flagged below the level of the debt owed. (Ignoramuses in the Doomosphere everywhere cried "Insolvency" at the time, not understanding the meaning of the term "net"). Ex post facto, net worth has made a dramatic upswing while the debt owed has increased at a much reduced rate by historical standards. To quote a famous president, "That doesn't make any sense."

Despite all the debt naysayers out there, total credit market debt is not increasing at anything like it should be, and appears to be disconnected to a significant degree from the recent increase in total net worth, which is up 29% since its nadir at the beginning of 2009, or $14.7 trillion. For the whole five year period from July 2007 (the last time TCMDO doubled, going back to 1999) to July 2012, TCMDO increased at a rate of just 12% and real GDP increased just 2.9%, whereas TCMDO increased at a rate of 100% between 1949 and 2007 on average every 8.25 years. The shortest doubling times have included two periods of 6 years each, one of 6.75 years, one of 8 years, one of 9.5 years, one of 10 years, and one of 11.5 years. The very worst real GDP performance of all of those was for a 6 year doubling period when we got 14% real GDP, nearly 5 times better than we're getting now. All the rest posted real GDP of between 23% and 56%.

It is evident that Ben Bernanke's quantitative easing program (right scale) anticipated the leveling off of TCMDO (left scale). Clearly he expected the troubled banks to need a push to keep the credit money creation process going, but didn't understand how fruitless it would be. One notes that he has added about $2 trillion to the monetary base from the middle of the late great recession. By contrast, TCMDO is up (only!) $9 trillion from the beginning of 2007. By historical standards TCMDO should be up $25 trillion by now if TCMDO is to double again in ten years from 2007. And it should be up a lot more than even $25 trillion by now if it's to double sooner than ten years. At the average doubling time of 8.25 years, the $49.8 trillion of TCMDO in July 2007 should hit $99.684 trillion by October of 2015 if the postwar pattern is to continue. Instead, at the current rate of growth in TCMDO, it's going to take an unprecedented 27 years to double it, unless of course there are limits to borrowing to fuel growth, as many are beginning to tell us. In either event one can only assume there will be only pathetic real GDP growth going forward, if there is any at all.

Clearly something is horribly amiss in the transmission process of credit money creation for the first time in the postwar. Seemingly gargantuan quantities of money from the Fed through the process of quantitative easing should be seeding the banks who in turn should be creating massive amounts of credit way beyond the $9 trillion so far created. Instead, the banks are doing something else with it, by-passing the normal distribution channel. Some of the seed money is being held back to comply with increased capital requirements, to be sure, but more appears to be going directly into household net worth creation through investment gains from the stock market, enriching a very few bondholders, shareholders and banking industry players through the private trading desks of the banks, a unique development by historical standards made possible only since 1999 with the abolition of Glass-Steagall through the Gramm-Leach-Bliley Act. As an act of Congress, Ben Bernanke can't do much about that even if he is the most powerful man in the country.

In the absence of a creative policy change from the Fed whereby Congressional intent would be thwarted and money would actually reach the marketplace through a different avenue than the uncooperative banks, one must conclude that the Fed thinks it necessary to continue the various easing schemes because it judges the banks to be still too fragile to risk stopping them. That would be putting the best construction on the matter, to borrow a phrase from Luther's catechism. Either that, or the Fed itself has been completely captured by the bankers.

In the absence of a creative policy change from the Fed whereby Congressional intent would be thwarted and money would actually reach the marketplace through a different avenue than the uncooperative banks, one must conclude that the Fed thinks it necessary to continue the various easing schemes because it judges the banks to be still too fragile to risk stopping them. That would be putting the best construction on the matter, to borrow a phrase from Luther's catechism. Either that, or the Fed itself has been completely captured by the bankers.

Labels:

Ben Bernanke,

Capital requirements,

cash,

Currency,

Education,

Federal Reserve,

GDP 2013,

Glass-Steagall Act,

net worth,

SPX,

TCMDO

Cyprus: "Punishing A Whole Country Just To Hit Russians"

'Particularly successful at luring Russians, Cyprus has built up a large infrastructure of lawyers, accountants and other professionals schooled in the arts of tax avoidance. Its corporate registry now has 320,000 registered companies, a staggering number for a country with only 860,000 people. Most are hollow shells set up for foreign companies and wealthy individuals seeking to avoid taxes.

'"We have been thrown to the wolves, and now the wolves have responded," said Nicholas Papadopoulos, who heads the financial and budgetary affairs committee in the House of Representatives.

'Bitterly critical of last week's bailout deal — which is forcing Cyprus to shrink its banking and financial services industry drastically and stick the largest bank depositors with much of the bill — Mr. Papadopoulos said the European Union was "punishing a whole country just to hit Russians."'

More here.

Developing Countries Bail Out Of The Euro Big Time Since 2009

"The choice of where to hold reserves sends a clear signal of which currencies developing countries regard as the most stable, safe and liquid. Euros now make up only 24 percent of their reserves, the lowest since 2002, and down from a peak of 31 percent as recently as 2009. The dollar has held steady at about 60 percent."

Read the rest, here.

David Stockman Hates Everything About America, Except Cash

Just like, you guessed it, The New York Times!

He hates:

Crony capitalism, Keynesianism, imperialism, stimulus, social insurance, incumbency, the constitution, free elections, lobbying, deficit spending, the Fed's discount window, the FDIC, the Gramm-Leach-Bliley Act, quantitative easing, interest rate repression, and currencies in a race to the bottom.

But honestly, all he really hates are the new stock market highs.

"When the latest bubble pops, there will be nothing to stop the collapse. If this sounds like advice to get out of the markets and hide out in cash, it is."

Wah. Wah. Wah.

Read it all here.

Sunday, March 31, 2013

The US Dollar Has A Long Way To Go, But The Trend Has Been Up

The US dollar is up for a number of reasons:

permanency in the tax code effective January 1, 2013;

elevated spending by the federal government arrested, due to PARTISAN gridlock (hurrah!);

and increased US DOMESTIC oil production from technology advances, despite the most anti-oil president ever to sit in the Oval.

Just think where we would be if we actually had a pro-US president.

Well, for one thing, we'd be WORKING, most likely.

Charlie Maxwell Believes Increased US Oil Production Strengthens The Dollar

Summary transcript of his comments from March 24th, here:

Next was a discussion of how the production from the Baaken formation in North Dakota affected supply and demand in the U.S. It has had a favorable affect in that we now import about 8 million barrels per day and 4-5 years ago we imported about 11 million barrels. We are headed for 5-6 million barrels per day (of imports) within the next 10 years. Two favorable outcomes will be a stronger dollar and a delay of the time when we run short of oil, worldwide.

Why Deposit Confiscation On Cyprus Was Wrong

Liam Halligan, for the UK Telegraph, here:

"Across Cyprus this Easter, hundreds of family-owned businesses are trying to come to terms with what they see as the theft of their working capital. Numerous charities, universities and other educational endowments have also been whacked. As I said, depositors are not investors. There is an absolutely crucial distinction between them, or, at least, in a modern society, there should be. Moving on any depositors, large or small, seriously undermines the financial and legal fabric of capitalism itself."

Friday, March 29, 2013

Libertarian John Fund Bails Out Of The Tax Code's Marriage Bonus

Libertarians do not see the value to the country of providing tax incentives to couples who marry and make sacrifices to raise the next generation, usually in the form of one parent staying home and keeping deeply involved in the lives of their children while the other works for a paycheck. Libertarians have become used to the idea that America is OK with an increasingly maladjusted and malcontented population of fruits, nuts and flakes, perhaps because that's who they are.

Only Phyllis Schlafly, it seems, is old enough and conservative enough to remind people today how hard it was and how long it took to achieve "married filing jointly" in 1948, but when she is gone none will be left to carry the torch. Instead we will be left with the fiddlers like Gov. Rick Perry and the kooks like John Fund who will preside over the crack-up of America.

Here is John Fund, for National Review, just another reason I stopped subscribing long ago:

"The cherished principle of separating church and state should be extended as much as possible into separating marriage and state. ... But instead of fighting over which marriages gain its approval, government would end the business of making distinctions for the purpose of social engineering based on whether someone was married. A flatter tax code would go a long way toward ending marriage penalties or bonuses. We would need a more sensible system of legal immigration so that fewer people would enter the country solely on the basis of spousal rights."

You see, it doesn't just stop with the one thing. Everything conservative must go: America's Protestant inheritance, the primacy of the nuclear family and national identity rooted in law and order. Libertarians, like other ideologues, aren't called the terrible simplifiers for nothing.

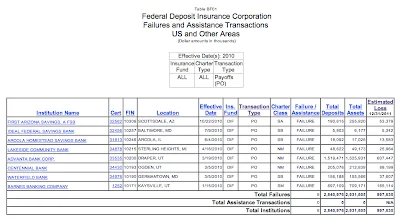

US Bank Failures 2009-2011 See $3.92 Billion In Uninsured Deposits Lost

Click each to enlarge.

Losses from 2012 payoffs remain as yet unconcluded at the FDIC website. These things do take time.

"Payoffs" involve those relatively few institutions for which no one could be found to Purchase and Assume the failed bank. Typically depositors with funds in excess of FDIC limits are still made good in P&As, but not in Payoffs.

By way of contrast, bank failures have cost industry far more directly than customers directly during the late financial crisis. Uninsured depositors may have lost nearly $4 billion, but the Deposit Insurance Fund of the FDIC, paid into by every member bank, has had to shell out $87 billion from 2007. Just think what you'd have been hearing in the US if that sum had been sought from the uninsured depositors, who with $4.7 trillion today certainly have pockets deep enough! America actually treats its depositors, both insured and uninsured, far more fairly than in the EU, which is one important reason why the euro is doomed and net foreign investment in the US is gaining.

Uninsured deposits in little Cyprus are going to get hit to the tune of $6.5 billion to shore up its banks, which in turn are in trouble only because they held the bonds of Greece, on which the infamous Troika -- the European Central Bank, the European Union and the International Monetary Fund -- demanded haircuts in excess of 50% for the bailout of Greece. The Troika is actually directly responsible for causing the problem in Cyprus which the Troika now demands Cyprus depositors pay for. No wonder the European periphery hates the center.

Expect capital flight from Europe to accelerate to the US.

Uninsured US Deposits May Rise In 2013 Due To Expiry Of Crisis Backstop

So reported The New York Times, here, on December 30, 2012.

The uninsured sums are mostly in the large operating non-interest-paying accounts of businesses, municipal governments and non-profits which now enjoy only $250,000 of FDIC coverage like the rest of us.

The article indicates about $1.5 trillion is involved, supposedly 20% of US deposits, providing new protections for which is now the lucrative business of cash management firms which carve up the sum into chunks at various institutions for a fee to take advantage of the FDIC rules. Private wealthy depositors understand this business by analogy with CDARS, the Certificate of Deposit Account Registry Service, where up to $50 million can be safely deposited with full FDIC coverage among fewer than 250 banks and all on one statement.

At the end of 2012, the FDIC reported that just 64.27% of $9.447 trillion in deposits in domestic offices was insured, which must mean that of total US deposits of $10.8 trillion at the time, $4.7 trillion were not insured. Presumably that figure will rise during the year.

Thursday, March 28, 2013

The Millions Who Lost Their Jobs, 2006-2012

What follows are first time claims for unemployment compensation, not-seasonally-adjusted, by year from 2006 through 2012, using Department of Labor figures, here, rounded to the nearest thousand weekly and totaled:

2006 16.2 million

2007 16.7 million

2008 21.6 million

2009 29.5 million

2010 23.7 million

2011 21.7 million

2012 19.4 million.

ObamaCare Abortion Judas, Bart Stupak, Is Actually Thinking Of Running For Gov.

The Democrats in Michigan must really be desperate if they think this guy is a viable candidate. Do Democrats really want their candidate for governor of Michigan to be Bart Stupak, who sold out pro-lifers everywhere to get ObamaCare passed, when the ObamaCare storm hits next year? Or maybe they're just taking drugs again.

"Bart Stupak Democrat Candidate for Governor" would probably be the only thing on God's green earth that would actually get me to contribute some money to the re-election of Gov. Snyder.

Sounds like a Republican plot.

Story here.

Big Whoop: Final Report Of Q4 2012 GDP Comes In At +0.4%

(click the images, as always, to enlarge)

The report from the Bureau of Economic Analysis is here:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.4 percent in the fourth quarter of 2012 (that is, from the third quarter to the fourth quarter), according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1 percent.

The pathetic performance is being hailed as good news. It is, like when the guy with the drill stops boring holes in your head, but only good relative to the first awful estimate.

This final revision is a huge revision up from the first estimate of -0.1% and the second of +0.1%. Suddenly growth in the 4th quarter is 4 times better than it was just a month ago. Yet even at that these are remarkable depths for US GDP to be in when the recession is supposed to be long over since 2009.

Speaking of which, it was said by Ben Bernanke back then, here in July 2009, that growth of 2.5% was necessary to keep the unemployment rate constant. So why is unemployment coming down? Even after today we still have growth roundable to zero in Q4, but the unemployment numbers magically came down anyway, from 8.1% last August to 7.7% in February 2013. If weak GDP is having a long term affect on unemployment, I don't see it. Even today's annual averages in the 1.8% and 2.2% range in the report for the last two years do not support Bernanke's assertion in 2009. Unemployment has come down despite such anemic growth rates. And if anything, we should have seen a gradual uptick in unemployment over the last two years because GDP has been insufficient to keep it constant. I don't think Bernanke really knows what he's talking about, and just makes this stuff up to mollify people at the time as he pursues his only real goal: keeping the banks afloat. Everything else is just for public consumption.

And you can put that in your Easter basket, and crack it.

And you can put that in your Easter basket, and crack it.

Subscribe to:

Comments (Atom)