Monday, November 1, 2010

Enshrining Bailouts Into Law: Both Parties Terrified of Upsetting High Finance Status Quo

A reminder from Nicole Gelinas from July why the Dodd-Frank legislation was a failure:

For 25 years, Washington has done everything in its power to subsidize Americans' profligate borrowing habits. Debt became the fuel for economic growth. Washington subsidized the financial industry's borrowing through implicit guarantees against loss.

The feds first started rescuing creditors to "too big to fail" banks in 1984. Since then, it's become clear to lenders -- Wall Street's global bondholders and trading counterparties -- that the government would save them anytime a large financial firm foundered.

Indemnified against losses, bondholders could lend nearly infinitely to Wall Street. Wall Street found creative ways to lend that money right back to the public, through mortgage brokers and credit card marketers.

Some exceptions exist. In September 2008, the feds refused to rescue Lehman Brothers' lenders. But the exceptions have only proven the rule. Today, conventional Washington wisdom is that letting Lehman fail was a catastrophe.

The Dodd-Frank bill is a monument to the status quo. Despite promises that the bill will end bailouts, it enshrines bailouts into law.

Read the whole thing here.

Foreclosure and Securitization Fraud: Conjuring Collateral Documents From Thin Air

Yves Smith of Naked Capitalism writing for the New York Times zeroes in on the fraud which lies at the heart of the mortgage securitization and foreclosure crisis:

Consider a company called Lender Processing Services, which acts as a middleman for mortgage servicers and says it oversees more than half the foreclosures in the United States. To assist foreclosure law firms in its network, a subsidiary of the company offered a menu of services it provided for a fee.

The list showed prices for “creating” — that is, conjuring from thin air — various documents that the trust owning the loan should already have on hand. The firm even offered to create a “collateral file,” which contained all the documents needed to establish ownership of a particular real estate loan. Equipped with a collateral file, you could likely persuade a court that you were entitled to foreclose on a house even if you had never owned the loan.

That there was even a market for such fabricated documents among the law firms involved in foreclosures shows just how hard it is going to be to fix the problems caused by the lapses of the mortgage boom. No one would resort to such dubious behavior if there were an easier remedy.

Read the rest of her excellently presented discussion here.

Friday, October 29, 2010

GDP Q3 2010 at 2%

The Bureau of Economic Analysis has the numbers here. They're sticking with 1.7% for Q2, for now.

Thursday, October 28, 2010

Yves Smith of Naked Capitalism: Obama's Lies On Jon Stewart Epitomize His Failure

Wednesday, October 27, 2010

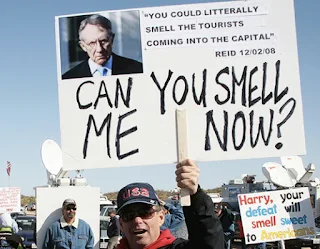

Katie Couric Wants a Whiff?

Divine this mood Tinkerbell:

Couric has spent recent weeks in Chicago, Philadelphia, Boston and New Brunswick, New Jersey. She is touring what she calls “this great unwashed middle of the country” in an effort to divine the mood of the midterms.

Quoted here.

Yea, we can't spell "literally" and "capitol" either, but "NO!" is really easy.

2010 Consumer Contraction Worse Than 2008

Read the data for yourself here at Pragmatic Capitalism, but don't miss the second half of the entry which discusses the genesis and meaning of "the new frugality" and the devastating consequences of the Fed's war on the average American through ZIRP (zero interest rate policy):

On Wall Street and inside the Beltway there are no perceived victims of low interest rates, because low rates result in obscene spreads between the real cost of institutional borrowing (essentially zero) and the real rate of consumer lending (18% to 24% on real-world short term loans). Meanwhile every barrier possible has been raised to prevent those lower rates from propagating to those most in need of longer term relief.

Down with debt! Down with the Fed!

Tuesday, October 26, 2010

Major Banks Appeal Federal Reserve Disclosure Ruling to Supreme Court

But the Federal Reserve did not join in the appeal, apparently in order to enhance the standing of the banks in the case.

At stake are the details of $2 trillion in Federal Reserve assistance to financial institutions beginning in late 2007 and running through the crisis of 2008, details which the Fed does not want to reveal to protect the institutions which received the dough.

Nevermind it's your money.

Down with the Fed!

Reuters.com has the story here.

Labels:

discount window,

Federal Reserve,

FOIA,

Reuters,

Supreme Court 2010

Monday, October 25, 2010

US Treasury Still Stonewalling FOIA Request on Citigroup Guarantees

Twenty months and counting, including a non-response response on what securities $300 billion of taxpayer monies guarantee. It's our money! We have a right to know!

And tomorrow it will be the Federal Reserve's turn to continue the stonewalling on a separate FOIA request involving $2 trillion in taxpayer guarantees for financial institutions from two years ago, and we still don't know even though the courts have ordered the Federal Reserve to comply with the requests. When they finally do, how much do you want to bet it will be a similar non-response response?

No wonder the people want the Federal Reserve abolished, and the Treasury to burn down.

Bloomberg, which supports the FOIA requests, has the full story here.

National Debt Up $5 Trillion Under Pelosi, $3.1 Trillion Under Hastert

The woman said in January 2007 that under Democrats there wouldn't be any more deficit spending but pay as you go instead. Yea right.

Under Hastert the deficit increased so much not because of war spending, but because of social spending, particularly on Drugs for Seniors, the largest expansion of government since the 1960s at the time.

You can't trust either party as far as you can throw them.

The story was reported here.

Labels:

CNS News,

Dennis Hastert,

Nancy Pelosi,

Spending 2010,

The National Debt

Sunday, October 24, 2010

A Libertarian Defends Local Bankers

An analyst of the banks and an increasingly visible commentator on the foreclosure mess, R. Christopher Whalen puts in a good word for local bankers on his blog at Reuters.com:

The bad guys in the housing bust are not the banks who must foreclose on homes, but the politicians in both political parties who used reckless housing policies to further their personal interests. This is a bipartisan national scandal. Barney Frank, Chris Dodd, Phil Graham, Alan Greenspan and their contemporaries are the authors of our collective misery, not the local banker who must clean up the mess created by government intervention in the housing market.

Read the rest here.

Friday, October 22, 2010

Corporate Cash Really Isn't

Mish has an interesting post which contrasts "corporate cash" with corporate debt. The upshot is the cash is concentrated in just four big financials (Goldman Sachs, JP Morgan Chase, Citigroup and Bank of America), and overall in about 50 companies. But corporates with cash are also in debt up to their eyeballs, so much so that the debt outweighs the cash by a TARP-size bailout amount:

As you can see, the total cash (in green) for the top 50 companies is $3.71 trillion, which sure sounds like a hell of a lot of cash, and it would be were it not for the debt (in red) totaling $4.45 trillion.

Read it all and see the graphic here.

Labels:

Bank of America,

Citigroup,

Corporate Cash,

Goldman Sachs,

JP Morgan,

Mish,

TARP

Promises! Promises!: Hurt US Congress

Story here.

Hurt is running against Tom “If you don't tie our hands, we will keep stealing” Perriello in VA-5.

Hurt is running against Tom “If you don't tie our hands, we will keep stealing” Perriello in VA-5.

Thursday, October 21, 2010

Obama Doesn't Know His (Foreclosure) Constituency

John Judis for The New Republic almost says he knew FDR and that FDR was a friend of his, but he does say that Obama is no FDR:

The left will support Obama and Democrats. It’s the working-class voters who reluctantly backed Obama in 2008, but have been turned off by the impression that the administration cares more about the banks than about them. ... [FDR] knew who his constituency was: His was the party of the common man. The Obama administration, meanwhile, worries about the people who listen to "Charlie Rose." And they and the Democrats are going to pay a steep price for their inattention to common concerns this November.

Read the full commentary here.

Read the full commentary here.

Labels:

Barack Obama 2010,

class,

Housing 2010,

John Judis,

The New Republic

Wednesday, October 20, 2010

Some Banksters May Yet Go To Jail for Fraud

According to a story today from CNBC.com:

In a number of cases in the past year — sources put it between five and ten — auditors have found enough evidence of fraud by bankers that they referred the cases to criminal investigators within the Treasury Inspector General’s office for a more detailed analysis.

The rest is here.

On the Lesson of the Log Cabin Republicans

"If you let in a bunch of pricks, eventually you'll get screwed."

-- Imam John

Subscribe to:

Comments (Atom)