"I would go a hundred percent equities if I thought that we had reached a point when equity values made sense."

"People always say stocks are cheap, stocks are cheap. They're trading 10 times forward PE, 12 times PE. The problem is, I don't know the E[arnings]."

"What if the U.S. had a balanced budget? What would GDP be? Then what would earnings be? The U.S. cannot in perpetuity run a $1.3 trillion annual deficit. I don't believe in any of the earnings numbers."

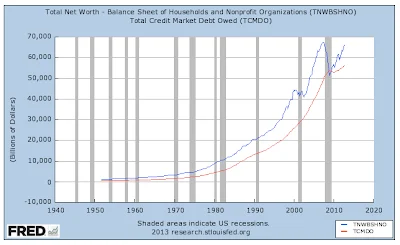

"You basically have 30 years of accumulated debt that funds consumption and that has to unwind. And as it unwinds, it's going to have implications on economic activity and it's impossible that it won't ultimately find its way back to U.S. companies."

"You basically have 30 years of accumulated debt that funds consumption and that has to unwind. And as it unwinds, it's going to have implications on economic activity and it's impossible that it won't ultimately find its way back to U.S. companies."

--Andre Kovensky, Managing Director of bond and real estate investment firm, Octavia Investment, quoted

here.

Stocks presently are relatively expensive when measured by the Shiller p/e, which this morning stands at 21.21, almost 34 percent elevated from the median level of 15.84 going back to 1881. Investors might want to consider that the Shiller median level itself incorporates earnings from past decades when increased borrowing by both business and government might make the metric somewhat artificially elevated anyway.

The assertion that debt "has to unwind", however, is evidenced in the post-war period by the corporate data set only in the early 1990s when aggregate quarterly debt dropped briefly by 2 percent, and in the decline just concluded when it dropped briefly by 3.5 percent or just $256 billion.

Total corporate assets, by way of contrast, have reached an all time high of nearly $30 trillion.

One wag notes that Kovensky is just talking his book.

Bonds remain at nose-bleed prices, as do all assets.