Left: U.S. Secretary of State Hillary Clinton raises her glass for a toast during a State Dinner in honor of China’s President Hu Jintao at the White House in Washington, January 19, 2011. REUTERS/Jim Young

Sunday, December 30, 2012

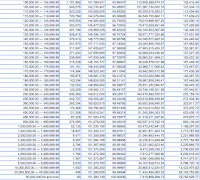

Equality Of Taxation Would Completely Wipe Out The First 41 Million Wage Earners

If we had anything like equality of taxation in this country, it would completely wipe out roughly the first 41 million of 151 million total wage earners. That's how bad federal spending has become.

In 2011 the first 37.4 million individual wage earners had net compensation of up to $10,000. Add in those making up to $15,000 and you get up to 49.6 million wage earners. So the 41 million mark is reached roughly somewhere between the $11,000 and $12,000 per year level of earnings.

For fiscal 2011, federal spending came to $3.6 trillion, and US population came to 313.85 million people.

If we taxed everyone equally as the US Constitution called for originally (you know, "direct taxes shall be apportioned among the several states according to their respective numbers", which is one reason why we must have a census every ten years to begin with), all that federal spending in 2011 divided by all those millions of population comes to . . . wait for it . . . $11,480 per person.

So federal spending in this country is so bad that we'd have to reduce the lowest paid 41 million Americans to what amounts to slavery, to be fair, because they'd owe everything they make to the government. Everything.

"How much government is spending is the true tax", Milton Friedman once said (quoted here). And also the true tyranny.

Compared To Cash Or Stocks, Bonds Were Best In Last 5 Years

Not adjusted for inflation, the average annual return of the S&P500 Index has been about 0.84% over the last five years, October on October, dividends fully reinvested, but you didn't get much sleep.

The average annual return of the Vanguard Prime Money Market Fund has been about 0.76%, November on November, and you slept like a baby.

Stocks vs. cash has been nearly a wash, but the average annual return of the Vanguard Total Bond Market Index has been 5.88%, November on November. The big gains began in earnest late in 2008.

Saturday, December 29, 2012

Perhaps The Most Important Argument Against Consumption Taxes

Perhaps the most important argument against consumption taxes is Murray Rothbard's critique of them here, noting their time-preference prejudice:

"The major argument for replacing an income by a consumption tax is that savings would no longer be taxed. A consumption tax, its advocates assert, would tax consumption and not savings. The fact that this argument is generally advanced by free-market economists, in our day mainly by the supply-siders, strikes one immediately as rather peculiar. For individuals on the free market, after all, each decide their own allocation of income to consumption or to savings. This proportion of consumption to savings, as Austrian economics teaches us, is determined by each individual's rate of time preference, the degree by which he prefers present to future goods. For each person is continually allocating his income between consumption now, as against saving to invest in goods that will bring an income in the future. And each person decides the allocation on the basis of his time preference. To say, therefore, that only consumption should be taxed and not savings is to challenge the voluntary preferences and choices of individuals on the free market, and to say that they are saving far too little and consuming too much, and therefore that taxes on savings should be removed and all the burdens placed on present as compared to future consumption. But to do that is to challenge free-market expressions of time preference, and to advocate government coercion to forcibly alter the expression of those preferences, so as to coerce a higher saving-to-consumption ratio than desired by free individuals."

Rothbard goes on to ascribe this prejudice to "Calvinism", which may be entertaining to the libertarian who is interested in wine, women and song now and has a devil may care attitude about present frugality as a defense against want later. But this assumes there is no moral difference between savings and consumption, which there certainly is when the penniless old man turns up on your doorstep, hat in hand. The libertarian has his own time preference prejudice, were he to admit it, which life teaches us has serious consequences, more often than not.

Be that as it may, it is important to recognize that standard measurements of economic activity in the United States have for some time shown, in something like the following formulation, that "70% of GDP consists in consumer spending", and were it not for schemes like Social Security and Medicare there would be far more ringing of the bell going on at the front. This is quite a remarkable fact in a supposedly Calvinist civilization, a fact which argues for the moral superiority of savings over consumption because despite our better natures we in reality live otherwise. This suggests that we still ought to do everything we can to encourage the former and punish the latter, for the simple reason which the observation of human nature teaches. We are mixtures of good and evil, but unfortunately too often it turns out to be a bad mixture.

The ancient Greeks, among other things, notably taught us "nothing too much", by which we may infer that the preponderance of present spendthrifts demonstrates individual and social excess which ought to be remedied by tax policy encouraging the increase of savers. To right the ship would mean achieving a better balance between the two, and to Rothbard's main point, which is that under a consumption tax savings would inevitably be taxed in the long run anyway just as consumption is in the present because that is what savings becomes, we therefore ought to have no compunction about taxing savings in the end. That is what the death tax accomplishes, the final message to an excess of savings.

In the present context this recommends taxation of consumption in some form to encourage marginally less of it, better mechanisms of rewarding savings of which we have too little, and a death tax which approximates the same level as a consumption tax would operate at. This means that draconian schemes of estate confiscation by the government at death are in principle unjust because as consumption taxes we would never think of imposing similar levies on the living.

Unless, of course, we subscribe to The New Republic.

The Middle Third Of Net Compensation In 2011

The middle third of net compensation in 2011 went to 28 million earners who represent just 19% of all earners. They made $1.95 trillion of the $6.24 trillion of total net compensation in 2011.

In this group earning the middle tranche of all compensation you make between $50,000 and $100,000 a year as an individual.

The Bottom Third Of Net Compensation In 2011

The bottom third of net compensation in 2011 went to 112 million earners who comprise the first 74% of all earners. Altogether they earned $2.2 trillion of the $6.24 trillion of total net compensation for the year.

You remain in this group until you earn somewhere between $45,000 and $50,000 a year, after which you may be said to join those earning the middle third of net compensation.

The Top Third Of Net Compensation In 2011 Went To 10.7 Million Earners, The Top 7%, Making $100,000/yr Or More

As shown here.

The top 7% of earners, 10.7 million workers, made $2.07 trillion of the $6.24 trillion total of net 2011 compensation.

You entered this group once you made $100,000/yr.

Friday, December 28, 2012

Obama Raises Federal Pay $11 Billion Over 10 Years On Eve Of Fiscal Cliff

Now you know why Obama cut his vacation short . . . to raise spending! And rub our noses in it!

This guy is the biggest jerk ever to sit in the Oval Office, maybe excepting Lyndon Baines Johnson who reportedly pissed on the shoes of a soldier who dutifully stood at attention.

If ever anyone needed evidence that El Presidente couldn't care less about the consequences of federal spending for the fiscal situation, this is it. He's "in your face" about it, on the very eve of the biggest tax increase on the American people in living memory, and Republicans still take this guy seriously.

As reported here:

CBO [The Congressional Budget Office] says the (discretionary) cost of the .5% pay-hike the President is calling for in the Exec Order – relative to a freeze – is about $500m in FY 2013 and $11 billion over the ten years from FY 13 - FY 22. The reason why the FY ’13 savings is only $500 million is because the pay hike as proposed by the President’s Exec Order would not go into effect until April 1st, 2013 - when the current CR [Continuing Resolution] expires. So it only covers half the fiscal year. The annualized cost of the pay hike is about $1 billion/year."

If Republicans had any imagination, they'd shut the damn government down . . . for the next two years, and teach Obama what it's like to run something. Teh.

That would save about $2 trillion of the taxpayers' money as government makes do with current revenues. The sound of the squealing pigs would be worth it.

Consumer Prices Up 8.4% Under Four Years Of Obama

The Consumer Price Index is up 8.4% under four years of Obama (November 2008 to November 2012).

Similarly measured, the CPI rose 10.05% in the first term of George W. Bush, 11.15% in the second term.

The worst record in the post-war period was Carter's four years when CPI rose over 47%. In Eisenhower's first term CPI rose just 3.07%.

Measured from April 1973 (after the world went to a floating exchange rate system of currencies in the wake of the end of the gold standard in August 1971) to April 1999, 26 years, CPI raged 280% (a factor of 10.8 per year).

From April 1947 to April 1973 (CPI data not available before 1947), CPI rose a comparatively more modest 99% over 26 years (a factor of 3.8 per year).

For the 13 years since 1999, April to April, CPI has risen just 38% (a factor of 2.9 per year).

A composite of measures for the consumer bundle going back to the year 1900 at measuringworth.com here provides an interesting tool for comparison purposes.

While the dollar suffered a 446% decline for the 73 years between 1900 and 1973, a factor of 6.1 per year, in the 38 years between 1973 and 2011 the 406% decline is a factor of 10.7 per year, 75% worse per year since moving to a floating exchange rate currency system.

Viewed more broadly from the point of view of gold, from 1932 (the year of FDR's election and before his massive 69% devaluation of the gold-linked dollar in the spring of 1933) to the present day, the devaluation of the dollar has been in excess of 1500%.

From 1790 to 1932 the dollar declined just 54%.

At this hour, gold is $1,656.80 the ounce, $1,636.13 the ounce higher than it was in 1932, the last year of its fixed price at $20.67 the ounce, just another way of expressing the devaluation of the dollar.

Similarly measured, the CPI rose 10.05% in the first term of George W. Bush, 11.15% in the second term.

The worst record in the post-war period was Carter's four years when CPI rose over 47%. In Eisenhower's first term CPI rose just 3.07%.

Measured from April 1973 (after the world went to a floating exchange rate system of currencies in the wake of the end of the gold standard in August 1971) to April 1999, 26 years, CPI raged 280% (a factor of 10.8 per year).

From April 1947 to April 1973 (CPI data not available before 1947), CPI rose a comparatively more modest 99% over 26 years (a factor of 3.8 per year).

For the 13 years since 1999, April to April, CPI has risen just 38% (a factor of 2.9 per year).

A composite of measures for the consumer bundle going back to the year 1900 at measuringworth.com here provides an interesting tool for comparison purposes.

While the dollar suffered a 446% decline for the 73 years between 1900 and 1973, a factor of 6.1 per year, in the 38 years between 1973 and 2011 the 406% decline is a factor of 10.7 per year, 75% worse per year since moving to a floating exchange rate currency system.

Viewed more broadly from the point of view of gold, from 1932 (the year of FDR's election and before his massive 69% devaluation of the gold-linked dollar in the spring of 1933) to the present day, the devaluation of the dollar has been in excess of 1500%.

From 1790 to 1932 the dollar declined just 54%.

At this hour, gold is $1,656.80 the ounce, $1,636.13 the ounce higher than it was in 1932, the last year of its fixed price at $20.67 the ounce, just another way of expressing the devaluation of the dollar.

Thursday, December 27, 2012

Democrats Funded Libertarian In MT Senate Race As They Did In AZ For Rep. Giffords

The m/o in AZ in 2010 was Democrats spending money to portray a libertarian as the true conservative in order to bleed-off votes from the Republican candidate and Iraq War veteran Jesse Kelly and thus re-elect the Democrat, Rep. Gabby Giffords, who went on to get shot by a lunatic with libertarian ideas named Jared Loughner. To add insult to injury, liberals nationwide then went on to blame her shooting on Republicans and the Tea Party.

I reported on this in early January 2011, here, showing a mailer for the libertarian paid for by the Arizona Democrat Party.

Now it turns out the same strategy was used in Montana in 2012 to boost the libertarian candidate as the real conservative, funded by liberal money, in order to bleed-off votes from the Republican Rehberg and re-elect the Democrat Senator Tester.

Propublica has the in-depth story, here.

Everyone thinks the Republicans are the stupid party when in two recent elections it's the libertarians who got played for fools and tools. But the Republicans really are the stupid ones for thinking an alliance with libertarians isn't just possible but natural when far more often than not libertarians view themselves as successful when they prevent Republicans from getting elected, as they themselves say here (h/t Chris).

We know whose side they are on. Libertarians are natural liberals, not conservatives.

The Full-Time Jobs Depression: 6.2 Million, 5.1%, Off 2007 High

Full-time jobs hit their all-time high in November 2007 at 121.9 million. Five years later they are at 115.7 million. That's down 6.2 million full-time jobs, or 5.1%.

And US population has grown 13 million over the five year period.

And US population has grown 13 million over the five year period.

Figures through 11-01-12.

Chart and data here.

Wednesday, December 26, 2012

Just Under 47% (!) Of Households Own Stocks

As reported here:

The percentage of households owning stock mutual funds has also fallen, dropping every year since 2008 to 46.4 percent in 2011, the second-lowest since 1997, according to the latest ICI [Investment Company Institute] annual mutual fund survey.

Hm.

The percentage of households owning stock mutual funds has also fallen, dropping every year since 2008 to 46.4 percent in 2011, the second-lowest since 1997, according to the latest ICI [Investment Company Institute] annual mutual fund survey.

Hm.

Investors "All In" 10/1/07 To 10/1/12 Are Down 1.19% Per Year

Investors who have remained "all in" the Standard and Poor's 500 Index for the last five years from October 2007 to October 2012 are still down 1.19% per year in real terms, with dividends fully reinvested.

If you've been taking your dividends, say as a retiree, you are down 3.35% per year.

This is pretty grim news when you consider that one school of thought for a conservative retirement drawdown from a portfolio is $40,000 a year, a 4% rate on a $1 million.

If you have been "all in" the SP500 with that sum, which you probably shouldn't be but let's say you are, it is throwing off just about $21,000 in dividend income right now (a little over 2%), so you've got to make up the difference from capital which over the last five years is already posting a 3.35% loss per year. So on top of that 3.35% loss you are taking another 2% per year from the seed corn to make up the difference, meaning your drawdown rate has been really more like 5.35% per annum.

This means that over the last five years such a $1 million retirement portfolio has been plundered by market vicissitudes and the retiree's human necessity by about $268,000. Nothing lasts forever, especially at that rate.

Chart and data here.

Monday, December 24, 2012

What If Most Of What You Buy Made In China Is Made By Slave Labor?

"If you occasionally buy this product, please kindly resend this letter to the World Human Right Organization. Thousands people here who are under the persicution of the Chinese Communist Party Government will thank and remember you forever."

"People who work here have to work 15 hours a day without Saturday, Sunday break and any holidays. Otherwise, they will suffer torturement, beat and rude remark. Nearly no payment (10 yuan/1 month [$1.61])."

"People who work here, suffer punishment 1-3 years averagely, but without Court Sentence (unlaw punishment). Many of them are Falun Gong practitioners, who are totally innocent people only because they have different believe to CCPG. They often suffer more punishment than others."

-- From a letter written by someone from Unit 8, Dept. 2, Masanjia Labor Camp, Shenyang, China, found by an American in a Halloween toy.

Story here.

Subscribe to:

Comments (Atom)