If you generally tax some income at one rate and other income at a lower one, what do you think would happen over a long period of time?

Obviously you would see income shift to the category taxed at the lower rate, to the extent that this is possible for those earning it.

This is what has happened with income from capital gains, the tax rate on which has been much lower by law than the tax rates paid on ordinary income.

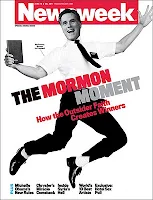

That's the long-term lesson from the data, the salience of which seems to elude Bruce Bartlett writing for

The New York Times:

For most people, income is simple: it means wages or perhaps a pension or Social Security benefits. Income from capital – dividends, interest, rent and capital gains – seldom enters into the calculation. The vast bulk of such income is earned by the ultrawealthy, like Mr. Romney.

According to the Tax Policy Center, in 2011 those in the middle of income distribution got about 70 percent of their income from labor and only about 3 percent from capital. By contrast, those in the top 1 percent of income distribution got 30 percent of their income from labor and 35 percent from capital.

The disparity is even more pronounced when one looks at the distribution of aggregate capital income. The total came to $1.1 trillion last year. Of this, 86 percent was earned by those in the top 20 percent of households, ranked by income. But this figure is misleading, because within the top quintile, the vast bulk of capital income went only to those at the very top. ...

[T]he tax code makes a sharp distinction between income from labor and income from capital. Wages are fully taxed at rates as high as 35 percent by the income tax, plus taxes for Social Security and Medicare. In contrast, realized capital gains and dividends on corporate stock are taxed at a maximum rate of 15 percent and do not bear any taxes for Social Security or Medicare.

Income inequality in America has grown precisely for this reason, and it is an artifact of progressivism, and of liberalism generally.

The contemporary distinction between capital gains and ordinary gains got much of its impetus under FDR, when the modern tax code differentiated for the first time between capital gains held for 1, 2, 5 and 10 years, exempting from taxation 20 percent of gains, 40 percent, 60 percent and 70 percent, for the respective holding periods. Considering how steep and confiscatory marginal tax rates became after 1916, the provisions under FDR look like a bone thrown to the rich. What these reforms did, however, was cement the trend toward tax avoidance for the rich which had been introduced earlier.

Originally capital gains had been taxed as ordinary income up to a rate of 7 percent, which was the top marginal income tax rate for the first three years of the modern income tax. But as marginal tax rates on ordinary income skyrocketed after 1916, the low 7 percent capital gains rate continued to apply until 1921, after which the rate was 12.5 percent, regardless of holding period and despite the fact that marginal income tax rates soared to 63 percent and higher as the years marched on.

So from the very beginning the rich were given their privileges in tax avoidance by making distinctions between income while the broad mass of the people got soaked with income taxes on their ordinary income. The steeply progressive rates made it appear that the rich were paying their fair share when in effect they had recourse to a back door to ameliorate their condition through the capital gains code provisions. Liberalism was nothing if not hypocritical.

If our tax policy goal today is to reduce income inequality, as seems to be the prevailing notion among liberal and liberal-leaning commentators, we ought to reconsider that history and appreciate better how tax policy is often just pushing on a string. To a conservative what leaps to mind is making taxes on ordinary income look more like taxes on capital gains income by flattening rates, not the other way around, raising capital gains rates to look more like progressive income tax rates, and broadening the base up the scale by capturing all income of all kinds for Social Security and Medicare before considering broadening the base down the scale by abolishing tax loss expenditures like the mortgage interest deduction.

Income inequality begins with treating some forms of income differently than others for tax purposes. There may be important social and economic reasons for doing so, such as promoting family formation or capital investment, but it should never be forgotten that you will immediately be introducing inequality into the equation when you do. How you compensate for that is what matters in approximating a just society.