All figures are raw, not-seasonally-adjusted.

The 15.9 million figure is now the lowest in the 21st century, beating the heretofore best level achieved under Bush, which was 16.2 million (but when the participation rate of the labor force was much higher than it is today, 66.4% in November 2006 vs. 62.8% in November 2014). Previously I had expected claims to total 15.7 million in 2014, but first time claims for unemployment ramped up a little higher in December than they had been averaging through November.

Here's the historical record:

2001 20.9 million

2002 20.9 million

2003 20.8 million

2004 17.7 million

2005 17.7 million

2006 16.2 million

2007 16.7 million

2008 21.6 million

2009 29.5 million

2010 23.7 million

2011 21.7 million

2012 19.4 million

2013 17.8 million

2014 15.9 million.

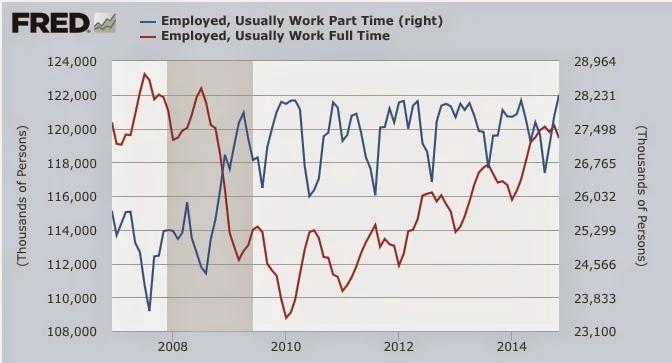

Conditions remain very favorable for making continued progress on a recovery of full-time jobs, which are still 3.8 million off their 2007 peak, over seven years ago.