This week provided a reminder that inflation isn’t going away anytime soon :

The bad news began Monday when a New York Federal Reserve survey showed the consumer expectations over the longer term had accelerated in February. It continued Tuesday with news that consumer prices rose 3.2% from a year ago, and then culminated Thursday with a release indicating that pipeline pressures at the wholesale level also are heating up. ...

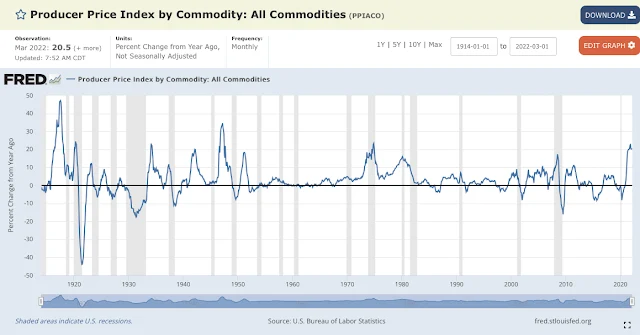

The latest jolt on inflation came Thursday when the Labor Department reported that the producer price index, a forward-looking measure of pipeline inflation at the wholesale level, showed a 0.6% increase in February. That was double the Dow Jones estimate and pushed the 12-month level up 1.6%, the biggest move since September 2023.