The passing scene is hilarious, until it careens through the front yard and crashes into my living room.

Wednesday, September 13, 2023

The inflation adjusted average price of white potatoes in the United States

In March 1986, potatoes were $0.21/pound.

Adjusted for inflation to August 2023, they should be $0.59/pound, according to the inflation calculator at bls.gov.

They are actually $1.09, 85% higher.

Tuesday, September 12, 2023

Wednesday, September 6, 2023

Chris Christie credits Fed interest rate policy for denting government-spending-induced inflation but misses the role of collapsing energy prices

Chris Christie is a smart guy with many of the right ideas about government spending, taxes, inflation, energy, and the environment.

But it's a real stretch to think that the timid interest rate increases of the Fed are responsible for this year's so-far moderating inflation indicators when it's falling energy prices since the winter which deserve the real credit. Christie himself admits that outrageous government spending hasn't been curbed at all.

His is a simple binary view which, while conventional and correct as far as it goes, doesn't get to the heart of the current matter.

Low energy prices have always been and remain key to a successful economy, and it was the spike in natural gas cost inputs because of the Russia-Ukraine war which accelerated inflation globally, not just in the US.

Fed chair Jerome Powell was correct in June of 2021 to believe that inflation would be transitory for "weak supply" reasons, but the Fed rate increases didn't actually commence until the start of the war in Ukraine, which compounded those reasons with the cutoff of European natural gas supplies.

But since the winter the natural gas price is down 73% from peak, coal is down 70%, and gasoline is down too, but a comparatively modest 24%.

Americans consumed in 2022 the energy equivalent of 26.9 billion kWh/day of natural gas, 13 billion kWh/day of gasoline, and 7.9 billion kWh/day of coal.

Natural gas is twice as important as gasoline in the overall American energy picture, primarily for heating, and as a substitute for coal in electricity generation.

Natural gas produced 4.6 billion kWh/day of electricity in 2022, the top source of electricity, vs. coal at 2.3 billion kWh/day and nuclear at 2.1 billion kWh/day.

Chris Christie is right though. We must "uncap" US oil and gas production and be energy independent.

Europe's natural gas storage, by the way, is presently 93% full as the war in Ukraine drags on. They are ready.

The US used 88.5 billion cubic feet of natural gas per day in 2022. We presently have about 35 days in storage.

Crude oil consumption in 2022 was about 20.3 million barrels per day. The Strategic Petroleum Reserve is down to about 17 days of supply, from about 35 in 2011.

Watch CNBC’s full interview with GOP Presidential Candidate Chris Christie

Christie lets Fed off the hook for inflation, blames Trump and Biden for overspending

Thursday, August 31, 2023

Friday, August 18, 2023

The money men have the best Fed and the best Fed chair that money can buy

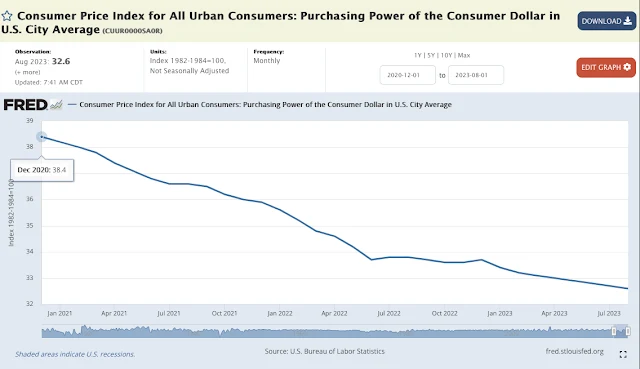

The 10-year US Treasury note has averaged BELOW average inflation for three consecutive years, and is set to make it four.

This is unprecedented, and shows that the authorities have not been serious about fighting inflation. Inflation is actually what they want when the country is $32 trillion in debt, aka a devaluation of the liability.

Notice that they actually tried this for a couple of years in the mid-1970s, after which all hell broke loose with the highest inflation on record and the people revolted. We got Ronald Reagan as a result.

Inflation is the same thing in the world of money as immigration is in the world of labor. Inflation devalues what you owe, and immigration devalues what you make.

You are just collateral damage.

Powell, a Republican, was elevated to the Fed by Obama, appointed to the Fed chair by Trump, and reappointed by Biden.

The Uniparty.

Thursday, August 10, 2023

Friday, July 28, 2023

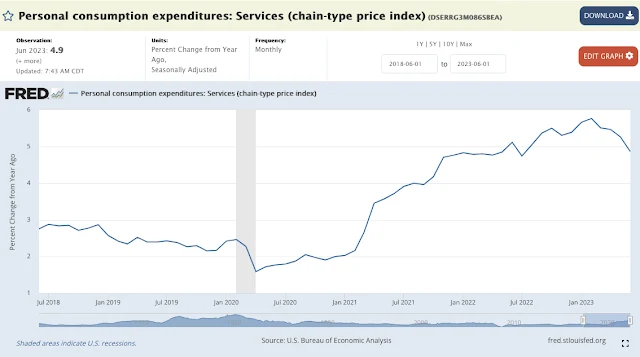

Headline pce inflation of 3% year over year is driven lower by the collapse in energy prices, mostly natural gas not gasoline

Natural gas is twice as important as gasoline for America's energy needs.

eia.gov says the United States used 369 million gallons of gasoline per day in 2022. That's the equivalent of 13 billion kWhr/day last year.

America also consumed 88.52 billion cubic feet of natural gas per day in 2022. That's the equivalent of 26.88 billion kWhr/day last year, 2.06 times as much.

Gasoline is down 14.6% in 1H2023, natural gas 60.5%.

Wednesday, July 12, 2023

Friday, June 30, 2023

Sunday, June 18, 2023

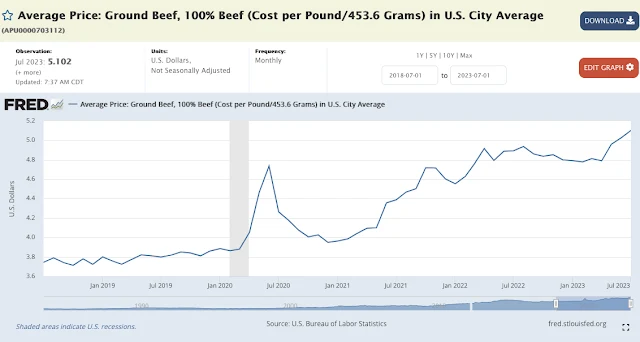

On the Sunday grill: My May 1984 33-cent hamburger should cost 96-cents in May 2023, instead it costs $1.24

It's nearly 30% overpriced.

The inflation-adjusted pound of ground beef over the period should cost $3.82.

I buy the good stuff, however. My burger costs $1.50, washed down with a cheap pint of Hamm's Beer for 83-cents.

I'll be back to beans and rice on Monday.

A man's gotta do what a man's gotta do.

Thursday, June 15, 2023

The Fed left the Funds Rate unchanged yesterday, and no members of the Federal Reserve Board currently anticipate a rate lower than at present through the end of the year

They anticipate higher, but not by much, which means more rate hikes this year.

The yield curve aggregate yesterday closed just 4 basis points lower than the current cycle high of 4.674% achieved on March 8th, at 4.671%. That's the sum of the basis points for all US Treasury securities marketed yesterday divided by 13 (ranging from 1-month securities to 30-year).

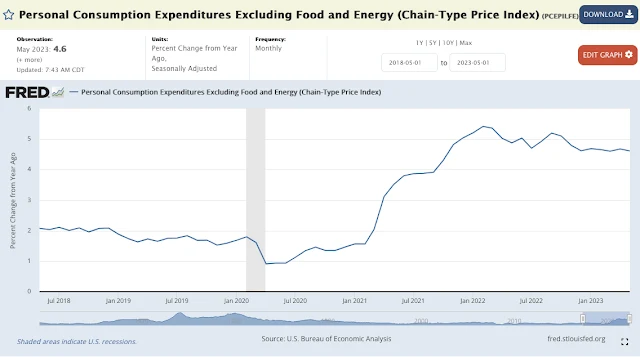

To say the Fed's response to inflation has been timid would be an understatement.

In the 1980s the Fed's response to core inflation such as we experience today at 5.3% year over year was a Fed Funds Rate in excess of 10%. We're at 5.08%. The yield curve is not steppin' and fetchin' when the big dog won't bark.

This is not a serious country, and is perversely more than willing to inflict the worst tax on all, namely inflation, mostly because the whole damn economy is predicated on 2% inflation, which halves your nestegg in 35 years.

At 5% it does that in just fourteen.

It's criminal.

Tuesday, June 13, 2023

Permanently higher prices for the basics looks to be the future

The simple egg is now 25% more expensive at Sam's Club compared with pre-Covid. I used to pay routinely $3.98 for two dozen like those shown below. Prices nationally have fallen only to the unusually high levels of 2015.

Whole chicken is up 23%, electricity 18%, and both appear to be stable or rising.

Avian flu is now only sporadic.

Monday, June 12, 2023

My local utility has repriced my fixed monthly payment for natural gas and electricity for the next year

The new price is down 30% from last year's horrendous price.

The monthly payment will now resemble the high end of normal I experienced in the years prior to the Russia-Ukraine War.

Like a boot off my neck.