Sunday, January 19, 2014

Obama Exports 2.5 Times More Gasoline Per Day Than Bush, But Consumers Now Pay 1.5 Times More

Over the span of eight years of George Bush finished gasoline exports from the US averaged just 135,000 barrels per day. But over the first four years of Obama the average soared to nearly 345,000 per day, 2.5 times more.

Under Bush gasoline's average annual price for all formulations was just $2.13/gallon, but under Obama it has soared to $3.16/gallon for the five years 2009 through 2013, 1.5 times higher on average.

So who's the bigger friend of Big Oil, George Bush or Barack Obama?

Saturday, January 18, 2014

Tom Coburn Is Mistaken: He Thinks Changing The Actors In Washington Will Change It

This is the conceit shared by many Republicans, and by many of their supporters in the country, but it is mistaken.

We have the government we deserve, and it sucks because we do, and it will keep on sucking until we stop sucking as much as we do.

And what do you think are the chances of that changing?

And what do you think are the chances of that changing?

Video here.

Both Shiller p/e and Tobin's q warn stocks are seriously overvalued

As reported by Brett Arends, here:

Smithers found that over the past century the Shiller PE had an R-squared to subsequent returns of 0.52, the “Pseudo-Indicator” one of 0.61, and the q an astounding 0.79.

So if the past is any guide, if you want to get a good estimate of the future returns from today’s stock market you should completely ignore the low yields on cash, certificates of deposit, or bonds. You should pay more attention to the Shiller PE, and you should pay the most attention to the Tobin’s q.

And what do these tell you? “As at the 31st December, 2013,” says Smithers, the “q indicated that U.S. non-financial equities were overvalued by 73% and CAPE indicated an overvaluation of 76% for equities, including financials.”

Friday, January 17, 2014

The First Bank Failure Of 2014 Is DuPage National Bank, West Chicago, Illinois

The first bank failure of 2014 is DuPage National Bank, West Chicago, Illinois, costing the FDIC $1.6 million.

Bill Binney, 32-Year Veteran And Critic Of NSA, Says America Is Now A Police State

Too bad he had to say that here, where they believe 9/11 was an inside job:

The main use of the collection from these [NSA spying] programs [is] for law enforcement. ... [N]one of the NSA data is referred to in courts – cause it has been acquired without a warrant. [Law enforcement agencies] have to do a “Parallel Construction” and not tell the courts or prosecution or defense the original data used to arrest people. This I call: a “planned program[m]ed perjury policy” directed by US law enforcement. ... [T]his also applies to “Foreign Counterparts.” This is a total corruption of the justice system not only in our country but around the world. ... This is a totalitarian process – means we are now in a police state.

Michigan Ranks Third Worst For Employment But Gov. Rick Snyder Wants More Immigrants

Here's our insane governor last night:

"We need to encourage immigration in our state," said Snyder, who has backed national reform efforts. "That's how we made our country great. We need to focus on legal immigration to make sure Michigan is the most welcoming place."

--------------------------------------------------------------------------

Too bad Michigan isn't a more welcoming place for the unemployed who already live here.

Thursday, January 16, 2014

White Hat Hacker Says Security On Healthcare.gov Is Worse Now Than In November

David Kennedy, quoted here by NBC News:

“The reason we’re concluding that this is so shockingly bad is that the issues across the site are so varied. You don’t even have to hack into the system to see big issues – which means there are [major problems] underneath. Nothing’s really changed since our November 19 testimony. In fact, it’s worse. Some issues still include critical or high-risk findings to personal information."

Corelogic Foreclosure Rate In November 2013 Still 119% Above Normal Pre-Crisis Rate

As reported here on January 9th:

There were 46,000 completed foreclosures in the United States in November 2013, down from 64,000 in November 2012, a year-over-year decrease of 29 percent. On a month-over-month basis, completed foreclosures decreased 8.3 percent, from 50,000 in October 2013. ... Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. As a basis of comparison to the 46,000 completed foreclosures reported for November 2013, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006 before the decline in the housing market in 2007. Since the financial crisis began in September 2008, there have been approximately 4.7 million completed foreclosures across the country.

5.6 Million American Homes Repossessed 2006-2013

As reported here:

Including the 2013 numbers, over the past eight years 10.9 million U.S. properties have started the foreclosure process and 5.6 million have been repossessed by lenders through foreclosure.

Tuesday, January 14, 2014

Is It A Coincidence John Roberts' Law Clerk Is A Utopian Progressive?

Birds of a feather flock together.

Joshua D. Hawley, here, clearly a friend of "The Battle Hymn of the Republic":

Joshua D. Hawley, here, clearly a friend of "The Battle Hymn of the Republic":

Christians’ purpose in politics should be to advance the kingdom of God—to make it more real, more tangible, more present. Or should I say, to immanentize the eschaton.

Monday, January 13, 2014

Estimating Retirements Added To Those "Not In Labor Force" 2009-2013

It is often forgotten that retired people are classified as not in the labor force. The measure of those "Not in labor force" has grown to a staggering all time high of 92.338 million, not-seasonally-adjusted, as of December 2013.

Between 2009 and 2013 alone, the figure has grown by 11.05 million, and people like Rush Limbaugh thump loudly about all these people "not working" because of the bad economy.

The question is, though, how many of these are retirements?

I say it's theoretically possible that all of them are.

Those turning 66 years of age each year from 2009-2013 were born between 1943 and 1947.

And here are births from 1943 to 1947:

3.1 million 1943

2.9 million 1944

2.9 million 1945

3.4 million 1946

3.8 million 1947.

How many of these survived to age 66?

The CDC publishes annually the life tables, the latest of which came out a few days ago for the year 2009. A person aged 63 in 2009 (born in 1946) was among the 86% who survived to 63, according to the tables. In the 2008 tables from a year ago, that same person at age 62 was among the 87% who survived to 62. In the 2007 tables at 61 he was among the 88% who survived to 61. Extrapolating forward to 2012, we will estimate that at 66 he was among the 83% who survived.

So for persons born earlier than 1946 we can estimate their survival rate as follows:

Born in 1943, retiring at 66 in 2009: 80% survive, or 2.48 million

Born in 1944, retiring at 66 in 2010: 81% survive, or 2.35 million

Born in 1945, retiring at 66 in 2011: 82% survive, or 2.38 million

Born in 1946, retiring at 66 in 2012: 83% survive, or 2.82 million

Born in 1947, retiring at 66 in 2013: 84% survive, or 3.19 million.

Total theoretically possible retirees: 13.22 million, 2.17 million more than actually left the labor force.

Obviously, not everyone retires at 66. Some keep working. And especially these days some keep working because they have to. The employment level of the 55 and over set has grown by 4.5 million over the period 2009-2013.

It appears to be the case, however, that an even larger number are deferring both Social Security benefits and work because they can afford to: Social Security reports that retired workers and their dependents receiving benefits grew only 5.6 million from the end of 2008 to the end of 2013.

Of the 11.05 million added to "not in labor force", I'd estimate at least 5.4 million are well off enough to forgo both work and Social Security until they reach age 70, and perhaps more than that if Social Security recipients who continue to work according to the rules are counted instead as part of the labor force.

Sunday, January 12, 2014

Saturday, January 11, 2014

Why HealthCare.gov still isn't fixed: Obama regime quietly dumps CGI Federal on Friday, to hire Accenture which built California exchange

WaPo reports here:

The Obama administration has decided to jettison from HealthCare.gov the IT contractor, CGI Federal, that has been mainly responsible for building the defect-ridden online health insurance marketplace and has been immersed in the work of repairing it.

Federal health officials are preparing to sign early next week a 12-month contract worth roughly $90 million with a different company, Accenture, after concluding that CGI has not been effective enough in fixing the intricate computer system underpinning the federal Web site, according to a person familiar with the decision who spoke on the condition of anonymity in order to discuss private negotiations.

... it is not yet able to automatically enroll people eligible for Medicaid in states’ programs, compute exact amounts to be sent to insurers for their customers’ federal subsidies or tabulate precisely how many consumers have paid their insurance premiums and are therefore covered.

... As federal officials and contractors have been trying to fix various aspects of the Web site in the past few months, about half the new software code the company has written failed when it was first used, according to internal federal information.

"Bad" job reports for two years have been great for higher corporate earnings

Barry Ritholtz, here:

It has taken quite a long time for many investors to understand that reduced labor costs, greater productivity and ever-increasing efficiency has led to higher earnings. The basic assumptions about “good” or “bad” job reports may not be accurate relative to what equities do over time.

-------------------------------------------------------

That's correct. The latest employment situation report indicates that there hasn't been much change up or down in jobs for two years running even as the stock market made over fifty new all-time highs in 2013.

Additions to non-farm payrolls have been averaging 182,000 and 183,000 a month in 2013 and 2012. Same old same old.

To the unemployed: The L-shaped "recovery" continues . . . without you.

To the unemployed: The L-shaped "recovery" continues . . . without you.

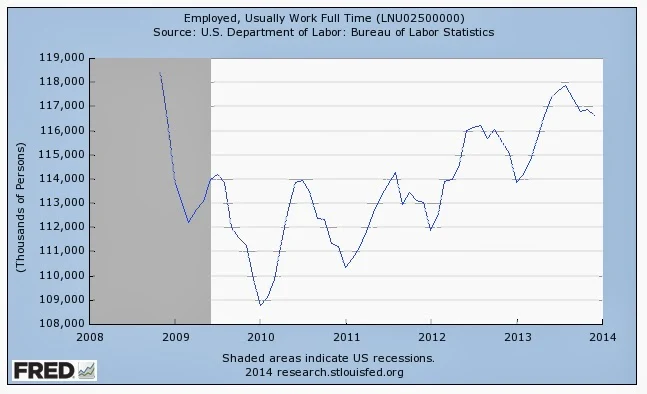

Those usually working part-time have not increased in number since passage of ObamaCare in 2010

|

| November 2008 through December 2013 |

And that's because the government measure of part-time doesn't care if you work 29 hours, 30 hours or 34 hours per week . . . all are equally part-time schedules to the Bureau of Labor Statistics.

The increasingly less deep lows in the summers since 2010 are consistent with the long term trend of increasing part-time work as population grows. Significant new highs above 28 million, however, remain non-existent.

Crony Capitalism Is A Feature, Not A Bug, Of Contemporary Liberalism

Jeffrey Snider, here:

Employment grows not on the pace of redistribution-derived consumer spending in the lower classes, but as new firms innovate and grow to replace older firms that have seen their last days. Failure and rebirth are the capitalist "secrets", and demand always follows supply in that line. Interrupt it at your peril.

Unfortunately, we see in the 21st century a different strain of imperialism that is rooted in Hobson's preferred solutions to it. By giving government more power over industry and business, Hobson suggested that government would be able to end business agitation toward external colonialism. But in doing so, governments have introduced the seeds of cronyism that take the form of internal imperialism. Big businesses have achieved regulatory leverage in a manner that may preclude the innovation and business cycles from creating that positive economic trajectory. And monetary policy, all in the name of aggregate demand, appears to be playing a large role.

... OWS [Occupy Wall Street] and its sympathizers ... are really protesting their own philosophies put into practice via a bastardized capitalism - so corrupted by devotion to aggregate demand in this era that it can hardly be referred to as such.

There will never be, and has never been, any such thing as fully free markets, nor should there be. What we are arguing is not absolutes but proportions. ... In perhaps the greatest and most tragic of ironies here, the Fed appeals directly to inflation as a means to destroy savings, an impulse to which I have to think Hobson would readily approve, but that inflation is itself a means of redistribution that further concentrates savings among the wealthy. More than an irony, it seems as if this inconsistency is a feature of this philosophy, as taken to its logical ends it produces something akin to circular reasoning. It is a place where the socialists of OWS criticize directly the tools of socialist monetary policy as if they are anything apart from each other.

New study finds psychotic episodes occur at an earlier age among marijuana users

Yahoo reports here:

Among more than 400 people in South London admitted to hospitals with a diagnosed psychotic episode, the study team found the heaviest smokers of high-potency cannabis averaged about six years younger than patients who had not been smoking pot. ... The researchers found that males were more likely overall to use cannabis and also had a younger age of onset of psychosis. The mean age at the time of the first psychotic episode for male users of cannabis was 26, and for female users was nearly 29. That compared with nearly 30 years old for male non-users and 32 for female non-users.

Friday, January 10, 2014

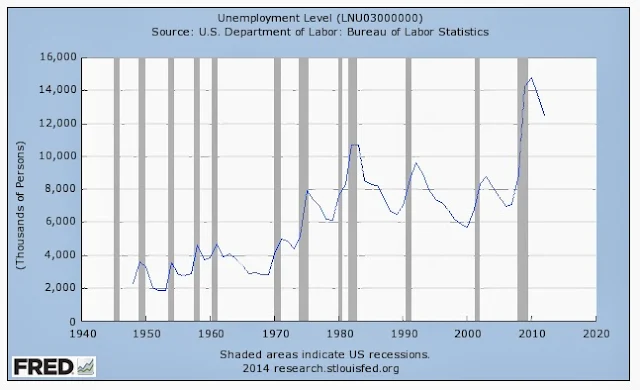

December 2013 Unemployment Falls To 6.7%, Total Nonfarm Jobs Up Only 74,000

The employment situation report for December 2013 is here.

The headline rate falls to 6.7% ending 5 years of unemployment at or above 7%, with massive numbers of people continuing to leave the labor force.

In the last year the number counted as unemployed fell 1.9 million, while nonfarm employment grew at a rate of 182,000 per month in 2013 vs. 183,000 per month in 2012, or 2.18 million. Roughly a wash.

Total nonfarm employment continues below the 2007/2008 peak of 138.1 million, still lagging that level by 1.2 million fully 6 years later (seasonally adjusted) despite growth in the population since that time of at least 14.3 million.

The headline unemployment rate has fallen from 7.9% at the beginning of 2013 to 6.7% at the end largely because those not in the labor force increased by 2.89 million in the last year (not-seasonally-adjusted). The not-seasonally-adjusted level reached a new high at 92.338 million. People who leave the labor force are not counted as unemployed.

In the 8 years from 2001 through 2008 under Bush those not in the labor force increased by 10.3 million, or 14.7%. That record has already been matched under just 5 years of Obama: 11.3 million have left the labor force, or 14.0% (numbers seasonally adjusted).

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

The civilian labor force participation rate, the percentage of working age people actually working, remains mired at Carter administration levels from 1977 and 1978.

Thursday, January 9, 2014

Wednesday, January 8, 2014

Rush Limbaugh Today Totally Botches Income Quintiles On The Program

|

| "You keep using that word. I do not think it means what you think it means." |

The relevant passage is here:

Poverty is expressed as an income level. Most economists break down income in America to five brackets, called quintiles, and people move in and out of these. The top quintile, I think, is like a million plus, and that'd be the top 1% of 1%. I forgot what the breakdown is, but the poverty level, it's roughly, what, $14,000 for a family of four? It's around there. People move in and out of these all the time.

------------------------------------------------------------------------

This is rich.

A quintile in this instance is one of any of the five groups of American households divided into those five groups based on how much money they make.

By definition, then, the top quintile is the richest 20% of households in America. So it's impossible for the top quintile to be "the top 1%", let alone "the top 1% of 1%".

As embarrassing as that is, Rush has absolutely no concept what it means to reach the top 20% of household income in this country.

The fact is it doesn't take all that much, and certainly nothing close to $1 million, hard as it may be to get there.

Currently the point in the middle of the top 20% of households by income is only about $181,905 per annum. That means about half the people in the top quintile make more than that, and about half make less. And interestingly enough, the middle of the richest 5% of households in this country isn't anywhere close to $1 million, either. The average household income of the top 5% is just $318,052. (For a good presentation of the data, see here.)

And Rush is equally out of touch about what it means to be poor. The federal definition for a family of four is about $23,500, not $14,000. The latter is about what it means for just one person to be poor, not four (see here).

Rush Limbaugh complains constantly about the sorry state of public education in this country. He even did so today in the same segment:

[L]ook at [President] Johnson's solutions. Education, job training, medical care, housing. That hasn't changed. The same weapons, the same language, the same way they tug at heartstrings. It's 1964, and they keep using the same lingo, obviously because it works. But look at how our education system's been since 1964 with them in charge.

Yep. Look at how it's been.

Rush is Exhibit A . . . the most popular radio host ever for a reason.

Tuesday, January 7, 2014

Monday, January 6, 2014

"Ben Bernanke Has An Almost Unbroken Record Of Being Wrong"

Bye Bye Ben.

Seen here:

Ben Bernanke has an almost unbroken record of being wrong.

In 2006, at the zenith of the housing bubble, he told Congress that house prices would continue to rise. In 2007, he testified that failing subprime mortgages would not threaten the economy.

In January 2008, at a luncheon, he told his audience there was no recession on the horizon. As late as July 2008, he insisted that mortgage giants Fannie Mae and Freddie Mac, already teetering on the verge of collapse, were “ adequately capitalized [and] in no danger of failing.”

Following the Crash of 2008, Bernanke’s prognostications did not much improve. Nor did Yellen’s, who had also misjudged the housing bubble, and who became Fed vice chairman in 2010.

The two of them got the “recovery” they predicted, but the weakest “recovery” in history.

Labels:

Ben Bernanke,

crony,

Fannie Mae,

Freddie Mac,

homeownership,

Janet Yellen,

mortgages

Peter Wallison Says The Housing Bubble Is Back

Here in The New York Times, where he blames sub-prime down payments, not interest rates:

Between 1997 and 2002, the average compound rate of growth in housing prices was 6 percent, exceeding the average compound growth rate in rentals of 3.34 percent. This, incidentally, contradicts the widely held idea that the last housing bubble was caused by the Federal Reserve’s monetary policy. Between 1997 and 2000, the Fed raised interest rates, and they stayed relatively high until almost 2002 with no apparent effect on the bubble, which continued to maintain an average compound growth rate of 6 percent until 2007, when it collapsed. ... Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent.

Many commentators will attribute this phenomenon to the Fed’s low interest rates. Maybe so; maybe not. Recall that the Fed’s monetary policy was blamed for the earlier bubble’s growth between 1997 and 2002, even though the Fed raised interest rates during most of that period.

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down. ...

When down payments were 10 to 20 percent before 1992, the homeownership rate was a steady 64 percent — slightly below where it is today — and the housing market was not frothy. People simply bought less expensive homes.

Obama Has Completed 160 Golf Outings In The Last 5 Years: The Practice Hasn't Helped

White House Dossier here reports that the president golfed 9 out of the 15 days while on his Hawaiian vacation, which means Moochelle was pretty much a golf widow during the time.

She did not return to DC with her family. The cost to the taxpayers of this early "birthday gift" of an extended stay may come to as much as $200,000 or more according to a separate entry here.

The Washington Times noted here the family's vacation was already "regal", and featured a video in which the president misses a long put on a green and then takes what he clearly deems a "gimme" but misses it, and picks it up off the green, not out of the cup. I'll bet his scorecard is minus the stroke . . . a lie like everything else about these people.

Sunday, January 5, 2014

Saturday, January 4, 2014

Vanguard's Worst Performing Bond Funds In 2013

Long Term Treasury Fund, VUSTX: -13.03%

Long Term Government Index Fund, VLGSX: -12.74%

Long Term Bond Index Fund, VBLTX: - 9.13%

Inflation Protected Securities Fund, VIPSX: - 8.92%

Long Term Corporate Bond Index Fund, VLTCX: - 6.86%

Long Term Investment Grade Fund, VWESX: - 5.87%

And as badly as they have performed, I don't see a net asset value for any fund which represents a bargain: they all still look too expensive to me.

Friday, January 3, 2014

Antarctic Global Warming Scientists Rescued, But Rescue Ship Also Gets Stuck In Ice: Story Never Mentions It's Summer In Antarctica

|

| Chinese Snow Dragon stuck in ice after rescue |

Why would they go there at this time if they didn't think they could get to Antarctica?

The story is here.

Evidently the rescue ship is Chinese, but the scientists were transported from their stuck vessel to an Australian vessel which subsequently has been dismissed from the area despite the troubles of their rescuers' vessel, also now stuck.

Reminds me of the tow truck which came to retrieve a neighbor's dead vehicle the other day. The tow truck itself got stuck, and had to be towed by another tow truck. Needless to say the neighbor's vehicle didn't get towed until yet another tow truck came yesterday.

And that's how icy it is, from Antarctica to Michigan.

Current Fair Value Of The S&P500 Is . . . 1005

Doug Short updates his regression analysis for the S&P500, adjusted for inflation, to come up with the S&P500 today about 80% above the long term trend going back to 1871:

"If the current S&P 500 were sitting squarely on the regression, it would be around the 1005 level. If the index should decline over the next few years to a level comparable to previous major bottoms, it would fall to the 450-500 range."

Charts and discussion here.

Government Just Made Two Things You Liked Obsolete: Your Health Insurance And The Lightbulb

Tim Carney, here, says the government ban on the traditional lightbulb is a case of crony capitalism in which industry persuaded government to help it increase energy efficiencies profits by eliminating the bulbs which consumers preferred in order to give them bulbs they didn't want but which cost a lot more, boosting profits they couldn't otherwise make.

You know, just like ObamaCare gives you coverages you neither want nor need and makes your insurance much more expensive than it used to be, and forces everyone to buy it. Insurance companies are happy to get all the new customers, and all the extra profits.

Big business is the enemy of Americans, and of capitalism. Unfortunately, so is the government.

Labels:

crony,

health insurance,

lightbulb,

Obamacare,

Tim Carney,

Uncle Fester,

Washington Examiner

Thursday, January 2, 2014

Jobless Claims Average 435,000 Per Week In Last Month, 17.75 Million Total In 2013

The report for the last week of 2013 is here.

At the current average per week in the last month sustained over a whole year the result would yield 22.6 million first time claims. That doesn't square with the claim that the economy is now in full trot as one headline puts it this morning.

17.75 million actual first time claims for unemployment in 2013, not-seasonally-adjusted, represents the best showing yet under Obama, but still far above George W. Bush's best years in the 16 million range when participation rates were much higher.

With nearly 12 million people having left the labor force since Obama was elected in 2008, far too many of those still working in a much smaller labor pool continue to lose their jobs every week. The levels today only seem less alarming because we remember them from when labor force participation rates were much higher. Now that they are not and levels are still high shows that labor is still flat on its back in this country.

If this is the best Obama can do, it's going to be a very long three more years.

Wednesday, January 1, 2014

Obama's America: Nearly 12 Million Have Given Up And Left The Labor Force Since His Election

In April 2011 over 1 million people, desperate for work, applied for just 50,000 burger-flipping jobs at McDonalds, which ended up hiring 62,000, 24% more than planned.

Where are the other 938,000 today?

The story is still here, thanks to former Mayor Bloomberg.

Those 938,000 most likely ended up joining another 10 million-plus who have left the labor force altogether.

President Obama meanwhile enjoys day 12 today vacationing in Hawaii snorkeling and golfing, according to news reports, after all his hard work fundamentally transforming the country.

Tuesday, December 31, 2013

John Crudele Of NY Post Still Not Really Sure What The Fed Has Been Trying To Do

Here in "Bernanke's rate ploy robs from middle class" John Crudele of The New York Post still can't seem to put two and two together even after all this time:

1:

Bernanke, who is leaving his job next month, controls something called the Fed Funds Rate. That’s the rate at which banks can lend each other money for a very short term, generally overnight. That rate is set by the Fed and has been stuck at a puny 0.25 percent for the last few years as the Fed tries to — well, I’m not really sure what the Fed has been trying to do. ...

2:

One of the few rates he has been able to keep low is the yields on things like money-market and savings accounts. The banks love him, since the less they pay out to depositors, the more money they earn.

--------------------------------------------------------------------

What do I gotta do, John, spell it out for ya?

The Fed has been trying to . . . rescue the banks. They don't keep the rate next to zero for this long if they didn't need to.

The middle class has been punished in the process, but lower interest rates presumably have allowed some in the middle class to refinance expensive loans at lower rates while their retirement investments have reflated. That's the rationalization, if not the reality experienced by most.

The banking crisis is over when ZIRP is over.

Middle Class In Flames: All The Fed Has Done Is Help The Banks

|

| Naked Capitalism supports Occupy Wall Street. Heh, heh. Does Jeep know? |

Yves Smith of Naked Capitalism, here:

Oh, puhleeze. Robust recovery for who? The Fed not only threw staggering amounts of firepower at salvaging bank balance sheets, while showing no interest in rescuing ordinary Americans. It was also all-in on the Administration’s program to paper over the banks’ chain of title problems and their widespread servicing abuses, and didn’t bother to obtain any meaningful concessions or reforms, the most important of which would have been principal modifications, a remedy favored by investors as well as homeowners. The Fed has been all too happy to accept mission creep rather than speak up forcefully for the need for more fiscal stimulus.

-------------------------------------------------------------------------------

The analysis is right, but the prescriptions are left: raising the minimum wage, breaking mortgage contracts, and spending money we do not have. Oh, puhleeze. It's Naked Liberalism.

But she's great on Obama's Mussolini-style corporatism, most recently here in response to The New Republic:

I’m actually a bit miffed that Konczal treats the “corporatism” appellation as the sole property of the right wing (in the style sheet of the Vichy Left, calling them “hysterics” is redundant but necessary for the rubes), since I have a prior claim. And what is particularly rich is that Konczal apparently regards the allusion to Mussolini to be unfair . . ..

Obamacare IS corporatist. Here we have the industries that are significant contributors to why the American medical system is so overpriced – the health insurers and Big Pharma – actually playing a major role in writing the legislation. And how is it not a sop to large companies to have the government require that citizens buy your product or else pay large tax penalties? Mr. Market certainly thought so, for the price of health insurer and drug company stocks jumped the day the ACA passed. And remember, the beneficiaries of Obamacare extend beyond the insurers and pharmaceutical makers. Hospitals, who increasingly engage in oligopoly pricing (most surgeries need to be done in hospitals), also come out even stronger because new requirements imposed on doctors’ practices will make it difficult for a retiring MD who practices medicine, as opposed to servicing the rich (e.g., cosmetic surgeons) to sell their business to anyone other than a hospital.

And the label fits in the banking arena like a glove. I’ve ... called both the Bush, but far more often the Obama bank-friendly policies “Mussolini-style corporatism” since 2008, and well before what [Mike] Konczal [of The New Republic] claims is the origin of this description, Tim Carney’s book Obamanomics, published November 30, 2009.

Subscribe to:

Posts (Atom)