Pure gobbledygook.

The limit, a facet of American politics for over a century, prevents the Treasury from issuing new bonds to fund government activities once a certain debt level is reached. That level reached $22 trillion in August 2019 and was suspended until Saturday.

The new debt limit will include Washington’s additional borrowing since summer 2019. The Congressional Budget Office estimated in July that the new cap will likely come in just north of $28.5 trillion.

More gobbledygook.

The government's bookkeeping shenanigans here are always amazing, but especially now given the orgy of spending during the pandemic, and the reporting is nearly as bad.

The debt ceiling was "set" at $22 trillion in August 2019, but it wasn't "reached" until April 2021.

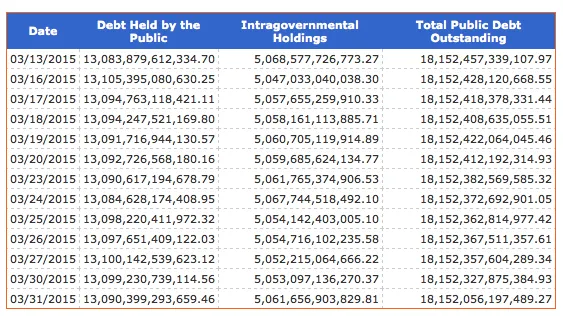

Add in the ever present "intragovernmental" borrowings and the total debt is now $28.46 trillion at the end of July. Intragovernmental holdings is code for raiding the Medicare and Social Security Trust Funds. It's one of the weird things about how bureaucrats think that the extent to which they must raid those funds plus the "normal" public debt becomes the sum they'll use to set the new "public" portion, the debt ceiling, when Congress gets around to it.

They all should be in jail. Instead we are.