Tuesday, January 14, 2014

Monday, January 13, 2014

Estimating Retirements Added To Those "Not In Labor Force" 2009-2013

It is often forgotten that retired people are classified as not in the labor force. The measure of those "Not in labor force" has grown to a staggering all time high of 92.338 million, not-seasonally-adjusted, as of December 2013.

Between 2009 and 2013 alone, the figure has grown by 11.05 million, and people like Rush Limbaugh thump loudly about all these people "not working" because of the bad economy.

The question is, though, how many of these are retirements?

I say it's theoretically possible that all of them are.

Those turning 66 years of age each year from 2009-2013 were born between 1943 and 1947.

And here are births from 1943 to 1947:

3.1 million 1943

2.9 million 1944

2.9 million 1945

3.4 million 1946

3.8 million 1947.

How many of these survived to age 66?

The CDC publishes annually the life tables, the latest of which came out a few days ago for the year 2009. A person aged 63 in 2009 (born in 1946) was among the 86% who survived to 63, according to the tables. In the 2008 tables from a year ago, that same person at age 62 was among the 87% who survived to 62. In the 2007 tables at 61 he was among the 88% who survived to 61. Extrapolating forward to 2012, we will estimate that at 66 he was among the 83% who survived.

So for persons born earlier than 1946 we can estimate their survival rate as follows:

Born in 1943, retiring at 66 in 2009: 80% survive, or 2.48 million

Born in 1944, retiring at 66 in 2010: 81% survive, or 2.35 million

Born in 1945, retiring at 66 in 2011: 82% survive, or 2.38 million

Born in 1946, retiring at 66 in 2012: 83% survive, or 2.82 million

Born in 1947, retiring at 66 in 2013: 84% survive, or 3.19 million.

Total theoretically possible retirees: 13.22 million, 2.17 million more than actually left the labor force.

Obviously, not everyone retires at 66. Some keep working. And especially these days some keep working because they have to. The employment level of the 55 and over set has grown by 4.5 million over the period 2009-2013.

It appears to be the case, however, that an even larger number are deferring both Social Security benefits and work because they can afford to: Social Security reports that retired workers and their dependents receiving benefits grew only 5.6 million from the end of 2008 to the end of 2013.

Of the 11.05 million added to "not in labor force", I'd estimate at least 5.4 million are well off enough to forgo both work and Social Security until they reach age 70, and perhaps more than that if Social Security recipients who continue to work according to the rules are counted instead as part of the labor force.

Sunday, January 12, 2014

Saturday, January 11, 2014

Why HealthCare.gov still isn't fixed: Obama regime quietly dumps CGI Federal on Friday, to hire Accenture which built California exchange

WaPo reports here:

The Obama administration has decided to jettison from HealthCare.gov the IT contractor, CGI Federal, that has been mainly responsible for building the defect-ridden online health insurance marketplace and has been immersed in the work of repairing it.

Federal health officials are preparing to sign early next week a 12-month contract worth roughly $90 million with a different company, Accenture, after concluding that CGI has not been effective enough in fixing the intricate computer system underpinning the federal Web site, according to a person familiar with the decision who spoke on the condition of anonymity in order to discuss private negotiations.

... it is not yet able to automatically enroll people eligible for Medicaid in states’ programs, compute exact amounts to be sent to insurers for their customers’ federal subsidies or tabulate precisely how many consumers have paid their insurance premiums and are therefore covered.

... As federal officials and contractors have been trying to fix various aspects of the Web site in the past few months, about half the new software code the company has written failed when it was first used, according to internal federal information.

"Bad" job reports for two years have been great for higher corporate earnings

Barry Ritholtz, here:

It has taken quite a long time for many investors to understand that reduced labor costs, greater productivity and ever-increasing efficiency has led to higher earnings. The basic assumptions about “good” or “bad” job reports may not be accurate relative to what equities do over time.

-------------------------------------------------------

That's correct. The latest employment situation report indicates that there hasn't been much change up or down in jobs for two years running even as the stock market made over fifty new all-time highs in 2013.

Additions to non-farm payrolls have been averaging 182,000 and 183,000 a month in 2013 and 2012. Same old same old.

To the unemployed: The L-shaped "recovery" continues . . . without you.

To the unemployed: The L-shaped "recovery" continues . . . without you.

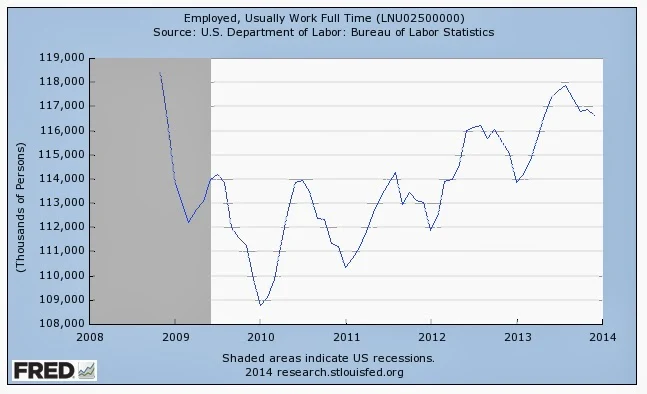

Those usually working part-time have not increased in number since passage of ObamaCare in 2010

|

| November 2008 through December 2013 |

And that's because the government measure of part-time doesn't care if you work 29 hours, 30 hours or 34 hours per week . . . all are equally part-time schedules to the Bureau of Labor Statistics.

The increasingly less deep lows in the summers since 2010 are consistent with the long term trend of increasing part-time work as population grows. Significant new highs above 28 million, however, remain non-existent.

Crony Capitalism Is A Feature, Not A Bug, Of Contemporary Liberalism

Jeffrey Snider, here:

Employment grows not on the pace of redistribution-derived consumer spending in the lower classes, but as new firms innovate and grow to replace older firms that have seen their last days. Failure and rebirth are the capitalist "secrets", and demand always follows supply in that line. Interrupt it at your peril.

Unfortunately, we see in the 21st century a different strain of imperialism that is rooted in Hobson's preferred solutions to it. By giving government more power over industry and business, Hobson suggested that government would be able to end business agitation toward external colonialism. But in doing so, governments have introduced the seeds of cronyism that take the form of internal imperialism. Big businesses have achieved regulatory leverage in a manner that may preclude the innovation and business cycles from creating that positive economic trajectory. And monetary policy, all in the name of aggregate demand, appears to be playing a large role.

... OWS [Occupy Wall Street] and its sympathizers ... are really protesting their own philosophies put into practice via a bastardized capitalism - so corrupted by devotion to aggregate demand in this era that it can hardly be referred to as such.

There will never be, and has never been, any such thing as fully free markets, nor should there be. What we are arguing is not absolutes but proportions. ... In perhaps the greatest and most tragic of ironies here, the Fed appeals directly to inflation as a means to destroy savings, an impulse to which I have to think Hobson would readily approve, but that inflation is itself a means of redistribution that further concentrates savings among the wealthy. More than an irony, it seems as if this inconsistency is a feature of this philosophy, as taken to its logical ends it produces something akin to circular reasoning. It is a place where the socialists of OWS criticize directly the tools of socialist monetary policy as if they are anything apart from each other.

New study finds psychotic episodes occur at an earlier age among marijuana users

Yahoo reports here:

Among more than 400 people in South London admitted to hospitals with a diagnosed psychotic episode, the study team found the heaviest smokers of high-potency cannabis averaged about six years younger than patients who had not been smoking pot. ... The researchers found that males were more likely overall to use cannabis and also had a younger age of onset of psychosis. The mean age at the time of the first psychotic episode for male users of cannabis was 26, and for female users was nearly 29. That compared with nearly 30 years old for male non-users and 32 for female non-users.

Friday, January 10, 2014

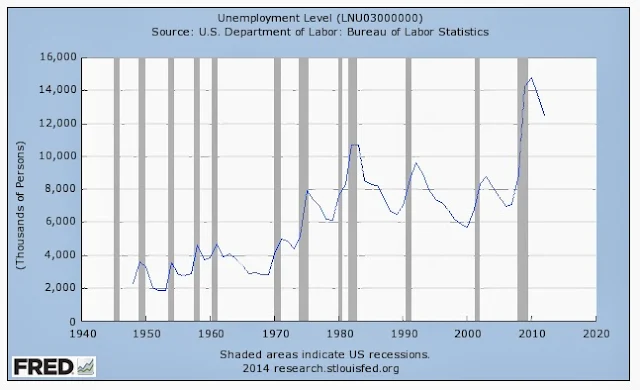

December 2013 Unemployment Falls To 6.7%, Total Nonfarm Jobs Up Only 74,000

The employment situation report for December 2013 is here.

The headline rate falls to 6.7% ending 5 years of unemployment at or above 7%, with massive numbers of people continuing to leave the labor force.

In the last year the number counted as unemployed fell 1.9 million, while nonfarm employment grew at a rate of 182,000 per month in 2013 vs. 183,000 per month in 2012, or 2.18 million. Roughly a wash.

Total nonfarm employment continues below the 2007/2008 peak of 138.1 million, still lagging that level by 1.2 million fully 6 years later (seasonally adjusted) despite growth in the population since that time of at least 14.3 million.

The headline unemployment rate has fallen from 7.9% at the beginning of 2013 to 6.7% at the end largely because those not in the labor force increased by 2.89 million in the last year (not-seasonally-adjusted). The not-seasonally-adjusted level reached a new high at 92.338 million. People who leave the labor force are not counted as unemployed.

In the 8 years from 2001 through 2008 under Bush those not in the labor force increased by 10.3 million, or 14.7%. That record has already been matched under just 5 years of Obama: 11.3 million have left the labor force, or 14.0% (numbers seasonally adjusted).

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

Thursday, January 9, 2014

Wednesday, January 8, 2014

Rush Limbaugh Today Totally Botches Income Quintiles On The Program

|

| "You keep using that word. I do not think it means what you think it means." |

The relevant passage is here:

Poverty is expressed as an income level. Most economists break down income in America to five brackets, called quintiles, and people move in and out of these. The top quintile, I think, is like a million plus, and that'd be the top 1% of 1%. I forgot what the breakdown is, but the poverty level, it's roughly, what, $14,000 for a family of four? It's around there. People move in and out of these all the time.

------------------------------------------------------------------------

This is rich.

A quintile in this instance is one of any of the five groups of American households divided into those five groups based on how much money they make.

By definition, then, the top quintile is the richest 20% of households in America. So it's impossible for the top quintile to be "the top 1%", let alone "the top 1% of 1%".

As embarrassing as that is, Rush has absolutely no concept what it means to reach the top 20% of household income in this country.

The fact is it doesn't take all that much, and certainly nothing close to $1 million, hard as it may be to get there.

Currently the point in the middle of the top 20% of households by income is only about $181,905 per annum. That means about half the people in the top quintile make more than that, and about half make less. And interestingly enough, the middle of the richest 5% of households in this country isn't anywhere close to $1 million, either. The average household income of the top 5% is just $318,052. (For a good presentation of the data, see here.)

And Rush is equally out of touch about what it means to be poor. The federal definition for a family of four is about $23,500, not $14,000. The latter is about what it means for just one person to be poor, not four (see here).

Rush Limbaugh complains constantly about the sorry state of public education in this country. He even did so today in the same segment:

[L]ook at [President] Johnson's solutions. Education, job training, medical care, housing. That hasn't changed. The same weapons, the same language, the same way they tug at heartstrings. It's 1964, and they keep using the same lingo, obviously because it works. But look at how our education system's been since 1964 with them in charge.

Yep. Look at how it's been.

Rush is Exhibit A . . . the most popular radio host ever for a reason.

Tuesday, January 7, 2014

Monday, January 6, 2014

"Ben Bernanke Has An Almost Unbroken Record Of Being Wrong"

Bye Bye Ben.

Seen here:

Ben Bernanke has an almost unbroken record of being wrong.

In 2006, at the zenith of the housing bubble, he told Congress that house prices would continue to rise. In 2007, he testified that failing subprime mortgages would not threaten the economy.

In January 2008, at a luncheon, he told his audience there was no recession on the horizon. As late as July 2008, he insisted that mortgage giants Fannie Mae and Freddie Mac, already teetering on the verge of collapse, were “ adequately capitalized [and] in no danger of failing.”

Following the Crash of 2008, Bernanke’s prognostications did not much improve. Nor did Yellen’s, who had also misjudged the housing bubble, and who became Fed vice chairman in 2010.

The two of them got the “recovery” they predicted, but the weakest “recovery” in history.

Labels:

Ben Bernanke,

crony,

Fannie Mae,

Freddie Mac,

homeownership,

Janet Yellen,

mortgages

Peter Wallison Says The Housing Bubble Is Back

Here in The New York Times, where he blames sub-prime down payments, not interest rates:

Between 1997 and 2002, the average compound rate of growth in housing prices was 6 percent, exceeding the average compound growth rate in rentals of 3.34 percent. This, incidentally, contradicts the widely held idea that the last housing bubble was caused by the Federal Reserve’s monetary policy. Between 1997 and 2000, the Fed raised interest rates, and they stayed relatively high until almost 2002 with no apparent effect on the bubble, which continued to maintain an average compound growth rate of 6 percent until 2007, when it collapsed. ... Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent.

Many commentators will attribute this phenomenon to the Fed’s low interest rates. Maybe so; maybe not. Recall that the Fed’s monetary policy was blamed for the earlier bubble’s growth between 1997 and 2002, even though the Fed raised interest rates during most of that period.

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down. ...

When down payments were 10 to 20 percent before 1992, the homeownership rate was a steady 64 percent — slightly below where it is today — and the housing market was not frothy. People simply bought less expensive homes.

Obama Has Completed 160 Golf Outings In The Last 5 Years: The Practice Hasn't Helped

White House Dossier here reports that the president golfed 9 out of the 15 days while on his Hawaiian vacation, which means Moochelle was pretty much a golf widow during the time.

She did not return to DC with her family. The cost to the taxpayers of this early "birthday gift" of an extended stay may come to as much as $200,000 or more according to a separate entry here.

The Washington Times noted here the family's vacation was already "regal", and featured a video in which the president misses a long put on a green and then takes what he clearly deems a "gimme" but misses it, and picks it up off the green, not out of the cup. I'll bet his scorecard is minus the stroke . . . a lie like everything else about these people.

Sunday, January 5, 2014

Saturday, January 4, 2014

Vanguard's Worst Performing Bond Funds In 2013

Long Term Treasury Fund, VUSTX: -13.03%

Long Term Government Index Fund, VLGSX: -12.74%

Long Term Bond Index Fund, VBLTX: - 9.13%

Inflation Protected Securities Fund, VIPSX: - 8.92%

Long Term Corporate Bond Index Fund, VLTCX: - 6.86%

Long Term Investment Grade Fund, VWESX: - 5.87%

And as badly as they have performed, I don't see a net asset value for any fund which represents a bargain: they all still look too expensive to me.

Friday, January 3, 2014

Antarctic Global Warming Scientists Rescued, But Rescue Ship Also Gets Stuck In Ice: Story Never Mentions It's Summer In Antarctica

|

| Chinese Snow Dragon stuck in ice after rescue |

Why would they go there at this time if they didn't think they could get to Antarctica?

The story is here.

Evidently the rescue ship is Chinese, but the scientists were transported from their stuck vessel to an Australian vessel which subsequently has been dismissed from the area despite the troubles of their rescuers' vessel, also now stuck.

Reminds me of the tow truck which came to retrieve a neighbor's dead vehicle the other day. The tow truck itself got stuck, and had to be towed by another tow truck. Needless to say the neighbor's vehicle didn't get towed until yet another tow truck came yesterday.

And that's how icy it is, from Antarctica to Michigan.

Current Fair Value Of The S&P500 Is . . . 1005

Doug Short updates his regression analysis for the S&P500, adjusted for inflation, to come up with the S&P500 today about 80% above the long term trend going back to 1871:

"If the current S&P 500 were sitting squarely on the regression, it would be around the 1005 level. If the index should decline over the next few years to a level comparable to previous major bottoms, it would fall to the 450-500 range."

Charts and discussion here.

Government Just Made Two Things You Liked Obsolete: Your Health Insurance And The Lightbulb

Tim Carney, here, says the government ban on the traditional lightbulb is a case of crony capitalism in which industry persuaded government to help it increase energy efficiencies profits by eliminating the bulbs which consumers preferred in order to give them bulbs they didn't want but which cost a lot more, boosting profits they couldn't otherwise make.

You know, just like ObamaCare gives you coverages you neither want nor need and makes your insurance much more expensive than it used to be, and forces everyone to buy it. Insurance companies are happy to get all the new customers, and all the extra profits.

Big business is the enemy of Americans, and of capitalism. Unfortunately, so is the government.

Labels:

crony,

health insurance,

lightbulb,

Obamacare,

Tim Carney,

Uncle Fester,

Washington Examiner

Thursday, January 2, 2014

Jobless Claims Average 435,000 Per Week In Last Month, 17.75 Million Total In 2013

The report for the last week of 2013 is here.

At the current average per week in the last month sustained over a whole year the result would yield 22.6 million first time claims. That doesn't square with the claim that the economy is now in full trot as one headline puts it this morning.

17.75 million actual first time claims for unemployment in 2013, not-seasonally-adjusted, represents the best showing yet under Obama, but still far above George W. Bush's best years in the 16 million range when participation rates were much higher.

With nearly 12 million people having left the labor force since Obama was elected in 2008, far too many of those still working in a much smaller labor pool continue to lose their jobs every week. The levels today only seem less alarming because we remember them from when labor force participation rates were much higher. Now that they are not and levels are still high shows that labor is still flat on its back in this country.

If this is the best Obama can do, it's going to be a very long three more years.

Wednesday, January 1, 2014

Obama's America: Nearly 12 Million Have Given Up And Left The Labor Force Since His Election

In April 2011 over 1 million people, desperate for work, applied for just 50,000 burger-flipping jobs at McDonalds, which ended up hiring 62,000, 24% more than planned.

Where are the other 938,000 today?

The story is still here, thanks to former Mayor Bloomberg.

Those 938,000 most likely ended up joining another 10 million-plus who have left the labor force altogether.

President Obama meanwhile enjoys day 12 today vacationing in Hawaii snorkeling and golfing, according to news reports, after all his hard work fundamentally transforming the country.

Tuesday, December 31, 2013

John Crudele Of NY Post Still Not Really Sure What The Fed Has Been Trying To Do

Here in "Bernanke's rate ploy robs from middle class" John Crudele of The New York Post still can't seem to put two and two together even after all this time:

1:

Bernanke, who is leaving his job next month, controls something called the Fed Funds Rate. That’s the rate at which banks can lend each other money for a very short term, generally overnight. That rate is set by the Fed and has been stuck at a puny 0.25 percent for the last few years as the Fed tries to — well, I’m not really sure what the Fed has been trying to do. ...

2:

One of the few rates he has been able to keep low is the yields on things like money-market and savings accounts. The banks love him, since the less they pay out to depositors, the more money they earn.

--------------------------------------------------------------------

What do I gotta do, John, spell it out for ya?

The Fed has been trying to . . . rescue the banks. They don't keep the rate next to zero for this long if they didn't need to.

The middle class has been punished in the process, but lower interest rates presumably have allowed some in the middle class to refinance expensive loans at lower rates while their retirement investments have reflated. That's the rationalization, if not the reality experienced by most.

The banking crisis is over when ZIRP is over.

Middle Class In Flames: All The Fed Has Done Is Help The Banks

|

| Naked Capitalism supports Occupy Wall Street. Heh, heh. Does Jeep know? |

Yves Smith of Naked Capitalism, here:

Oh, puhleeze. Robust recovery for who? The Fed not only threw staggering amounts of firepower at salvaging bank balance sheets, while showing no interest in rescuing ordinary Americans. It was also all-in on the Administration’s program to paper over the banks’ chain of title problems and their widespread servicing abuses, and didn’t bother to obtain any meaningful concessions or reforms, the most important of which would have been principal modifications, a remedy favored by investors as well as homeowners. The Fed has been all too happy to accept mission creep rather than speak up forcefully for the need for more fiscal stimulus.

-------------------------------------------------------------------------------

The analysis is right, but the prescriptions are left: raising the minimum wage, breaking mortgage contracts, and spending money we do not have. Oh, puhleeze. It's Naked Liberalism.

But she's great on Obama's Mussolini-style corporatism, most recently here in response to The New Republic:

I’m actually a bit miffed that Konczal treats the “corporatism” appellation as the sole property of the right wing (in the style sheet of the Vichy Left, calling them “hysterics” is redundant but necessary for the rubes), since I have a prior claim. And what is particularly rich is that Konczal apparently regards the allusion to Mussolini to be unfair . . ..

Obamacare IS corporatist. Here we have the industries that are significant contributors to why the American medical system is so overpriced – the health insurers and Big Pharma – actually playing a major role in writing the legislation. And how is it not a sop to large companies to have the government require that citizens buy your product or else pay large tax penalties? Mr. Market certainly thought so, for the price of health insurer and drug company stocks jumped the day the ACA passed. And remember, the beneficiaries of Obamacare extend beyond the insurers and pharmaceutical makers. Hospitals, who increasingly engage in oligopoly pricing (most surgeries need to be done in hospitals), also come out even stronger because new requirements imposed on doctors’ practices will make it difficult for a retiring MD who practices medicine, as opposed to servicing the rich (e.g., cosmetic surgeons) to sell their business to anyone other than a hospital.

And the label fits in the banking arena like a glove. I’ve ... called both the Bush, but far more often the Obama bank-friendly policies “Mussolini-style corporatism” since 2008, and well before what [Mike] Konczal [of The New Republic] claims is the origin of this description, Tim Carney’s book Obamanomics, published November 30, 2009.

Monday, December 30, 2013

North Dakota Railroad Involved In Accident Causing Oil Inferno Is Wholly Owned By Warren Buffett

The New York Post has the story here, but never mentions Warren Buffett, who has become richer off transportation of oil by rail because his pal Barack Obama did him a favor by stopping the XL pipeline in exchange for his support for higher taxes on the rich:

The derailment happened amid increased concerns about the United States’ increased reliance on rail to carry crude oil. Fears of catastrophic derailments were particularly stoked after last summer’s crash in Canada of a train carrying crude oil from North Dakota’s Bakken oil patch. Forty-seven people died in the ensuing fire. The tracks that the train was on Monday pass through the middle of Casselton, and Morris said it was “a blessing it didn’t happen within the city.” The train had more than 100 cars, and about 80 of them were moved away from the site.

According to Wikipedia, here, and BNSF's own website:

The BNSF Railway is the second-largest freight railroad network in North America, second to the Union Pacific Railroad (its primary competitor for Western U.S. freight), and is one of seven North American Class I railroads. It has three transcontinental routes that provide high-speed links between the western and eastern United States. BNSF trains traveled over 169 million miles in 2010, more than any other North American railroad. ... Headquartered in Fort Worth, Texas, the railroad is a wholly owned subsidiary of Berkshire Hathaway Inc.

Global Warmists Stuck In 5 Meters of Sea Ice In Antarctic SUMMER Now Require RESCUE

|

| Warming scientists stopped by 5m of SUMMER Antarctic ice |

Story here, which never mentions it's the Antarctic SUMMER, and you have to read the picture caption to know how DEEP the ice is:

They went in search evidence of the world’s melting ice caps, but instead a team of climate scientists have been forced to abandon their mission … because the Antarctic ice is thicker than usual at this time of year. The scientists have been stuck aboard the stricken MV Akademik Schokalskiy since Christmas Day, with repeated sea rescue attempts being abandoned as icebreaking ships failed to reach them. Now that effort has been ditched, with experts admitting the ice is just too thick. Instead the crew have built an icy helipad, with plans afoot to rescue the 74-strong team by helicopter.

-----------------------------------------------------------------------------

Yeah, "thicker than usual this time of year": five meters of ice. Do you think these warmists went there expecting to be stopped in their tracks by that?

When tabloid journalists start telling the truth . . . what? Hell will freeze over?

Sunday, December 29, 2013

Aging Lesbian Camille Paglia Still Longs For A Man

Reported here:

Politically correct, inadequate education, along with the decline of America's brawny industrial base, leaves many men with "no models of manhood," she says. "Masculinity is just becoming something that is imitated from the movies. There's nothing left. There's no room for anything manly right now." The only place you can hear what men really feel these days, she claims, is on sports radio. No surprise, she is an avid listener. The energy and enthusiasm "inspires me as a writer," she says, adding: "If we had to go to war," the callers "are the men that would save the nation."

Saturday, December 28, 2013

One Week Later, Michigan Ice Storm Still Had 30,000 Without Power Saturday Morning, But Only 8,100 By Evening

Story here:

In Michigan, roughly 30,000 Consumers customers remained without power, down from 399,000 since a weekend ice storm swept across the state. The worst-hit area continued to be around Lansing, where 3,000 customers were still in the dark Saturday morning.

But this evening, the number is down to 8,100 as reported here:

As of 4:30 p.m. Saturday, Dec. 28, 8,100 customers statewide remained without service. The majority of those people are expected to be restored by midnight Sunday, the utility says.

Mortgaged States Their Grandsires' Wreaths Regret

Where wasted nations raise a single name,

And mortgaged states their grandsires' wreaths regret,

From age to age in everlasting debt;

From age to age in everlasting debt;

Wreaths which at last the dear-bought right convey

To rust on medals, or on stones decay."

To rust on medals, or on stones decay."

-- Samuel Johnson, The Vanity of Human Wishes (1749)

Total Credit Market Debt Owed Has Grown Just 16% In 6 Years, The Smallest Increase On Record

Between July 2007 and July 2013, total credit market debt owed (TCMDO) has grown just 16%, by barely $8 trillion. It's the smallest increase on record for any six year period going back to when the data series begins in October 1949.

Going back six years from 2013 is instructive because the summer of 2007 was when the level of TCMDO last doubled (going back to the summer of 1999), and if you go back to the beginning of the data series you find doubling times of as few as 6 years in length to as many as almost 12. In other words, in a period of rapid credit expansion TCMDO might have conceivably doubled in our last six year period, but it hasn't. We sure could have used it. Instead it has for all intents and purposes collapsed, growing just $8 trillion from $50.032 trillion in 2007 to $58.082 trillion now.

From humble beginnings in 1949 when TCMDO stood at $400 billion, the level went on to double in the summers of 1961, 1970, 1977, 1983, 1989, 1999 and 2007. In order to double again (to a level of $102 trillion) by, say, 2019 (12 years from 2007), we're going to have to pick up the pace just a little . . .. Unless, of course, this debt-based economy has reached the limits of what it can do, which may be what the last six years is trying to tell us.

Here's the data for TCMDO for the six year periods going back to July 1953:

7/1/13 $58.1 trillion (up 16%)

7/1/07 $50.0 trillion (up 74%)

7/1/01 $28.8 trillion (up 58%)

7/1/95 $18.3 trillion (up 45%)

7/1/89 $12.6 trillion (up 102%)

7/1/83 $06.3 trillion (up 97%)

7/1/77 $03.2 trillion (up 87%)

7/1/71 $01.7 trillion (up 57%)

7/1/65 $01.1 trillion (up 49%)

7/1/59 $00.7 trillion (up 42%)

7/1/53 $00.5 trillion.

As Ambrose Evans-Pritchard formulated it in 2011, "debt draws forward prosperity". In other words, we've already enjoyed the prosperity years ago which should be present today by literally pulling it back there from here, and now that we're here, well, there's nothing here, except for a measly 0.97% real average GDP report for the six years 2007-2012.

Time to pay.

Friday, December 27, 2013

About 61,000 In Michigan Still Without Power Two Days After Christmas

|

| Blotches indicate some of the 61,000 still w/o power today in MI |

Story here:

Michigan utilities reported that over 61,000 customers remained without power Friday morning and said it could be Saturday before all electricity is restored.

Wednesday, December 25, 2013

Over 200,000 Still Without Power In Michigan On Christmas Day After Ice Storm

|

| Consumers Energy outage map showing some of Michigan's 200,000 without electricity on Christmas Day |

According to The Detroit News, here:

Roughly 214,000 homes and businesses across lower Michigan were without power late Tuesday. Officials at the area’s major provider, Consumers Energy, described the storm that hit the region over the weekend as the largest Christmas-week storm in its 126-year history. Overall, it’s the largest storm in the last decade, they added.

Labels:

Christmas,

Consumers Energy,

Detroit News,

electricity,

power outage

Subscribe to:

Posts (Atom)