Conservatives have become wrong-headed about the tax code.

Steven Malanga provides an exasperating take on "tax reform", here, which was really a liberal Democrat conceit from the beginning but became a so-called conservative one under Ronald Reagan, who was, need we remind everyone, a "former" Democrat:

Most conservatives (though certainly not most Republicans) have come to see the range of incentives and exemptions in the tax code as wrongheaded, including those for businesses which smack of little more than corporate cronyism. This is in sharp contrast to 1986, when many Republicans in Congress resisted reform until a popular GOP president came along willing to take on the business community.

Sacre bleu. The liberal Democrats are nothing if they are not great simplifiers, and if conservatives join them in that enthusiasm, it doesn't mean they are right. Little ideologues all, regardless of party.

Prior to the income tax, a president had to be a pretty smart cookie to figure out all the ins and outs of the tariff system if he wanted his federal government to have enough revenue to continue operations. By 1909, however, the whole country seemed to have wound down so far intellectually that it was just too tired to carry on any longer with that rigorous enterprise and bowed instead to the simplicity of an income tax. Tax reformers today, take note. It doesn't speak well of you that you admit the code is too much for you.

Actually real conservatism opposed the income tax way back when not because it would grow too complex but because it was wrong. When amending the constitution is necessary in order to make something legal, conservatives' first instinct is always to question the advisability of the idea before they conclude there is a defect in the constitution requiring a remedy. The income tax was one such idea. It took four years to gain ratification in the states. As an invention of progressivism the income tax eventually worked a revolution in government by allowing government to grow to gargantuan size with a ready pool of available cash, stolen by force from the population's income. And it is no coincidence that the first major expenditure financed by the income tax was US entry into The Great War. Not long after which came The Great Depression. If progressive ideas were good ones, no one seems to have paid much heed to the early evidence to the contrary.

Every effort by the people since the introduction of the income tax to obtain deductions, exemptions, credits and other incentives in the tax code should be understood by conservatives as wholesome reactionary, counter-revolutionary, rear-guard opposition to what the income tax represents, but today you can hardly find a conservative who will even entertain the idea of overthrowing the income tax, let alone any other of the so-called "achievements" of the progressive era. In fact, some so-called conservatives have become veritable cheerleaders for the income tax. Rush Limbaugh, for one, can't seem even to imagine an America without one for the first 137 years of its existence. An originalist in name only is he.

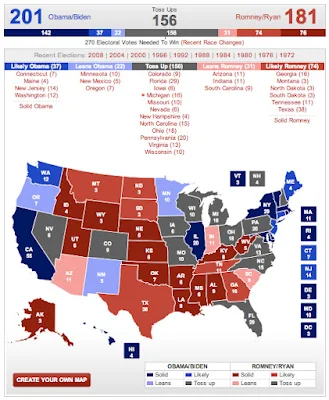

The problem with so-called Reagan conservatism, then and now, is that it makes peace with the tax code, just as it does with the social welfare state, including Social Security and especially Medicare. Mitt Romney and Paul Ryan actually campaign on just such a platform of preserving Medicare for future generations. As Reagan compromised in the direction of liberalism in the 1986 tax reform, so will they.

These people wouldn't know conservatism if it ran up and bit them in the ass.

Tax reform is a fool's errand. You can't "reform" something which is fundamentally wrong in the first place.