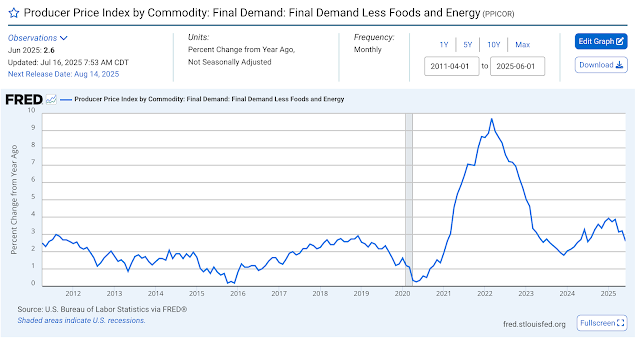

Here are the current June 2025 yoy figures for core producer price increases Dec-Jun, followed by the figures reported the previous month, followed by the figures as originally reported:

December 2024: 3.74%, 3.74%, 3.5%

January 2025: 3.92, 3.92, 3.6

February 2025: 3.73, 3.74, 3.4

March 2025: 3.86, 3.91, 3.3

April 2025: 3.13, 3.18, 3.1

May 2025: 3.20, 3.02 (revised up as predicted)

June 2025: 2.60.

The optimism of the original figures has been removed by the revisions to Dec-Mar available only but lately.

December and January revisions alone still hold fast today, but not thereafter.

As always it is important not to press the monthly results too strongly, but the May revised uptick is consistent with a down-up, down-up, down-up pattern which is obviously trending down.

Viewed on a semiannual basis, however, we are Wei Tu Hai, and trending Wong Wei Charlie.