Rich Lowry in The New York Post, here:

Having done the deed, Democrats now expect Republicans to salute smartly, accept “the law of the land” and suggest minor improvements that Democrats will, in their wisdom, decide whether or not to adopt. In other words, they recommend the acquiescence of surrender. If this were a consistent principle rather than opportunistic advice, Democrats would have been content to leave “don’t ask, don’t tell” in place and never would have agitated to repeal the Bush tax cuts, out of deference to duly constituted policy and law. ...

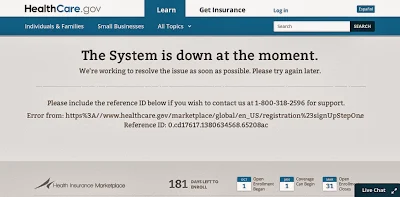

[T]he law suffers from basic design flaws beyond the question of whether the Obama administration can get its software to work. It depends on young, healthy people buying insurance even as it reduces their incentive to do so; it encourages employers to dump workers off their current insurance; it suppresses full-time work, through the employer mandate; in 10 years, the law still leaves 30 million people uninsured.